Summary:

- Merck & Co., Inc. substantially outperformed in 2022.

- Merck achieved a series of positive trial outcomes and approvals.

- Global revenue growth has been solid.

- The Wall Street consensus rating is a buy, but MRK’s current share price is close to the 12-month price target.

- The market-implied outlook (calculated from options prices) is bullish through 2023.

JHVEPhoto

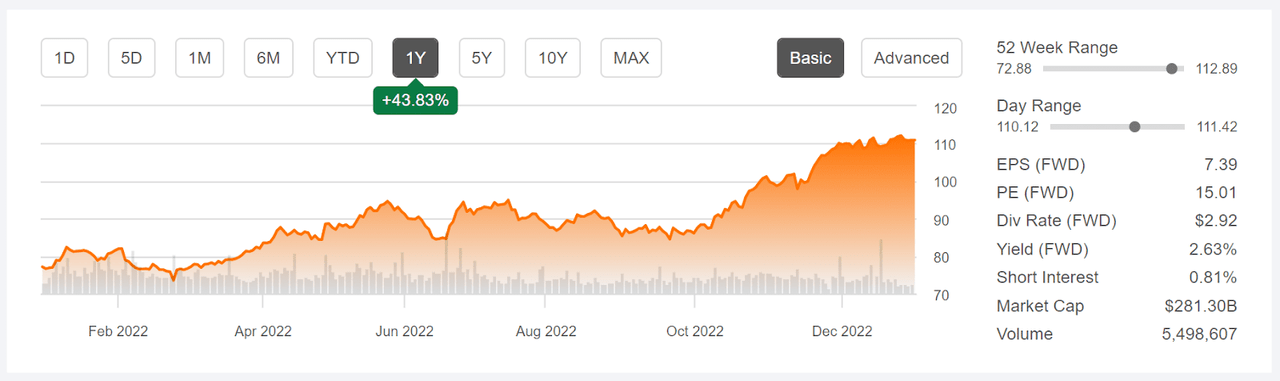

Merck & Co., Inc. (NYSE:MRK) was the top-performing large U.S. pharma stock for 2022, and the shares had their best year since 1995. MRK had a total return of 48.4% for 2022, as compared to 20.6% for the drug manufacturers industry group (as tracked by Morningstar) and -4.9% for the iShares U.S. Pharmaceuticals ETF (IHE). Much of the year’s gain has come in the last 3 months of 2022, with the shares returning 29.7% in Q4 (including dividends).

Seeking Alpha

12-Month price history and basic statistics for MRK (Source: Seeking Alpha).

The company has had a number of important wins in trials and approvals in Q4. The European Commission (EC) approved the use of MRK’s pneumococcal vaccine for treating children. Merck’s blockbuster cancer drug, Keytruda, had a positive Phase 3 trial for use in treating Gastric cancer. Working with Moderna (MRNA), MRK reported encouraging test results for a personalized cancer treatment. A New England Journal of Medicine paper reported positive results for Merck’s Ebola vaccine. Right at the end of the year, Merck’s oral antiviral treatment for COVID was granted conditional emergency approval for use in China.

Merck is adding depth to its drug development pipeline with a recently-announced agreement to acquire Imago BioSciences, Inc. (IMGO). In addition, the company may be continuing to work on a potential acquisition of Seagen Inc. (SGEN), although discussions are reported to be at a standstill. The first of these adds to Merck’s hematology portfolio, while the second would add to the oncology pipeline. Recent years have demonstrated the importance of broad diversification for big pharmaceutical companies, with huge sales for COVID vaccines and treatments, and patients deferring care for other conditions.

Merck’s global sales were up 14% YoY for the most recently reported quarter, Q3, with EPS rising 4% (see slide 6). Keytruda, Merck’s cancer blockbuster drug, saw sales rise 26% YoY (slide 12). Sales of Gardasil, the company’s HPV vaccine, rose 20% YoY. Earnings have beaten the consensus value for 6 successive quarters. The consensus estimate for EPS growth over the next 3 to 5 years is 10.3% per year.

MRK’s TTM and forward P/E ratios are 14.5 and 15.0, respectively. These levels are quite low compared to recent years.

Major risk factors for MRK include the potential for poor results in drug trials, possible litigation, and issues around intellectual property protection, as well as possible changes in regulations and legislation to constrain drug costs. Foreign exchange continues to be a drag on performance.

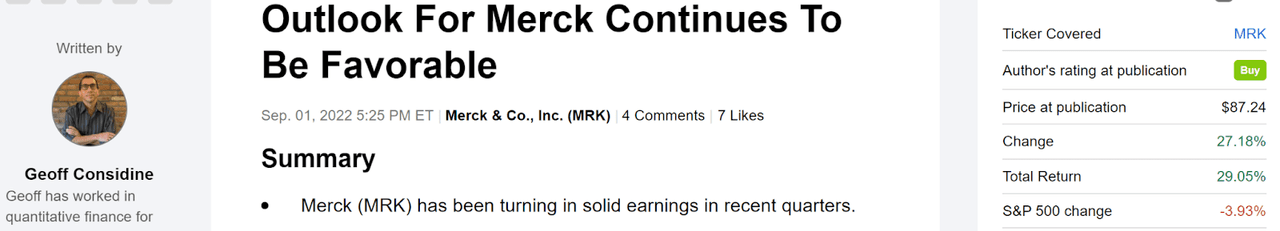

I last wrote about MRK four months ago, on September 1, 2022, at which time I maintained a buy rating on the shares. At that time, the Wall Street consensus rating was bullish and the consensus 12-month price target corresponded to an expected return of 17.5% to 18%. The valuation was notably low, with a forward P/E of 11.6. The market-implied outlook, a probabilistic price forecast that represents the consensus view from the options market, was slightly bullish out to the middle of 2023, with a moderate expected volatility of about 26%. As a rule of thumb for a buy rating, I want to see an expected return that is at least ½ of the expected volatility. Taking the Wall Street consensus at face value, MRK met this criterion. In the period since this post, MRK’s share price has surged, for a total return of 29%.

Seeking Alpha

Previous analysis of MRK and subsequent performance vs. the S&P 500 (Source: Seeking Alpha).

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate the probable price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper discussion than is provided here and in the previous link, I recommend this outstanding monograph published by the CFA Institute.

I have calculated updated market-implied outlooks for MRK and compared these with the current Wall Street consensus outlook in revisiting my rating.

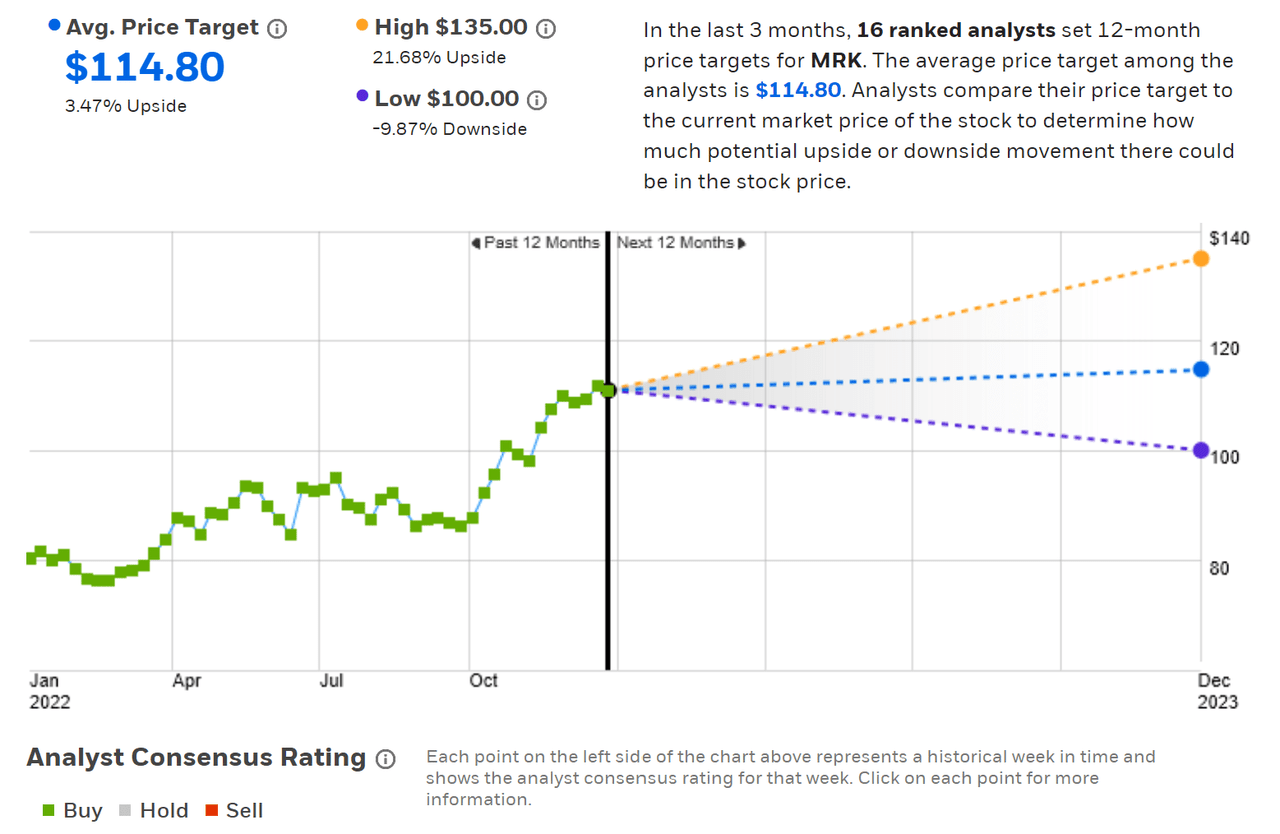

Wall Street Consensus Outlook for MRK

Etrade calculates the Wall Street consensus outlook for MRK by combining the views of 16 ranked analysts who have published price targets and ratings over the past 3 months. The consensus rating is a buy, as it has been for all of the past year. The consensus 12-month price target is 3.5% above the current share price, for a total expected return of 6.1%. Even though the price target has risen substantially (it was $100 for my September post), the gains in recent months have resulted in the share price being close to the 12-month price target.

ETrade

Wall Street analyst consensus rating and 12-month price target for MRK (Source: Etrade).

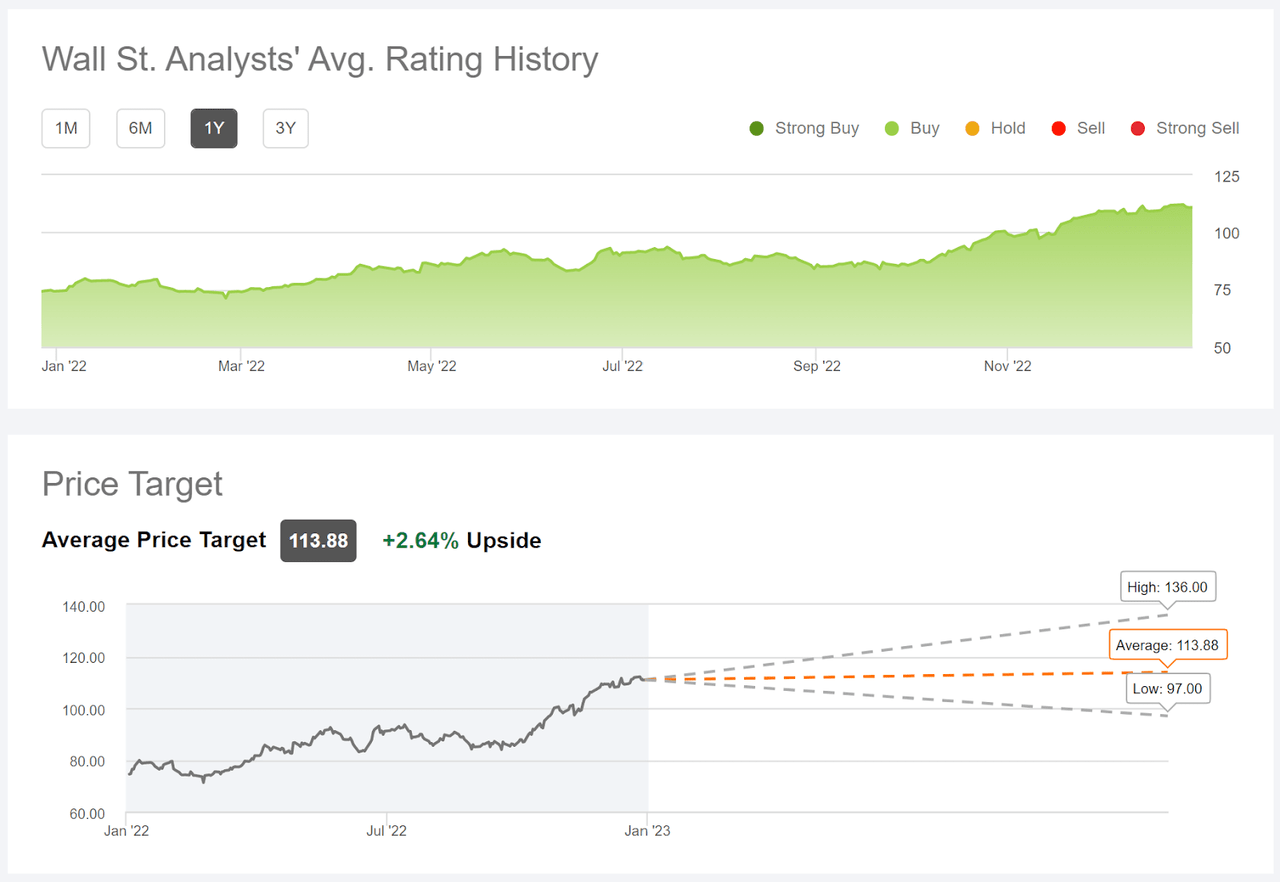

Seeking Alpha’s version of the Wall Street consensus outlook is calculated using the views of 26 analysts who have published ratings and price targets over the last 90 days. The consensus rating is a buy, and the consensus 12-month price target is 2.6% above the current share price, for expected total return of 5.2%.

Seeking Alpha

Wall Street analyst consensus rating and 12-month price target for MRK (Source: Seeking Alpha).

Market-Implied Outlook for MRK

I have calculated the market-implied outlook for MRK for the 5.4-month period from now until June 16, 2023 and for the 12.5-month period from now until January 19, 2024, using the prices of call and put options that expire on these dates. I selected these two expiration dates to provide a view to the middle of 2023 and through the entire year.

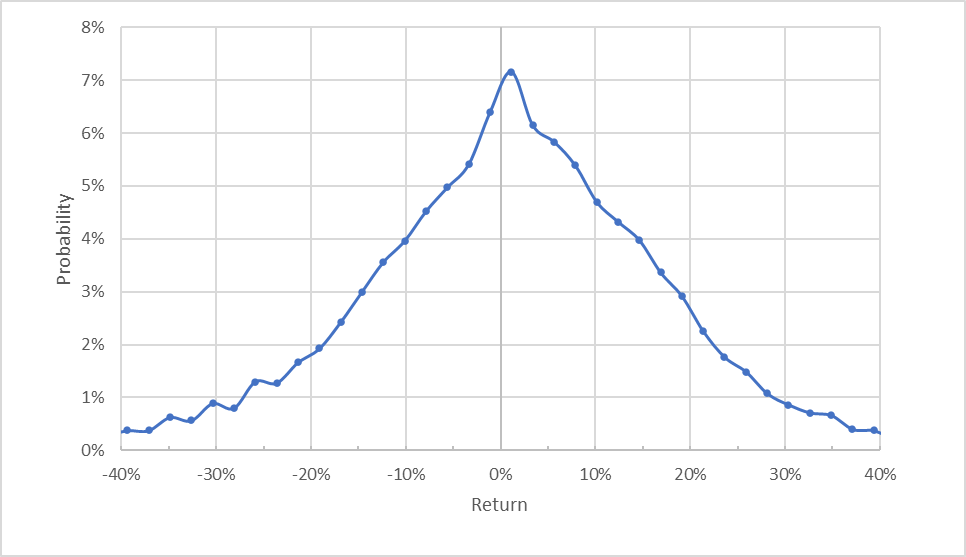

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Geoff Considine

Market-implied price return probabilities for MRK for the 5.4-month period from now until June 16, 2023 (Source: Author’s calculations using options quotes from Etrade).

The outlook to the middle of June is generally symmetric, although the peak in probability is very slightly shifted to favor positive returns. The expected volatility calculated from this distribution is 24.9%, close to the expected volatility that I calculated at the start of September (26%).

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

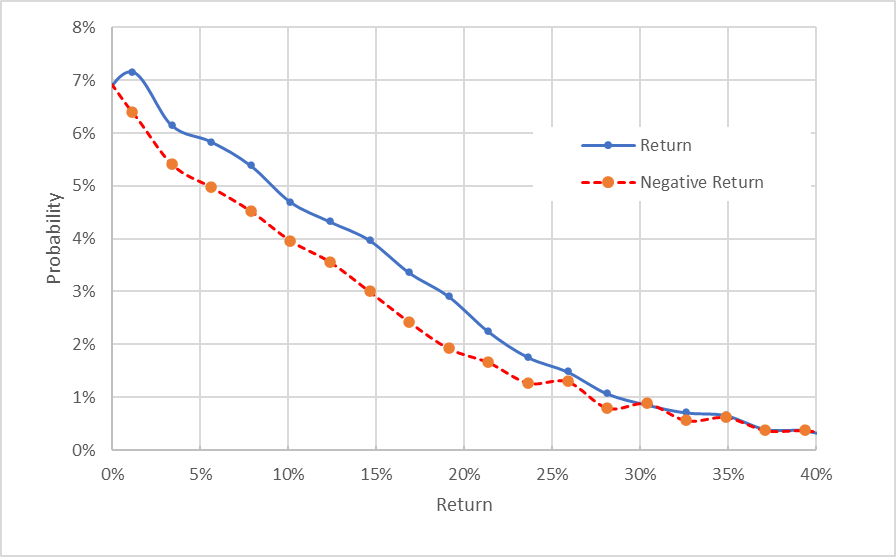

Geoff Considine

Market-implied price return probabilities for MRK for the 5.4-month period from now until June 16, 2023. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from Etrade).

This view shows that the probabilities of positive returns are consistently above the probabilities of negative returns (the solid blue line is above the dashed red line over almost all of the chart above). This tilt suggests a bullish view to the middle of 2023.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. The expectation of a negative bias reinforces the interpretation of this outlook as bullish.

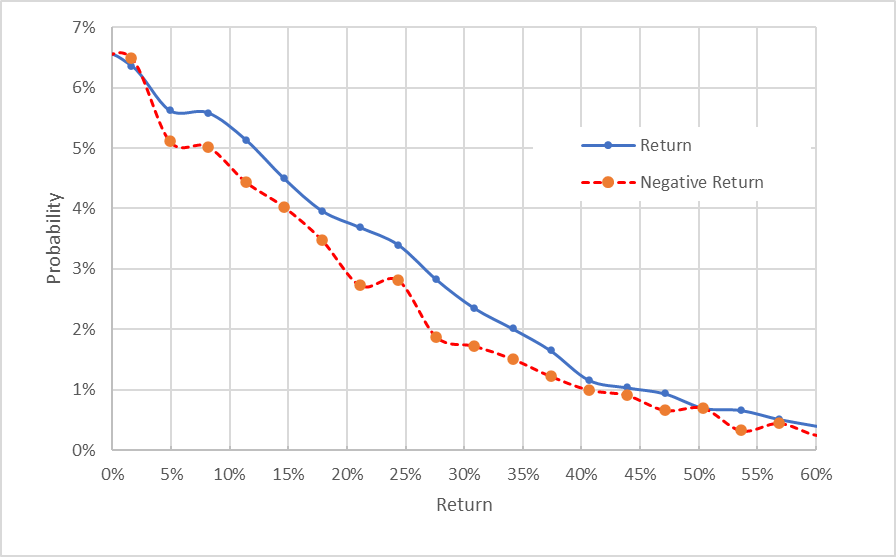

The outlook for the next 12.5 months is also bullish, with a clear shift in probabilities to favor positive returns. The expected volatility is 25.2%.

Geoff Considine

Market-implied price return probabilities for MRK for the 12.5-month period from now until January 19, 2024. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from Etrade)

The market-implied outlook for MRK is bullish to the middle of 2023 and into the start of 2024, with expected volatility of about 25%. These outlooks are more bullish than those from the start of September and the expected volatility has fallen slightly.

Summary

Merck & Co., Inc. had a strong 2022, and the company is well-positioned to continue to outperform in 2033. The company has fared well in drug trials and new approvals for use. The acquisition of Imago is expected to close in Q1 2023. The Wall Street consensus rating for MRK continues to be a buy, although the share price has risen sufficiently that there is little potential gain to reach the 12-month price target. In other words, the market has largely priced in the expected growth for 2023.

The valuation remains low enough to support further gains, however. The market-implied outlook for MRK is bullish to the middle of 2023 and into the start of 2024. While Merck, like any other pharmaceutical company, faces substantial idiosyncratic risks in the form of litigation, failed drug trials, and patent challenges, the market-implied outlook indicates that the overall risk level for the stock is quite low. I am maintaining a buy rating on Merck & Co., Inc.

Disclosure: I/we have a beneficial long position in the shares of MRK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.