Summary:

- Merck has managed to thrive throughout its 132-year corporate history.

- The company posted healthy sales and non-GAAP EPS growth in the third quarter.

- Merck boasts an A+ credit rating from S&P on a stable outlook.

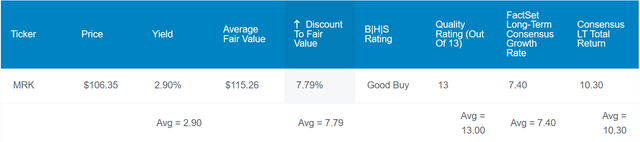

- The pharmaceutical giant appears to be trading at a 6% discount to fair value.

- Merck could outperform the S&P 500 index by over 40% through the next 10 years.

A patient and a pharmacist talk to each other. Drazen Zigic/iStock via Getty Images

It’s been repeated ad nauseam, but there are no guarantees in equity investing. Even the most storied companies are susceptible to fading into the ash heap of history. At the time Lehman Brothers went bankrupt in 2008, it was in business for more than 150 years. The company established itself as the fourth-largest investment bank in the United States.

High debt can only be overlooked for so long before the perfect storm brings consequences with it, which brings the following Warren Buffett quote to mind:

Only when the tide goes out do you discover who’s been swimming naked.

The good news is that there are warning signs that often arise when a business is on the path toward insolvency. Unsurprisingly, Lehman Brothers was very leveraged at the time of its bankruptcy. The consequences of this unsustainable debt load were manifested when the Great Recession reared its ugly head, resulting in the collapse of a once-fabled American company.

This is why I generally prefer to own companies not just with established track records but robust financial positions. I believe the pharmaceutical giant Merck (NYSE:MRK) fits this profile. For the first time in three months, I will discuss the company’s fundamentals and valuation to explain why I am reiterating my buy rating.

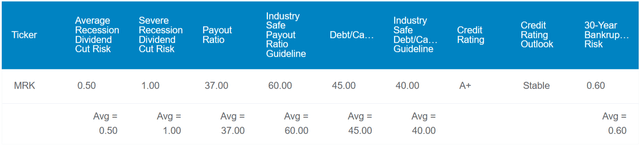

Merck’s 2.9% dividend yield clocks in at nearly twice the 1.5% yield of the S&P 500 index (SP500). On top of this higher starting income, the company’s payout appears to be secure. This is because Merck’s 37% EPS payout ratio comes in well below the 60% payout ratio that rating agencies like to see from the pharmaceutical industry.

Furthermore, the company’s 45% debt-to-capital ratio is reasonably close to the 40% debt-to-capital ratio that rating agencies prefer from the industry. Along with robust profitability and industry leadership, this is why Merck enjoys an A+ credit rating from S&P on a stable outlook. This suggests that the company is at just a 0.6% risk of going to zero by 2053.

Considering all of these factors, Dividend Kings estimates that the risk of a dividend cut in the next average recession is just 0.5% for Merck. A severe recession raises that probability to just 1%.

As a 13/13 ultra SWAN per Dividend Kings, Merck also appears to be a wonderful business that is fairly priced. This is supported by the fact that the company’s historical dividend yield and P/E ratio point to a fair value of $115 a share. Relative to its current $108 share price (as of December 22, 2023), Merck could be trading at a 6% discount to fair value.

If the company returns to fair value and matches the growth consensus, here are the potential total returns that it could produce over the next 10 years:

- 2.9% yield + 7.4% FactSet Research annual growth consensus + 0.6% annual valuation multiple upside = 10.9% annual total return potential or a 181% 10-year cumulative total return versus the 8.6% annual total return potential of the S&P or a 128% 10-year cumulative total return.

A Remarkable Showing In The Third Quarter

Merck Q3 2023 Earnings Press Release

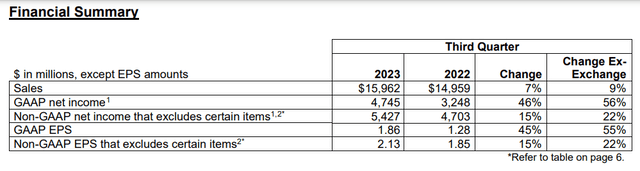

When Merck reported its financial results for the third quarter in late October, it defied expectations. The company’s sales surged 6.7% higher year-over-year to $16 billion, which surpassed the analyst consensus by a whopping $730 million.

This sales beat was made all the more impressive by the fact that the U.S. dollar’s strength compared to other currencies weighed on Merck’s results during the third quarter. Backing out unfavorable foreign currency translation, the company’s sales grew by 9% in the quarter.

As has been the case for years, the multinational pharmaceutical’s results were primarily driven by Keytruda’s strength. The smash-hit oncology drug’s total sales grew by 16.8% over the year-ago period to $6.3 billion for the third quarter. This growth was fueled by improved global uptake in its triple-negative breast cancer and renal cell carcinoma indications.

The Gardasil human papillomavirus vaccine also did quite well, growing its total sales by 12.7% year-over-year to $2.6 billion during the third quarter. Vigorous demand in China coupled with price hikes in the U.S. led to this double-digit growth rate.

Strength in these products and its Lagevrio COVID-19 oral antiviral treatment offset double-digit sales declines in its Januvia/Janumet diabetes franchises. This drop-off in sales to $835 million in the third quarter was the result of generic competition in Europe. Lower demand in the U.S. stemming from competition like Eli Lilly’s (LLY) Mounjaro was another contributor.

Merck’s non-GAAP EPS roared 15.1% higher over the year-ago period to $2.13 for the third quarter. For context, this trounced the analyst consensus by $0.18. Aside from the higher sales base, this outperformance was due to a 260 basis point uptick in non-GAAP net margin to 34% during the quarter.

Beyond the third quarter results, Merck has a pipeline that should generate growth: The company has 8 programs that are currently under regulatory review, more than 30 programs that are in phase 3 clinical trials, and over 80 programs in phase 2 clinical trials. This should keep sales and EPS growing for the foreseeable future.

The Safest Dividend Is The One Just Raised

Last month, Merck upped its quarterly dividend per share by 5.5% to $0.77. This was in line with my expectations. Moving forward, similar dividend growth should be able to continue.

Through the first nine months of 2023, Merck has posted $9.9 billion in free cash flow. Against the $5.6 billion in dividends paid over that time, this works out to a 56.6% free cash flow payout ratio (page 5 of 52 of Merck’s 10-Q filing). This allows Merck to retain more than enough capital to execute acquisitions to strengthen its pipeline and keep debt within reason.

Risks To Consider

Merck is a high-quality business, but it still has risk factors that merit at least brief mentions.

The success of Keytruda has put the company in an enviable position for quite a while now. However, that success could be a double-edged sword with key patents set to expire as soon as 2028. The drug accounted for 40.5% of its $45.5 billion in total sales through September 30 (page 29 of 52 of Merck’s 10-Q filing). If Merck can’t put that off further with its subcutaneous version of Keytruda and maintain a deep enough pipeline, its fundamentals could take a hit.

In the pharmaceutical industry, especially, there is often pressure to execute M&A to position a company for loss of exclusivity on important products. Merck’s recent acquisition of the immunology company, Prometheus Biosciences, for $10.8 billion is a recent example of this in action. If the assets acquired fail to produce results, this acquisition could weigh on the company’s results.

Lastly, regulatory risk is undeniable for the pharmaceutical industry. Admittedly, this risk is relatively low because of the considerable influence that industry lobbying has on politicians. Pharmaceutical lobbying in 2022 was about as much as the next two lobbying industries combined. But if pressure from the electorate outweighs that from lobbying firms, there is the potential for substantive regulatory reform that could hurt the pharmaceutical industry’s margins.

Summary: An Above-Average Company For A Below-Average Valuation

From my perspective, Merck checks off all the boxes that I look for in a company. An encouraging growth outlook? Yes. A firmly investment-grade credit rating? Yep. A manageable payout ratio? Indeed. A commitment to shareholders? Affirmative.

Overall, Merck is a superior company relative to most others. Yet, with the current valuation, shares of the stock could be 6% undervalued. This doesn’t make it the biggest bargain in the market right now, but along with Merck’s superior quality, it is enough to continue warranting my buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MRK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.