Summary:

- Merck offers strong forward earnings growth trends and a compelling current valuation, making it a GARP play with a high yield.

- The health care sector trades at an 18.9 forward earnings multiple, below that of the broader market.

- Merck’s strong quarterly results, focus on new launches, and solid outlook make it a buy with the potential for double-digit growth in the coming years.

- I highlight key price levels to monitor ahead of earnings due out later this month.

Sundry Photography

Merck (NYSE:MRK) is one of the increasingly rare companies that boasts both strong forward earnings growth trends and a compelling current valuation. Call it a GARP play, but investors also can bank on a high yield with this health care sector stock. I have a buy rating on the $324 billion market cap company.

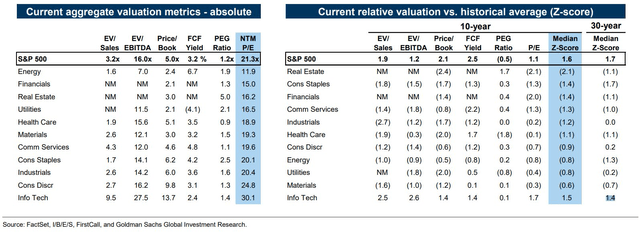

Stepping back, with the second half in full swing, the health care sector trades at an 18.9 forward earnings multiple, according to Goldman Sachs. While that’s not cheap on its own, it is more than two turns less expensive compared with the S&P 500. So there are some deals to be had in the pharma space, all while GLP-1 weight-loss drugs command much of the media’s attention.

S&P 500 Sector Valuations

Merck is a global pharma company focused on discovering, developing, and marketing drugs for respiratory, immunology, cardiovascular, diabetes, infectious diseases, oncology, and other indications. The company is a global leader in vaccines and is further diversified with an animal health division.

Back in April, Merck reported a very strong set of quarterly results. Q1 non-GAAP EPS of $2.07 topped the Wall Street consensus estimate of $1.92 while revenue of $15.8 billion, up 9% from year-ago levels, was a material $600 million beat. Keytruda sales soared 20% to $6.9 billion – a 24% y/y jump when backing out adverse currency impacts. Elsewhere, Gardasil/Gardasil 9 revenue rose 14% to $2.2 billion; +17% on a fx-neutral basis.

In terms of the outlook, Merck’s management team raised and narrowed its FY 2024 top-line guidance and now expects non-GAAP EPS to come in between $8.53 and $8.65, above the consensus estimate at the time. Buttressing the strong year is the firm’s focus on driving business beyond its hallmark drug Keytruda – its new launches such as Winrevair (sotatercept) and its partnership with Prometheus should set the stage for solid operating profits in the quarters to come while its core drugs of Keytruda, Lagevrio, and Vaxneuvance should lead to reliable sales.

Key risks for Merck include increasing competition from other immuno-oncology companies, weakness in late-stage drugs, and adverse regulatory changes should policymakers take a stricter stance on the pharma industry.

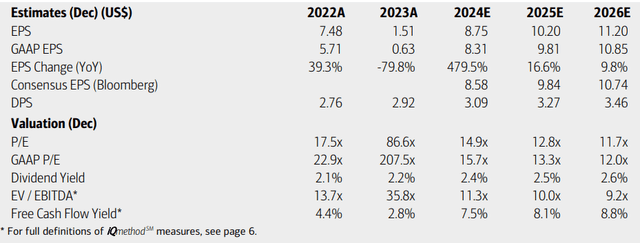

On earnings, analysts at Bank of America see operating EPS rising sharply this year and then posting solid double-digit growth in the out year, with operating per-share profits potentially topping $11 by 2026. The current Seeking Alpha consensus figures show slightly less sanguine EPS trends, but collective growth estimates are still quite solid. Merck’s top line is expected to increase at a mid-single-digit percentage pace through 2026, implying strong operating leverage.

Dividends, meanwhile, are seen rising rather impressively too, resulting in a yield that could keep growing versus that of the S&P 500 if shares continue to trade sideways. With a below-market EV/EBITDA ratio and a very high free cash flow yield over the next several quarters, there’s both a growth and value case with MRK.

Merck: Earnings, Valuation, Dividend Yield, Free Cash Flow Yield Forecasts

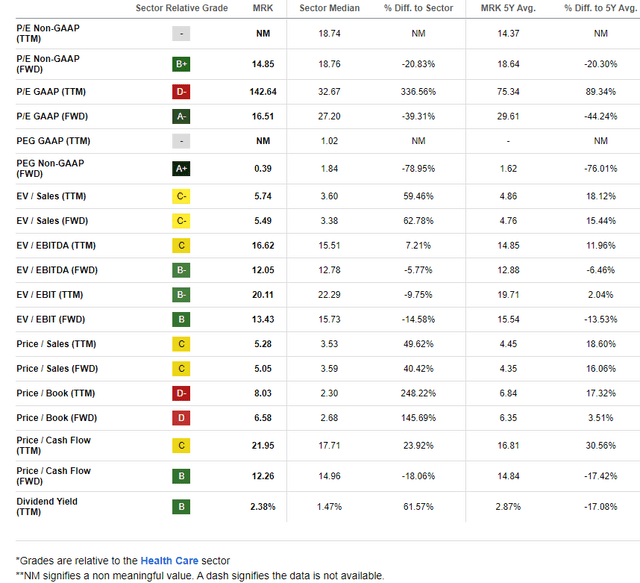

Merck’s valuation is quite attractive today. If we assume that the consensus operating EPS estimate over the next 12 months of $9.30 plays out and apply the stock’s five-year average P/E multiple of 18.6x, then shares should trade near $179. I don’t think that is too bullish either, considering that we could be looking at a company earning $11 by 2026.

A risk is its somewhat high 5.05x price-to-sales ratio, implying that the firm could be over-earning in the near term. Even with a 10% margin of safety, shares appear undervalued.

Merck: Strong Valuation, Impressive Yield

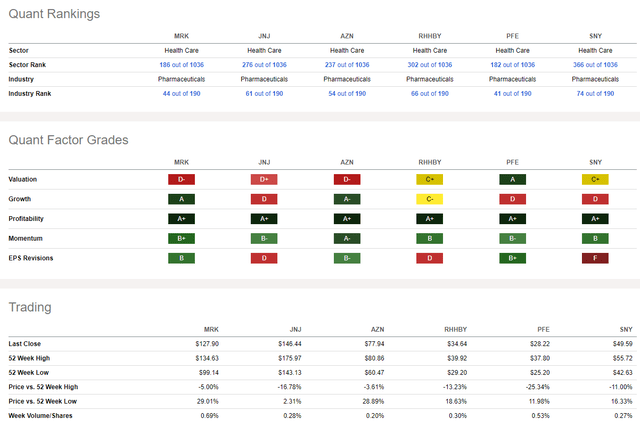

Compared to its peers, Merck features a poor valuation rating, but that’s not uncommon across the industry today. Its growth trajectory is among the best in its peer group, while the firm’s profitability trends are very impressive with high free cash flow.

Moreover, the sell side has turned more bullish – there has been a high of 18 upward EPS revisions in the past 90 days following the Q1 beat, with just four downgrades. Finally, share-price momentum, which I will detail later, is healthy.

Competitor Analysis

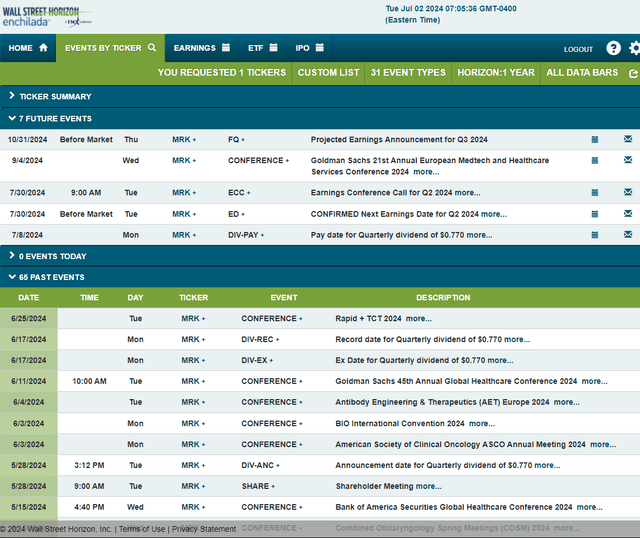

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q2, 2024 earnings date of Tuesday, July 30 BMO with a conference call later that morning. You can listen live here. Before that, the company pays a $0.77 quarterly dividend on Monday, July 8.

Corporate Event Risk Calendar

The Technical Take

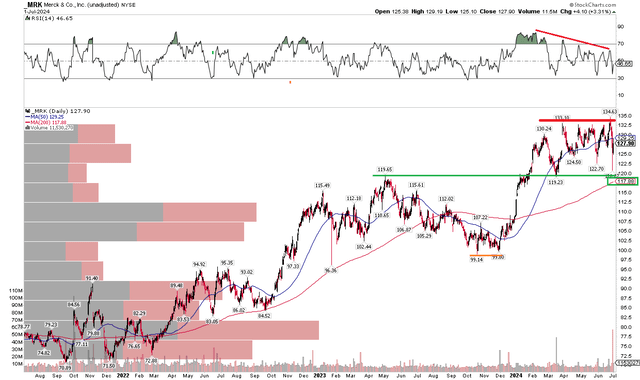

With a robust growth backdrop and attractive valuation, MRK’s technical chart is generally solid in my view. Notice in the graph below that shares have traded sideways for the past five months, but that’s not necessarily a bad thing. The current consolidation comes after a strong rally of lows notched in the fourth quarter of 2023. While the RSI momentum oscillator at the top of the chart shows weakening trends, the stock remains confined to a trading range between $119 and $135.

Also take a look at the long-term 200-day moving average – it’s positively sloped with the stock price above that key trend indicator line. The 200dma is now very close to the $119 to $120 support range, so investors have a clear line in the sand from a momentum perspective. I’d like to see a definitive breakout above $135, but long with a stop under $105 appears as a solid risk reward. Based on the low from last year at $99 and the resulting $20 range height, a measured move upside price target to about $140 is in play.

Merck: Shares Consolidate After A Strong Rally, $119 Support

The Bottom Line

I have a buy rating on Merck. This health care sector stock sports a reasonable valuation with a positive growth outlook. Its chart appears attractive for the most part, with a rising long-term trend ahead of earnings later this month.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.