Summary:

- On April 25, one of the leaders in the global oncology drugs market published extremely positive financial results for the first quarter of 2024.

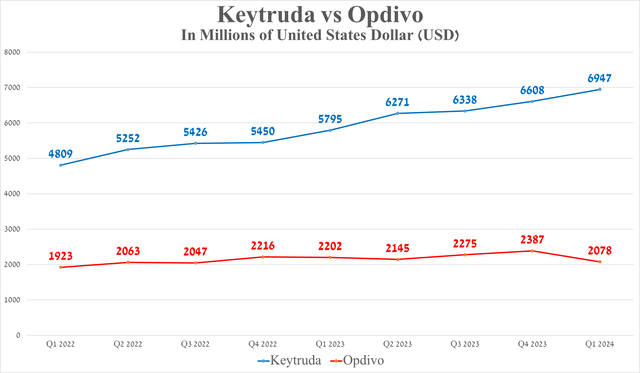

- Keytruda sales were about $6.95 billion in the first quarter of 2024, up 19.9% year-over-year.

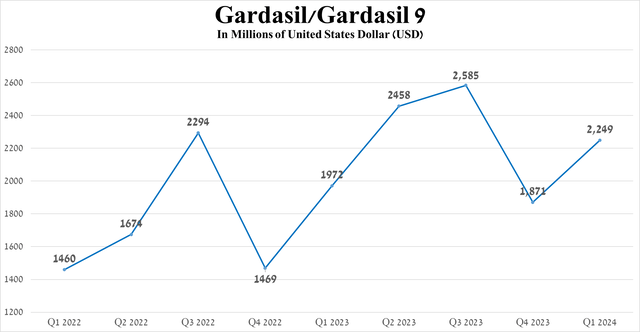

- Additionally, Gardasil/Gardasil 9 sales totaled about $2.25 billion in the first three months of 2024, up 14% year over year.

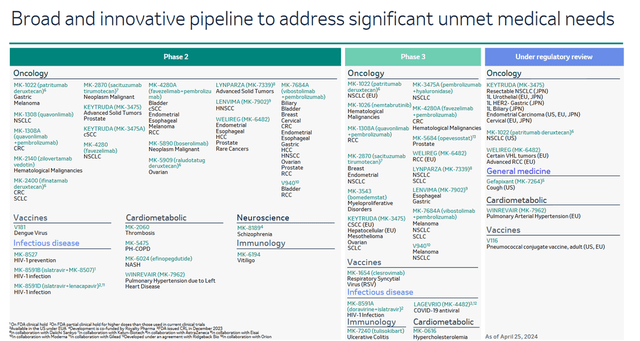

- Merck continues to make tremendous progress in developing its rich portfolio of experimental drugs and vaccines.

- As a result, I am upgrading Merck’s rating from ‘Hold’ to ‘Buy’.

Luke Chan/E+ via Getty Images

Merck (NYSE:MRK) is one of the largest pharmaceutical companies in the world, occupying one of the leading positions in the global vaccines and oncology drugs markets.

Investment thesis

Since the publication of my last article on January 8, 2024, the company’s share price, after a brief bull run, began to move sideways despite Merck announcing a lot of positive news in recent months.

On April 25, Merck published financial results for the first three months of 2024, which pleasantly surprised me with the progress in the development of its pipeline of product candidates, guidance, growth in its operating income and gross margins despite the acquisitions of Harpoon Therapeutics and Caraway Therapeutics, as well as the conclusion of a multi-billion dollar deal with Daiichi Sankyo (OTCPK:DSKYF).

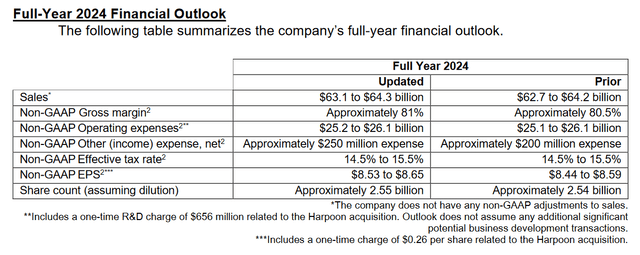

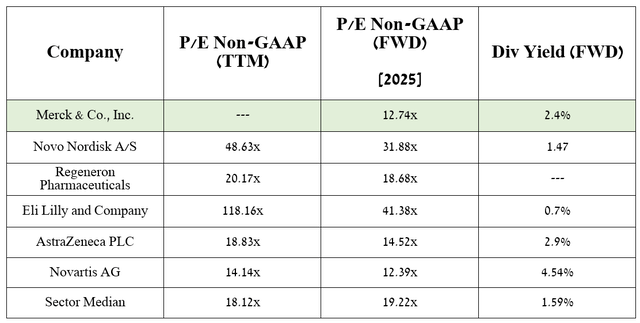

So, the company’s management raised expectations for its total sales from $62.7-$64.2 billion to $63.1-$64.3 billion and also raised its 2024 non-GAAP diluted EPS guidance from $8.44-$8.59 to $8.53-$8.65, representing a P/E of 15x, indicating that Merck is trading at a discount not only to the sector but also to its key competitors including Takeda Pharmaceutical (TAK), Pfizer (PFE) and AstraZeneca (AZN).

In my assessment, in addition to its experimental drugs, which will be discussed in more detail later in the article, key contributors to improving the company’s financial position also continue to be its FDA-approved medications and vaccines, including Keytruda, Gardasil 9, Vaxneuvance, Lenvima, and Welireg.

So, Keytruda (pembrolizumab) is a monoclonal antibody against PD-1 receptors, whose mechanism of action contributes to a significant enhancement of the antitumor immune response. Merck’s flagship product is used to treat patients with a variety of common types of cancer, including melanoma, non-small cell lung cancer, gastric cancer, cervical cancer, kidney carcinoma, and more.

Its total sales were about $6.95 billion in the first quarter of 2024, an increase of 19.9% year-over-year, due in part to the rapid expansion of its indications and continued high demand in the USA and Europe for the treatment of patients with cervical, breast, and lung cancer, as well as competitive advantages relative to Bristol Myers Squibb’s Opdivo (BMY).

Source: graph was made by Author based on 10-Qs and 10-Ks

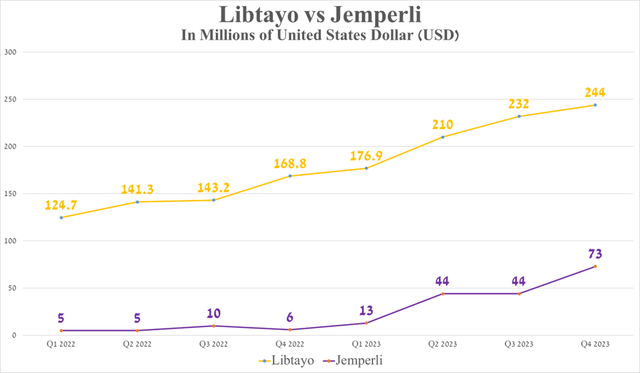

Additionally, I want to point out that the pace of demand growth for the company’s blockbuster is astonishing, even compared to relatively recently launched PD-1/PD-L1 immune checkpoint inhibitors, including Regeneron’s Libtayo (REGN) and GSK’s Jemperli (GSK).

As a result, this underscores the dominance of Keytruda in the oncology drugs market, highlighting the success of Merck’s commercial tactics and the direction of its R&D department, which is also tasked with evaluating the efficacy of this blockbuster in combination with drugs such as vibostolimab, quavonlimab, and faveselimab.

Source: graph was made by Author based on 10-Qs and 10-Ks

Moreover, on March 28, 2024, the EMA approved Keytruda in combination with platinum-based chemotherapy for the treatment of certain adult patients with resectable non-small cell lung cancer. Regulatory approval was based on the phase 3 KEYNOTE-671 study, which demonstrated a significant improvement in overall survival and a reduced risk of relapse in a group of patients treated with the company’s medication.

As a result, I am upgrading Merck’s rating from ‘Hold’ to ‘Buy’.

Prospects for Merck’s business development in 2024

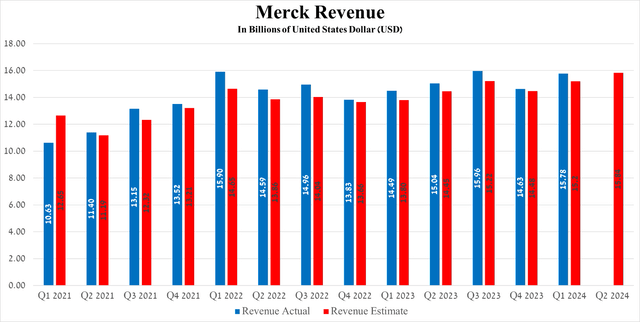

Merck’s revenue for the first three months of 2024 was $15.78 billion, up 8.9% year over year and beating analysts’ expectations by $580 million.

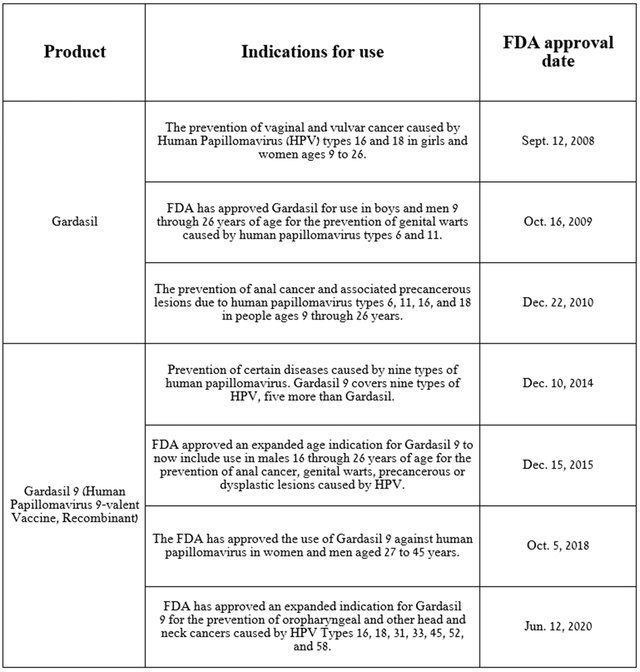

Besides Keytruda, other contributors to the company’s accelerating revenue growth are Gardasil and Gardasil 9, which are non-infectious recombinant vaccines that protect against multiple strains of the human papillomavirus (HPV).

Source: table was made by Author based on Merck press releases

The main difference between these two vaccines is that Gardasil 9 protects against nine types of HPV (6, 11, 16, 18, 31, 33, 45, 52, and 58), which is five more than Gardasil. As a result, the quadrivalent HPV vaccine provides less protection against the virus than Gardasil 9.

The danger of the human papillomavirus, which is a sexually transmitted infection, is that it can cause the development of various types of cancer, including cancer of the cervix, anus, pharynx, and more.

The CDC estimates there were approximately 43 million cases of HPV infection in 2018, and with that number steadily increasing year over year, there is an urgent need to improve people’s access to vaccinations and diagnostics against the virus. Ultimately, I believe that various immunization programs aimed at slowing the spread of this dangerous infection will become one of the key factors in the growth of sales of Gardasil/Gardasil 9.

So, sales of Gardasil/Gardasil 9 amounted to about $2.25 billion in the first three months of 2024, an increase of 14% year-on-year, mainly due to an increase in its price, as well as its extremely high efficacy in protecting against HPV, which ultimately reflected in the continued high demand for it in China and the USA.

Source: graph was made by Author based on 10-Qs and 10-Ks

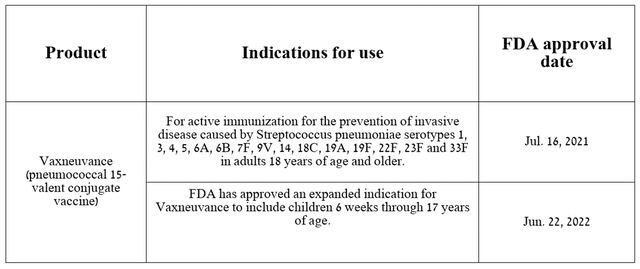

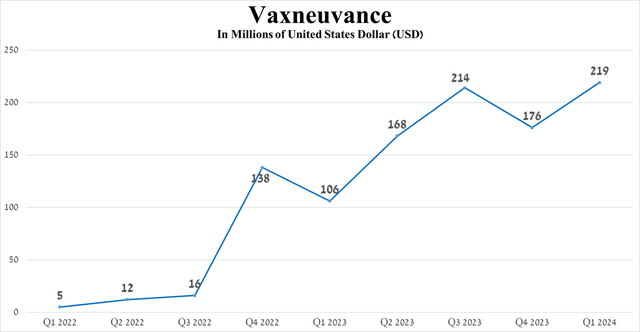

In addition, I would like to note the growing demand for Vaxneuvance, which is a vaccine approved by regulatory authorities for the prevention of invasive disease caused by several types of pneumococcus in adults and children aged six weeks to 17 years.

Source: table was made by Author based on Merck press releases

Pneumococcus is the cause of the development of numerous disorders, some of which can be extremely dangerous to health, including pneumonia, septic arthritis, bacteremia, and osteomyelitis. As a consequence, as with the human papillomavirus, there is an urgent need for active immunization against Streptococcus pneumoniae, especially among children under two years of age.

Total sales of Vaxneuvance were $219 in the first quarter of 2024, an increase of 106.6% year-over-year, driven by its ongoing launch for pediatric use in the United States, geographic expansion of its use, and competitive advantage over Pfizer’s Prevnar 13 (PFE).

Source: graph was made by Author based on 10-Qs and 10-Ks

In addition to the growth in sales of Merck’s key drugs, I believe that its management continues to effectively cope with one of the main tasks facing it, namely, minimizing the financial risks associated with the expiration of Keytruda’s patent protection in the United States in 2028 through actively expanding the portfolio of product candidates over the past year.

Based on the results of numerous clinical trials, I believe that sacituzumab tirumotecan and patritumab deruxtecan, if approved by regulatory authorities, could become the “gold standards” in the treatment of widespread cancer types such as non-small cell lung cancer, breast cancer, and endometrial cancer.

Patritumab deruxtecan is a first-in-class HER3-targeting antibody-drug conjugate that is under review by the FDA for the treatment of certain patients with EGFR-mutated non-small cell lung cancer. The U.S. health regulator’s decision will be based on the results of the HERTHENA-Lung01 phase 2 study, and its announcement is expected in less than two months.

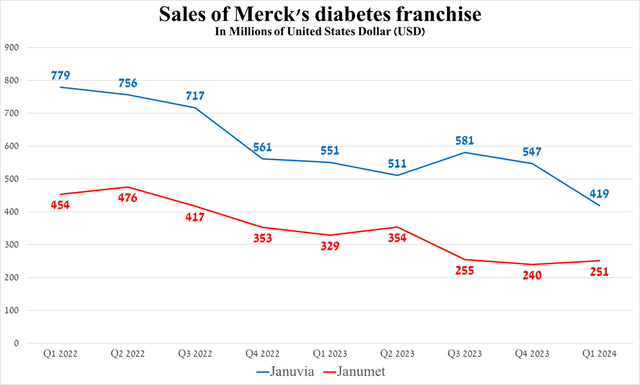

Risks

Before jumping to a conclusion, I would like to highlight some of the key financial risks that could affect Merck’s share price in the medium term. These risks include increasing U.S. annual inflation, which reduces the likelihood of the Fed cutting interest rates until the third quarter of 2024, accelerating decline in sales of Januvia and Janumet due to raised competition from generic versions in the European Union, as well as increased demand for more effective medications to treat type 2 diabetes, including Novo Nordisk’s Ozempic (NVO) and Eli Lilly’s Mounjaro (LLY).

Source: graph was made by Author based on 10-Qs and 10-Ks

Takeaway

In recent months, concerns among institutional investors about Keytruda’s patents expiring in five years have been eroded by its higher rates of sales and progress in developing its rich portfolio of experimental drugs and vaccines.

So, one of the latest positive news was the publication on April 29 of additional results from a pivotal clinical trial in which V116, a 21-valent pneumococcal conjugate vaccine, demonstrated higher efficacy compared to Pneumovax 23.

In addition, according to my estimate and analysts’ expectations, thanks to both FDA-approved medicines, as well as favezelimab, ifinatamab deruxtecan, and the label expansions for Lenvima, the company’s price-to-earnings ratio will reach 12.74x in 2025.

As a result, given that it is trading at a discount to many of its peers, and given the company’s year-on-year increase in dividend payouts, as well as its management’s active use of a share repurchase program, Merck represents an attractive asset for investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.