Summary:

- Merck stock is still a buy despite near-record stock prices.

- Thanks to its growth outlook, its current valuation is still far below the Graham P/E, leaving a wide margin of safety.

- Its well-balanced business model, top-grossing Keytruda franchise, and superb financial strength further skew the return/risk profile.

kemalbas/iStock via Getty Images

MRK stock: Still a Buy

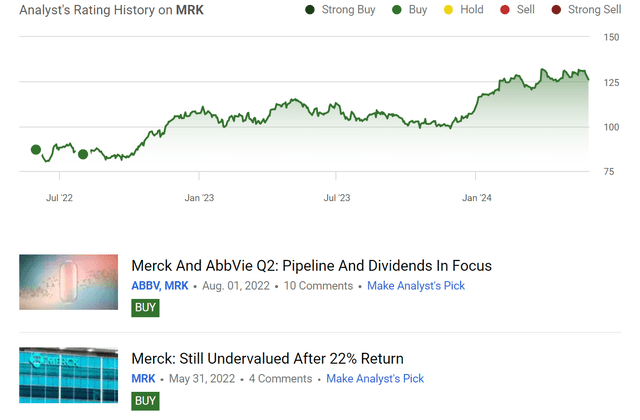

We last covered Merck (NYSE:MRK) back in July 2022 with a bullish thesis (as you can see from the chart below). At that time, the stock was trading around $75 per share at about 12.5x FWD P/E. And the bullish thesis was pretty obvious to us (with our key points quoted below).

Merck, currently priced at about 12.5x FW P/E, is still undervalued by a sizable margin. Growth from pipeline drugs and especially Molnupiravir is not properly priced in, leading to a PEG ratio of only 0.78. We anticipate strong performance in its cornerstone oncology franchise Keytruda to continue. The combination of a valuation discount and mispricing of growth potential offers excellent prospects for double-digit annual returns in the next few years. Its A+ financial strength and secular support in the long term add additional draw to conservative investors.

Seeking Alpha

The above points have all panned out with MRK. All told, MRK has delivered a total return of more than 45% since then, far outperforming S&P 500’s ~30% return. Usually, an effective bull thesis tends to undo itself. As prices rise, valuation expands and risks mount. This is certainly true for MRK in some respects. At its current price levels, the P/E ratio is about 14.6x based on its FY1 EPS, about 17% above the time we last wrote on it.

However, in the remainder of this article, we will argue that our bullish thesis is still valid despite the valiant expansion. Specifically, we will argue that the valuation is still reasonable (or even discounted) once its projected growth is factored into consideration. Specifically, its Graham P/E (more on this in the next section) is about 23.7x by our estimate, leaving a wide margin of safety at its current prices. Our other earlier considerations remained either valid (such as the success of its Keytruda franchise) or even further strengthened (such as its financial strength).

MRK’s: Growth outlook and Graham P/E

As a mature and leading company in a stable sector (that also pays consistent dividends for many years), I think it’s very reasonable to consider MRK as a typical “defensive stock” that Ben Graham described in his book The Intelligent Investor. Therefore, I will gauge its valuation following the so-called Graham’s method in the book (now named after him). More specifically,

The Graham P/E is calculated as 8.5 plus twice the expected annual growth rate. In other words, in Graham’s mind, a business that stagnates and has 0% growth potential should be worth 8.5x P/E.

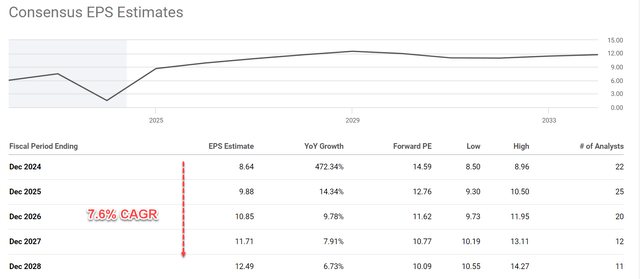

In this approach, we will need to form a growth projection first. The chart below shows the consensus EPS estimates for MRK stock in the next five years. As you can see from the chart below, the consensus EPS estimates for MRK stock show significant growth in the next few years. To wit, the EPS is expected to grow from $8.64 by the end of fiscal year 2024 to almost $12.5 by the end of fiscal year 2028. The growth will be a bit uneven, with a rate of more than 14% in fiscal year 2025, followed by a few years of continued growth rate in the upper single digits. By the way, we should ignore the 472% growth rate this year. It was caused by the charges tied to Merck’s cancer drug collaboration deal with Daiichi Sankyo, which was previously announced and widely anticipated.

All told, analysts’ estimates point to EPS growth at a compound annual growth rate (“CAGR”) of 7.6% between fiscal years 2024 and 2028. By the way, the forward P/E ratio is expected to decline in tandem to about 10x only by the end of fiscal year 2028. Here, we will use the growth rate implied by the projection to estimate MRK’s Graham P/E and explain why I agree with such projections in a minute. With a 7.6% CAGR, MRK’s Graham P/E is around 23.7x, which equals 8.5+2×7.6). Compared to its FWD P/E of 14.6x as just mentioned, this leaves a wide margin of safety despite its near-record prices.

Seeking Alpha

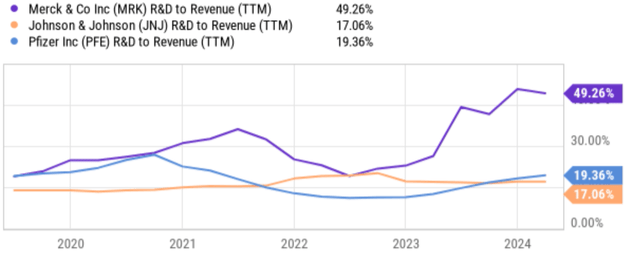

Now, let us explain the key profit drivers in our mind that could support the above growth. The top differentiating factor in our mind is its well-balanced business model and income streams. MRK focuses on a diversified portfolio across established and emerging markets. Unlike many of its peer companies that are heavily reliant on blockbuster drugs in developed markets, MRK generates a significant portion of its revenue from vaccines and established therapies in developing markets. This strategy mitigates risk by reducing dependence on any single product or geographic region. MRK also continues to invest heavily in R&D for areas with high unmet medical needs, such as oncology and immuno-oncology (as you can easily tell from the chart below). This focus on future growth areas positions MRK well to capitalize on upcoming advancements in these fields.

Thanks to such a strong portfolio and pipeline, MRK has been delivering strong results (often surpassing consensus expectations) lately. For example, its top-grossing product Keytruda saw sales surge by 21% in Q4 of 2023 on a YoY basis (to $6.61 billion) and Gardasil sales grew 27% (to $1.87 billion). The Keytruda franchise has also surpassed Pfizer’s Comirnaty COVID-19 franchise as the top-selling drug in the world in 2023. Looking ahead, we anticipate Keytruda’s momentum to continue, considering its favorable position in the market and the fact that it’s patent-protected until 2028. We also consider immunotherapy to remain a key growth engine for the next few years, driven by increased global uptake in earlier-stage indications and continued strong demand from the metastatic segment.

Seeking Alpha

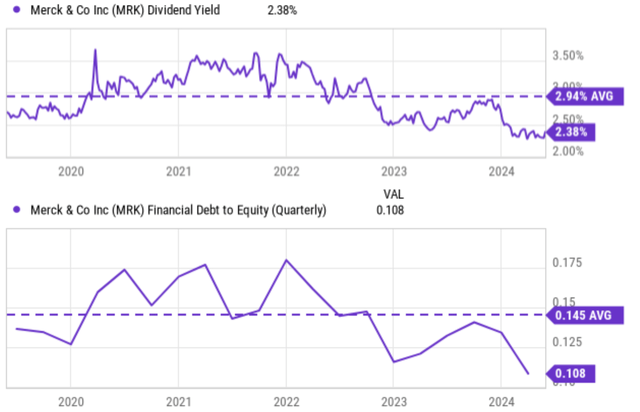

Other risks and final thoughts

In terms of downside risks, MRK shares two of the most crucial risks with its peers: Clinical trial failures and drug pricing pressures. Unsuccessful clinical trials can significantly delay or even derail promising drugs, leading to revenue shortfalls and stock price declines. Increasing scrutiny of drug pricing by governments and payers (which has been a sensitive political issue in recent years in our view) can squeeze profit margins. In addition to these common risks, MRK also faces some distinct challenges. Its large portfolio in developing markets exposes it to currency fluctuations and potential political instability. In terms of valuation, other metrics could send a contraction signal to our assessment above. For example, in terms of dividend yield, the stock’s current yield is near the lowest level in at least five years, as you can see from the top panel of the chart below, indicating overvaluation. However, given its relatively low payout ratio (about 35% on FY1 EPS), we do not think it’s a good idea to rely too heavily on yield as a valuation metric here. Also, the company has been allocating a substantial portion of its capital toward shoring up its balance sheet (see the bottom panel) and growing its book value in recent years, which is a good move in our view. As a result, it’s totally reasonable for its dividend growth to lag behind its EPS growth and dividend yield to be below its historical average.

To conclude, MRK still presents a compelling buying opportunity in our view despite the large price advancements since our last coverage. In a nutshell, we still see an excellent package of growth and value. Admittedly, the valuation has expanded somewhat since our last writing, from about 12.5x FWD P/E then to about 14.6x now. But the valuation is still reasonable once its growth potential is factored in, such as by the Graham P/E. The other considerations in our earlier thesis have either remained valid or even further strengthened since our earlier coverage, such as the momentum of its Keytruda franchise and its financial strength.

Seeking Alpha

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.