Summary:

- Merck & Co., Inc. trades at a higher valuation than its peers, but there’s a good reason for that.

- Merck has some of the best-selling drugs in the world, while having key patents that last till the end of the decade to protect sales.

- We expect Merck to continue its strength and be able to provide some substantial shareholder returns.

Marko Georgiev

Merck & Co., Inc. (NYSE:MRK) is one of the largest global pharmaceutical companies at an almost $300 billion market capitalization. The company’s share price has been incredibly strong recently. However, despite that, as we’ll see throughout this article, the company should be able to continue driving substantial shareholder returns.

Merck 1Q 2023 Results

The company posted strong 1Q 2023 results in April, showing its strength.

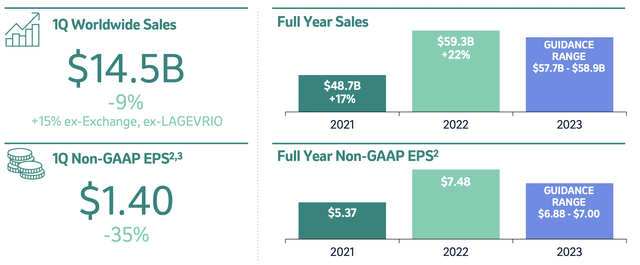

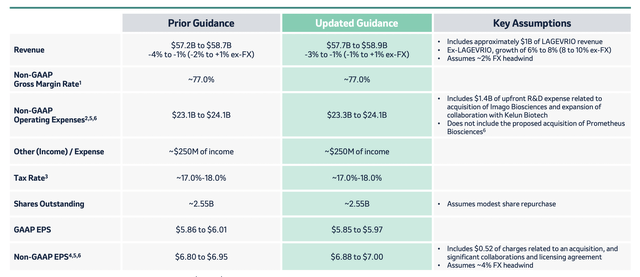

The company had $14.5 billion in 1Q 2023 sales. The company’s guidance remains just over $58 billion in sales for the year, a small YoY decrease, with EPS targeted for $6.94 / share. That would give the company a P/E of just over 15, highlighting its relatively low variation, especially presuming the company can continue its growth.

The company’s human health revenue was $12.7 billion, while its animal health revenue grew slower and was at $1.5 billion. The company had strong double-digit growth in its core human health portfolio, outside of Lagevrio (its COVID-19 drug), which makes sense given the trend of the pandemic.

Merck Oncology

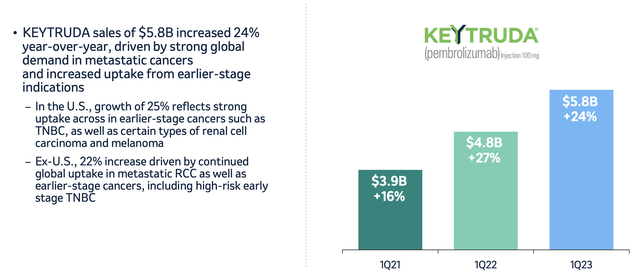

The company’s oncology portfolio remains key, specifically Keytruda.

Keytruda has strong patent protection, with no expected threats for the next 5-years at least. The drug is expected to keep growing into 2026+ and we expect revenue to continue growing. The drug continues to achieve new indications, and we expect that growth to continue at least into the latter half of the decade, making Keytruda a major earnings driver.

Additionally, even when patents expire, we expect competition to take several years to ramp up, providing a nice tailwind.

Merck Vaccines

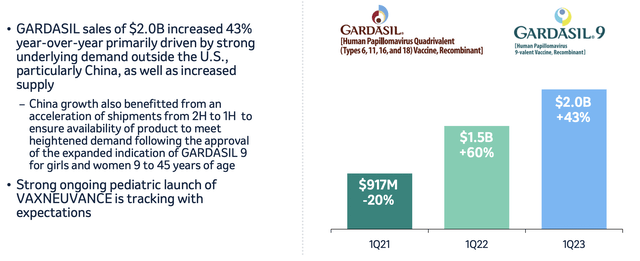

Gardasil, as a vaccine, is another market where Merck is a leader.

Sales have continued to increase dramatically, especially outside the U.S., with new indications and a ramp up in demand. Sales have annualized at $8 billion, and this is another drug where the company has patent protection until the late-2020s. That will also help to protect patent revenue and earnings for the company, highlighting its strength.

Merck’s Other Businesses

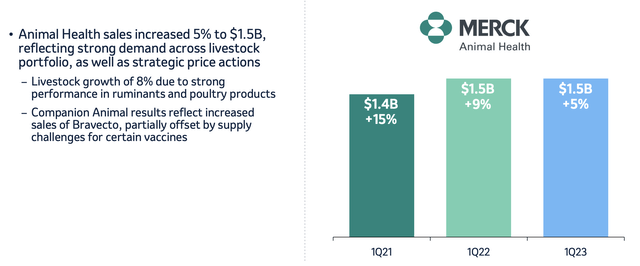

The company’s other businesses such as animal health also remain strong.

For the company, animal health provides a strong source of diversification, with much less volatility due to government / population dynamics. Demand remains strong for the company. The company has had some supply challenges, but overall, we expect this business to maintain its modest strength and continued growth.

Merck FY 2023 Guidance

Putting this all together, the company’s 2023 guidance, which we partially discussed above, should enable increased shareholder returns.

Merck expects strong margins and modest share repurchases to have roughly 2.55 billion outstanding shares. The company has a share price of just under $111, with a GAAP P/E of 18.6, and a non-GAAP P/E of 16. That’s a relatively low valuation given that we expect the company’s earnings to grow going into the end of the decade.

The company’s growth will also be supported by Prometheus Biosciences, a more than $10 billion acquisition, that will increase the company’s pipeline candidates and enable the company to increase shareholder returns.

Thesis Risk

The largest risk to our thesis flows from Merck’s exciting portfolio and long-term patents for many of its key drugs. That means the company trades at a higher valuation, one that it needs to continue to succeed with to justify. That means failures in its pipeline could impact Merck more and hurt its ability to drive future returns.

Conclusion

Merck & Co., Inc. has a higher valuation than some of its competitors. The company’s P/E ratio based on not only its best-selling drugs and vaccines, such as Gardasil and Keytruda, but the fact that it has patents going into the end of the decade. That means that the company’s revenue and profits will likely grow from current levels, at least from a few years.

Merck has the issue that it will need to build a portfolio going into the end of the decade. The Prometheus Biosciences acquisition at more than $10 billion will help with that. We expect Merck & Co., Inc. will continue its growth, making MRK stock a valuable investment at this time. Let us know your thoughts int he comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MRK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.