Summary:

- Merck has a strong track record of financial performance and a diverse product portfolio.

- With a strong commitment to research and development, Merck can stay at the forefront of the industry.

- With fair valuation and manageable risks, Merck is a good option for investors looking to generate long-term growth.

Sundry Photography

Introduction

As a dividend growth investor, my strategy is to seek new opportunities to invest in income-generating assets continuously. I frequently add to my current investments when I believe they are reasonably priced, and I also take advantage of market fluctuations by initiating new positions to broaden my portfolio. I try to take advantage of the current volatility to acquire income for less capital.

The healthcare sector is an exciting area for investment, especially during volatile times. The pharmaceutical industry is a significant part of the healthcare sector and offers investors many opportunities. Merck (NYSE:MRK) is a company worth considering among the companies in this sector. It has a long track record of success and a history of providing innovative products and treatments to patients. I own shares of Merck in my dividend growth portfolio, and I will analyze it again today.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Merck operates as a healthcare company worldwide. It operates through two segments, Pharmaceutical and Animal Health. The Pharmaceutical segment offers human health pharmaceutical products in oncology, hospital acute care, immunology, neuroscience, virology, cardiovascular, and diabetes, as well as vaccine products, such as preventive pediatric, adolescent, and adult vaccines. The Animal Health segment discovers, develops, manufactures, and markets veterinary pharmaceuticals, vaccines, and health management solutions and services, as well as digitally connected identification, traceability, and monitoring products.

Fundamentals

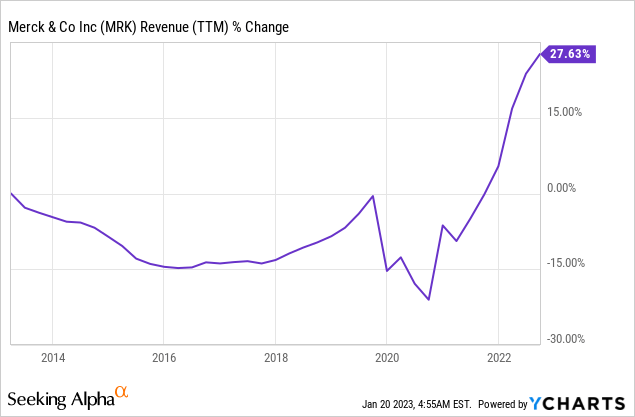

Merck has had a decent financial performance over the last decade, with revenues growing by 27%. This growth can be attributed to both organic and inorganic strategies. The company has had a robust pipeline of new products and treatments, which has helped to drive organic growth. Merck has also been active in pursuing inorganic growth through strategic acquisitions. One example is the acquisition of Imago, which has significantly expanded Merck’s product portfolio in the cancer therapeutics space. In the future, as seen on Seeking Alpha, the analyst consensus expects Merck to keep growing sales at an annual rate of ~8.5% in the medium term.

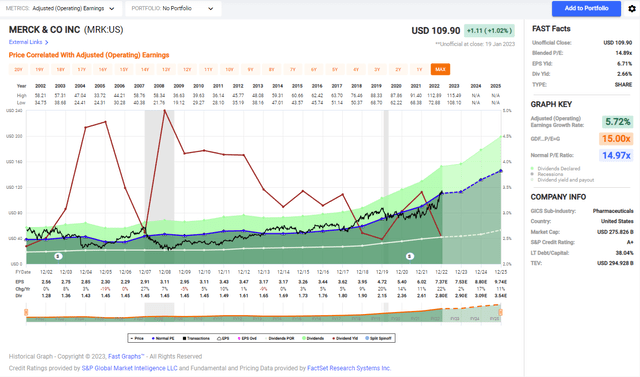

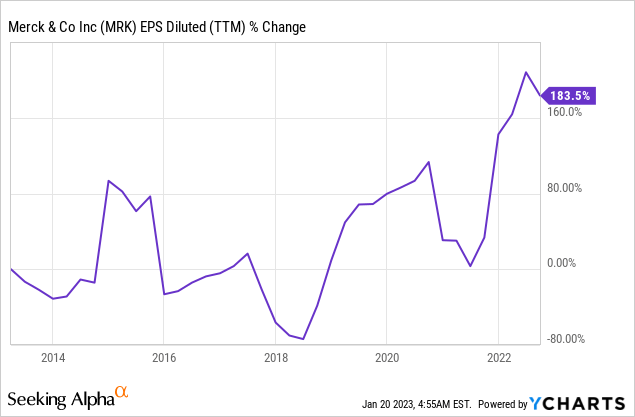

Merck has seen an impressive increase in EPS (earnings per share) over the last decade, with an increase of 184%. This growth can be attributed to various factors, including revenue growth, improved margins, and share buybacks. The company’s strong revenue growth has led to an increase in earnings, and this has been further boosted by margin expansion. The company’s strong performance in terms of EPS is a positive indicator for investors and suggests that the company is well-positioned for future growth. In the future, as seen on Seeking Alpha, the analyst consensus expects Merck to keep growing EPS at an annual rate of ~13% in the medium term.

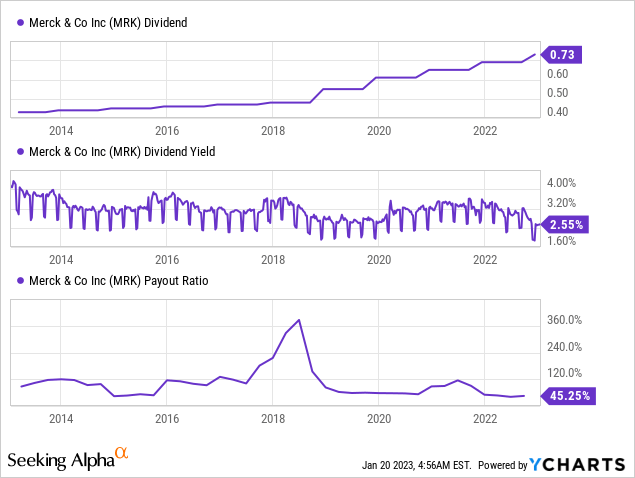

The dividend is one of Merck’s most significant advantages. The company has been paying a dividend without reducing it for over fifty years. Over the last decade, the dividend payment has increased annually, and in the previous five years, the CAGR was 7%. The dividend payment seems safe and unlikely to be cut as the current payout ratio is 50%. The entry yield is decent at 2.66%, with future growth prospects intact.

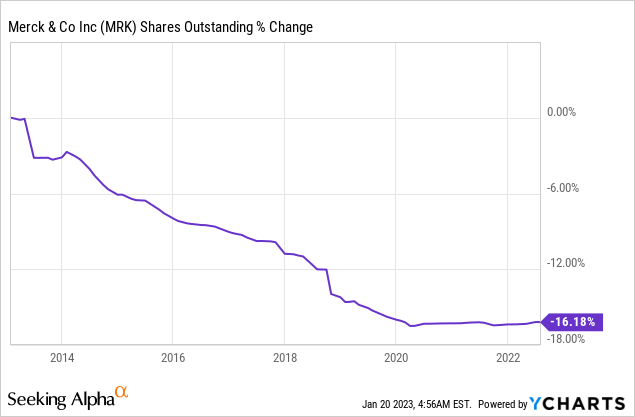

In addition to the dividends, Merck has also been active in buying back shares, which has helped to increase EPS by reducing the number of outstanding shares by 16% over the last decade. The company has employed this strategy to boost EPS and enhance the value for its shareholders. Buybacks are highly effective when the share price is low, as each dollar invested buys more of the float.

Valuation

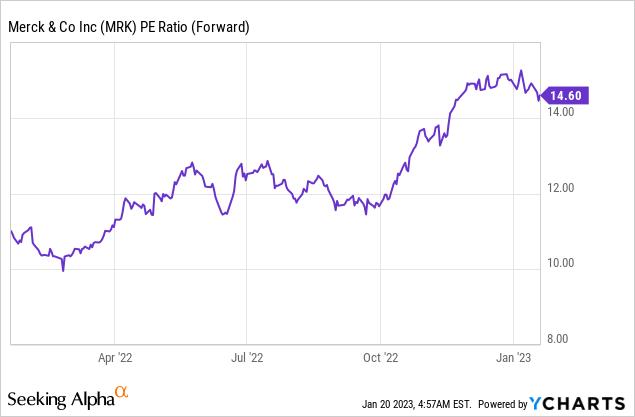

When looking at the forecasted EPS for 2023, Merck’s P/E (price to earnings) ratio is 14.6. While this ratio is higher than it has been in the past twelve months, it is still considered attractive for a growing company. A P/E ratio of 14.6 is lower than the average P/E ratio for the broader market. Additionally, with forecasted growth in earnings and a relatively low P/E ratio, the company has room for growth, which can be rewarding for investors.

The graph below from FAST Graphs shows that Merck is at least fairly valued. Over the last two decades, the average P/E ratio was 15, which is almost in line with the current valuation. During that period, the EPS grew at an annual pace of nearly 6%, and today’s growth rate is faster at 14%. Therefore, while the current valuation seems in line, the growth rate is very promising and may leave room for P/E expansion.

Merck has strong fundamentals with a good track record of financial performance. Revenue growth led to EPS growth which fueled both dividends and buybacks. With a P/E ratio of 14.6, it appears to be fairly valued, making it an exciting opportunity for investors. As with any investment, it is necessary to analyze the company’s prospects and risks, and if they are compelling, Merck might be attractive.

Opportunities

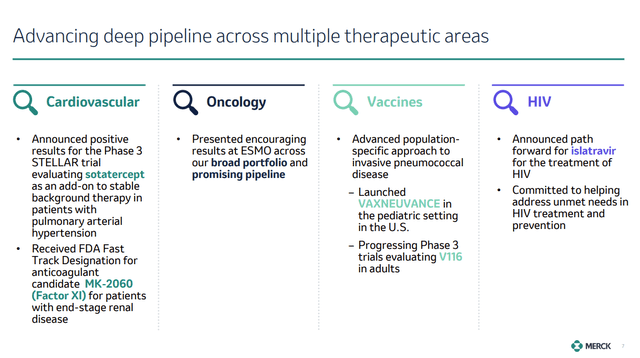

One growth opportunity for Merck is the company’s diverse product portfolio. Merck has a wide range of pharmaceutical products, including those for treating cancer, diabetes, and heart disease. This diversification helps mitigate risk for investors, as the company is not overly reliant on any product or therapeutic area. Additionally, the company has a strong pipeline of new products that could drive future growth.

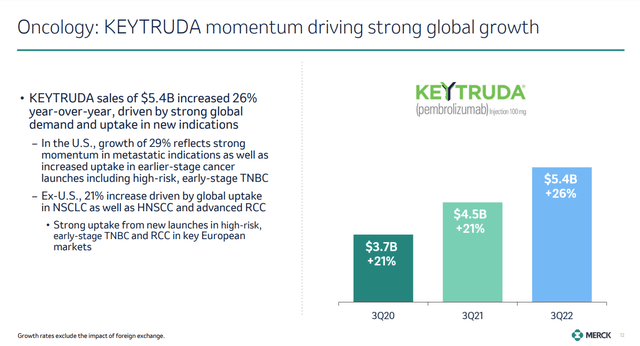

Another reason to invest in Merck is the opportunity presented by Keytruda, the company’s flagship cancer immunotherapy drug. Keytruda has been approved for treating multiple types of cancer, including lung, head and neck, and melanoma, and has demonstrated strong efficacy in clinical trials. The drug is also being investigated in over 600 ongoing clinical trials, suggesting that its potential could be even greater than what is currently known. The drug sales reached $5.4B in Q3, a 26% compared to Q3 2021, which also showed a 21% increase over Q3 2020.

A third reason to invest in Merck is the company’s commitment to research and development. Merck has a significant R&D budget and a strong track record of innovation. It has led to the development of new, cutting-edge treatments that have helped to drive the company’s financial performance. The company’s investment in R&D also suggests a commitment to staying at the forefront of the industry, which can provide long-term benefits for investors. Merck spends almost twice on R&D than its dividend payment spending, showing its focus on innovation.

Risks

One risk to investing in Merck is the company’s reliance on Keytruda. While Merck has a diverse product portfolio, the company’s financial performance is heavily dependent on sales of Keytruda. In Q3 2022, Keytruda accounted for 36% of the sales. Suppose Keytruda experiences a decline in sales due to its patent cliff in 2028 or face competition from other drugs. In that case, it could significantly negatively impact the company’s financial performance. It is a significant risk for the company as it heavily depends on the sales of Keytruda for its revenue.

Another risk to investing in Merck is the company’s exposure to regulatory and legal challenges. The pharmaceutical industry is heavily regulated, and companies are subject to various laws and regulations. Merck has faced legal challenges, including lawsuits related to the safety and efficacy of some of its products. These challenges can be costly and time-consuming, damaging the company’s reputation and hurting its financial performance.

Another risk to investing in Merck is the competition. The pharmaceutical industry is highly competitive, and Merck faces competition from large, established, and smaller emerging firms. This competition can take the form of new drugs developed by rival companies or price competition from generic drugs. Additionally, the company faces increasing competition from biosimilars, which are cheaper alternatives to some of Merck’s drugs. This competition can lead to a decrease in pricing, market share, and revenue for the company.

Conclusions

Merck has strong fundamentals, a good track record of financial performance, a diverse product portfolio, and a solid commitment to research and development. With a P/E ratio of 14.6, it appears to be fairly valued, which makes it an exciting opportunity for investors. The company has decent growth opportunities, both from the existing product portfolio and pipeline. However, there are some risks involved. But the company’s track record and strategies to manage the risks can provide a level of comfort for investors.

Merck is an excellent addition to dividend growth portfolios looking for stability and reliability. Therefore, overall, Merck is a BUY for investors looking for a well-managed company with the potential for long-term growth. The company has five years to deal with diversifying its reliance on Keytruda. The company will be a STRONG BUY if the share price reaches again $90-$100.

Disclosure: I/we have a beneficial long position in the shares of MRK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.