Summary:

- Despite the increasing number of emerging challenges for the pharmaceutical industry, the management teams at GSK and Merck are successfully coping with them.

- GSK’s revenue was $9.12 billion in the second quarter of 2023, up 8.1% year-over-year, beating analysts’ estimates by $0.38 billion.

- Meanwhile, Merck’s revenue continued to grow quarter over quarter and reached approximately $15.04 billion for the three months ended June 30, 2023.

- For GSK, sales of Cabenuva were $219 million in the second quarter of 2023, an increase of 140.7% year over year.

- For Merck, sales of Keytruda were approximately $6.27 billion in the second quarter of 2023, an increase of 19.4% year-over-year due in part to increased indications for use and raised demand for treatment of patients with non-small cell lung cancer and breast cancer.

skynesher/E+ via Getty Images

GSK (NYSE:GSK) is a British pharmaceutical company leading in developing vaccines against numerous viruses. In addition, demand for its drugs for treating HIV and respiratory diseases continues to grow yearly, thanks to maintaining competitive advantages. Merck (NYSE:MRK) is a recognized leader in cancer treatment and played a key role in the fight against the COVID-19 pandemic in 2022, supplying Lagevrio, which saved the lives of tens of thousands of people.

However, between these companies, only one stands out with a more extensive portfolio of experimental drugs and vaccines, a higher dividend yield, and lower total debt. This last aspect is crucial in light of the intentions for global central banks to increase interest rates further to counter inflation.

Financial position of Merck vs. GSK

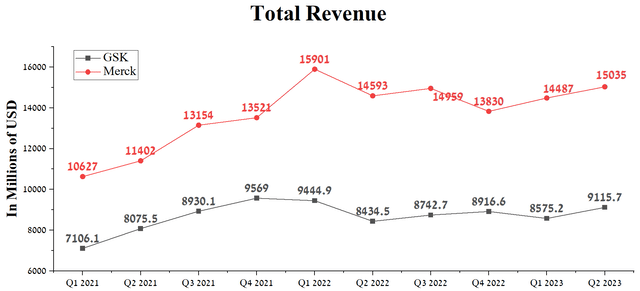

GSK’s revenue was $9.12 billion in the second quarter of 2023, up 8.1% year-over-year, beating analysts’ estimates by $0.38 billion. Meanwhile, Merck’s revenue continued to grow quarter over quarter and reached approximately $15.04 billion for the three months ended June 30, 2023. Moreover, the company’s actual revenue beat analysts’ consensus estimates in nine of the last ten quarters, outperforming GSK on that metric by just one quarter.

Author’s elaboration, based on Seeking Alpha

As a result, this is the first signal indicating that both companies are effectively adapting to rapidly changing market conditions, identifying and implementing growth opportunities. Despite the numerous challenges arising due to the entry into force of President Biden’s Inflation Reduction Act, GSK and Merck remain among the leaders in the pharmaceutical industry.

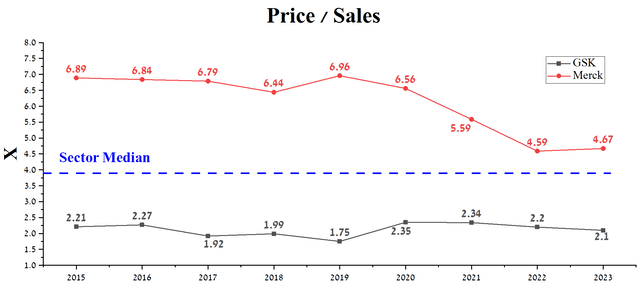

Merck’s price/sales ratio [TTM] is 4.67x, which is not only higher than the healthcare sector average but also 5.49% higher than the average over the past five years. While both companies have similar revenue growth rates, GSK’s price/sales ratio is significantly lower at 2.05x. The continued low value of this financial indicator is caused, among other things, by institutional investors’ concerns about the impact of the ongoing legal battles over Zantac-related lawsuits on GSK’s margins.

Author’s elaboration, based on Seeking Alpha

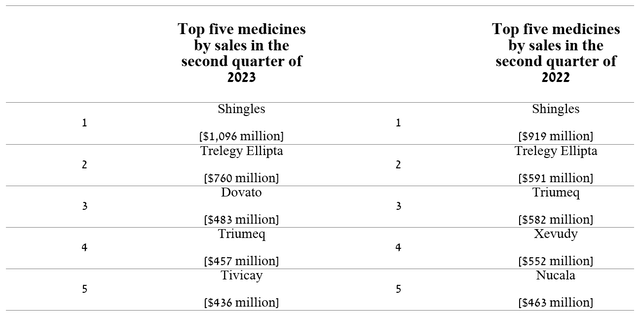

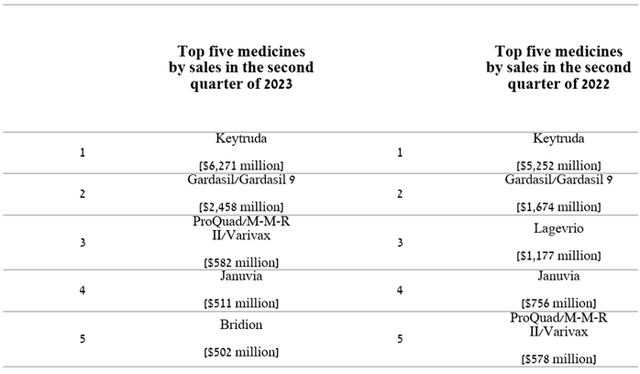

Although both companies’ portfolios are diversified and have first-class drugs, only a specific part of them is strategically important to maintain an aggressive R&D policy, increase dividend payouts, and expand the portfolio of product candidates by acquiring pharmaceutical companies. So, GSK’s best-selling products in 2022 and 2023 were as follows.

Author’s elaboration, based on quarterly securities reports

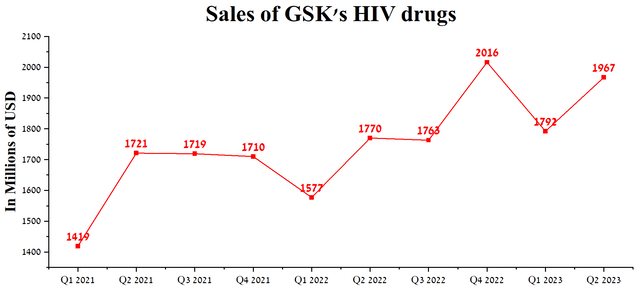

Despite the lack of sales of Xevudy, a monoclonal antibody used to treat COVID-19, GSK’s revenue growth slowed only slightly. Key contributors to improving the company’s financial position were Shingrix, a vaccine to protect against shingles, and medicines to combat HIV. GSK’s total HIV product sales totaled $1.97 billion in the second quarter of 2023, up 11.1% year-over-year, driven by rising prices and increased demand for oral medications such as Dovato (dolutegravir/lamivudine) and Juluca (dolutegravir/rilpivirine), despite competition from Gilead Sciences’ Biktarvy (GILD) and the appearance of generic versions of Truvada on the market.

Author’s elaboration, based on quarterly securities reports

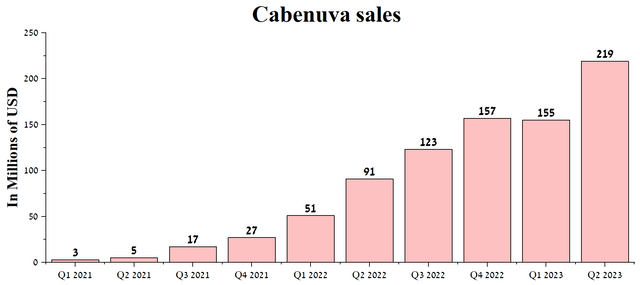

In addition, Cabenuva (cabotegravir/rilpivirine) continues to raise its share of the global HIV drug market due to its significant competitive advantage over daily oral pre-exposure prophylaxis (PrEP) options (FTC/TDF pills). The benefit is that patients only have to take Cabenuva once every two months, whereas other competing medications require daily administration. As a result, GSK’s drug significantly contributes to improving the quality of life of HIV-infected patients even though they will need to manage this condition for the duration of their lives.

Sales of Cabenuva were $219 million in the second quarter of 2023, an increase of 140.7% year over year. Simultaneously, we anticipate the drug’s sales will maintain a positive growth trajectory over the next few years. First of all, this growth will be achieved through its commercialization in new markets and an increase in the number of indications for use.

Author’s elaboration, based on quarterly securities reports

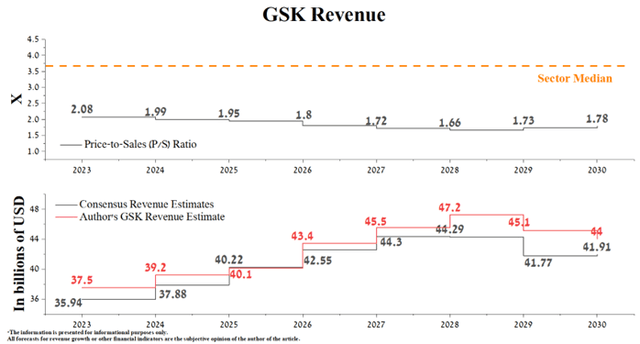

According to Seeking Alpha, GSK’s revenue for 2023 is expected to be $35.18-$36.74 billion, slightly less than analysts’ expectations for 2022. At the same time, according to our model, the total revenue of the British pharmaceutical company will be above the median value of this range and will be $37.5 billion. This growth will be primarily fueled by the launch of Arexvy, a respiratory syncytial virus (RSV) vaccine for older people, and stronger sales of Trelegy Ellipta and Jemperli.

At the same time, by 2028, we expect the company’s total product sales to reach more than $47 billion not only due to the expansion of indications for the use of its already approved medicines but also through the commercialization of such revolutionary product candidates. Some of GSK’s key gems are cobolimab, camlipixant, and depemokimab, which is a long-acting anti-IL-5 monoclonal antibody that is being developed to treat severe eosinophilic asthma, hyper-eosinophilic syndrome and chronic rhinosinusitis with nasal polyps.

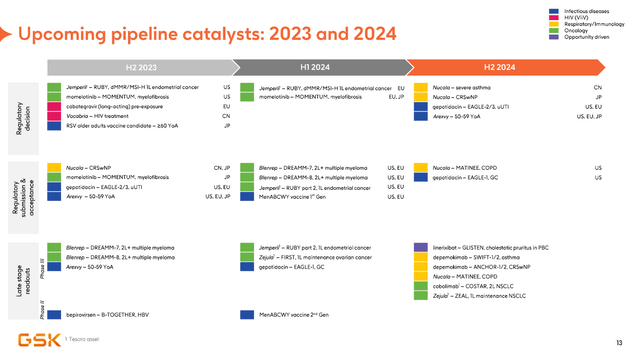

Q2 2023 Pipeline assets and clinical trials report

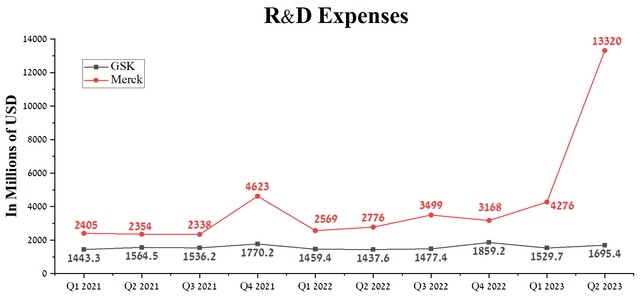

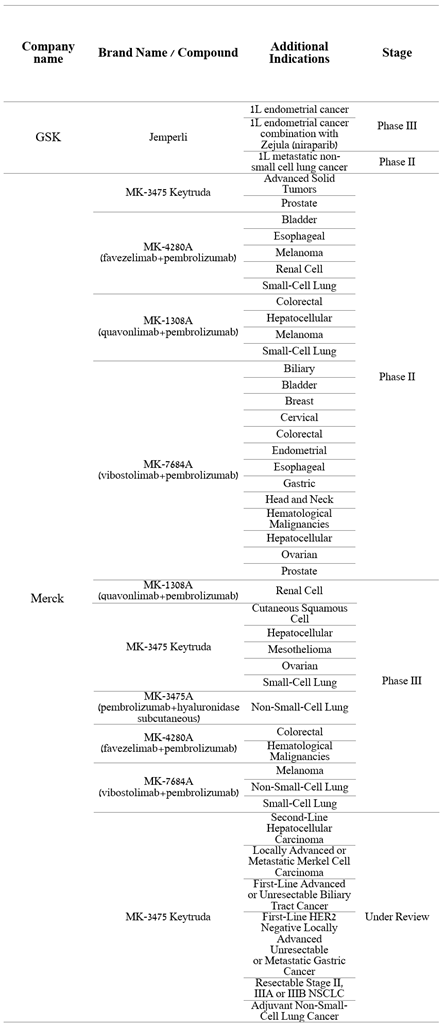

Merck and GSK continue to expand their portfolio of experimental drugs primarily to minimize the potential decline in sales of their blockbusters due to the loss of their exclusivity over the next five years. As a result, both companies’ R&D expenses continue to increase yearly even as concerns about further interest rate hikes by central banks remain, which puts pressure on both companies’ margins. In mid-April 2023, Merck completed the acquisition of Prometheus Biosciences for $10.8 billion, the goal of which was to reduce the share of oncology drugs in the company’s portfolio and enter the fast-growing global autoimmune disease therapeutics market.

Author’s elaboration, based on Seeking Alpha

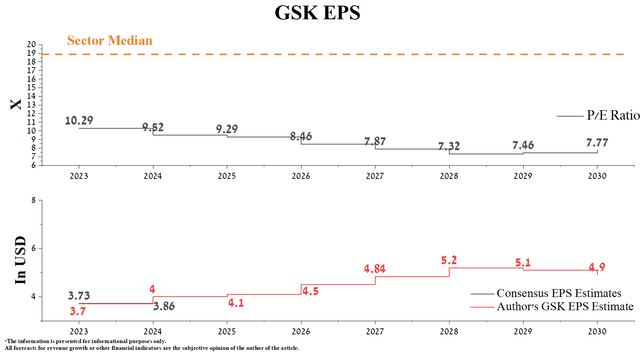

GSK’s earnings per share (EPS) for 2023 are expected to be $3.72-$3.73, up 8.4% from the prior year. According to our model, GSK’s EPS for 2023 will be slightly lower and amount to $3.70 even despite the disastrous sales of Zejula (niraparib), which is a once-daily PARP inhibitor. However, thanks to the launch of next-generation medicines for the treatment of patients with cancer and the expansion of the vaccine portfolio, this financial figure will increase to $4.90 by 2030. Given GSK’s current share price, its P/E ratio would then be below 8x, which is one of the factors indicating that Mr. Market is significantly undervaluing the company relative to other pharmaceutical companies.

On the other hand, Merck’s top-selling medicines in 2022 and 2023 were as follows.

Author’s elaboration, based on quarterly securities reports

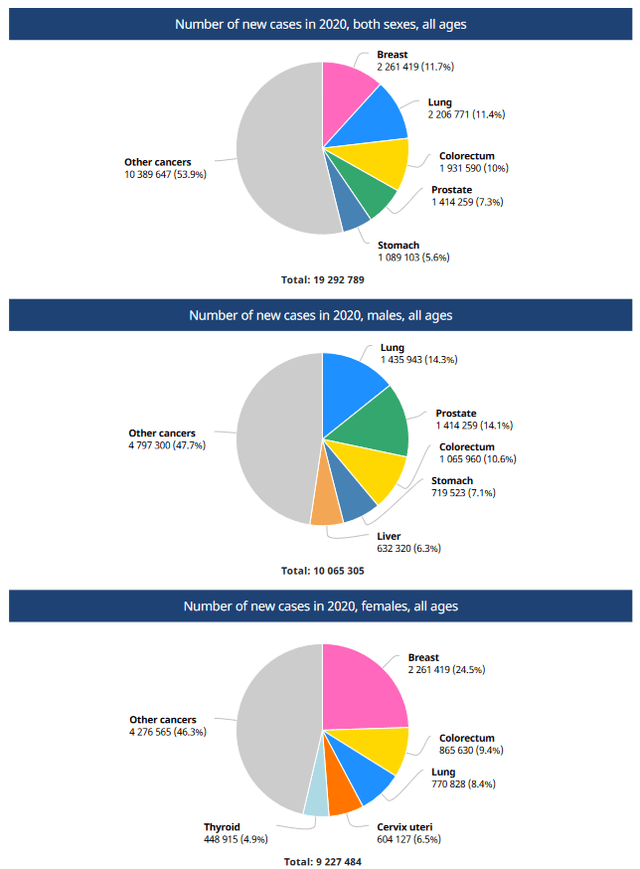

Unlike GSK, the strength of Merck’s portfolio is drugs aimed at combating cancer, which continue to affect millions of people worldwide every year and thereby opens up significant commercial opportunities for pharmaceutical companies, which earn tens of billions of dollars from their treatment.

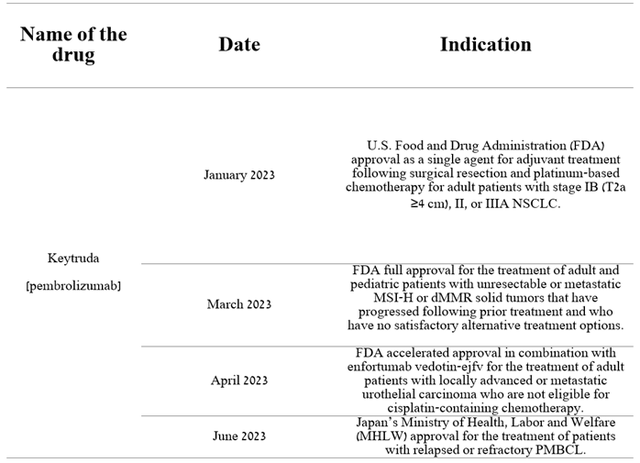

In recent years, Merck’s top-selling drug has been Keytruda (pembrolizumab), an immune checkpoint inhibitor whose mechanism of action is based on blocking the PD-1 pathway. Sales of Keytruda were approximately $6.27 billion in the second quarter of 2023, an increase of 19.4% year-over-year due in part to increased indications for use and raised demand for treatment of patients with non-small cell lung cancer and breast cancer.

Author’s elaboration, based on 10-Q

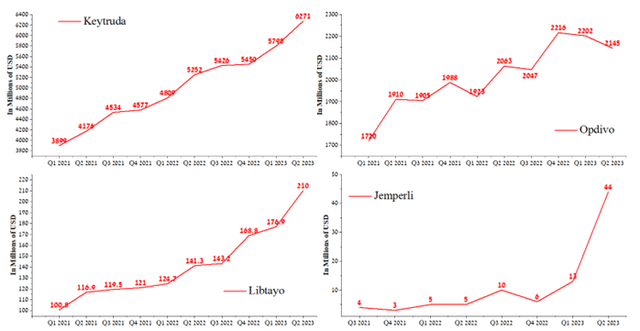

Despite the increase in GSK’s Jemperli sales to $44 million in the second quarter of 2023, Merck’s product remains the leader in the global PD-1 and PD-L1 inhibitors market, even taking into account the expansion of the label of such drugs as Regeneron Pharmaceuticals’ Libtayo (REGN) and Bristol Myers Squibb’s Opdivo (BMY).

Author’s elaboration, based on quarterly securities reports

Moreover, the clinical research program in which pembrolizumab is involved is much richer than Jemperli, which again is an advantage for Merck relative to GSK in the global anticancer drugs market.

Author’s elaboration, based on quarterly securities reports

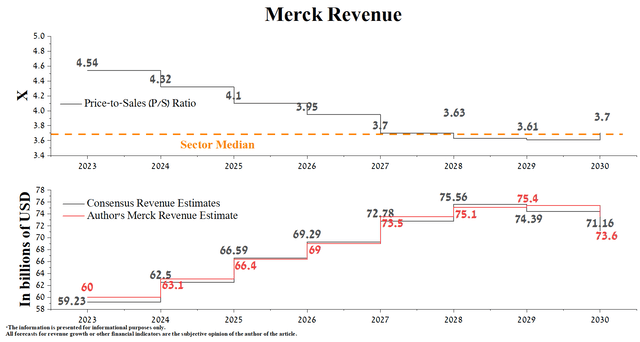

According to Seeking Alpha, Merck’s revenue for 2023 is expected to be $58.5-$60.2 billion, which is slightly higher than analysts’ expectations for 2022. At the same time, under our model, the total revenue of the leader in the treatment of oncology diseases will be $60 billion, mainly due to stronger sales of Keytruda and Gardasil/Gardasil 9.

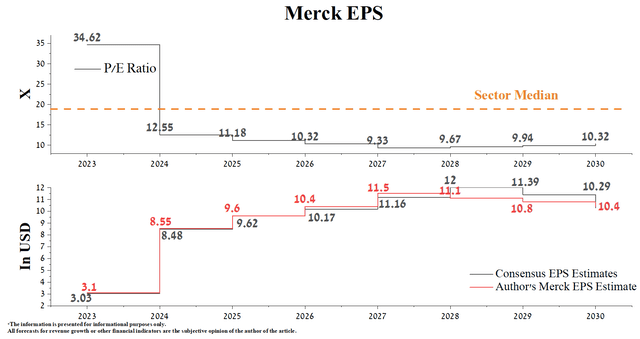

Merck’s 2023 EPS is expected to be $2.80-$3.22, down 59.1% from analysts’ expectations for the prior year due to the acquisition of Prometheus Biosciences. At the same time, we expect the company’s EPS for 2023 to be slightly higher than its guidance of $2.95-$3.05.

However, Merck’s Non-GAAP P/E [FWD] is 34.62x, which is 84.43% higher than the sector average and 131.14% higher than the average over the past five years. Given the company’s current share price of $106.70, the use of its share repurchase program, and our expected growth in its net income, the Non-GAAP P/E will decline to 10.32x by 2030.

Conclusion

Despite the increasing number of emerging challenges for the pharmaceutical industry, the management teams at GSK and Merck are successfully coping with them. GSK is a leader in developing vaccines against numerous viruses and medicines to treat HIV and respiratory diseases. While Merck is a recognized leader in treating oncological disorders, the demand for its drugs is snowballing due to numerous advantages over the products of such giants of the healthcare sector as AbbVie (ABBV) and Pfizer (PFE).

While we continue our analytics coverage of both companies with an “outperform” rating, GSK has a more diversified portfolio of experimental drugs and vaccines, a higher dividend yield, and lower total debt. As a result, we believe that GSK is a more promising asset in the long term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.