Summary:

- Merck is a legacy drugmaker with a history of fat margins and occasional robust growth.

- The company is entering a new growth phase, making it a good investment opportunity.

- Merck has a low forward P/E ratio and strong growth prospects, making it suitable for retirees and investors approaching retirement.

- Investors can expect a 5.5% dividend hike in late November.

Erik S. Lesser

It might not be the sexiest business of all — researching, developing and selling medical drugs, but it sure has been lucrative over the decades. Merck (NYSE:MRK) is one of those legacy drug makers that has been enjoying fat margins and, at least occasionally, robust growth. Now it seems this company is entering a new growth phase, and investors have the chance to get in at a decent price.

I have not previously covered Merck, but analyzing the company, I find it to be a good combination of decent valuation, solid profitability and robust prospects for growth. This company is a stock particularly suitable for retirees and investors looking to retire over the next ten or so years.

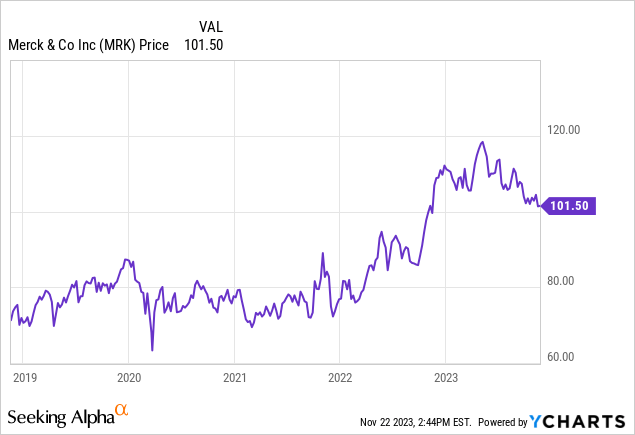

The stock is up 43% over the last five years. That is 7.4% on average per year. Decent, but not something to throw your hat off to. On the positive side, the volatility is fairly low, so you can sleep pretty well at night with this stock. Also on the positive side: This company has paid a pretty handsome dividend around the 3% mark over these years, which brings the total annual return up to 10.6%. This is equivalent to long-term average stock market returns.

Historical Dividend Growth

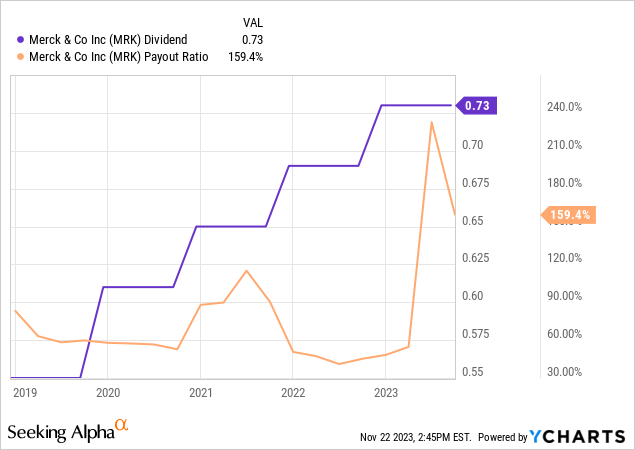

If this company is anything, it is a solid dividend payer. It has had its ups and downs, but it has continuously raised its dividend since December 2011 when the dividend was raised from $0.38 to $0.42 or 10.5%. For many years, though, it was only raised by a cent every year, until December 2018 when it was raised by a full 14.6%. Over the last five years the dividend has grown from $0.48 to the current level of $0.73, which is an average annual growth rate of 8.7%. Not quite double-digits, but getting darn close.

We can see the dependable annual hiking cycle in the purple line above. The slightly more erratic line is the payout ratio, which has varied from a low of 40% to a high of 210%. This is impacted by one-off items to earnings and is thankfully on the way down. Quarterly EPS has been just above $2 lately so a dividend of $0.73 would entail a payout ratio of about 36%. Further back we can also see that the ratio has usually been between 40% and 90%. If the current trend of a sub 50% payout ratio persists, there is no need to worry.

Such a payout ratio would leave a lot of room for investments in R&D as well as money for potential add-on acquisitions of companies with promising drug pipelines, which would again fuel future EPS growth. It looks like the company follows a fairly conservative payout strategy, emphasizing dependable dividend growth, but with a conservative payout ratio.

November Dividend Hike

In recent years, the annual dividend increase has been announced in late November, and I expect an announcement in late November or early December this year as well. The exact timing is not as important as the magnitude of the potential dividend increase. In order to gauge that potential, we have to look at the company’s financials.

In late October, the company announced its Q3 results. And the results looked pretty good. Sales growth year-over-year was 7% with the key drug Keytruda growing at a robust 17% rate to $6.3 billion. Non-GAAP EPS landed at $2.13. It also raised its sales outlook for fiscal year 2023 and provided a mid-range EPS guidance for the year of $1.36. This number includes a negative upfront charge of $1.70 per share related to the collaboration agreement with Daiichi Sankyo.

It seems the company is capitalizing on its high-margin and high-growth products like Keytruda and Gardasil as well as proactively collaborating with others — like Daiichi Sankyo — in order to broaden its pipeline. What’s more, looking ahead into next year when the one-off items have worn off, we should expect the latest quarterly earnings figure north of $2 per share to be the new normalized level. That means ample room for a higher dividend as well as money for the most important thing of all: Reinvestment in the business.

If you were truly bearish, you could make an argument for not hiking — or even cutting — the dividend this year, on the back of this year’s low earnings number. I am not worried about that. Most Boards are able to see beyond the current slump. Given the track record this company has built over many years now, I expect the absolute minimum would be an increase of one cent, in line with the dismal years between 2011 and 2017.

If we view Q3 in isolation, EPS was up 15% from a year ago. Even though there are always some differences between the quarters, the pharmaceutical industry is less seasonal than most other industries. Annualizing the latest quarterly figure gives us an EPS of $8.52, whereas it was $7.48 last year — a growth rate of 14%. I would view that as the bullish potential for a dividend increase.

Looking at recent history as a guide, we can see that the three latest increases were increases of $0.04 per share per quarter. If that were to happen, the new dividend would be $0.77 for an increase of 5.5%. That would mean a payout ratio of 36% if we assume the EPS of $8.52 above. More than conservative if you ask me. Though I think this is on the low side, I also think the Board will be a bit cautious this year as the company’s reported earnings in FY2023 will be subpar. Perhaps next year the Board will be confident enough to really boost the dividend, but it is too early yet. My prediction is therefore a new dividend of $0.77 for a 5.5% increase.

Risk Factors

This industry requires a boat load of R&D spending, either directly or via acquisitions. Over the past twelve months Merck spent $10.1 billion on R&D. This number will only have to grow in coming years, in order to replace blockbusters such as Keytruda. If such enormous investments do not pay off, that money is lost forever. Investments are upfront, the payoff comes way later — maybe.

Regulation is another major risk factor for big pharma. Most countries have lower drug prices than the U.S. but even in the U.S. drug prices look set to be increasingly regulated. It is hard to know the final outcome of these attempts, but there is no doubt where the trend is headed. Undoubtedly, there is a high risk of reduced ability of setting prices freely in the future. So not only will companies have to take all the investment risk, after successfully developing a useful drug, they will not know what they can charge for the drug.

The last risk I would highlight is currency risk. The U.S. dollar has trended stronger against most other currencies over the last decade. This reduces foreign earnings when they are converted back into U.S. dollars. Currencies tend to mean-revert over time. But over time can be a long time, as evidenced over the last decade. There is some room for adjusting prices in local currency, but in the drug space, local price regulations can severely restrict that effort.

Current Valuation

I always look at valuation before I invest, looking both at the company itself and how it is valued compared to its closest peers. As a peer group I’ve chosen Eli Lilly (LLY) and Pfizer (PFE), two other large global pharma players.

| Merck | Eli Lilly | Pfizer | |

| Price/Sales | 4.3x | 15.9x | 2.9x |

| Price/Earnings | 74.3x | 89.2x | 19.4x |

| Yield | 2.9% | 0.8% | 5.4% |

Source: Seeking Alpha

The first thing that strikes me is that Eli Lilly is really priced for perfection. The Price/Sales ratio looks like it is supposed to be a Price/Earnings multiple. A P/E ratio approaching 100 is just too expensive, even if we know Eli Lilly has some high-growth potential over the coming years. Pfizer, on the other hand, looks decently priced at just below 20x and downright juicy on its dividend yield.

To be fair, the P/E ratio of Merck is also high, but as we’ve seen, this year’s ratio is rather skewed because of one-offs. Using the earnings number of $8.52 per share we calculated above, we get a P/E ratio of 11.9x. Suddenly it’s cheap. If we are to believe the analysts, earnings for FY 2024 translates into a forward P/E ratio of 12.1x.

These same analysts on Wall Street expect Merck to grow EPS by an annual rate of 14.4% over the next five years. If we assume no change to the multiple and add in the current dividend yield of 2.9%, we arrive at an expected average annual total return of 17.3%. Well, that has to be enticing for most investors. A global, diversified leader with a generous dividend, decent dividend growth and the potential to generate almost 20% annual returns in coming years. There is really not much more to ask for.

Investors getting close to retirement as well as investors already in retirement, should add Merck to their portfolios. You get well paid, you will be more than compensated for inflation via dividend growth, and there is serious upside potential over the coming years.

Conclusion

Merck has been around for a long time, selling high-margin products that is increasingly demanded around the world. The dividend has been increased every year since 2011 and will be increased again in late November or early December — probably by 5.5%. In coming years the hike will probably be even bigger as the company seems to be entering a new growth phase. Investors getting close to, or already in retirement should add Merck to their portfolios for a high current dividend yield and robust growth of that dividend going forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MRK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.