Summary:

- Meta’s unique advertising solutions and 3.3 billion user base create a unique growth flywheel, driving mid-teens earnings growth and making it a market-beating investment.

- User engagement and ad impressions are rising, with Meta AI and unified recommendation algorithms boosting near-term engagement and advertiser demand.

- New product opportunities in WhatsApp, Llama, Threads, and AR/VR offer significant future revenue potential, despite current minimal contributions.

- Concerns about rising expenses and capex are valid but short term; Meta’s strong execution and profitable growth trajectory justify a ‘Buy’ rating.

mactrunk

Exactly two years have passed since Meta’s (NASDAQ:META) stock has reached rock bottom, amid worries of reckless spending, growth dead-end, competition from TikTok, and struggles to deal with Apple’s (AAPL) ATT.

And boy, how things have changed. Besides Nvidia (NVDA), Meta is the top performing big-tech stock, as Mark Zuckerberg answered virtually all doubts, and then some.

Still, ahead of Wednesday’s third quarter report, I believe there are multiple under-the-radar catalysts the market is underappreciating.

Let’s dive in.

Revisiting The Meta Investment Thesis

I initiated coverage on Meta in July of last year. In a series of five articles, I talked about Meta’s year of efficiency success, the burden of the Reality Labs segment, the significant remaining upside heading into 2024, the potential implications of a TikTok ban, and its critical-to-understand growth algorithm.

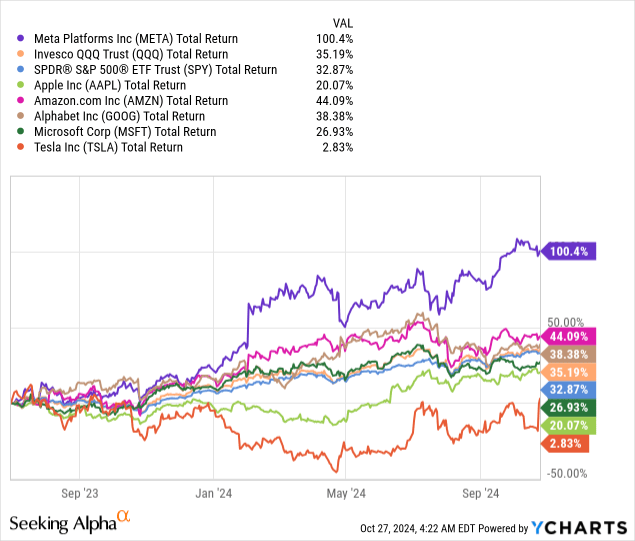

I maintained a Buy rating throughout the period, encouraging investors to focus on the future, rather than being deterred by the sharp rise in stock price. So far, it seems like we were right:

Before we dive into some more specifics for the near-to-mid term, I think it’s worth looking at the bigger picture.

The combination of Meta’s second-to-none advertising solutions suite, and its unparalleled reach with a 3.3 billion user base that’s growing, positions Meta as a one-of-a-kind proposition for advertisers, especially those who want to acquire new customers.

This creates a classic flywheel, with multiple paths to drive growth. Meta has opportunities across four key verticals: (1) Users; (2) Advertisers; (3) Platform & Product and (4) Profitability.

This flywheel should drive at least mid-teens earnings growth for the foreseeable future, which means Meta should continue to be a market-beating investment for years to come.

Still, I believe the market is missing the abundance of opportunities across each of these four verticals, so let’s get to that now.

User Count And Engagement

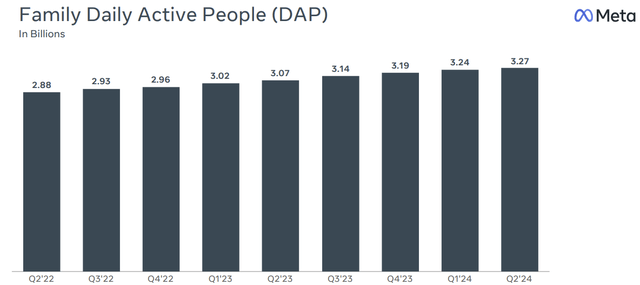

As of Q2-24, Meta had 3.27 billion users across its family of apps, a 6.5% increase from the prior year. Importantly, this number represents the number of unique people across all the apps together. For example, if I’m both on Instagram and Facebook, I count as only 1 daily user.

We don’t have the number, but I think it’s safe to assume there’s a huge opportunity in adding users across apps. Although some of the apps cannibalize each other in a certain way (time spent on Facebook is a time that can’t be spent on Instagram), a user who’s on several apps is highly likely to be more engaged with Meta as a whole.

Meta is constantly working on appealing to more users, and so far, it seems to be working. WhatsApp recently surpassed a 100 million users in the U.S., Threads surpassed 200 million, and overall all platforms are seeing positive growth.

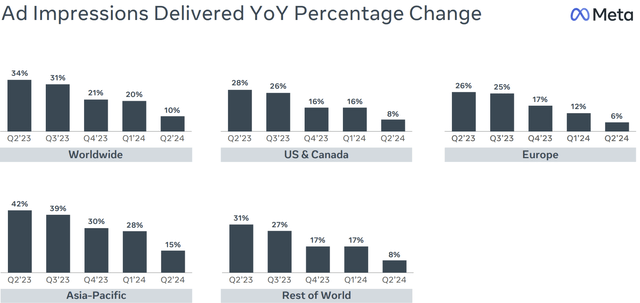

Aside from growing the user count, it’s equally important to increase the engagement of each individual user. This is best reflected by ad impressions, which is a metric that’s driven by user count, user engagement, and ad load.

The two main drivers for near-term engagement are Meta AI, and Meta’s project to unify its recommendation algorithm across apps and across formats (reels, stories, feed).

In the upcoming quarter, investors should closely monitor updates on this project’s process, as well as ad load updates, and continued growth in user count.

Advertisers – Demand Exceeding Supply, CRM Integration & Advantage

There’s no official figure regarding the number of unique advertisers on Meta’s platforms, but we do know that there’s at least 10 million, with the primary cohort being small and medium businesses (in contrast from YouTube (GOOG) (GOOGL)).

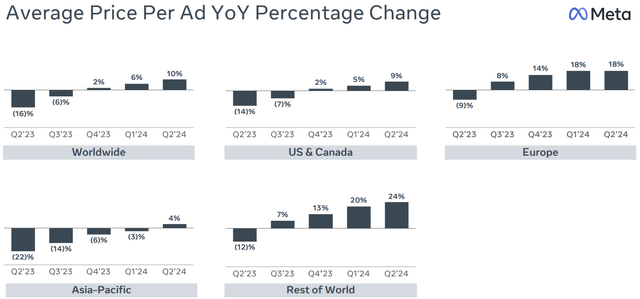

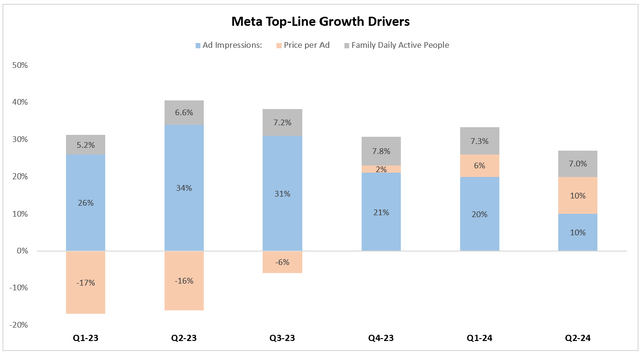

The best way to gauge the strength of advertiser demand is price per ads:

Importantly, price per ad should not be looked at in a vacuum. Advertising markets are classic supply-demand markets, where supply reflects inventory, or ad impressions, and demand reflects how many advertisers want to buy the inventory, and for how much.

This means that the most significant demonstration of strength occurs when price per ad is growing concurrently with ad impressions, which is exactly what’s been happening in the past three quarters.

Created by the author using data from Meta’s reports.

Looking ahead, especially in the upcoming quarter, Meta is expected to benefit greatly from election ads, as well as advertisers going away from TikTok amid a ban speculation.

In addition, during the year, Meta added multiple new capabilities to its advertising suite that should be highly attractive for advertisers.

One of the most interesting recent launches from Meta was the integration with clients’ CRMs. Until now, clients had to download Excel files and do a lot of the work “manually”. Critically, when advertisers calculate return-on-ad-spend (‘ROAS’), they typically include the expenses required to facilitate their advertising on Meta. By integrating, Meta will save clients money, which means they would be willing to spend more directly.

The main theme in the foreseeable future though, remains Meta Advantage. Meta is constantly adding more and more capabilities to this AI-driven platform for advertisers, which enables automated ad campaigns, including optimization, targeting, creative, and more. This should be the number one driver for increasing demand from advertisers in the near-to-mid term.

Platform & Product – WhatsApp, Llama, Threads & Glasses

WhatsApp has been on a tear, surpassing the 100-million milestone in the U.S., with click-to-message advertising and WhatsApp business growing rapidly. This is a huge opportunity, especially as LLMs improve, which should enable much better chatbots at a lower cost for businesses worldwide. I can’t think of a company that’s better positioned to capitalize on this opportunity, with the combination of existing business relationships, Llama, and WhatsApp.

Regarding Llama, I think the direct monetization opportunity, from revenue-share with hyperscalers, is an under-the-radar catalyst to monitor, especially amid worries of elevated capex spending.

Lastly, we have the “long shots”, although they’re not that long anymore. Threads, which had nearly 200 monthly actives as last disclosed, is on track to become a billion-user platform, and at some point, it should become an additional monetization engine.

Similarly, Meta’s AR/VR initiatives, are gaining traction, with the Meta Ray Bans already becoming successful, the Quest doing OK, and the recent Orion demo which fuelled high enthusiasm.

All of those are not yet meaningful contributors to revenue, but it’s easy to envision a future where they become large businesses for Meta.

Profitability – Worries About Over Spending Are Reasonable, But Will Be Short-Lived

If there’s one thing Mark Zuckerberg always talks about in his interviews over the past two years, is how satisfied he is with the new structure of his company.

Execution and being fit has been one of Meta’s strongest advantages since Apple’s ATT. It is now years ahead on several fronts, and it was able to catch up quickly in areas where it lagged.

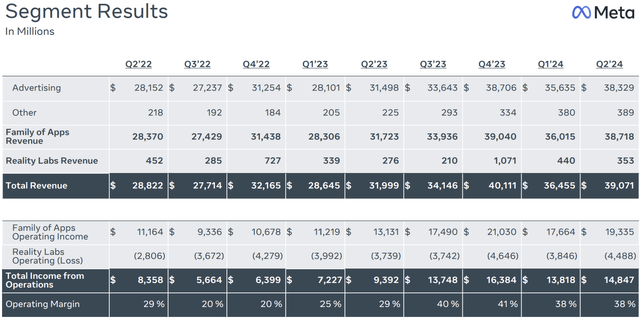

This is clearly reflected in the company’s operating margin expansion, which is back to pre-ATT levels, despite higher losses in Reality Labs.

I don’t expect Meta to change its approach to operational expenses anytime soon. However, there are two key questions. One, regarding Orion, and whether its demo was aimed at least in part to make investors more susceptible to increased expenses to accelerate progress towards a commercial launch.

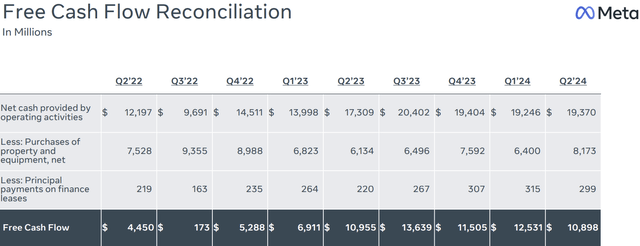

Two, is about capex, which has been growing faster than revenues and operating cash flow.

As a result, free cash flow actually declined last quarter, and it’s highly likely it’ll decline yet again in the upcoming quarter.

Meta has plenty of avenues to utilize their investments in AI infrastructure, and I don’t think investors are worried about that. What they are worried about, and rightfully so, is how long will this investing stage last, and how big is it going to get. Any color on that front will be, in my opinion, the key determining factor on where the stock goes in the near term.

Valuation

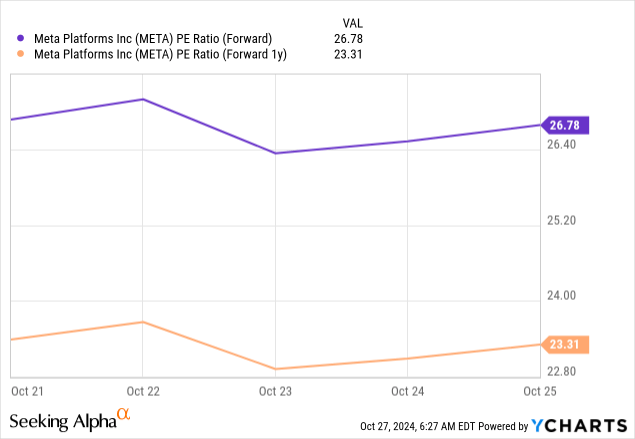

I hope that at this point we’ve all reached the conclusion Meta has a very attractive profitable growth trajectory across multiple verticals. Consensus estimates seem to reflect that as well, with expectations for 15% growth next year, with slightly declining margins.

I find the revenue estimate reasonable, considering the tougher comparison from the elections, although I think it’s highly likely Meta beats it and grows in the high-teens.

The EPS estimate is too conservative in my view, as it reflects a somewhat significant decline in margins, or very little buybacks, neither of which seem probable to me.

Even so, at 23 times ’25 earnings, Meta is trading at about 1.5x PEG:

As I wrote in previous articles, I believe a fair multiple would put Meta closer to 1.75x PEG, which would put it in the big-tech average, in-line with Amazon (AMZN), above Google, and below Microsoft (MSFT), and Apple.

I expect that to be achieved with more clarity about mid-term capital spending, and more progress across all the early opportunities we discussed.

This brings us to a 25x multiple by the end of 2025. Applying that on 2026 EPS, gets us to a price target of $710 per share, reflecting 23% upside.

Conclusion

I look at Meta from the perspective of four key verticals, in users, advertisers, new products, and profitability.

Across each of them, I believe Meta has huge opportunities, that should drive mid-teens growth for the foreseeable future.

I view current worries about increasing expenses and capex as reasonable, but I don’t expect them to last very long, as Meta constantly executes and demonstrates the return.

With beatable consensus estimates and a convenient low-twenties multiple, I still see significant upside and reiterate Meta at a ‘Buy’.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.