Summary:

- Meta Platforms has proved an excellent investment since going public, and I expect this to continue going forward.

- META has developed a strong competitive advantage due to its scale and network effects.

- META has numerous growth avenues including ARPU growth outside the U.S. and Canada, WhatsApp monetization, AI, and the Metaverse.

- META trades at a cheap valuation relative to the S&P 500 considering META’s above market growth potential.

- I am initiating META with a strong buy rating.

Justin Sullivan

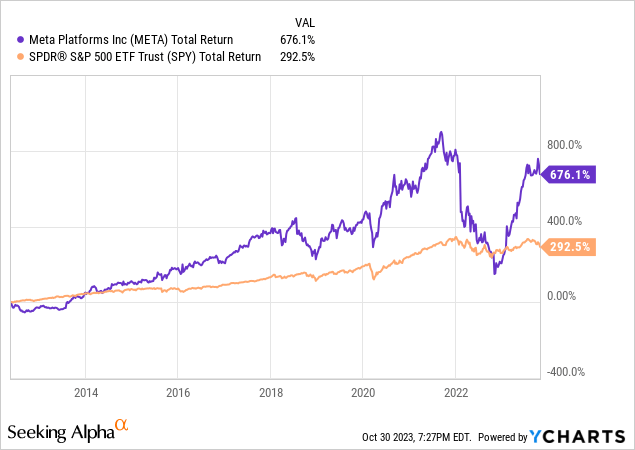

Meta Platforms (NASDAQ:META) has proved an excellent investment since going public in 2012. Since inception, META has delivered a total return of 676% compared to 293% delivered by the S&P 500 over the same period.

While META is now one of the biggest companies in the world with a market capitalization close to $800 billion, I believe significant growth opportunities lie ahead for the company.

There are 8 reasons why I believe META is a strong buy at current levels.

1. Competitive Advantage and Wide Moat

META is the leading social network in the world with 3.14 billion daily active people across its apps which include Facebook, Instagram, Messenger and WhatsApp.

The network effects make it very difficult for other social media platforms to compete with META. While competitors such as TikTok, Snap Inc. (SNAP) and Twitter also have large social networks, META remains the dominant force in social networking. META’s large scale allows it to offer advertisers highly targeted advertising. META is second largest player in the U.S. digital advertising market with ~18.4% market share. META trails only Alphabet (GOOG) (GOOGL) owned Google which has ~26.5% of the market. The only other major players in the market are Amazon and TikTok.

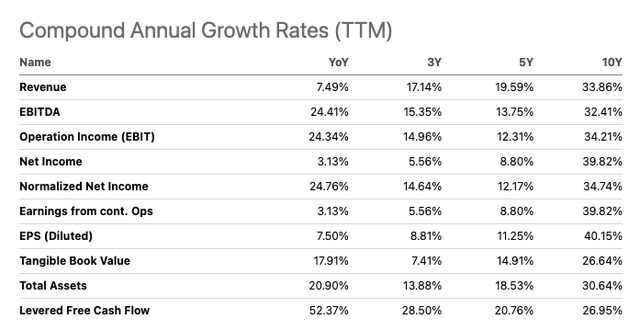

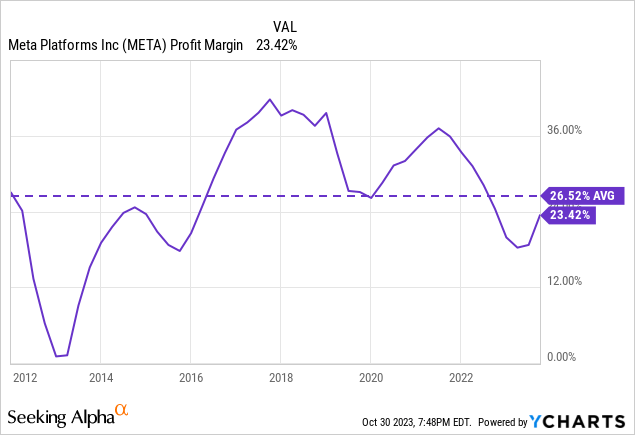

META’s competitive moat has allowed it to achieve rapid growth historically. META has grown revenue and EPS at 19.6% and 11.3% CAGRs over the past 5 years respectively. Moreover, META has also enjoyed consistently high profit margins which have averaged ~27% since inception.

Seeking Alpha

2. International APRU Growth Potential

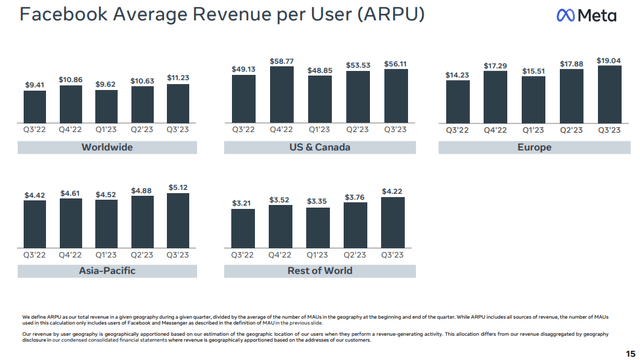

I believe one of the most underappreciated long-term growth opportunities for META is in terms of increasing the Average Revenue Per User (“ARPU”) outside of the U.S. and Canada.

As shown by the chart below, META currently generates ~$56.11 quarterly Facebook ARPU in the U.S. & Canada, $19.04 in Europe, $5.12 in APAC, and $4.22 in the rest of the world. In particular, I believe there is substantial growth potential in the APAC and rest of world markets.

META has a significant number of users in countries such as India, Brazil, Indonesia, Turkey, Mexico, and others. In fact, India has the most Facebook and Instagram users in world.

On a year-over-year basis, ARPU in the U.S. & Canada increased by 14%. Comparably, ARPU on a year-over-year basis increased by 33.8% in Europe, 16% in APAC, and 37% in the rest of the world.

I expect META to be a major beneficiary of increased economic growth in emerging countries (particularly India and Brazil) over the medium to long term. This growth opportunity represents a key long-term driver of growth potential for the company.

3. WhatsApp Monetization Potential

WhatsApp has over 2 billion active users and META has only scratched the surface in terms of monetization potential. In Q3 2023, META reported just $293 million of revenue from Family of Apps which includes WhatsApp. This represents a 53% increase in a year-over-year basis.

META is in the early innings of rolling out its Click-to-Message ads on WhatsApp. To get a sense of the opportunity, 60% of WhatsApp users in India message a business app account and revenue from click-to-message ads in India has doubled on a year-over-year basis. WhatsApp represents a significant growth opportunity which META is just beginning to tap into.

4. Big Beneficiary of AI

AI is META’s largest investment area for 2024 and represents another significant growth driver for the company.

As noted by META CEO Mark Zuckerberg on the Q3 earnings call, the company is already benefiting from AI:

AI-driven feed recommendations continue to grow their impact on incremental engagement. This year alone, we’ve seen a 7% increase in time spent on Facebook and a 6% increase on Instagram as a result of recommendation improvements. Our AI tools for advertisers are also driving results with Advantage+ shopping campaigns, reaching a $10 billion run rate and more than half of our advertisers using our Advantage+ creative tools to optimize images and text in their ads creative…

Today, most commerce and messaging is in countries where the cost of labor is low enough that it makes sense for businesses to have people corresponding with customers over text. And in those countries like Thailand or Vietnam, there’s a huge amount of commerce that happens in this way. But in lots of parts of the world, the cost of labor is too expensive for this to be viable. But with business AIs, we have the opportunity to bring down that cost and expand commerce and messaging into larger economies across the world. So making business AIs work for more businesses is going to be an important focus for us into 2024.

In addition to some of the positive impact that AI feed recommendations are already having on META’s business, the company has a number of AI-related developments in the pipeline which represent significant growth opportunities.

On September 27, 2023, META announced the beta product rollout of new AI experiences in the U.S. The launch included 28 different AI’s which users can message with and interact with on Instagram, Messenger, and WhatsApp. Additionally, the beta launch also included Meta AI which can give users real-time information and generate photorealistic impacts from text prompts within seconds to share with friends. META also will be releasing an AI studio for people and developers to build their own AIs.

AI experiences represents an important way for creators to extend their virtual presence across META platforms.

In addition to these initiatives, META is also working on technology to overcome the limitations of the most advanced AI systems today. META’s Joint Embedding Predictive Architecture (I-JEPA) is being developed with a vision for more human-like AI.

I believe the additional capabilities which will be available through META’s AI experiences have the potential to drive stronger user engagement and result in individuals spending more time on META’s platforms and thus revenue growth.

5. Potential Upside From Metaverse Investments

META has consistently been criticized for the scale of investment which the company has made in the Metaverse. Thus far, these investments have not yet paid off as the company generated just $ 210 million in Q3 2023 revenue from the Reality Labs segment which includes the Metaverse. Comparably, the company generated $285 million in revenue from the same segment a year ago.

While META has scaled back investment in the Metaverse, the Reality Labs segment has generated ~$11.5 billion in losses thus far in 2023.

I believe Wall Street is overly skeptical regarding the Metaverse and I continue to believe this investment will pay off for META over the long term.

6. Valuation

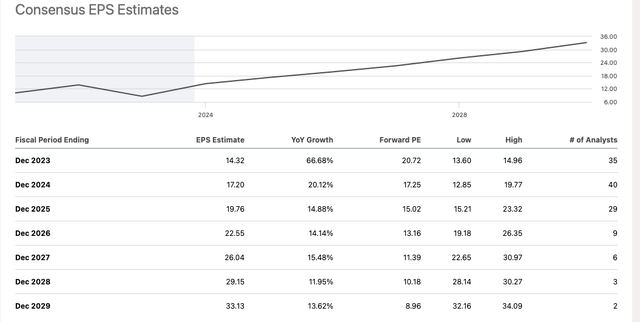

META trades at just 17.2x 2024 consensus earnings estimates and 15x consensus 2025 earnings estimates. Comparably, the S&P 500 trades at ~17x 2024 consensus earnings. While META trades at a similar P/E ratio to the S&P 500, I believe META has a much stronger business due to its competitive advantages. Additionally, I believe META has significant growth drivers which will allow it to grow earnings much more rapidly than the S&P 500. As shown below analysts currently expect META to grow earnings by mid-double digits through 2028. Comparably, I expect the S&P 500 will grow earnings by mid-single digits over the long-term.

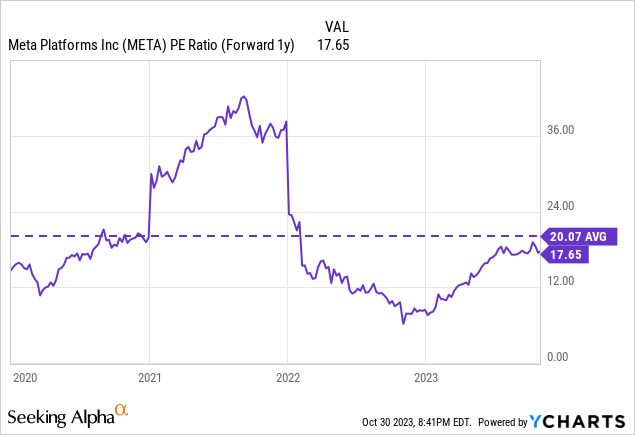

In addition to trading at an attractive level vs the S&P 500, META is also trading at an attractive level relative to its own historical valuation range. Since 2020, META has traded at an average forward P/E ratio of ~20x compared to ~17x currently.

Seeking Alpha

7. Aggressive Share Repurchase Program

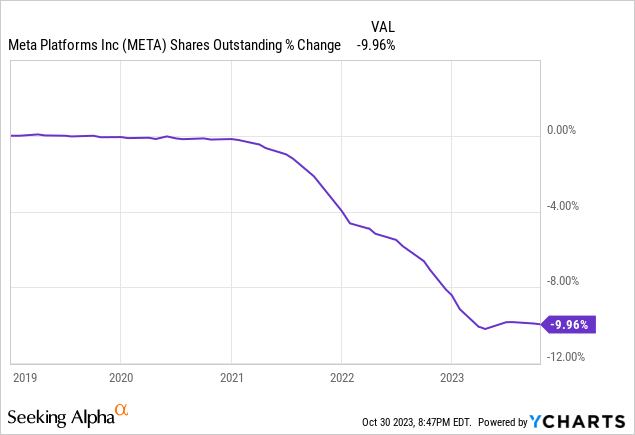

While some investors favor dividends, I favor share buybacks. I believe buybacks are favorable to dividends as they allow shareholders to compound their investment on a tax-deferred basis and give investors control regarding the timing of realizing capital gains. META does not pay a dividend but has been an active repurchaser of its own stock over the past few years.

Over the past few years, META has returned a significant amount of capital to shareholders via share repurchases. The result has been a nearly 10% decrease in the number of shares outstanding over the past 5 years.

During Q3 2023 META repurchased $13.7 billion worth of shares. The company currently has an additional $37.2 billion in remaining share repurchase authorization. Thus, I expect META to be an active buyer of its own shares over the next few quarters.

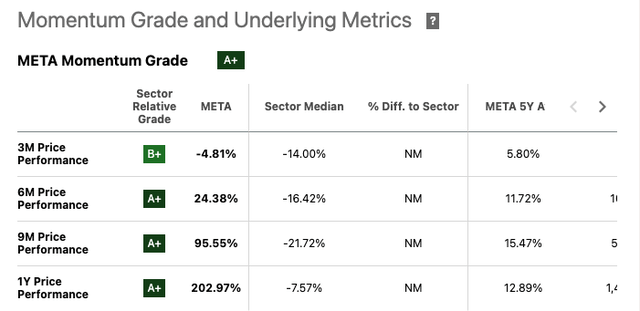

8. Strong Momentum

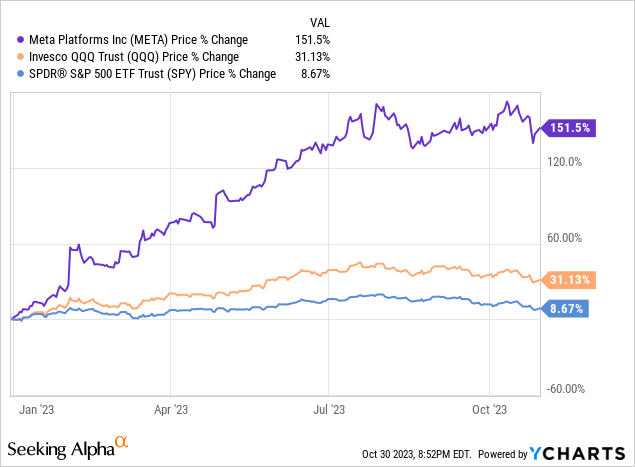

META receives an A+ momentum rating from Seeking Alpha quant grades and I tend to agree. META has significantly outperformed both the S&P 500 and Invesco QQQ Trust ETF (QQQ) on a year-to-date basis.

Seeking Alpha

Risks to Consider

The biggest short-term risk to bullish thesis on META is a significant global economic downturn. Advertising revenue tends to be somewhat cyclical and thus META earnings will come in below expectations in the event of an economic slowdown. However, I believe the impact from a recession will be transitory in nature as the company is well-positioned to ride out a challenging economic environment.

Another important risk that META faces is related to regulatory risk. Increasing EU and U.S. regulatory scrutiny has been a constant theme over the past few years. META is set to roll out an ad-free subscription model for Facebook in Europe in response to regulatory changes. In May 2023, the FTC came out with a proposal seeking to prevent Facebook from monetizing youth data. META is currently contesting this and other regulatory proposals but the risk remains that the company will be unsuccessful.

Conclusion

META is a high-quality company with a wide moat around its business due to network effects. The company has been able to grow revenue and earnings at above-market rates historically and I expect this to continue in the future.

Significant growth opportunities for META include organic user growth, increases in ARPU (especially outside the U.S. and Canada), monetization of WhatsApp, benefits of AI, and the Metaverse.

Despite having significant growth opportunities ahead and a high-quality business, META trades at a P/E ratio which is broadly in line with the S&P 500. Additionally, META has a large share repurchase program and is currently exhibiting strong positive momentum relative to its peers and the market more broadly.

I am initiating META with a strong buy and believe shares represent an attractive investment at current levels. I would consider changing my rating in the event of any significant negative regulatory event or a significant increase in valuation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.