Summary:

- I discuss a framework for investing in public markets, applicable to any company.

- I made the mistake of not increasing my investment in Meta Platforms 2 years ago when it was trading at an 8%-10% FCF yield.

- Meta’s current valuation isn’t as fruitful, but the digital advertising space has a positive future.

Galeanu Mihai

Meta Platforms Analysis

Eight years ago, I wrote an article titled – What If You Could Buy 100% Of Apple? This basic question can be applied to any company, and it’s a good framework for investing in public markets. I stated in the article there are advantages to controlling the whole company, but it still is a good reminder for investors that you are an owner of the business and even though it’s not tangible, we must remind ourselves to think like owners.

At the time, Apple (AAPL) was selling for a 14% free cash flow yield. It didn’t make sense, this was an extreme mispricing from my judgement. Investors were concerned about the growth rate and the size of the company. Whereas, I was happy to own a very sticky business with everyone’s life basically being attached to Apple’s products with a 14% cash flow yield. This ended up being the correct reasoning as the total return reported on Seeking Alpha at the time of publishing is 806% compared to the S&P 500 157%. I say this not to brag, but to highlight a framework that, I think, should be part of the investment process that helped me believe Apple was undervalued.

So, what’s this all have to do with Meta Platforms (NASDAQ:META)? Well, I made a mistake about 2 years ago now, and didn’t apply this same principle to Meta.

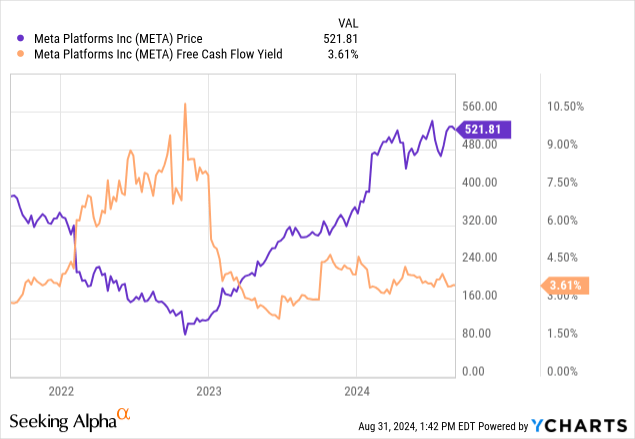

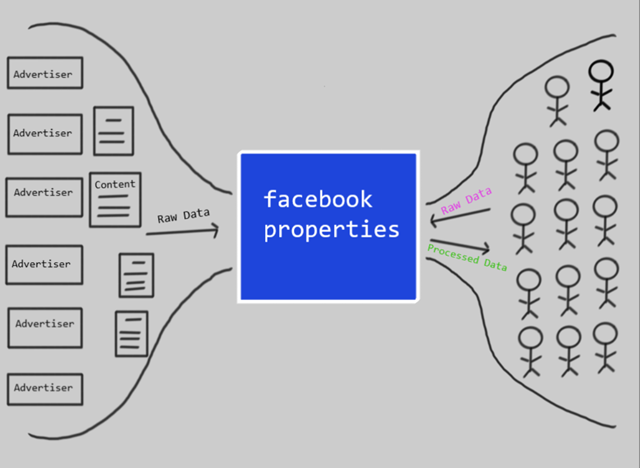

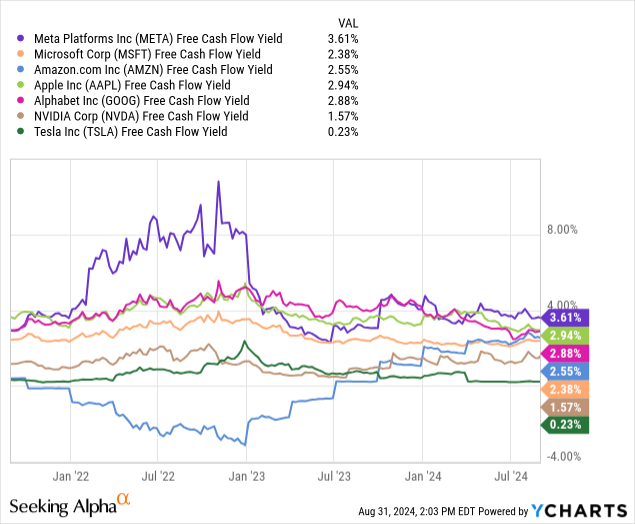

From the chart above, it’s easy to see late in 2022 Meta was trading at an 8-10% free cash flow yield. A great yield for a company with network effects, operating leverage, and a historical track record of efficient capital allocation. I should note they also had $36 billion in cash and investments net of debt. Even during those times, I felt the company was high quality. There were some concerns, such as Apple’s privacy changes affecting Meta’s ability to optimize ad targeting.

I think those concerns would have been less in the front of mind if I and other investors stopped and thought about owning this whole company at a 9-10% cash flow yield, considering the business has a family of apps with billions of daily active users. Even with some new ad target constraints, the sheer number of eyeballs actively using the products is extremely valuable. Meta has a wonderful funnel of information being pushed through their apps alone.

Author’s Work

Pessimism was ramped up on Meta and I believe investors still saw the organization as a high growth company, which they no longer were producing what the investors wanted, leaving it by the waste side. This is more of a behavioral shift/investor base but something I’ll continue to think about as companies transition from high growth to steady growth, where extreme mispricing’s can occur.

Moat and Industry Thoughts

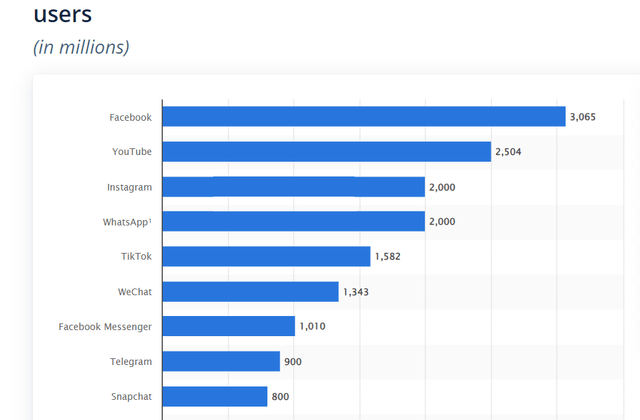

I still own shares of Meta and held on during the rollercoaster ride as I’ve always thought the network effects and talent at the company would be difficult to replicate/compete against. We all now know who the major players are within the social media landscape, and they all do things slightly different.

Meta is the only one within the landscape with a portfolio of apps that captures many of the different niche networks like connecting with friends, sharing pictures, creating videos, and texting. The company has leveraged its knowledge and network to create other valuable networks. Many touchpoints.

With taking a market leadership position, barriers are significantly high, making it unattractive for competitors to compete as the cost of gaining share is insurmountable. The networks have already been established. The apps are on the phone, being used daily. The installment base has gotten so big, the value for the users is impactful. Think about an Instagram user that built their business on the platform, having 100,000 followers. The amount of utility this user is receiving for free is insane, and they could have a hard time replicating their follower base to another platform. These network nodes are hard to break once connected. Family connections, friend connections, businesses, and more. Even with competitors coming up with valuable tools to try and switch users over to a different platform, Meta has been adapting to new trends and quick to implement. This is the value of being the market leader. With Meta, I think about this quote Warren Buffett said about Coca-Cola (KO) and I think you could replace Cola-cola with Meta and the industry of operation description:

If you gave me $100 billion and said, ‘Take away the soft-drink leadership of Coca-Cola in the world,’ I’d give it back to you and say it can’t be done.

Few Interesting Facts About the Digital Advertising Market

- In 2024 most digital advertising spend will occur in the United States.

- Total digital advertising is estimated to be $670 billion.

- 10 million plus digital advertisers use one of Meta’s social platforms.

Here are some graphs to really highlight projections:

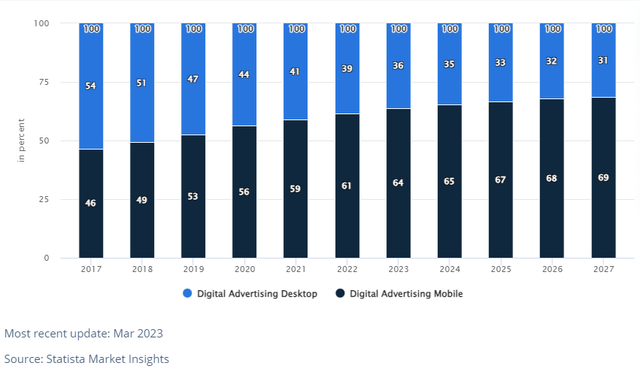

Desktop vs Mobile Change over time

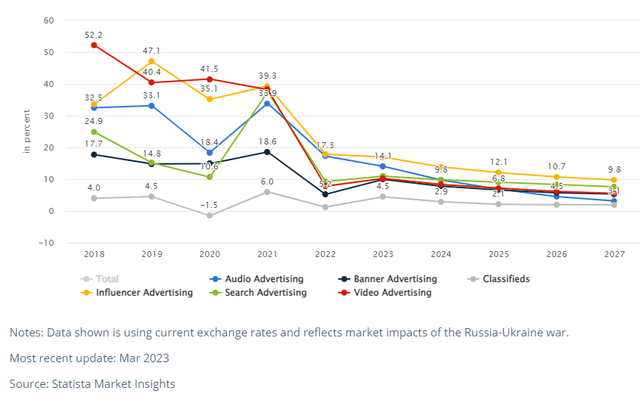

Ad Spending Growth Projections

The data points indicate to a prosperous future for digital advertising. Market leaders will be in a good position to capture these tailwinds.

Valuation Data

Market Cap (8/31/24): $1.32 Trillion

Short-Term Cash and Investments: $58 Billion

Long-Term Debt: $38 Billion

Enterprise Value: $1.3 Trillion

Cash Flow Yield: 3.6%

As a cash flow investor, this is a suboptimal yield at current prices to consider investing. Risk-free rates are hovering in the 4-5% rates with no equity exposure. Now, this isn’t the perfect method for comparison, but I always like to compare the two to get an understanding of current cash flow rate I would receive from owning the equity exposure vs debt exposure.

Comparison data against all Mag 7 companies, Meta has the highest free cash flow yield. This would indicate a mispriced security, but I don’t find this variance giving a high margin of safety.

Risks

Increased Government Regulation We’ve already seen this in Europe and somewhat in the United States. You can also look at this as a growing barrier to entry but a touchy balance.

Fixed number of hours in a day to keep engagement up. There are also trends to reduce phone screen time.

Privacy Concerns. Hard to predict what the next constraint could be on Meta being able to target ad’s to the proper users.

Final Thoughts

I really like the framework of figuring out if this is a business you would want to own 100% at the current price. It’s a great reminder of being a business owner, even if you own .0001% of a company.

Mistakes will be made and opportunities will be missed in investing. Learning from these decisions will increase the probability of favorable future investment outcomes.

Meta has wonderful attributes for a quality company investor. Current cash flow yields don’t look attractive, but future earnings make the value reasonable. At the current state, I would like to see a few more quarters of growth rates and R&D spend to get a better understanding of what the future may hold for Meta from these economic metrics. I also will be following digital advertising trends, as the projections are lower than they were a few years ago. Meta is a company to follow as opportunities will come to patient investors. Two years ago highlights this very reason to have a database of must own businesses and buy when given a high FCF yield.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained on this article is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors' own review of publicly available information and should not rely on the information contained herein. The information contained in this article has been prepared based on publicly available information and proprietary research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein are the sole opinion of the author and are subject to change without notice. Any projections, market outlooks or estimates herein are forward-looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. The author, the author's affiliates, and clients of the author's affiliates may currently have long or short positions in the securities of certain of the companies mentioned herein or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions. Neither the author nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. In addition, nothing presented herein shall constitute an offer to sell or the solicitation of any offer to buy any security.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.