Summary:

- META remains a compelling Buy, attributed to its global social media dominance with 3.29B users, leading to its rich advertising revenues and operating margins.

- Much of the tailwinds are also attributed to TikTok’s potential ban in the US, building upon the growing list of countries which have limited the use of the social media.

- These developments have naturally led to META’s leading total US digital ad spending in 2024, compared to its social media and advertising peers.

- Despite the recent rally, we believe that the stock remains cheaply valued compared to its hyperscaler/ advertising/ social media peers.

- Even so, with the CBOE Volatility Index increasingly elevated, we may see a market-wide pullback occur in the near-term, bringing forth more attractive entry points for those looking to add META.

J Studios/DigitalVision via Getty Images

META Remains Attractively Valued As The Undisputed King Of Social Media

We previously covered Meta Platforms, Inc. (NASDAQ:META) (NEOE:META:CA) in August 2024, discussing its robust FQ2’24 earnings results and promising FQ3’24 guidance, well balancing the market’s uncertainty surrounding slower AI monetization.

We had reiterated our Buy rating then, thanks to its robust advertising prospects, strategic focus on AI-related investments, and cheap valuations, with it bringing forth attractive entry points for those looking to dollar cost average.

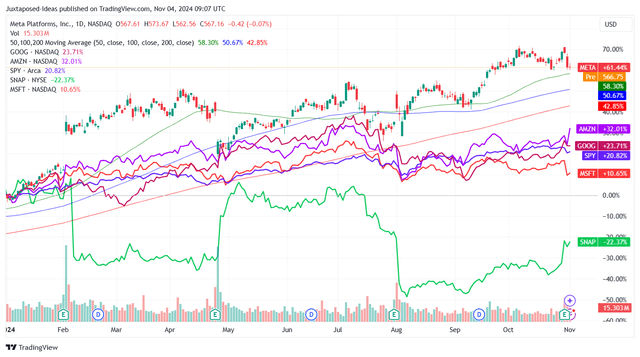

META YTD Stock Price

Trading View

Since then, META has offered a robust total return of +11.3% after the worst of the July/ August 2024 market rotation compared to the wider market at +7.7%, with a similar recovery trend observed in its hyperscaler/ advertising/ social media peers in varying degrees.

Much of META’s outperformance is naturally attributed to the robust moat surrounding its social media platform, significantly aided by the potential ban of TikTok (BDNCE) in the US, building upon the growing list of countries which have limited the use of the social media app on government devices and/ or removed from the app store.

It is unsurprising then that META is likely to be the beneficiary from the potential ban, allowing it to be the de facto king of the global social media market – as observed in Facebook’s leading number of monthly active users at 3.06B as of April 2024, compared to Google’s (GOOG) YouTube at 2.5B and TikTok at 1.58B.

By FQ3’24, the social media giant’s Family Daily Active People has further grown to 3.29B (+0.02B QoQ/ +0.15B YoY), accounting for a large portion of the world’s current population at 8.18B.

These numbers further underscore META’s undisputable moat in the social media market, across Facebook, Instagram, WhatsApp, and even, Threads at nearly 275M monthly active users, despite only launched in July 2023 – compared to X (previously Twitter) at 600M as of May 2024.

This is also why the social media giant has been able to report robust FQ3’24 advertising revenues of $39.88B (+4% QoQ/ +18.5% YoY) and increasingly richer operating profit margins of 42.7% (+4.8 points QoQ/ +2.5 YoY/ +8.8 from FY2019 levels of 33.9%), with it demonstrating why the market has richly awarded the stock on a YTD basis compared to its hyperscaler/ social media peers.

This is despite META’s guidance for Reality labs to report higher operating losses “meaningfully year-over-year due to our ongoing product development efforts and investments to further scale our ecosystem,” with it remaining to be seen when the CEO’s Metaverse dream may be successfully monetized.

Even so, the management has guided a robust FQ4’24 revenues of $46.5B (+14.5% QoQ/ +15.9% YoY) – with it further highlighting its excellent advertising prospects as one of the leading global players at an estimated market share of 22.8%, compared to GOOG at 27.7% and Amazon (AMZN) at 8.8%.

The same has been observed in the US, with META commanding 7.5% of the time spent per day by US adult users and 21.3% of the total US digital ad spending in 2024.

This is compared to GOOG’s YouTube at 7.4%/ 5.6%, Netflix (NFLX) at 7.3%/ 0.3%, and TikTok at 3.6%/ 3.4%, respectively, with it further demonstrating META’s absolute moat as the king of social media and along with it, a leading advertising player.

With market analysts already projecting the expansion of the global advertising market from $1.07T in 2024 to $1.23T in 2026, expanding at a CAGR of +7.2%, one cannot deny META’s immense opportunity for further top/ bottom-line growth indeed.

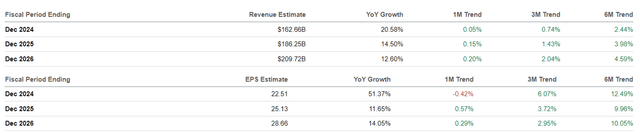

The Consensus Forward Estimates

Seeking Alpha

This may also be why the consensus have raised their forward estimates, with META expected to generate an accelerated top/ bottom-line growth at a CAGR of +15.8%/ +24.3% through FY2026.

This is compared to the original estimates of +9.24%/ +11%, while building upon its historical growth at a CAGR of +33.7%/ +26.6% between FY2016 and FY2021 (pre-Apple privacy changes), respectively.

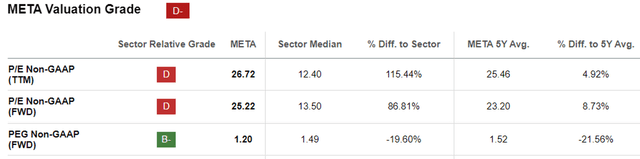

META Valuations

Seeking Alpha

This is also why we believe that META remains reasonably valued at FWD P/E non-GAAP valuations of 25.22x, compared to its 5Y mean of 23.20x and 10Y mean of 26.05x.

The same compelling valuation has also been observed in its relatively cheap FWD PEG non-GAAP ratio of 1.20x, compared to its 5Y mean of 1.52x and 10Y mean of 0.97x.

Even when we compare META’s valuations to its hyperscaler/ social media/ advertising peers, including Google (GOOG) at FWD PEG non-GAAP ratio of 1.30x, Amazon (AMZN) at 1.81x, Microsoft (MSFT) at 2.40x, and Snap (SNAP) at 0.86x, the former’s reasonable valuations cannot be ignored indeed – with it offering interested investors with an excellent margin of safety.

So, Is META Stock A Buy, Sell, or Hold?

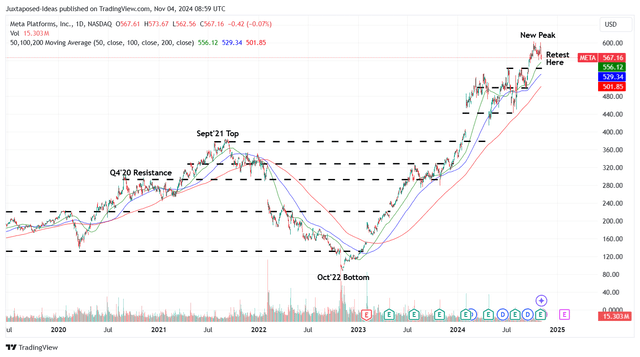

META 5Y Stock Price

Trading View

For now, META has had a robust +25% recovery from the worst of the July 2024 correction, with the stock charting new peaks at $590s while running away from its 50/ 100/ 200 day moving averages.

For context, we had offered a fair value estimate of $465.30 in our last article, based on the LTM adj EPS of $19.56 ending FQ2’24 (+127.9% sequentially) and the 1Y P/E mean of 23.79x.

Based on the LTM adj EPS of $21.23 ending FQ3’24 (+87.3% sequentially), it is apparent that META has ran away from our updated fair value estimates of $505.00.

Even so, based on the consensus raised FY2026 adj EPS estimates from $27.53 to $28.58, there remains an excellent upside potential of +19.8% to our updated long-term price target of $679.90, despite the recent recovery.

META has also been rather shareholder friendly thus far, based on the $2 per share annualized dividends along with 1.5% of its float retired over the LTM and 9.4% since FY2019, with it demonstrating the excellent use of its rich LTM Free Cash Flow generation of $52.1B (+38.1% sequentially/ +145.6% from FY2019 levels).

As a result of the dual pronged prospective returns, we are maintaining our Buy rating for the META stock.

For now, as the stock fails to break out of the $590s resistance levels, we believe that interested investors may observe its movement for a little longer before adding.

This is because we may see META further pullback to its previous support ranges of between $500s and $530s, with it implying a downside of -9% from current levels as those levels also offer an improved upside potential while nearing our updated fair value estimate.

The projected correction is not overly aggressive as well, since the CBOE Volatility Index is increasingly elevated at 22.34x by the time of writing, compared to the start of the year at 13.20x – with the eventual normalization potentially bringing forth a market wide pullback, META included.

Patience may be more prudent in the mean time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.