Summary:

- All eyes are on earnings, and this article is intended to provide a quantitative overview of Meta, Alphabet, and Apple ahead of their quarterly results this week.

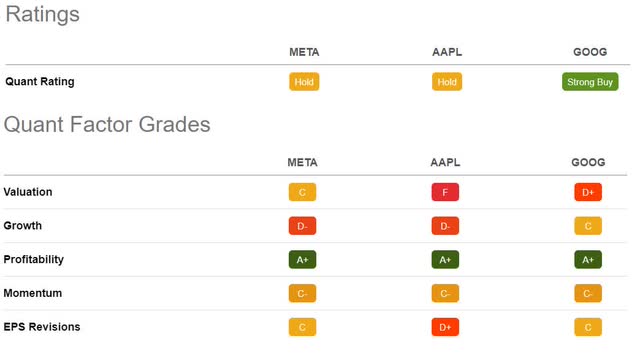

- Alphabet is our only Wall Street consensus strong buy and Seeking Alpha quant-rated strong buy. Meta and Apple are rated Hold.

- In the last 90 days, Wall Street analysts have overwhelmingly lowered their earnings estimates ahead of results this week; 42, 46, and 33 downward revisions for Meta, Alphabet, and Apple, respectively.

- An indication that investors were displeased with the slowdown in revenue growth and negative earnings growth, Meta Platforms suffered the worst performance, -50% over the last 52 weeks. However, Meta is +29%, twice as much as Alphabet and Apple in the last month. Despite falling short on growth, Meta has the best Quant value grade and underlying value metrics (except for the PEG ratio).

- Alphabet has the strongest analysts’ consensus revenue and earnings growth rates as measured relative to their sectors. At the same time, Meta is anticipated to have a negative forward EPS growth rate. Apple, with a forward P/E, is the most expensive. How will they report the next earnings?

Malik Evren/iStock Unreleased via Getty Images

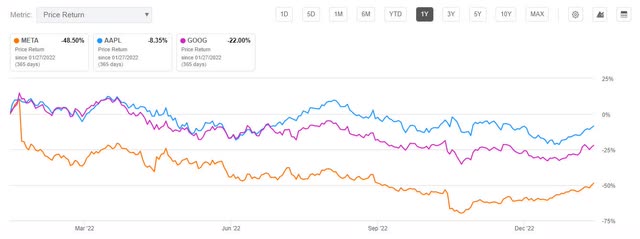

Tale of the Tape

Kicking off a lackluster earnings season, Microsoft (MSFT) and Intel (INTC) served up big misses last week that, according to Morgan Stanley’s chief investment officer Michael Wilson, may be the start of an earnings recession. With $120B in Big Tech losses, 2023 is starting a lot like last year’s disappointing tech results. FAANG and many tech stocks were a flop in 2022, with the Mega caps like Meta Platforms (NASDAQ:META), Alphabet (NASDAQ:GOOG), and Apple (NASDAQ:AAPL) amongst the most widely held stocks in the world, on a tailspin. The tale-of-the-tape, or comparison between rivals, showcased how 2022 was not a great year for any of these three stocks. Their performance marked a harsh end to the FAANG boom years.

1-year Comparison (Tale of the tape) between META, AAPL, and GOOG

1-year Comparison (Tale of the tape) between META, AAPL, and GOOG (SA Premium)

Over the last 52 weeks, Meta Platforms suffered the worst performance, indicating that investors were not pleased with the slowdown in revenue growth and the negative earnings growth. However, in the last month, the performance has been more than doubled that of Apple and Google. Perhaps the stock was oversold, or it is a sentiment that investors could believe the stock is fairly valued and growth could improve in 2023. With all of the negative sentiment surrounding Meta, any positive news showcasing better-than-expected results could offer an upside. But for the analysts and naysayers who believe the S&P 500 will fall to 3,000 in the first part of 2023, “The January rally might be over if the rest of the big-tech earnings and multi-nationals paints the same downbeat picture. Stock bulls may hate, but it ain’t no lie, it is time to say Bye Bye Bye to a soft landing,” writes Oanda analyst Ed Moya.

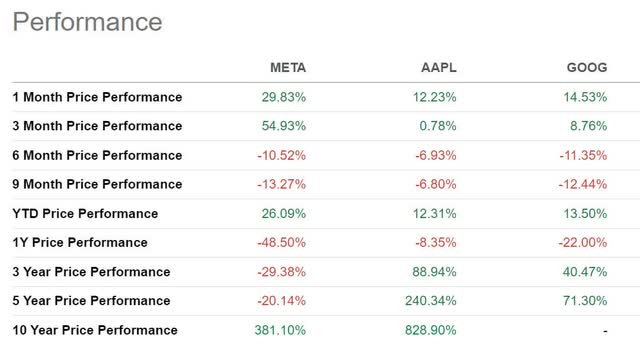

With this in mind, the one-month price performance for all three stocks has been very strong, heading into earnings announcements. Yet, Wall Street analysts lowering earnings estimates for the quarter and the fiscal year on all three stocks has been well telegraphed for the last 90 days. As stocks are a leading indicator, the lower 9-month and 6-month performance still shows concern by the investment community. The recent 1-month positive performance indicates that the stocks may have been oversold on heavy pessimism.

META, AAPL, & GOOG Performance Table (SA Premium)

Stock price performance aside, the quant grades and rating provide an instant characterization of how the data looks for these stocks relative to their sectors. Meta and Apple possess Hold recommendations and a plethora of Seeking Alpha ‘C’ grades, which are middle of the road. Google crosses over to Buy territory with better growth grades. However, when looking at the sector, there are far better investment opportunities based on valuation, stronger growth, and upward analysts’ earnings revisions. My 10 Top Tech Stocks possess forward EPS growth rates ranging from 20% to 118%, and eight have forward P/E ratios below 18x. All have solid profitability, excellent ratings, and factor grades compared to the Mega-Tech stocks below.

META, AAPL, & GOOG Ratings and Factor Grades (SA Premium)

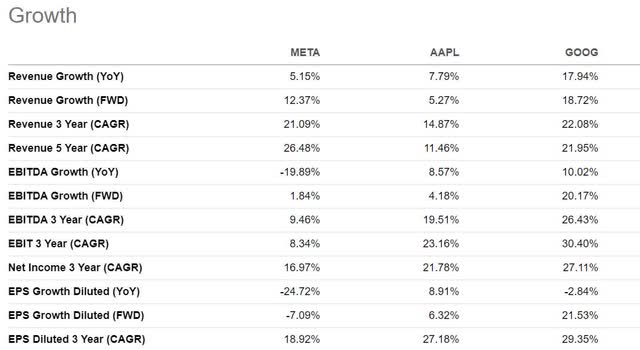

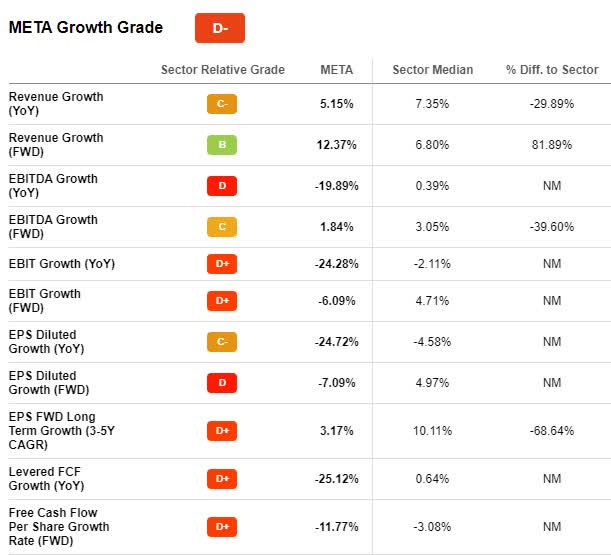

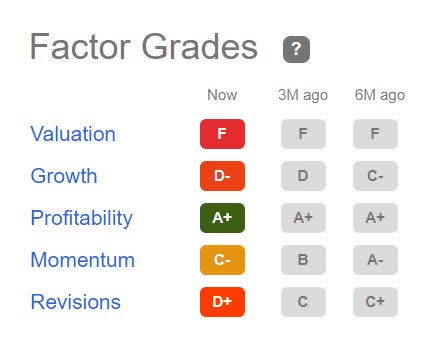

With double-digit growth on most counts, Alphabet has the best top-line year-over-year growth, the highest projected growth, and the best forward EBITDA and EPS growth estimates.

Solid growth rates help to justify both the Quant and consensus Strong Buy ratings. The most alarming number that stands out is Meta’s Forward EPS Growth rate at -7.09%. Despite the stock coming off sharply in 2022, the EPS growth is significantly below the sector and its historical 5-year average growth rate of 19.72%. The YTD stock price performance for the shares almost seems overdone, considering the negative forward earnings growth rate.

META, AAPL, & GOOG Growth Figures (SA Premium)

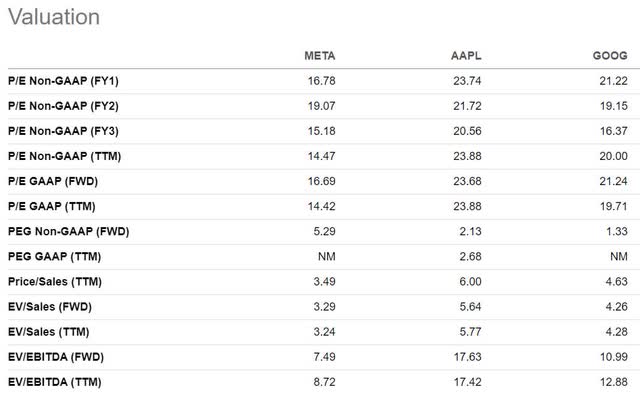

Although FAANG stocks come at a premium, it’s essential to dive into their fundamentals and metrics like valuation because not all mega-caps are the same. “Priced to perfection,” Big Tech comes with expensive valuation frameworks. Their valuation metrics below show that each is overvalued, especially on the all-important PEG ratio.

META, AAPL, & GOOG Valuation Grades (SA Premium)

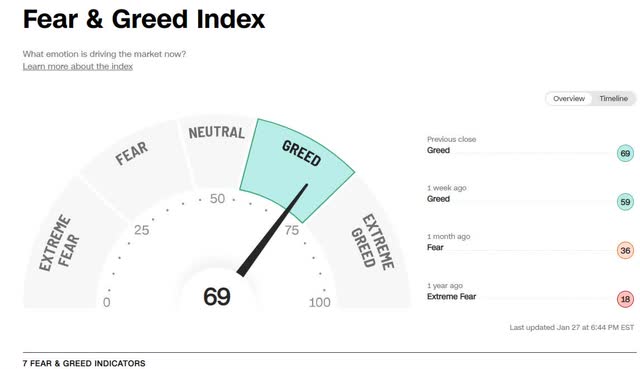

Yet, the three companies’ customer bases and revenue sources differ. They possess such strong profitability that they’ve been able to withstand slowdowns and macroeconomic factors negatively affecting smaller companies. With FX and supply chain headwinds, fear of recession, loss of digital advertising dollars, and geopolitical constraints, none seems to be a concern for investors in the new year.

Fear & Greed Index (CNN Fear & Greed Index)

Investor sentiment in 2023 has turned from fear to greed despite concerns about a recession. And although each of the three stocks offers some consumer discretionary products and services, a sector that was one of the worst performing in 2022, consumer discretionary (XLY) is one of the best-performing YTD, which may prompt bullish investors to take a bite out of these FAANGs.

1. Meta Platforms, Inc (META)

-

Market Capitalization: $397.89B

-

Quant Rating: Hold

-

Quant Sector Ranking (as of 1/27/23): 80 out of 251

-

Quant Industry Ranking (as of 1/27/23): 22 out of 60

Meta Platforms, Inc. is expected to report earnings on 02/01/2023 after market close. Formerly known as Facebook, Meta Platforms, Inc. is largely a social media platform that enables people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, and in-home devices worldwide. Operating in two segments, Family of Apps and Reality Labs, most of the firm’s revenues and earnings are tied to Facebook, part of its Family of Apps segment.

Meta Stock’s New Growth Reality & Profitability

Facebook generates the most significant portion of digital sales for META. More than 97% of Meta’s revenues are produced through advertising and include its other platforms like Instagram, Messenger, and WhatsApp, the company took a big hit as digital dollars decreased last year. In their Q2 Earnings call, Meta CEO Mark Zuckerberg stated,

“We seem to have entered an economic downturn that will have a broad impact on the digital advertising business. And it’s always hard to predict how deep or how long these cycles will be, but I’d say that the situation seems worse than it did a quarter ago.”

In 2021, META generated more than $117 Billion in sales. Meta Platforms’ other core business, Reality Labs, provides virtual reality (VR) related products, including VR hardware, software, and content. The company’s revenue and earnings indicate that Meta may be hitting a point where their main business is maturing, and its up-and-coming Reality Labs is not panning out as fast as hoped, posing a significant drag on capital expenditures and cash flow.

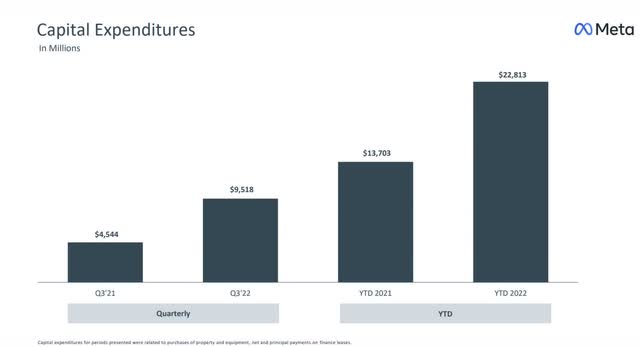

Capital Expenditures Has Been Surging Due To Reality Labs

META CapEX Chart (META Investor Presentation)

According to Meta, as of October 2022, $12.5B was spent developing Reality Labs for the full-year 2021, yet only brought in $2.3 billion in revenue. Last year, Reality Labs CAPEX for the first nine months of the year grew to $10.8B, generating a mere $1.4B in revenue. What is almost unthinkable from just a few years ago, Seeking Alpha’s Growth Grade for Meta, is a D-. The combination of recent top and bottom line growth slowing and forward consensus growth estimates for earnings are overwhelmingly negative for the overall growth grade.

META Stock Growth Grade (SA Premium)

Additionally, META’s net income and EPS trends look bleak. As evidenced in the Q3 Earnings charts below, free cash flow has dropped off a cliff, as highlighted above in the D+ grades and percentages. With a higher cost of revenue and a 6% decline in gross profits from 2020-2021, the company continues to face headwinds in 2023.

The Net Income And EPS Trends Look Bleak For Meta

The Net Income And EPS Trends (Meta Investor Presentation)

And despite an extremely strong profitability grade, as showcased above, Meta’s profitability ratios have decreased.

The Meta Legacy

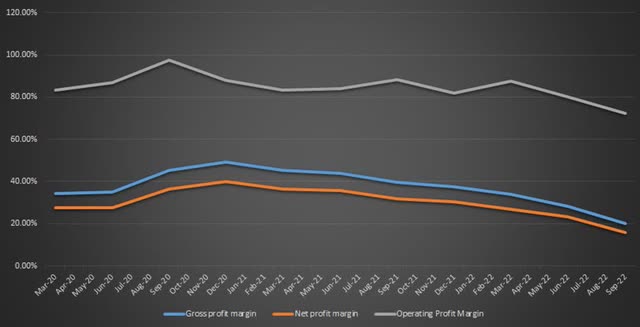

Meta Platforms’ stock had performed well for over a decade, with a solid and consistent upward trend in both share price and volume as a validator of the company’s success. The company demonstrated strong growth in its revenue and earnings, outpacing industry averages. In terms of profitability, the company has long had strong gross margins and operating margins, along with a Return on Capital (ROC) and Return on Equity (ROE) that was the industry gold standard. The company’s profitability indicated that it effectively leveraged its technology and business model to generate profit. And although the company is taking steps to be more efficient by cutting 11,000 employees and approximately 15% of its workforce to lower costs, improve margins and maintain its profitability, Meta’s profitability ratios: gross profit margin, net profit margin, and operating profit margin have declined.

META Stock Profitability Ratios

META Stock Profitability Ratios (SA Author Dang Quan Vuong)

“Furthermore, Meta’s ROE (Net Income/Equity) and ROA (Net Income/Total Assets) have decreased, reaching 3.54% and 2.46%, respectively. The reason is that Net Income decreased sharply while Equity and Total Assets increased, indicating that the company’s ability to generate profits for shareholders from business activities has also declined,” writes SA Author Dang Quan Vuong.

META Valuation Grade (SA Premium)

Despite Meta’s pioneering technology and potential, consensus revenue growth is a mere 5% this year. However, given its C valuation grade – one of the only mega caps relatively discounted – the jury is still out on whether this quant Hold-rated stock will see an upside following this week’s earnings. Stay tuned to Meta’s soon-to-be new reality and Apple’s Q1 Earnings.

2. Apple, Inc (AAPL)

-

Market Capitalization: $2.31T

-

Quant Rating: Hold

-

Quant Sector Ranking (as of 1/27/23): 178 out of 661

-

Quant Industry Ranking (as of 1/27/23): 9 out of 29

Apple Inc. is expected to report earnings on 02/02/2023 after market close. A multinational technology company headquartered in Cupertino, California, that designs, develops, and sells consumer electronics, computer software, and online services, Apple Inc. is known for its flagship products, including the iPhone, iPad, and Mac computer lines.

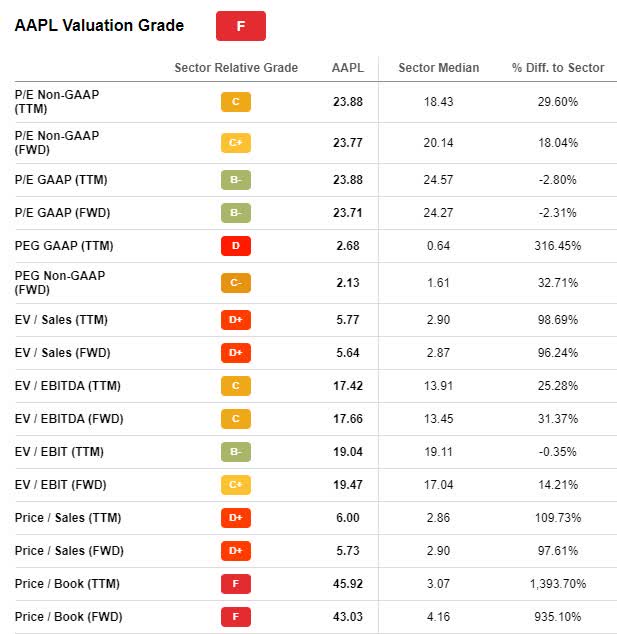

Apple Stock Valuation

One of the most well-known global brands, Apple offers an economic moat that provides excellent returns on capital to support its premium valuation. Apple’s competitive advantage results from high switching costs surrounding its iOS mobile operating system. Apple’s differentiated product and service lines, unique hardware, software, and, more recently, semiconductor designs make it very difficult for customers to switch away, adding to its overvaluation.

Apple’s current forward non-GAAP P/E ratio is 23x, higher than the industry average of 20x. Notably, its non-GAAP PEG ratio of 2.13x possesses a C- Seeking Alpha grade, a 32% premium to the sector. The company’s forward Price/Sales ratio of 5.73x is 97% higher than the industry average of 2.90x, indicating that it is trading at a premium to its peers. The conventional P/E ratios look about average for Apple. This is not the case for PEG, Price to Sales, or Price to Book.

Apple Stock Valuation (SA Premium)

The PEG ratios (P/E Ratio divided by diluted EPS YoY growth (%) show the stock’s valuation framework is expensive when combined with growth. Apple has a strong revenue and earnings growth history as a dominant player in the global smartphone market.

Apple Stock Growth & Profitability

With a market share of approximately 14%, Apple holds a significant stake in the tablet and personal computer markets and offers a diversified revenue stream, with several product lines and a growing services segment. Over the past five years, Apple has grown its revenue CAGR by 11% per year and its 3-year earnings CAGR by 27%. The iPhone is the company’s primary revenue driver, accounting for over 55% of the company’s total revenue pre-pandemic. Other major contributors include the iPad and Mac lines and the company’s services segment, which includes the App Store, Apple Music, iCloud, and Apple Care.

In recent years, Apple has secured several large contracts with major companies and government organizations. In 2020, the company announced a multi-year partnership with Google to integrate Apple’s fitness and health technologies into Google’s devices. In 2021, the company announced a deal to provide the United States military iPhones. With a strong presence in key markets like the U.S., China, and Europe, the company’s revenue from Greater China, which includes mainland China, Taiwan, and Hong Kong, increased by over 30% pre-pandemic. However, the current growth outlook is dismal compared to its longer stellar history.

Apple Stock Growth Grade (SA Premium)

Apple’s dependence on the iPhone – a significant portion of its revenue – is at risk as the smartphone market is becoming increasingly saturated.

“Apple’s upcoming earnings report could be their worst in a decade…Recently, more evidence has been mounting that the company may be facing receding demand across several product lines…Apple is facing headwinds across multiple divisions going into its crucial first fiscal quarter of 2023, setting the stage for a big earnings miss,” writes Christopher Robb, SA Contributor.

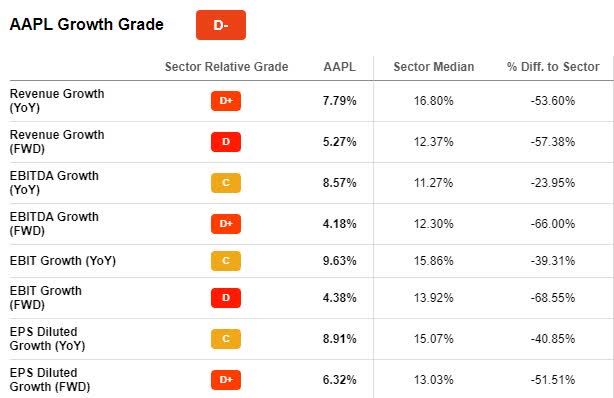

Seeking Alpha’s Factor Grades, which rate investment characteristics on a sector-relative basis, showcases Apple’s weak areas below.

Apple Stock Factor Grades (SA Premium)

Despite the weakness in growth, Apple is a highly profitable company. The company’s net income margin is currently at 25%, significantly higher than the industry average of 3%. This indicates that the company can generate a higher sales return than its peers. Apple’s gross margin, the difference between revenue and cost of goods sold, is a key driver of the company’s earnings. In the most recent quarter, the company’s gross margin at 43% was lower than the industry average of 49%, which may be a contributing factor to analysts’ recent downward revisions.

Apple Stock EPS Revisions (SA Premium)

Displaying a D+ Revision grade, over the past 90 days, only three analysts have revised their numbers up, and 33 analysts have revised down. With earnings announcements around the corner on the heels of an economic slowdown, Apple’s decision to maintain premium pricing may contribute to limited growth and lower gross margins. Because many of their product offerings are discretionary items, and should we enter a recession in 2023, discretionary spending is one of the first areas to decline. Despite Apple’s wide economic moat supported by its iOS ecosystem, the company is considered behind its competitors like Amazon (AMZN) and Google in terms of Ai, most notably Siri voice recognition. That being said, my only Mega-Tech Strong Buy is up next.

3. Alphabet (GOOG), aka Google Stock

-

Market Capitalization: $1.29T

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 1/27/23): 18 out of 251

-

Quant Industry Ranking (as of 1/27/23): 2 out of 60

Alphabet Inc. is expected to report earnings on 02/02/2023 after the market close. Dominating the global online search market with more than 80%, Alphabet Inc., formerly known as Google, offers global products and services, including advertising, its famous cloud-based tools, Android, Chrome, hardware, and Google products. The popular global online video and social media platform YouTube is owned by Google and is a cash cow, adding to the firm’s growing cash flow.

As showcased by its extremely strong product portfolio that adopts more and more users daily, Google is seeing continued growth in its online advertising services and revenue stream. Where other Big Tech names have experienced a fall in advertising dollars, Google remains a beneficiary, despite slowing momentum and a premium valuation.

Alphabet Stock Valuation & Momentum

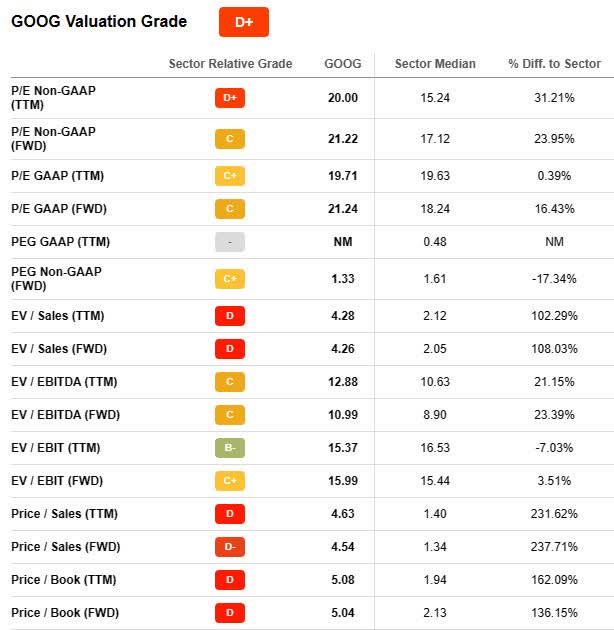

Like many popular names in tech, including Apple and Meta Platforms, Alphabet has a stretched valuation. Although its D+ valuation is not ideal, Alphabet’s trailing P/E ratio of 19.71x compared to the sector median of 19.63x is only a 0.39% difference to the sector, and its forward PEG of 1.33x showcases a -17.34% discount to the sector.

GOOG Valuation Grade (SA Premium)

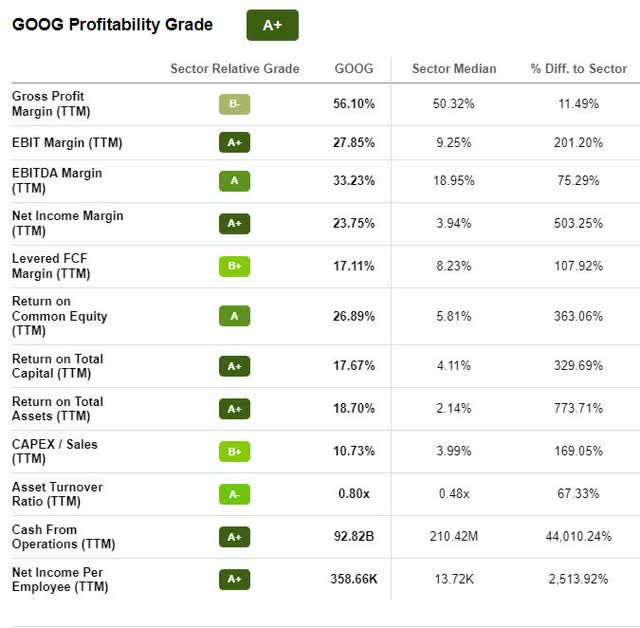

Given Alphabet’s competitive advantages, which include a vastly increasing number of daily users and usage and its one-year share price decline of 22%, investors interested in buying the stock near lows are appealing. Coupled with analysts calling the stock overbought as investors actively purchase shares, GOOG’s bullish momentum, A+ profitability, and solid growth make the stock look very attractive, which is also why the quant ratings recommend it as a strong buy.

Alphabet Growth & Profitability

Although Alphabet posted less-than-ideal Q3 results (EPS of $1.06 missed by $0.20 and revenue of $69.09B missed by 6.10%), the company is well-positioned with its unique product offerings to remain profitable, even amid a slowdown. Some analysts believe the fourth quarter could offer an improvement over the Q3 results, as highlighted in three main points from a Cavenagh Research article titled Google Stock Could Rise Sharply On Q4 Results.

“As compared to Q3, (1) global macro conditions have improved, (2) FX headwinds from a strong Dollar have eased, (3) and OPEX spending has likely been more disciplined.”

Of course, Google is a notable standout compared to most stocks on its incredible profitability. As displayed in the A+ profitability grade, Alphabet generates significant cash, particularly from its Google search business and Android, the latter’s dominant player in the smartphone business.

GOOG Stock Profitability (SA Premium)

Android contributes significantly to the company’s top-line growth. Although Alphabet has experienced headwinds, including the latest Department of Justice anti-trust lawsuits to break up the company, it doesn’t seem to phase investors like fellow SA author who writes, Google: I’m Buying The DOJ Panic. Alphabet’s technological expertise is the intangible asset providing the very economic moat that the DOJ views as a flaw or monopoly. Its pioneering tech expertise paves the way for long-term growth opportunities and is also why GOOG is my only Strong Buy quant-rated mega tech.

By monetizing nearly every algorithm behind searches and tracking user behavior and interests, users’ dependence on Google gives way to programmatic advertising, one of the company’s newest forms of ad revenue streams. Versus traditional advertising, programmatic ads use automated technology to identify trends. Through Google’s machine learning, more data can be collected for customers wanting to target a larger number of users for their products, creating more value. Coupled with the growing popularity of YouTube, which has become extremely attractive for advertisers, it’s also working on centralizing streaming channels and inked a multi-year deal with the NFL granting YouTube TV and YouTube Primetime Channels to showcase NFL Sunday Ticket. Although Alphabet – like other tech companies – may experience some headwinds, including margin compression amid substantial investments in tech infrastructure, including servers for growth and aggressively hiring 30,000 people in 2022, Alphabet’s products and services remain in high demand, regardless of the economic outlook. Possessing a forward EBIT growth of 24.59%, a 422% difference to the sector, based on our quant ratings, Alphabet offers a unique opportunity to buy an outstanding stock.

Conclusion

All eyes are on earnings, and these three mega-cap tech stocks’ results could influence the market for months to come. Meta, Alphabet, and Apple are some of the most closely followed stocks in the world. In fact, Big Tech accounts for the largest weight in the major indexes. Historically, they have offered:

-

Strong financial performance and growth potential

-

High brand recognition and consumer trust

-

Dominance in their respective markets

-

Investment capital and management breadth for investment in emerging technologies

-

Perception as a safe haven during economic uncertainty

However, with macroeconomic uncertainty and earnings recession fears on the rise, Meta, Apple, and Alphabet may have a tough road ahead. Let’s face it, consumers spend less money when the economy is tight, and corporations spend less on advertising.

Since 2022, tech has taken a hit, and the aforementioned reasons partially contributed to the stock price deterioration. Many investors also believe these stocks have matured and are past peak growth rates. Despite the apparent drawbacks, each stock has a proven track record of strong profitability, and much of the negative sentiment is discounted. In the current environment where tech is down and trading closer to 52-week lows, consider identifying tech stocks that are mispriced, with discounted valuations, vigorous growth, positive analysts’ earnings revisions, and solid fundamentals. In addition to the Quant Strong Buy rating on Alphabet, we have dozens of other Strong Buy technology recommendations that can be found on the Seeking Alpha screen Top Technology Stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.