Summary:

- Meta stock fell into a bear market, but dip-buyers returned with conviction.

- As a result, META is closing in on its all-time highs.

- Meta’s ad business has already recovered, bolstering its capabilities to invest further in AI monetization.

- Meta has a well-integrated AI tech stack, providing a vital boost against its smaller digital ad peers.

- My previous Hold rating played out. I explain why I’m ready to return to the bullish camp with META’s all-time highs in the crosshairs.

Alex Wong/Getty Images News

Meta: Buyers Returned Quickly As It Fell Into A Bear Market

In my previous article, I urged Meta Platforms, Inc. (NASDAQ:META) investors to be cautious as we headed into Meta’s Q1 earnings release. My Hold rating on META was timely, as META fell into a momentary bear market. While I remain confident about META’s long-term thesis, I assessed its AI optimism was overstated.

However, dip-buyers quickly returned, helping META stock to bottom out. Notwithstanding the market optimism, META’s buying momentum has fallen short of lifting it back to its previous all-time highs. As a result, investors are likely cautiously positioned, even as the S&P 500 (SP500) took out new recent highs. The surge in the leading semiconductor plays and Apple Inc. (AAPL) stock’s resurgence has lifted market sentiment further.

Meta: Ad Business Has Already Recovered

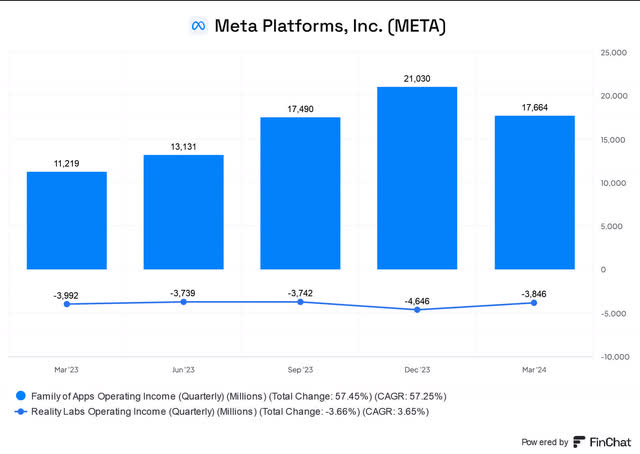

Meta’s first-quarter performance corroborates my thesis that Meta’s ad targeting capabilities have recovered remarkably. Accordingly, Meta posted a 57% increase in Family of Apps operating income. While the operating losses attributed to Reality Labs have dampened Meta’s recovery, I believe investors aren’t unduly concerned.

Meta CEO Mark Zuckerberg views its AI initiatives as increasingly aligned with Meta’s long-term objectives in Reality Labs. As a result, reports about Meta pursuing opportunities in “AI-powered earphones equipped with cameras” are constructive. It closely follows Zuckerberg’s vision of integrating AI into more functional hardware integration, such as the AI assistant in “Ray-Ban smart glasses.” However, it should be noted that Meta’s hardware initiatives remain nascent and are not likely to contribute materially to its operating profits in the near term.

Meta: Well-Integrated AI Stack

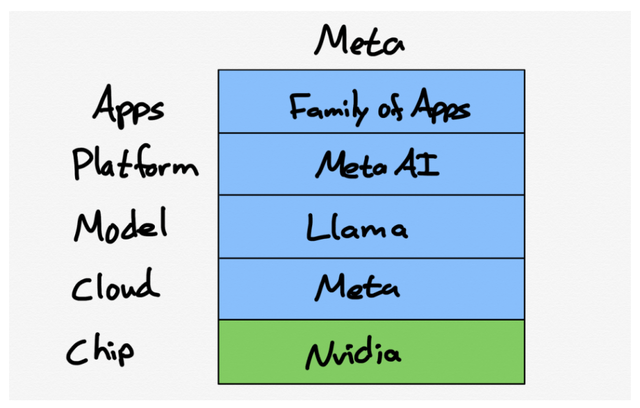

Meta is also well-equipped to pursue a tighter integration of its tech stack. As seen above, Meta already has a well-integrated ecosystem bolstered by its NVIDIA Corporation (NVDA) partnership. Furthermore, Meta’s customized chip projects have also yielded fruitful results, as seen with the launch of MTIA 2. The updated version of Meta Training and Inference Accelerator is customized to Meta’s needs and “specifically optimized for Meta’s recommendation algorithms.” Therefore, Meta’s customized chip efforts should help the company sustain its competitive moat against smaller digital advertising peers in the Generative AI era. Meta’s Q1 earnings commentary underscores the success of its engagement efforts in Instagram Reels. Accordingly, Meta indicated, “Reels alone now [make] up 50% of the time spent within the app.”

Wall Street is also confident in Meta’s AI monetization potential on its core ad business. However, the market could remain skeptical as Meta lacks the full-stack cloud ecosystem of its hyperscaler peers. Despite that, Meta’s well-integrated platform also removes a third-party managed layer, helping to improve operating efficiencies.

Moreover, Meta has embarked on GenAI projects to embed Meta AI within its Family of Apps ecosystem, lifting the opportunity for better ad monetization. In addition, Meta is also reportedly working to create a premium Meta AI assistant to rival the AI agents monetized by its leading rivals. These are considered early initiatives that might not gain near-term revenue traction. However, the market has learned its lesson in writing off Zuckerberg this early in the game, as seen with META’s outperformance from its late 2022 lows.

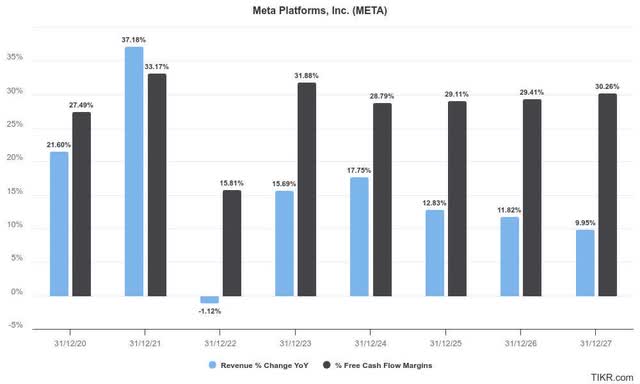

Meta revenue growth and free cash flow margins estimate % (TIKR)

Consequently, Meta’s ability to continue driving consistent revenue upside while maintaining free cash flow margin stability should keep investors onside. Meta’s upgraded 2024 CapEx guidance range of between $35B and $40B likely led to initial fears about increased spending without the concomitant AI monetization boost.

However, Meta’s recent AI initiatives suggest the company is cognizant of the need to monetize its GenAI projects quickly. Therefore, I urge Meta shareholders not to write off Zuckerberg and his team so quickly, as the GenAI landscape is still evolving rapidly.

Is META Stock A Buy, Sell, Or Hold?

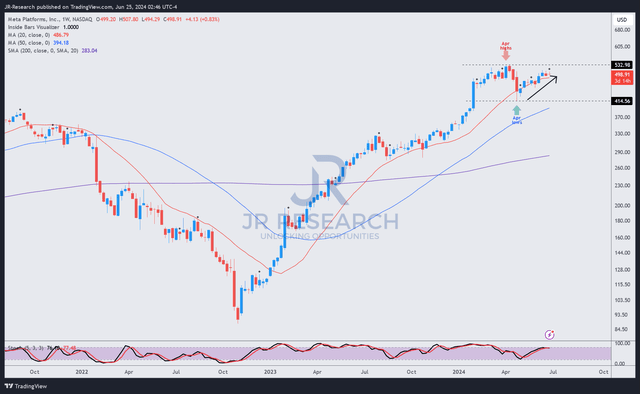

META price chart (weekly, medium-term, adjusted for dividends) (TradingView)

Since its bottom in April 2024, META has recovered most of the losses that came after it hit its all-time high. Therefore, dip-buyers have not been concerned with the fears about AI monetization, giving Zuckerberg time to work it out accordingly. META’s robust “A” momentum grade underscores the market’s conviction in its bullish thesis.

META’s forward-adjusted PEG ratio of 1.35 aligns with its sector median. Therefore, I assessed META as still reasonably valued. Consequently, it should help bolster buying confidence in META as it continues its recovery to potentially surpass its April highs.

With my previous Hold thesis playing out, I consider it timely to become more bullish on META.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!