Summary:

- Meta Platforms remains a “Buy” due to strong earnings, new AI features, and Ray-Ban smart glasses, which could drive future growth.

- META’s Q3 earnings showed a 22% YoY revenue increase, driven by higher ad prices and impressions, with a 58% jump in operating income.

- New AI features and Ray-Ban glasses are expected to boost user engagement and monetization, potentially leading to higher EPS and revenue growth.

- Despite risks like AI costs, ad market slowdown, and regulatory issues, Meta’s valuation appears low, suggesting an upward revision to EPS growth estimates. I reiterate a “Buy” rating again.

tumsasedgars

Intro & Thesis

I initiated coverage of Meta Platforms, Inc. (NASDAQ:META) stock in October 2022, when one share was trading at $99.2. While it may seem today that META “was an obvious Buy at $100”, that “obviousness” at the time wasn’t what it might seem in hindsight: many people liquidated their META long positions, expecting lower lows in 2023. History has decided otherwise.

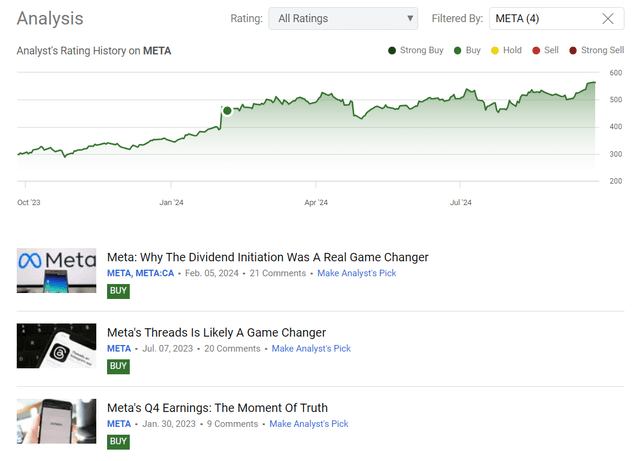

The last time I updated my “Buy” was in February 2024 – I noted at the time that META’s dividend initiation was a real game changer for its investment attractiveness as I saw in academic papers that dividend-paying stocks tend to have higher stock prices in the medium term (explained by a wider audience of investors buying the stock). I wrote META had an upside potential of 14-15% by the end of 2025, but I was clearly too conservative as the stock managed to give a total return of 21.3%, beating the S&P 500 (SP500) (SPY) return of 15.4%:

Seeking Alpha, my coverage of META stock

A few hours ago, Meta’s Mark Zuckerberg presented some upcoming new AI features for their social media apps and its Ray-Ban smart glasses. Among investors, global turning points for companies are commonly referred to as “iPhone moments”, and I think this is one of them. I believe that the new features and the glasses should boost Meta’s growth in the medium term, which is why I maintain my “Buy” rating.

Why Do I Think So?

Before reviewing the recent announcement, I believe it’s crucial to take a look at Meta’s earnings first as their strength is what should drive the stock over time.

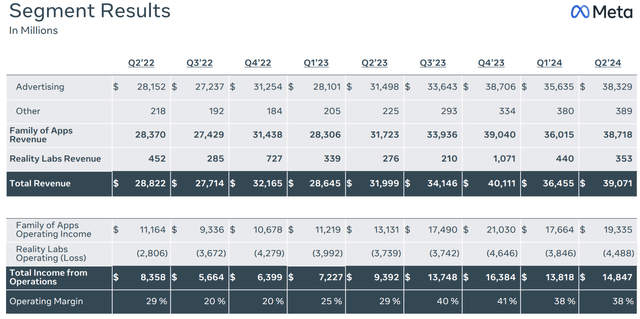

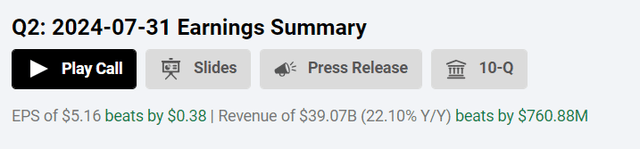

Meta’s results for Q2 FY2024 looked quite strong across the board, with year-over-year growth of 22% in consolidated revenue, to $39.1 billion, driven by a 22% increase in advertising revenue (to $38.3 billion, almost 98% of sales), as both average price per ad and ad impressions increased by 10%. The increase in ad pricing was driven by “strong advertiser demand, bolstered by stronger ad performance”, partially offset by growth in impressions from lower-monetizing regions and platforms, partially offsetting the increase in pricing.

One could see operational efficiency through the operating income numbers: $14.85 billion, a 58% jump YoY, with the operating margin going from 29.5% to 38% – almost 9% higher. The so-called Family of Apps, comprising Facebook, Instagram, Messenger, and WhatsApp, powered that, with its operating income up 47% to $19.3 billion. As a result, we saw GAAP diluted EPS of $5.16 which grew 73% year over year, beating the consensus by almost 8%:

Of course, the metaverse revelation of the call was an enormous ~$4.5 billion operating loss from the Facebook Reality Labs (FRL) segment, with a cumulative loss this year of $50.5 billion, but as you could see above, it made no difference for META. It seems like the management’s vision won’t change.

This brings us to the recent announcement of Ray Bans and new AI features for the family of apps. The deep losses Meta spent on Reality Labs were not in vain – these investments have apparently laid the groundwork for a whole new market for Meta to tap into soon.

A few years ago, I would have predicted that holographic AR would be possible before Smart AI, but now it looks like those technologies will actually be ready in the opposite order. We’re well positioned for that because of the Reality Labs investments that we’ve already made. Ray-Ban Meta Glasses continue to be a bigger hit sooner than we expected, thanks in part to AI. Demand is still outpacing our ability to build them, but I’m hopeful that we’ll be able to meet that demand soon.

[Mark Zuckerberg on the Q2 earnings call, emphasis added]

I think Meta’s lead comes from its ability to integrate better AI into its Ray-Ban smart glasses, which are “a sleeper hit”, as Martin Peers from The Briefing recently wrote. In large part, it’s due to their audio and photo features, not their existing AI features. But coming AI updates Zuckerberg demonstrated (with some controversy) will provide considerably more real-world services for people than most chatbots do today. A Ray-Ban wearer will be able to talk to someone speaking a foreign language and have the translation piped through the glasses’ speakers.

The Orion glasses Meta showcased are the first augmented reality glasses to project holograms onto the real world, heralding a future where “the virtual and real seamlessly coexist.” Orion is made from magnesium alloy, and runs custom silicon; its interaction is accomplished through hand-tracking, voice, and a neural wrist interface. Current prototypes are said to resemble a pair of ski goggles, but Meta is working on shrinking it down, making it sleeker and cheaper with a fully-fledged commercial release currently slated for 2027.

Orion is actually one of Meta’s projects for making its virtual and augmented reality products mainstream – and low-cost. Despite failures in past attempts at AR like Google’s (GOOG) Glass, Meta hopes it can conquer technological and pricing challenges.

From what I see, neither Google nor OpenAI currently has anything matching the Meta glasses – it’s not the same thing to have your apps on a smartphone. If the “AI” thing in Meta’s Ray-Bans would work as Zuckerberg’s demonstration promised, I believe the glasses will be a real game changer for the firm, as they can contribute a lot to Meta’s future top line and marginality growth.

I believe that many market participants continue to underestimate the growth potential stemming from these glasses. For instance, here’s how Malik Ahmed Khan from Morningstar (proprietary source) shared his perspective on the substantial investments Meta has consistently made in Reality Labs over time.

While the firm’s investments in AI could potentially improve its core business, we remain pessimistic on the long-term value created by Meta’s investments in its Reality Labs division and are reducing our Morningstar Capital Allocation Rating to Standard from Exemplary.

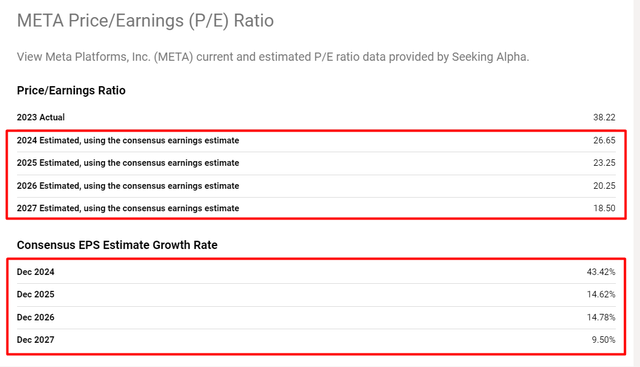

I think the skepticism surrounding Meta’s past investments lays the groundwork for future EPS and revenue revisions to the upside. The likelihood that Meta will achieve a good return on its investments has increased, which could be seen as a bullish catalyst today. Even though Orion is set to enter the AR market only in 2027, the company’s current EPS growth forecast for that year of just 9.5% seems low to me.

Glasses weren’t the only thing we heard from Zuckerberg. He also highlighted updates in new AI features, including new voice options for the AI assistant on platforms such as Messenger and Instagram that include the celebrity voices of the rapper Awkwafina and American actor John Cena, among others. A Meta AI translation tool is also being tested to automatically subtitle and dub Instagram Reels. I think that these new features, if successful, are likely to lead to higher user engagement and therefore possibly greater monetization through advertising.

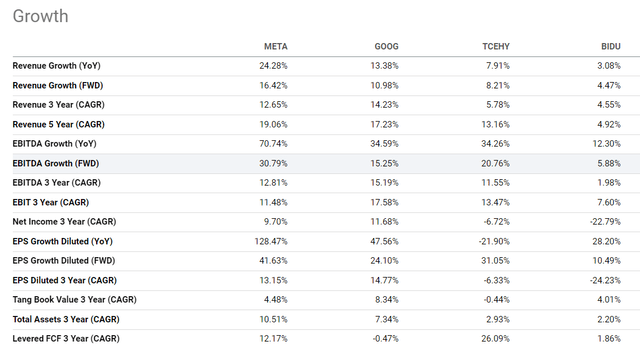

At the same time, I think META stock remains one of the cheapest big tech stocks out there. Trading at ~26.7x next-year earnings, which may seem to many as a pretty high number, Meta Platforms is expected to grow its EBITDA by 30.8% YoY on a forwarding basis – time more compared to the big Chinese peers and double the growth rate of Google for the same period:

As you can see, Meta looks quite superior in terms of top-line expansion and EPS FWD growth rates as well.

At the same time, the market is pricing in quite solid META’s EPS growth beyond 2024. As these forecasts probably don’t take into account the positive impact of the recently announced AI improvements (I said about it briefly above), the actual EPS growth rate is likely to be even more remarkable, in my opinion.

Assuming Meta beats FY2025 EPS estimates at about the level of previous years (on average I see it had delivered a positive surprise of 3-4% annually), then assuming the current FWD P/E multiple of 26.6x by the end of 2025, we’ll be dealing with a $674 stock. So the upside potential is going to be ~18.6% from the current stock price.

Based on all of the above, I decided to update my thesis on META without changing the “Buy” rating.

Risks To My “Buy” Rating

There are some risks with my thesis lying on the surface that every potential investor should be aware of.

First off, regarding the AI – Meta is going to give all their new AI features as an add-on to the existing product. Running LLM models is times more expensive than the usual search function as we know, so how much is it going to end up costing the company once hundreds of millions of people are using all these different AI features, all of the time? Meta’s chief product officer Chris Cox claimed in the presentation that its Llama 3 large language model is cheaper for developers to use than any other LLM, which presumably means that the operating costs are also low for Meta, but at mass scale, these could still mount up.

Moreover, softer macro deterioration could trigger a slowdown in the ad market, which makes up nearly all of Meta’s revenue (~98%). The shift to digital ads from offline ads provides some resilience, but would not insulate Meta from a meaningful pullback in ad spend. This would be a major risk to the bottom line.

Meta is also vulnerable to drastic regulatory responses in the US and abroad concerning antitrust; the sharing of misinformation, notably election interference; the dissemination of illegal content in private groups and end-to-end encrypted communications – for example, child pornography, hate speech; and misuse of members’ private information, among other issues.

The Bottom Line

Despite the many risks surrounding the company, I think the recently announced AI updates as well as the Ray-Ban glasses unveiled by Mark Zuckerberg with major advantages over anything else currently on the market – from pricing to particular features – should ultimately unlock a lot of value to investors. If I’m right, then the company’s current valuation may be too low even at 26.6x next year’s price-to-earnings ratio – I expect an upward revision to EPS growth estimates, which should theoretically fuel the current rally. That’s why I remain bullish, at least for the medium term.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in META over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!