Summary:

- Facebook-parent Meta Platforms Inc. remains a top bargain for long-term growth investors despite a 164% price return in 2023.

- The company is benefiting from a rebound in the online advertising industry, with sales increasing by 23% in the third quarter.

- Meta Platforms’ cost cuts and improved spending attitudes from advertisers make it an attractive investment with strong growth potential.

Justin Sullivan

Despite a substantial 164% price return in 2023, Facebook-parent Meta Platforms Inc. (NASDAQ:META) remains a top bargain for long-term growth investors.

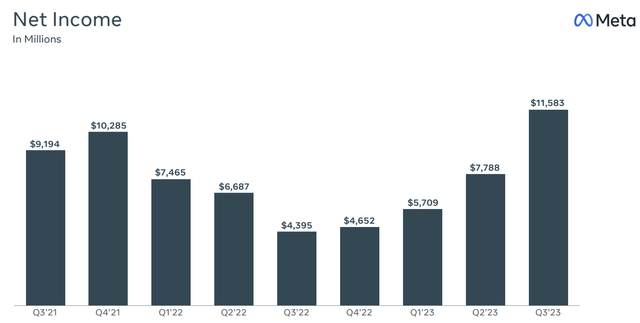

The company is profiting from an impressive rebound in the online advertising industry which has catapulted the company’s sales upwards by 23% in the third quarter. In addition, Meta Platforms’ operating margins doubled as earlier cost cuts paid big dividends.

With these cost cuts bearing fruit and advertising executives being willing to spend money again on online ads, I think the 18x earnings multiple that Meta Platforms’ is sporting makes the social-media company a steal.

My Rating History

My Buy rating has paid off so far as the social-media company enjoys a strong recovery in the advertising industry. The sales outlook for 4Q implies that this momentum has staying power.

Meta Platforms is also seeing a rather substantial free cash flow comeback as a result of an optimized cost structure and rebounding sales growth.

Advertising Rebound, Operating Margins Doubled YoY

Meta Platforms is seeing a rather substantial resuscitation of its main online advertising business which suffered substantially from falling advertising spending in 2022.

While the advertising sales trajectory determined the narrative last year, I think the growth of advertising spending on Meta Platform’s social-media platforms, improvement with respect to operating income margins and a linked recovery in free cash flow will be narratives for 2024.

As I already alluded to, Meta Platforms is seeing much-improved spending attitudes on the part of advertisers in 2023, a trend that accelerated in the third quarter.

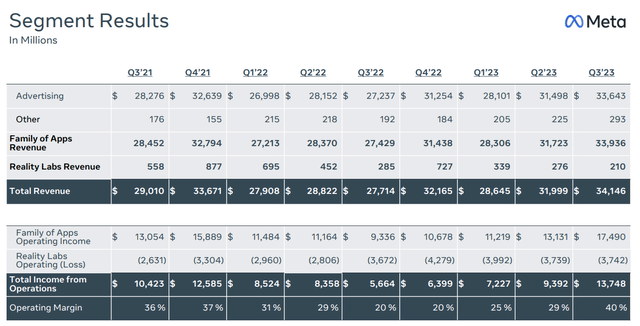

Meta Platforms produced 23% YoY sales growth in 3Q-23, primarily because advertisers felt more comfortable spending their ad budgets on Facebook and Instagram. Meta Platforms’ sales in the third quarter hit $34.1 billion and since costs and expenses were down 7% YoY as well, the social-media company has seen a huge boost to its operating margins.

Meta Platforms’ operating income margin doubled from 20% in 3Q-22 to 40% in 3Q-23 which not only attests to the strength of the advertising proposition for the platform itself, but also to the effectiveness of Meta’s lay-offs last year.

Segment Results (Meta Platforms)

Meta Platforms scaled back hiring and showed 21K employees the door in two major lay-off rounds in an attempt to protect profitability last year as advertisers scaled back spending. These aggressive cost cuts have resulted in a much-leaner cost structure and Meta Platforms now has considerable operating leverage to grow its profits.

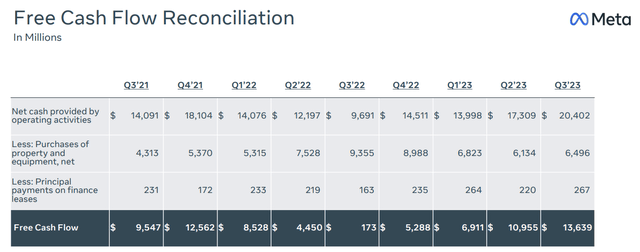

As far as Meta Platforms’ free cash flows are concerned, they also saw a rather substantial improvement compared to the year ago period.

In 3Q-23, Meta Platforms’ free cash flow amounted to $13.6 billion, reflecting an increase of 25% QoQ. Meta’s growth in free cash flow growth was not only tied to the company’s successful cost control programs it instituted last year.

A strong U.S. economy, which grew at a 4.9% rate in the third quarter, provided additional support and help ad spending for Meta Platforms’ multiple advertising platforms.

Free Cash Flow Reconciliation (Meta Platforms)

Sales Momentum Is Expected To Be Sustained In 4Q

Meta Platforms’ 4Q-23 sales are expected to fall into a range of $36.50 to $40.0 billion, reflecting a 19% sales growth rate. In short, the social-media company sees strong underlying growth trends in its advertising business that is expected to last at least throughout the fourth quarter.

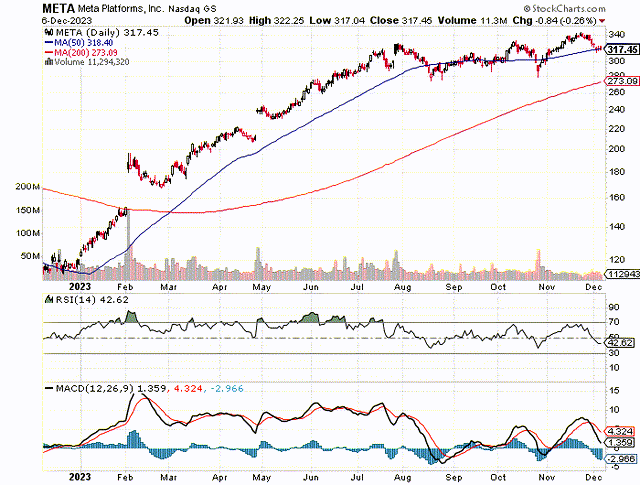

Technical Situation

It is not only the fundamental situation which has drastically improved for Meta Platforms in 2023, but the technical situation is also quite supportive. META has mostly traded above the 50-day moving average line throughout 2023 which is a bullish signal.

The 50-day moving average line, which presently runs at $318.40 should therefore be a strong support level for Meta Platforms. Should this level break, then the next support is around $280 which is where the stock bounced upwards on multiple occasions before. A break below the 200-day moving average line would be a negative short-term signal.

Moving Averages (Stockcharts.com)

Why Meta Platforms Is A Steal

The reason why I think Meta Platforms is a steal is because not only are its sales, free cash flows and profits in an upswing related to an advertising resurgence, but the social-media company has guided for 19% YoY sales growth for the fourth quarter, meaning Meta expects this sales momentum to continue.

The cost cuts last year were painful, but they have boosted Meta Platform’s operating leverage which might lead to stronger-than-expected profit growth next year.

The social-media company is expected to see 21% profit growth in 2024, a figure that I think Meta Platforms could easily exceed if advertisers remain in a buoyant state, and the fourth quarter outlook certainly implies that. The leading earnings multiple, at $17.39 per share in estimated earnings for 2024, is 18.3x.

Taking into account that the Facebook-parent is growing its sales at ~20% and produced 40% operating income margins, Meta Platforms is an extremely attractively valued technology company, even after a 164% price return this year.

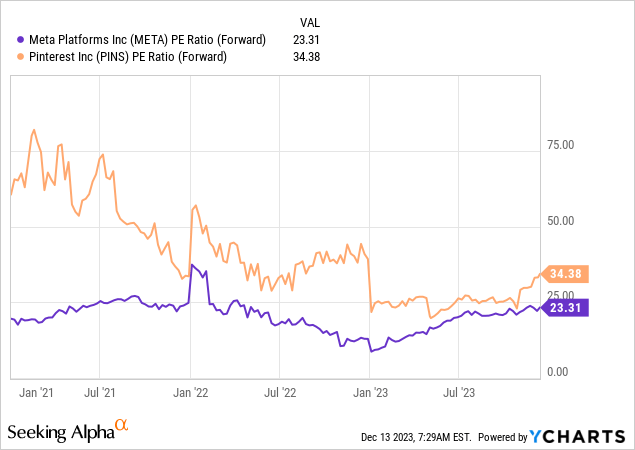

One platform that Meta can be compared against is Pinterest Inc. (PINS) for which the market models a similar growth rate for next year’s earnings: 22%.

Based on a stock price of $34.38, Pinterest’s stock sells for 27.9x leading earnings which means the earnings multiple is substantially higher than Meta Platforms’. Taking into account that Meta Platforms is producing an absolutely insane amount of profits and much cheaper than Pinterest, my choice for a social-media investment would definitely be Meta Platforms.

In my view, relative to Pinterest, Meta Platforms is still a bargain for investors seeking to select an earnings-strong social-media company to invest in.

Operating Income Margin Risks

Meta Platforms relies on the advertising market and since users on the platform are still growing, I think both investors and advertisers don’t have to be worried about the relevance of the company’s ad platform.

With that being said, though, a decline in monthly active users or a recession-driven cutback in advertising spending could throw off Meta Platforms’ extremely healthy looking operating income profile.

My Conclusion

Even after a 164% price increase in 2023, which exceeded my wildest expectations to be frank, I still see Meta Platforms as a steal, selling at only 18 times earnings. The underlying metrics like sales, free cash flow and profits are in an upswing and this is primarily due to advertisers returning to the social-media platform, while expense cuts instituted last year have started to bear fruit.

The outlook for 4Q-23 sales is a statement of confidence as well. Since the social-media company also saw a doubling of its operating income margin compared to last year, I think the advertising platform is in excellent shape.

With an 18x leading earnings multiple, double digit expected YoY profit growth and the odds in favor of a record sales quarter in 4Q-23, I think Meta Platforms was, is, and remains a steal.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.