Summary:

- Meta has spent $28 billion on buybacks in 2022 and has $51 billion allocated for future buybacks, potentially expunging 8% of outstanding stock.

- The company is focusing on improving margins, Reels monetization, and subscription, which should improve its fundamental performance.

- The share buyback will be a strong tailwind for Meta’s EPS as the company tries to improve margins through layoffs.

- New AI tools will also help in cost optimization and improve the ad-targeting ability of the company.

- Despite the recent bull run, the stock is still a good buy-and-hold bet with the potential to significantly beat market returns.

Justin Sullivan

Meta (NASDAQ:META) has jumped on the buyback bandwagon and is making higher investments in this initiative. In the last quarter, the company invested $9.4 billion in share repurchases. In trailing twelve months, Meta has spent a staggering $28 billion on buybacks. Additionally, Meta’s management has announced another $40 billion for share repurchase. This takes the total capital available for buybacks to $51 billion which is sufficient to expunge 8% of outstanding stock at the current price.

If the company continues on this trend, it could spend over half a trillion on buybacks in this decade which should be a positive tailwind for EPS and stock. In a previous article, it was mentioned that Meta would soon show positive YoY income results due to massive layoffs. We can already see progress in terms of margin in the recent quarter and this should improve as the entire layoff exercise is completed. Buybacks along with margin improvement should help in giving a long-term bullish momentum to the stock.

Apple (AAPL) has also spent over half a trillion on buybacks in the last ten years which has increased the company’s EPS by 5.2% annually. Meta should see strong improvement in margins after it absorbs the current round of layoffs. This will provide the company with additional resources to pursue buybacks. The company also has very few projects which are capital-intensive other than Reality Labs. Hence, higher free cash flow could be diverted for share purchases. The fundamentals of the company are quite strong and long term investors could gain from a steady increase in EPS through share repurchases.

Buyback pace can increase

Meta has spent close to $9.4 billion on buybacks in the recent quarter and $28 billion over the entire 2022. This has allowed the company to expunge a large number of shares. It has also announced another $40 billion in new authorization for buybacks. Most of the tech firms including Apple, Alphabet (GOOG), and Microsoft (MSFT) are putting more focus on buybacks to drive their EPS. Apple has already spent over half a trillion dollars in the last decade on buybacks which has reduced the outstanding stock by 40% and given the EPS an average annual boost of 5%.

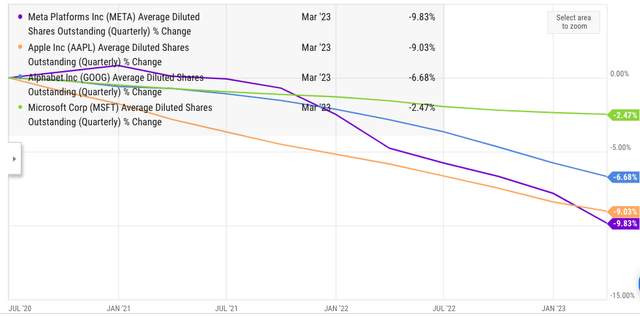

Figure 1: Stock reduction through buybacks in Meta, Apple, Alphabet, and Microsoft in last three years.

Despite a very high market cap, most tech companies are looking at buybacks as a key factor to improve their stock performance. We can see from the chart that Meta’s buyback pace has picked up in the last year and it is now ahead of Alphabet, Apple, and Microsoft in terms of percentage of shares expunged in the last three years.

Looking beyond buybacks

Buybacks provide a good tailwind to the stock but they are not the only factor affecting the performance. In 2022, Meta stock fell by 65% despite the enormous buyback. This shows that short-term sentiment can easily override any buyback boost. However, buybacks can help in the long-term reduction of outstanding shares. Apple has followed this principle by undertaking steady buybacks in the last ten years despite increase in stock price.

Meta had overhired in the pandemic and due to macroeconomic challenges faced a slowdown in revenue growth. This led to massive erosion of margins. The recent layoffs should allow the company to adjust headcount and revenue growth and boost margins. Meta would also need to show improvement in long term revenue growth runway. The company is focusing on Reels and any ban on TikTok should allow faster user engagement growth in Reels and better ad rates for this platform.

Meta is working on initiatives like subscription, Reality Labs, WhatsApp monetization, and others. This can help the company as the overall online ad market reaches saturation with a slower growth rate in the future.

Improvement in margin

Meta has posted one of the biggest drops in margins in its history as the company overhired during the pandemic. In November 2022, the company announced a massive layoff of 11,000 employees. It has recently announced another cut of 10,000 employees. Together, these two cuts should reduce Meta’s headcount by around 25%. It will have a massive impact on improving the margin and we could see the company post a profit margin similar to the quarters before it overhired.

Figure 2: Recent layoffs have allowed Meta to regain most of the lost income.

We can see from the above image that Meta has regained almost all the income from operations within Family of Apps segment. This is due to the cost optimizations achieved due to recent layoffs. It is also a good example for long-term investors to focus more on the fundamental business model instead of short-term quarterly losses. After Meta announced losses last year the stock went into correction mode and lost 65% of the market cap in 2022. It was inevitable that the management would take drastic actions like massive layoffs to regain earlier profit levels. Once the layoffs were announced, the stock gained momentum and has shown 120% jump year-to-date.

Most of this additional free cash flow from these layoffs will be diverted toward rewarding the investors. Meta does not need a huge pile of cash for incremental capital expenditure. The Reality Labs is still losing money but we could also see a slower burn rate in this division as the management focuses on profitable segments.

Meta is the ideal use case for AI

Meta has data for billions of people. Most of the recent focus within AI industry has been on the semiconductor companies like Nvidia (NVDA), Advanced Micro Devices (AMD)and others. However, the chip makers will only be providing shovels while the valuable gold lies with companies handling data. Meta will continue to be the leading social media company that controls massive data. It is likely that recent bans on TikTok will accelerate and Meta’s Reels will gain most of the market share and data.

Investors looking to make a play on AI stocks should keep Meta at the top of the list. AI will help Meta in optimizing a number of tasks which will have a direct impact on the bottom line. As an example, Meta has signed contractors who hire thousands of employees for content moderation. They make sure that all the content displayed on the platform meets the strict guidelines of the company. AI could help in optimizing this task and save hundreds of millions of dollars every year.

AI should also help in ad-targeting which is the bread and butter for Meta. The company has recently poached an entire team from Graphcore, one of the most valuable startups in UK. This team would be working on AI products and provide additional muscle in leveraging AI to build new features on Meta’s platform.

Impact on Meta stock

As noted earlier, the short-term impact of buybacks is limited. Even a massive buyback pace will not be able to overcome strong bearish sentiment in the near term. In 2022, Meta got poor ratings from Wall Street as the margins were dropping without any improvement in revenue. This led to a massive drop in the stock price. However, this has changed in 2023 as the company focuses on efficiency and reducing excess labor.

Buybacks can help the company over the long term when the company continuously invests to reduce share count while the fundamentals are strong. Meta is in a good position to deliver on some of the key growth drivers in future. This should give a strong boost to free cash flow and improve the EPS through buybacks.

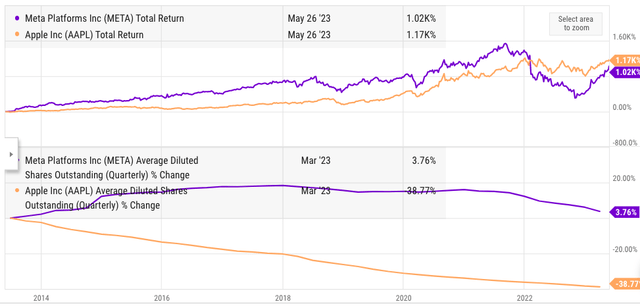

Figure 3: Comparison of outstanding shares and total return between Meta and Apple.

Over the last ten years, Meta has performed significantly better than Apple in terms of revenue growth. Meta started with a lower revenue base which helped the company. However, in terms of total returns, Apple has been able to outperform Meta. Apple’s management has made massive investments in buybacks and dividends by using the huge cash flow available to the company. The outstanding shares of Apple have declined by 40% while Meta’s outstanding shares increased by 4% in the last ten years.

In the future, Meta might not be able to deliver revenue growth similar to what it did five years back. However, the company will have a massive cash flow which can be diverted to reduce the share count or even start a robust dividend program. This should improve the long-term returns of the stock and make it more attractive for investors looking for a buy-and-hold option.

Investor Takeaway

Meta has invested $28 billion in buybacks in 2022. The company has another $51 billion for future buybacks which is equal to more than 8% of the current outstanding stock at the current price. Meta could show good performance in metrics like margins, Reels monetization, and subscription. This should improve the fundamental performance of the company. At the current pace of buyback, Meta could spend close to half a trillion dollars on share repurchases in this decade. This will be a strong tailwind for the EPS.

Meta stock is trading at close to 20 times forward PE which is one of the lowest among big tech companies. A strong boost from improvement of margins through layoffs should further improve the income and EPS potential in the future making the stock a good long-term bet.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.