Summary:

- Meta Platforms, Inc. has achieved strong revenue growth, with $36.5 billion in revenue and a 20% YoY increase.

- The company’s advertising business remains the main driver of revenue, benefiting from the growth in online ad demand.

- Despite losses from its Reality Labs business, Meta’s cash flow remains strong, with an annualized FCF of over $50 billion.

vm/E+ via Getty Images

Meta Platforms, Inc. (NASDAQ:META) is among the largest social networks in the world, with a market capitalization of more than $1 trillion. The company has been rewarded for its consistent growth by the market, even though it continues to spend $10s of billions on a Reality Labs business with no clear pathway to success.

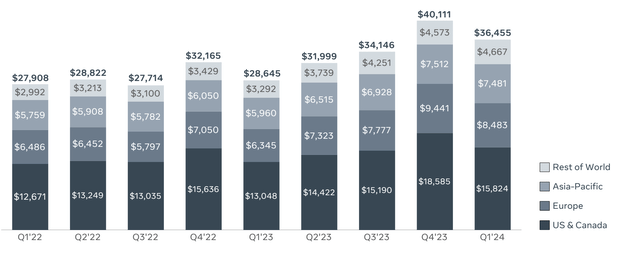

Meta Revenue

The company has managed to achieve strong revenue as its core social media business has continued to perform well, especially outside its core markets.

The company saw $36.5 billion in revenue up almost 20% YoY. Supporting that was an almost 50% increase in “Rest of World” revenue, along with strong growth in the company’s other markets. The company has seen strong advertising demand as it has continued to optimize its offerings to customers and grow its active users.

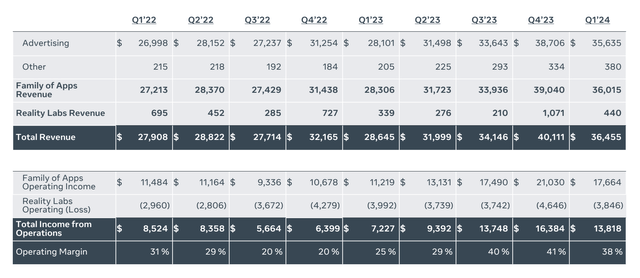

Meta Segment Performance

From a segment to segment performance, 98+% of the company’s revenue continues to come from advertising.

The key takeaway here is that advertising remains the key of the company’s business as online ad demand expands, and Facebook maintains a large market share. Facebook has actually seen its % of the digital ad business decline slightly. However, it has benefited from rapid growth in the digital ad business.

The company has continued to see massive losses from Reality Labs, with $3.8 billion in losses from the business in the most recent quarter. While those losses are down slightly YoY, the company continues to see more than $15 billion in annualized losses from the business. Given the minimal long-term strength of the business, we think existing could provide an immediate 20-30% boost to Meta’s share price.

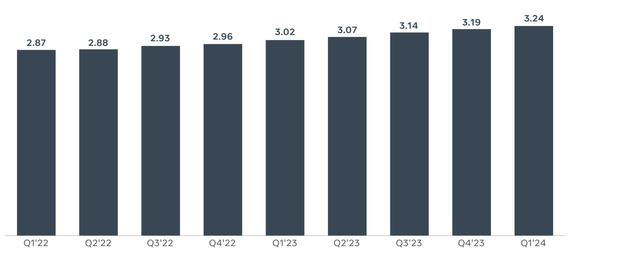

Meta User Activity

Meta has rebounded in user activity and managed to see much stronger growth.

From Q1 ’22 to Q1 ’23, the company saw monthly active user count increase by 15 million users. Over the last 12 months, that has become a 22 million user increase, or almost 50% more growth. That is impressive given that the company already has 40% of the global population as a monthly active user. It shows how the company’s platforms are integrated into daily life.

That continued and accelerated growth shows minimal wavering demand for the company’s products and will enable the company to continue shareholder returns.

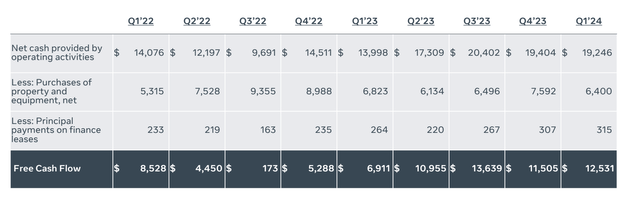

Meta Cash Flow

Meta’s cash flow remains strong, despite the company’s continued losses from Reality Labs.

The company’s annualized FCF is passing $50 billion, a substantial amount for a company with a market capitalization of almost $1.2 trillion. That’s an almost 5% FCF yield for the company, despite massive continued capital investments to the tune of almost $30 billion in 2023.

Meta is spending a massive amount on Nvidia GPUs, $30 billion worth, which is capital spending we don’t expect to sustain for the long term. We will say that while Meta is a company known for its technical prowess with long-term open-source accomplishments such as React and PyTorch, we are concerned about the company’s direction here.

The company spent many billions on Reality Labs, a thesis risk discussed below, with a minimal path to returns. We’re afraid the company is jumping on the AI model bandwagon with minimal pathways to returns.

However, Meta is committed to shareholder returns. The company has recently announced a dividend that will cost it ~$5 billion annualized. Meta also has a $50 billion authorized buyback program, enough for almost 5% of outstanding shares. It could complete it in just 14 months. The buyback model has worked well for Apple’s returns, and we expect it to continue well for Meta.

Thesis Risk

The largest risk to our thesis is Meta’s concentrated governance, with CEO Mark Zuckerberg controlling the company. While he obviously has a strong and vested financial interest in continued success for the company, we don’t believe that he has historically made decisions for the best interest of the company, such as with AR/VR.

That’s a risk worth noting going forward.

Conclusion

Meta has an impressive portfolio that’s continuing to grow as the company continues to generate massive ad revenue. At the same time, the company is continuing to see its user count grow, if not accelerate. That has pushed the company past $150 billion in annual revenue, as the company continues to earn almost $50 billion in annual cash flow.

The company is directing that cash flow towards shareholder returns. Buybacks and dividends will lead to reasonable returns that it can comfortably afford. However, we remain very concerned about Meta Platforms, Inc.’s continued expensive chasing of projects that show no sign of making back the money, such as Reality Labs and Artificial Intelligence Models.

How that pans out remains to be seen. Please let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.