Summary:

- Meta reported a 25% revenue growth and a 203% increase in EPS in Q4, with notable progress in improving free cash flow.

- China-based advertisers contributed 5% of growth in FY23, but geopolitical risks may impact Meta’s future growth.

- Meta anticipates increased capital expenditure and higher depreciation costs in FY24, and a return to 10% revenue growth without additional contribution from China.

JOSH EDELSON/AFP via Getty Images

Meta (NASDAQ:META) reported their Q4 results on February 1st, showing a 25% revenue growth and a 203% increase in EPS. I highlighted their rise in capital expenditure in FY24 in my previous article. China-based Advertisers Contribute 5% of Growth in FY23, which is unsustainable in my view. I maintain a ‘Sell’ rating with a fair value of $400 per share.

Q4 Review and China-Based Advertisers

In Q4 FY23, their revenue increased by 25%, and total expenses reduced by 8% year-over-year, contributing to 203% EPS growth in the quarter. For the full year, Meta made notable progress in improving their free cash flow generation, delivering $43.8 billion of free cash flow, a 130% year-over-year growth.

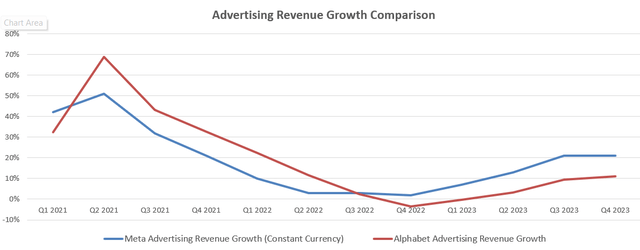

As shown in the chart below, their advertising revenue growth has been accelerating since Q4 FY22, and their growth rate has been superior to Alphabet’s (GOOGL) advertising business in the past few quarters.

Meta and Alphabet Quarterly Earnings

Their revenue growth has been driven by a couple of factors. Firstly, Meta’s advertising business didn’t experience similar high growth during FY21, as shown in the chart above. More specifically, Meta’s growth rate was around 10% lower than Alphabet’s advertising revenue growth during that period. Therefore, after Q4 FY22, Meta has faced less pressure from high comparables compared to Alphabet.

Additionally, Meta disclosed that revenue from China-based advertisers represented 10% of their overall revenue and contributed 5% of group revenue in FY23. These China-based advertisers are primarily in the online commerce and gaming sectors, and they contributed materially to Meta’s growth in FY23. Despite Facebook, Instagram, and WhatsApp being banned in China, Chinese advertisers aim to reach foreign consumers through Meta’s social platforms. I am encouraged to see the strong growth contribution from these Chinese advertisers. However, considering the intensifying geopolitical risks between the U.S. and China, I am concerned about Meta’s growth in the future.

Other than revenue growth, Meta delivered strong margin improvement in FY23. The contributing factors are as follows: in the earnings release, they disclosed that the total headcount was 67,317 as of December 31, 2023, a decrease of 22% year-over-year, and they incurred $3.45 billion of total restructuring costs in FY23. The massive layoff did help reduce their operating expenses in FY23. In FY24, they anticipate further shifting their workforce composition toward higher-cost technician roles, indicating they are going to hire more AI-related engineers with higher compensation costs in FY24. Additionally, their total revenue grew 15.7% in FY23, and the company is benefiting from operating leverage, thus expanding their operating margin meaningfully.

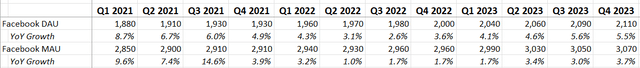

In Q4 FY23, Facebook daily active users grew 5.5% year-over-year, and monthly active users were up 3.7%, as shown in the table below. I have to acknowledge that their active user growth is nice in the post-pandemic era. Reel is quite successful for Meta, across both Instagram and Facebook platforms. As their management mentioned, Reel is contributing to their revenue across their apps. The success of Reel and video content are part of their continuing success in daily active user growth, in my opinion.

Meta ended the year with $65.4 billion in cash and $18.4 billion in debt, maintaining a robust balance sheet. They bought back $6.3 billion of their own shares in Q4, and for the full year, they repurchased $20 billion. They still hold $30.9 billion and announced a $50 billion increase in their share repurchase authorization during the earnings call. Their share repurchase is significant, with the total authorized dollar amount representing around 6.7% of the total market capitalization.

FY24 Outlook

For FY24, Meta anticipates capital expenditure to be in the range of $30 billion to $37 billion, a $2 billion increase from the high end of their prior guidance. I discussed Meta’s issue of increasing capital expenditure in my previous article. In order to maintain their competitive advantage in the AI era, they have no choice but to increase spending on AI-related data centers and hardware. The increased capex would result in higher depreciation costs for the company in the future. During the earnings call, they indicated that depreciation costs would be higher in FY24. Additionally, they anticipate FY24 total expenses to be $94 billion to $99 billion, unchanged from their prior outlook.

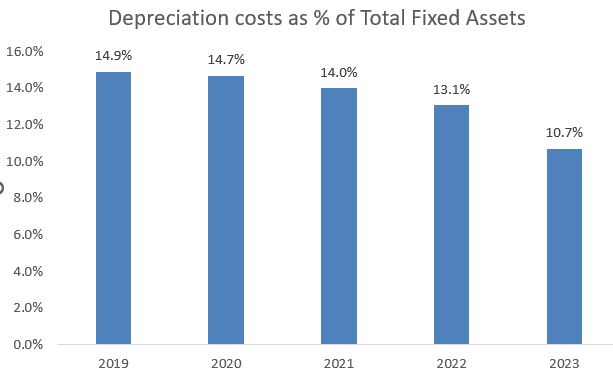

The mid-point of their total expense guidance implies approximately 9% year-over-year growth. I view this expectation as quite reasonable for several reasons. In FY23, they already completed a massive layoff, so the benefit in FY24 would be quite limited in the year-over-year comparison. Furthermore, as the company significantly increased their capital expenditure since FY22, and the mid-point of their FY24 capex plan is roughly double the amount of FY21’s level, they are expected to face a huge increase in depreciation costs in FY24. Over the past five years, the depreciation costs have averaged around 13.5% of total fixed assets, as illustrated in the chart below. Using the same straight-line method, their depreciation costs would be $13 billion in FY24, $2 billion more than FY22’s level.

Meta 10Ks

During the earnings call, their management indicated that Reality Labs would experience higher operating losses in FY24 due to their ongoing investment in AR/VR-related projects. Combined with all of these headwinds, a 9% increase in total expenses makes sense to me.

Regarding revenue growth, I won’t assume that China-based advertisers will continue to contribute additional growth for Meta in FY24, as Meta’s management might want to limit exposure to China-based advertisers due to potential regulatory scrutiny. Excluding the additional 5% growth from China, Meta is more likely to return to their typical 10% revenue growth in FY24, which aligns with their core growth in FY23.

Valuation

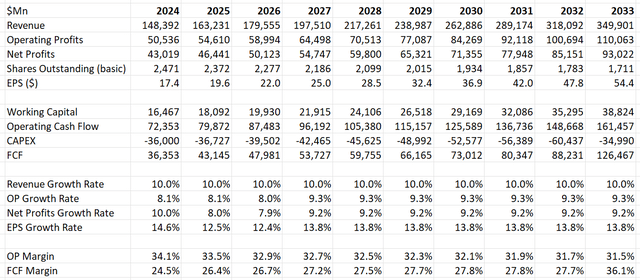

The assumptions for FY24 align with their full-year guidance, reflecting the higher depreciation costs. As analyzed previously, I estimate their revenue will grow by 10% in FY24 and don’t expect additional growth from China-based advertisers. I’ve maintained the same normalized revenue growth rate as in my previous model for the next ten years.

With Meta actively repurchasing their own shares, I calculate that their shares outstanding could be reduced by 4% annually. The model assumes continued investment in capital expenditure for the next few years, as Meta needs to heavily invest in data center buildings, servers, and GPUs to maintain their AI advantage.

On the margin side, I estimate Meta needs to grow their operating expenses between 10-11% annually to support double-digit revenue growth. As discussed above, the depreciation costs and ongoing losses in AR/VR would continue to put pressure on their cost side. As a result, I estimate their operating margin will gradually reduce to 31.5% by FY33.

I’ve kept the remaining assumptions intact compared to my previous model, and the fair value is calculated to be $400 per share. Currently, their stock price is trading at around 30x forward free cash flow.

Meta DCF – Author’s Calculations

Key Risks

Facebook or Instagram users might notice a significant presence of performance-based advertisements from Temu and Shein, the two prominent Chinese e-commerce players. These online retailers specialize in offering inexpensive goods shipped directly from China, positioning themselves as competitors to Amazon and other e-commerce giants. According to reports, Temu sells goods directly from manufacturers to end-consumers, leveraging its low prices to bypass ‘de minimis’ regulations. This loophole exempts imported items valued at less than $800 from taxes or inspection. However, despite their current success, I have reservations about the sustainability of Temu and Shein’s business model in the long term.

Conclusion

I appreciate Meta’s growth in their Reel and video content business across their apps. However, I’m concerned about the increasing depreciation cost pressure resulting from their heightened capital expenditure. Additionally, I’m wary of the growth contribution from China-based advertisers, as that aspect of the business may be unsustainable in the future. Given these factors and considering the stock’s overvaluation, I maintain a ‘Sell’ rating with a fair price target of $400 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.