Summary:

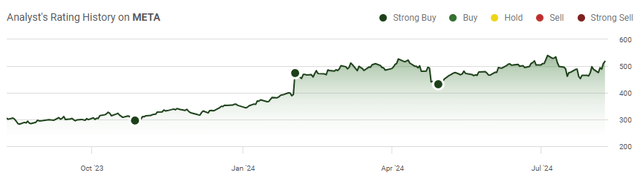

- Meta Platforms shares are up 46.28% YTD, outperforming the S&P 500 by 34.24%.

- Meta continues to see growth across its platforms, adding 30 million daily active users in Q2.

- Despite risks, Meta delivered a strong Q2 earnings beat, with revenue up 22.1% YoY and net income increasing by 72.89% YoY.

Kenneth Cheung

Meta Platforms (NASDAQ:META) is having an outstanding year as shares are up 46.28% YTD compared to the S&P 500 being up 12.04%. There is always something happening with META that spooks the investment community. Whether it’s lawsuits, scandals, Mark Zuckerberg testifying on the hill, spending on the Metaverse, or spending additional capital on AI, there are always bears trying to amplify a negative narrative. When shares of META were freefalling in 2022 and crashed below the $100 level, I was adamant that the fundamentals were strong, and that the selloff was unjustified. On 11/1/22, I wrote an article about META’s massive upside potential (can be read here), and since then, shares have appreciated by 448.89% compared to 37% for the S&P 500. I am just as bullish now as I was then. I haven’t sold any shares, and I believe META will continue going higher. META continues to see growth across its platforms as more than a 1/3rd of the global population utilizes one of its products. The election cycle is starting to heat up, and I believe we will see an influx of add dollars flowing to the bottom line. META is in a prime position to shape the narrative on AI and benefit at scale from companies and individuals getting a better ROI on their advertising dollars. META continues to rebound after earnings, and I believe shares are headed to all-time highs in the fall of 2024.

Seeking Alpha

Following up on my previous article about Meta Platforms

In my last article about META, which I wrote on 4/29/24 (can be read here), I had discussed why the meltdown from around $525 to $430 was unwarranted. Regardless of whether you don’t utilize their products or agree with Mark Zuckerberg, it’s hard to deny that they are one of the best companies in the world when looking at their market cap, revenue generated, and profits produced. After smashing Q2 earnings, I wanted to follow up with a new article to discuss how I believe META will shape a segment of AI, and why I see shares continuing to all-time highs. For years, I have heard that META is losing its relevancy, but time and time again, this narrative is proved incorrect when the updated user counts and top-line revenue are announced. I think shares of META are going higher, and even at the $500 level, shares look inexpensive on a forward basis.

Seeking Alpha

Risks to investing in Meta Platforms

Despite being one of the largest and most profitable companies in the market, there are always risks to investing, even when discussing META. At some point, user growth will plateau, and engagement could decline. META depends heavily on ad revenue, so if we see declines in engagement, META may not be able to charge as much as they do for ads, and we could see less demand for their advertising services. There are always privacy and regulation concerns, and it’s entirely possible that new legislation is crafted that negatively impacts META’s buisness. Realty Labs continues to lose money, and while the losses are embedded within a large pool of profitability, some investors look at this as recklessness and don’t trust Mark Zuckerberg to be a steward of shareholder capital. There are also competitive risk factors, such as new products capturing engagement and taking away ad dollars that were previously allocated toward META or companies such as Alphabet (GOOGL), Amazon (AMZN), or TikTok providing additional ROI on ad campaigns. META has many different types of risks, and investors should be aware of the potential headwinds that could materialize in the future.

META blew Q2 earnings out of the water, and I am expecting them to continue pulling ahead in the A.I race

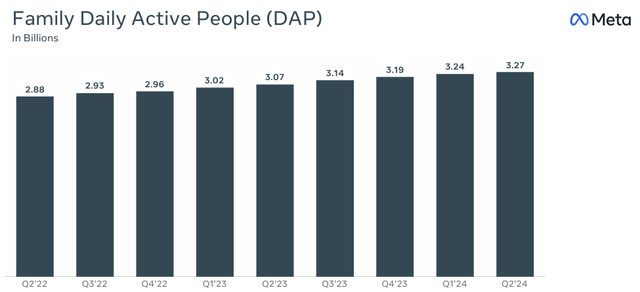

For anyone who thought META was losing a step, they’re not. What could arguably have been the most impressive aspect from earnings was that META added 30 million daily active people (DAP) over the past 3 months. There are currently 8.17 billion people globally, and META added 0.37% of the global population to their platforms in Q2. On a daily basis, 40.03% of the global population uses one of META’s products. Profitability aside, no other company that I know of has this type of global reach. When I think about the value added for anyone who is looking to deploy an advertising budget, META is at the top of the list. By adding 30 million DAPs in Q2, META increased its total DAPs by 7% YoY, and the number of ad impressions across the META ecosystem increased by 10% along with the price per ad. META’s average revenue per person increased by 14.11% YoY in Q2 from $10.42 to $11.89. In addition to the 10% global increase per ad, META recognized an 18% increase in ad pricing across Europe and 24% in the rest of the world category. The global growth in DAPs and ad cost continues to positively impact META, and despite what anyone is saying, META just produced its 2nd largest quarter for revenue as they added $7.07 billion (22.1%) YoY in Q2 to their top-line.

Meta Platforms

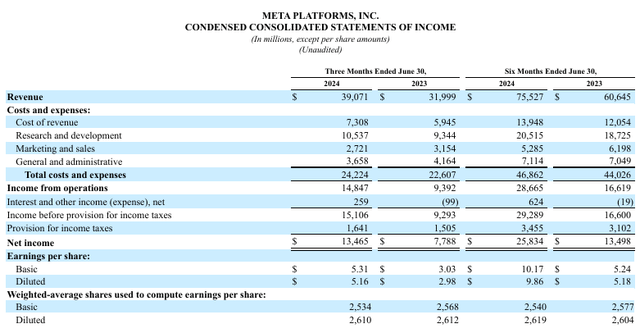

META delivered a large top and bottom-line beat in Q2 as they came in with $39.07 billion in revenue, which was ahead of the consensus estimates by $760 million. META grew its revenue by 22.1% YoY in Q2. META also generated $5.16 in GAAP EPS, which was a $0.40 beat on the bottom line. The reason why I continue to give Mark Zuckerberg the benefit of the doubt is because META continues to increase margins and profitability for shareholders, despite his forward-thinking around expenses. In Q2 2024, META increased its total costs expenses by 6.68% YoY to $24.22 billion. By spending an additional $1.62 billion, META was able to produce an additional $7.07 billion in revenue YoY, which was an 18.1% jump compared to the $32 billion in revenue they generated in Q2 2023. META also drove in $14.85 billion in income from operations, which was a 36.74% increase YoY as they added an additional $5.46 billion. META also expanded its operating margin by 8.65% to 38%. As a shareholder, I am extremely happy and applaud META’s operating proficiency, as all these financial accomplishments cost an additional $1.62 billion. After income taxes and all their other expenses, META’s net income in Q2 grew by $5.68 billion or 72.89% YoY to $13.47 billion. There were 13 weeks in Q2 2024, and META generated $1.04 billion in net income per week, which is a metric not many companies can compete with.

Meta Platforms

While Mark Zuckerberg was criticized for all the CapEx spending on the Metaverse, he was able to redeploy compute from GPUs toward AI. META is currently in an AI arms race, and he wasn’t shy about discussing spending. He specifically indicated on the earnings call that the amount of compute needed to train the Llama 4 model will be roughly 10x what was needed for Llama 3, and future models would need additional compute. Susan Li specified on the earnings call that META anticipates that the bottom range of their previous CapEx guide of $35 – $40 billion would increase to $37 billion, and they are planning on CapEx growth in 2025 to support AI research and development. These are big numbers, but I look through the Cash Flow Statements before I form an opinion. Last year, META spent $27.27 billion on CapEx but generated $71.11 billion in cash from operations, which allowed them to produce $43.85 billion in free cash flow (FCF). In the trailing twelve months (TTM) META has allocated $28.88 billion toward CapEx and generated $78.42 billion in cash from operations. Even if META generates $80 billion in cash from operations and spends $40 billion on CapEx in 2024, they will still produce $40 billion in FCF. As an investor, I don’t see a problem with this, considering that META is spending money on building their future and expanding its moat without tapping the debt markets.

When I listen to Mark Zuckerberg discuss his vision on how META will not only compete but be a winner take most in the new age of computing, I agree with the CapEx allocation. At the end of the day only a handful of companies will be able to compete with META because just about every company outside Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Alphabet (MSFT) doesn’t have the balance sheet or profitability to keep up with META from building out the compute to training the models. This will allow META to shape how AI performs, and provide better products and features to its clients. Their recommendation models will get more advanced, and META will be able to fine-tune every customer’s needs when it comes to reaching their desired demographic. Mr. Zuckerberg went as far as to say that in the future, a client will be able to just give META a budget and business objective, and they will take care of everything else on the backend. The other big aspect was AI Studio, which had just been launched. This lets anyone create AI to interact with across their products. Individuals or companies will be able to utilize META’s AI Studio to generate AI agents, which will be able to create content, interact with individuals within their community, and answer their questions. META is also testing its business AI and getting feedback. When I think about the use cases for these products and how this could add to META’s top and bottom line, I get very excited. While other companies may be able to provide similar enhancements in the future, many of the ecosystems that individuals are interacting with are on META’s platforms. META is just going to make their mousetrap better and more profitable. META is putting itself in a position where they will continue to be a dominant player in the online space, and paying for additional AI services from META will be critical for businesses to unlock more potential from their social media presence.

Meta Platforms still looks inexpensive, even after climbing past $500

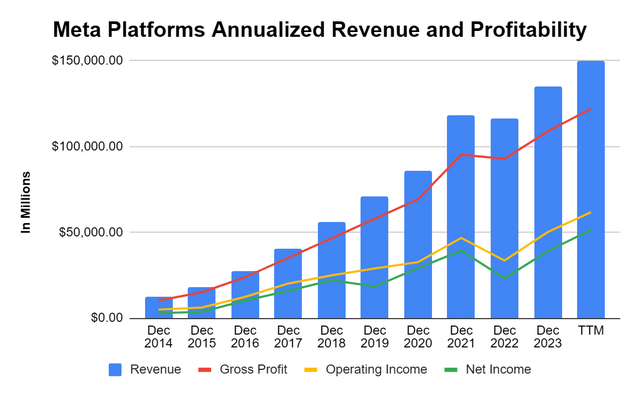

Before getting into the actual valuation, I wanted to highlight that META is still growing despite a slight setback in 2022. Over the past 10 years, META has grown its revenue by 1,101.54% ($137.32 billion) as its increased to 149.78 billion in the TTM. Its gross profit has increased by 1,083.55%, while operating income increased by 1,136.12% and net income grew by 1,649.46%. On a YoY basis, in the TTM, META has grown its revenue by $14.88 billion (11.03%), gross profit by $13.16 billion by 12.09%, operating income by $11.53 billion (22.96%), and its net income by $12.34 billion (31.55%). In addition to continued growth across many of the critical line items on an income statement, META has also expanded its profitability margins. In 2014, META finished the year with a 82.73% gross profit margin, 40.06% operating margin, and 23.58% profit margin. In the TTM 10 years later, META’s gross profit margin has declined by -1.24% to 81.49%, but they grew their operating margin by 1.15% to 41.21% and their net income margin by 10.75% to 34.34%. More than 1/3rd of every additional dollar generated of revenue hits the bottom line, and that is something most companies can’t achieve in addition to the level of revenue and profitability META produces. In addition to looking undervalued, META is still growing and isn’t just on the defensive trying to protect what they have built.

Steven Fiorillo, Seeking Alpha

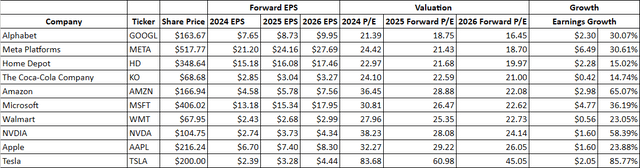

When I look at META on a forward basis, I get excited. META is expected to generate $21.20 of earnings this year, placing its 2024 forward P/E at 24.42. I compared META to the rest of the Magnificent Seven, in addition to Home Depot (HD), Walmart (WMT), and The Coca-Cola Company (KO) to add some perspective outside of big tech. Based on 2024 earnings, META trades at the 4th lowest level as Alphabet (GOOGL), HD, and KO trade between a P/E of 21.39 and 24.10. When I look out to 2025 and 2026, META trades at the 2nd lowest P/E level in both categories at 21.43 times 2025 earnings and 18.70 times 2026 earnings. META has 30.61% earnings growth on the horizon from the close of 2024 through 2026, which is double HD and KO, yet it trades at a lower multiple on forward earnings. I think META looks extremely cheap at this valuation.

Steven Fiorillo, Seeking Alpha

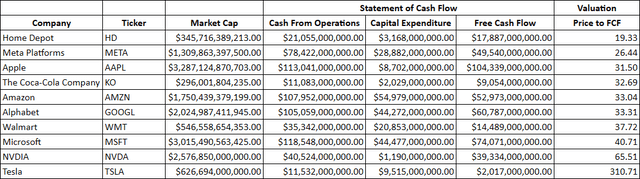

I also look at META on a free cash flow (FCF) basis, because I like to have confirmation to my valuation thesis from another profitability metric. I like FCF because it’s harder to manipulate than net income, as it’s simply cash in vs cash out. META is trading at 26.44 times its FCF, as it would take a little less than 27 years for META to generate its entire market cap in FCF. The only company that trades at a lower valuation is HD, and we know that META is on a spending spree to build its AI infrastructure. KO trades at 32.69 times its FCF, and the rest of big tech trades at over 30 times its FCF. I think that the price to FCF metric further validates that META is undervalued.

Steven Fiorillo, Seeking Alpha

Conclusion

I am going to make some predictions that might not come true, but I think shares of META have the potential to finish near $575 in 2024 and $700 by the end of 2025. If META was trading at $575 right now, it would still trade at less than 30 times earnings for 2024 and at 20.77 times 2026 earnings. I believe that META is going to outspend most of the competition and create more value for its clients through new product features that will enhance its advertising efforts and make its businesses more effective across social media platforms. The large spending on hardware and ramping up AI features could spawn a new era of growth for META, and I think the next several years could be very lucrative for shareholders. As a long-term shareholder, I am very excited about the future and think that META looks inexpensive on a forward basis.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AMZN, NVDA, GOOGL, TSLA, AAPL, KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.