Summary:

- META currently trades at 22x forward earnings despite double-digit bottom-line growth expectations in 2024-2026.

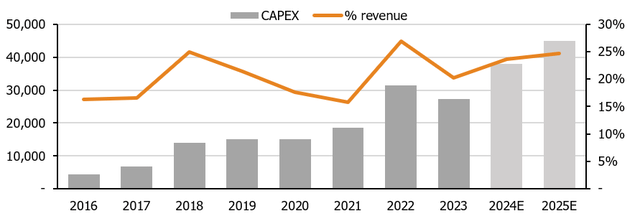

- CAPEX and Reality Labs are an overhang on the multiple, but management has shown cost discipline and consistently high incremental ROIC.

- After being battle-tested in 2022, META is more deserving than ever of a premium and of our confidence in its staying power as a core player in digital advertising.

cherdchai chawienghong/iStock via Getty Images

This article is a bottom-up overview of Meta Platforms, Inc. (NASDAQ:META), its key performance drivers, and why the market is still divided over its future.

META is an indispensable player in digital advertising, leading its peers in returns on ad spend for advertisers.

I am less worried about their spending and investments than the average investor. With solid returns on capital holding strong and its undemanding valuation, an investment in META is skewed to the upside.

One-Minute Summary of META’s Business

META sells advertising on its social media platforms (98% of revenue), most of which comes from Facebook and Instagram.

It competes with other social media and entertainment platforms for user engagement and with alternative marketing channels (digital and traditional) for advertisers’ marketing dollars.

It wins users by having a larger existing base (network effect) and better content/features. It wins advertisers by having more user data for better targeting, and more diverse user demographics, enabling better returns on ad spend (ROAS).

Its growth drivers are:

- Number of users.

- Engagement (Time spent per user).

- Ad Frequency (Ad per time spent).

- Monetization ($ received per ad).

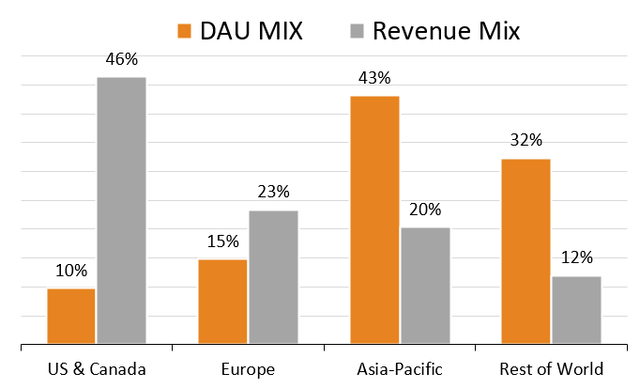

ROW and APAC dominate META’s user mix, but U.S./Can have a meaningfully higher ARPU so that it still dominates their total revenues.

The market’s current worries revolve around META’s investments in AI CAPEX and Reality Labs’ losses. We’ll explore both in depth.

Industry Highlights

Value Chain

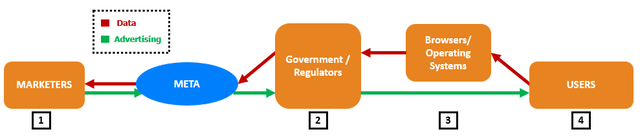

Here is a simple representation of META’s value chain, with the flow of data in red and advertising in green:

1. Marketers

As of 2024, META had 10mm active advertisers. There are no long-term advertising contracts, and many spend only a fraction of their total advertising budgets on META platforms.

Return on advertising spend (ROAS) guides their budget allocation between different potential platforms and media.

2. Governments and Regulators

Governments can either entirely block META’s apps from their country (ex. Russia, $2B revenue loss) or regulate how META operates (ex. how and to what extent it can collect users’ data).

3. Browsers and OS

META’s apps are subject to product and feature decisions from the OS and browsers on which its apps run on. They can affect how much data META can collect outside of its apps.

The clearest example is Apple’s decision to disable IDFA by default on its apps. According to META, this resulted in an estimated $10B revenue loss in 2022 (~10% of that year’s total).

This has certainly driven Mark’s decision to build the VR/AR computing platform and OS, which would limit 3rd parties interfering with what his apps can and can’t do. We’ll return to this strategy later.

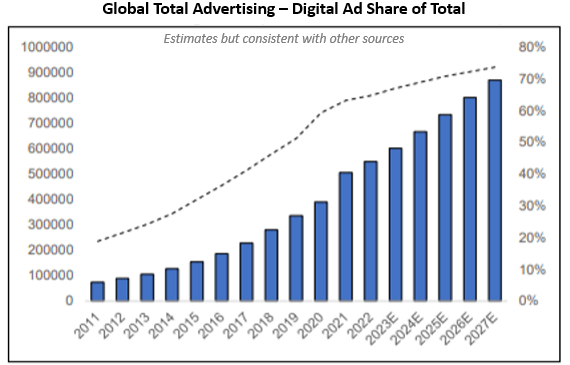

Advertising Market Overview

A growing share of advertising spending is going toward digital channels:

Statista

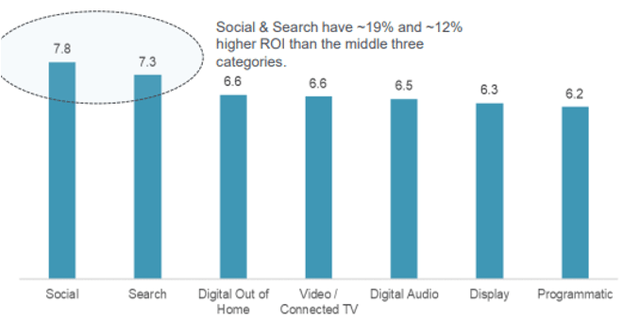

Returns on digital spending seem to justify this share gain. A survey asking advertisers to rank returns on spend from 1 (worst) to 10 (best), shows meaningful outperformance of digital advertising, but specifically social:

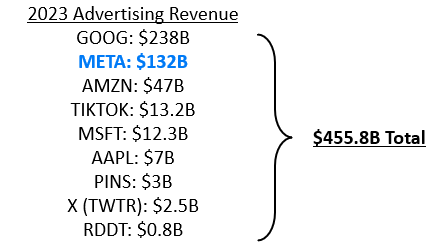

Estimates for the total advertising market spend in 2024 range from around $750 to $800B. Digital ranges from $500-600B. Looking at the top public advertising players and their 2023 ad revenues, this amount checks out with META and Alphabet Inc. (GOOG), (GOOGL) clearly leading the pack:

2023 Advertising Revenue (Company Filings)

How META’s Ad Auctions Work:

META’s platforms conduct ad purchasing through auctions. The auctions are held “automatically” for every instance where an ad could be shown (there are billions every day).

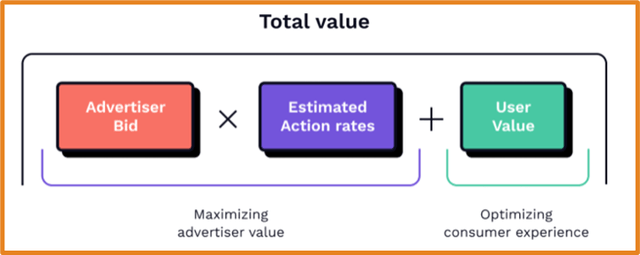

The winner, selected by META’s algorithm, will be the one with the highest total value, calculated as follows:

You’ll notice that the winner is not simply the highest bidder. This is similar to Google’s auction process, although the winning formula and other mechanics differ.

- Advertiser bid: Set a budget and a bidding strategy; META’s system attempts to get the best outcome within these parameters. If your bid is $3 and the closest is $2, you will pay $2.01.

- Estimated Action Rates: Done automatically by algorithm behind the scenes, how likely your ad is to drive the desired action. Will give priority to high action rate ads.

- User Value (Quality/Relevance Score): Ad quality and how much your target audience finds it relevant. If you get a low score, you may not win auctions even with high bids, driving costs higher.

AI Powers Advertising

Meta Advantage+ (launched in 2022) is a suite of automation tools to simplify and automate ad campaigns for advertisers. It can create variations in ads to test and select optimal placements, audience, etc. based on ROAS.

These tools are free to use. The playbook is that by increasing ROAS, more ad spend will come onto the platform, increasing competition, and in turn higher winning bid prices. Customers will also receive higher-quality ads. Win/win.

Management cited a study during their Q2 2024 call that found a +22% improvement in ROAS for advertisers using Advantage+.

As of Q4 2023, management estimates its active user base at 1mm+ advertisers or approximately ~10% of its total base.

Interestingly, the long-term product target according to Mark is to have advertisers only set an advertising objective and budget. Its tools would then determine how, and to whom they would show the ad to maximize returns.

While years away, this would easily solidify their competitive positioning.

Competitive Advantage

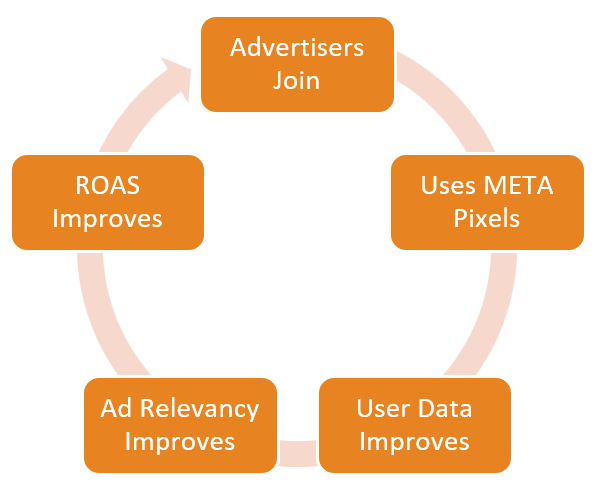

As stated earlier, META operates on a network effect/flywheel that aims to attract both users and advertisers.

Here’s how META fares relative to competitors in attracting both.

Competing for Advertisers

Advertisers use META pixels on their websites to help META track who uses their websites to better target advertising and measure conversions etc.

The more advertisers join and use Pixels, the more data META can collect about its users, improving ad relevance and monetization. The platform’s superior returns in turn drive more advertisers to use it and the cycle continues.

Advertiser Flywheel (Author)

Competing for Users

META’s platforms have transformed from recommending content related to acquaintances (thousands of possibilities) to unconnected content (millions of possibilities).

This has created a new network effect beyond “if your friends are there”

Now, the more creators use META’s apps, and the better the content they create, the higher the user engagement will be.

Their user/creator flywheel now looks a little like this:

User Flywheel (Author)

The presence of quality content reduces the risk of user churn beyond acquaintances remaining on the platform.

Recapping What Happened in 2022

In late 2022, META’s stock price fell ~76% from its peak, trading at ~9x blended forward EPS.

Let’s consider why this happened and whether the issues have been resolved.

The Setup

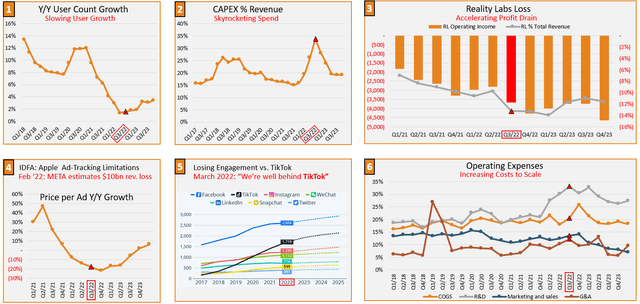

Six factors came together to catalyze the fall. They were:

- Slowing User Growth.

- Skyrocketing CAPEX as a percentage of revenue.

- Accelerating Reality Labs Profit Drain.

- $10Bn revenue hit from Apple’s tracking rule change.

- TikTok is ahead of META’s products and gaining user engagement.

- Operating expenses increase with scale.

Here they are visually, with Q3 2022 highlighted, the quarter during which META’s stock troughed:

Company Filings & Statista, formatted by author

Spending Reduced but Not Tamed

As you can see from the figure, the momentum of many KPIs shifted after Q3 ’22.

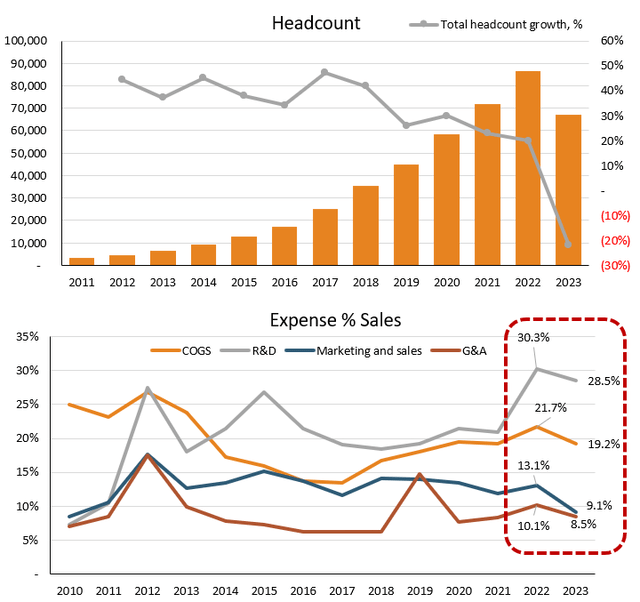

Headcount shrunk significantly the following year, along with operating expenses:

Post-cut Expense Trends (Company filings formatted by author)

I believe META has resolved most worries around its products as user count growth picked back up and Instagram gained on TikTok’s engagement.

META’s platforms have been battle-tested and the company’s moat re-affirmed

However, the company still has not fully addressed the investor’s concerns regarding investments and margins.

- R&D was by far the biggest cost increase in 2022, but it did not get scaled back proportionately. It remains ~8% higher than 2021.

- Reality Labs spending as a percentage of sales remains stable but is growing in absolute numbers. The product strategy remains unchanged.

- They have confirmed that the CAPEX investment cycle will endure over the next years with no clearer picture of the expected payoff. Consensus expects it to rise from ~$28B in 2023 to ~$45B in 2026.

Mark compares AI investments to the unmonetized phase of early product ramps like stories, reels, transition to mobile, etc. However, past product playbooks have not involved tens of billions of CAPEX ramp; the risks are higher, and it is fair to question the potential reward.

Investments Are Big, But Returns Hold Up

Reality Labs

This segment includes:

- Hardware (Headsets and glasses).

- Operating System (Horizon OS).

- Apps (Horizon Worlds/Workrooms).

- Store (Horizon Store).

The internal product roadmap for reality labs leaked in February 2023. The leaked internal product roadmap for reality labs targets the full release of AR glasses in 2027, expecting AR products to reach mass adoption by then, according to Mark.

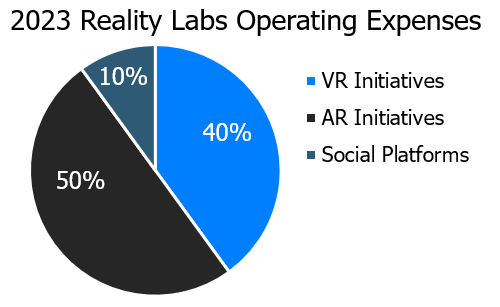

Currently, Reality Labs’ operating losses represent ~12% of total revenue, with this expense split:

Company Filings

Because the division’s CAPEX is negligible, its cost structure strength is that it could be shut off at any moment with little lasting impact on the P&L.

Starting from Scratch

Mark wants to own the computing platform of the future. Importantly, this also entails that the VR/AR apps built for this new computing platform won’t simply be Instagram or Facebook, but new apps altogether.

[…] The vision of Reality Labs is to build the next generation of computing platforms in large part so that way we can build the best apps and experiences on top of them

The positive is that they are the first trying to build these future social networking platforms. The negative is that adoption hinges on people owning the hardware to access this new platform, and that existing user network effects do not transfer over; META starts from scratch.

How fast adoption occurs hinges on how accessible and attractive the hardware is to consumers. It must have mass-market appeal.

Building the OS of the Future

META’s goal is not to win on hardware but on the OS. Their current hardware is more to drive consumer adoption and as a proof of concept to get other device manufacturers and app developers into the game rather than their first steps in trying to remain the product leader.

This OS vision seems in part motivated by Apple’s control over META’s products and its effects on monetization or features.

The strategic goal is to license the OS to the device manufacturers, similar to how Google’s Android works. So far in April, META has announced licensing for Horizon OS by Lenovo, Asus, and Xbox.

When mass device adoption occurs, META would generate income from OS licenses and a cut on its store transactions. According to Zuckerberg, this mass adoption should occur once AR holographic glasses become available.

Therefore, we should see and value META’s RL spending as an option for the success of AR/VR mass adoption and their success in building a winning OS. Their track record in hardware could delay or accelerate adoption depending on the consumer response.

Hardware success is therefore critical to the mass adoption roadmap, even if hardware may not remain a pillar of the company’s own product strategy a decade from now.

Artificial Intelligence

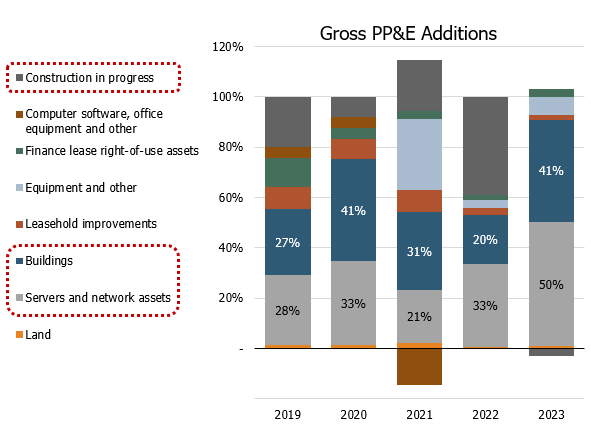

Investments in CAPEX have been rising significantly in absolute dollars, but hold steady as a percentage of sales. Most of the incremental additions to PP&E have been buildings and servers/network assets (GPUs etc.):

Company filings/Street Estimates (formatted by author) Share of Incremental PP&E addition (Company Filings formatted by author)

META categorizes its AI investments into two buckets: core AI work and strategic bets. Importantly, the capacity between these units is fungible; the company can allocate more to core AI work to reduce capacity in its other bets. We do not know the split in capacity between the two.

Core AI work includes META’s content recommendation algorithm. Remember that META’s apps went from recommending content from one of the thousands of videos your friends interacted with to now one of the millions of pieces of unconnected content. This is all very compute-intensive. The value of AI, GPUs, and the advanced models they enable have already proven their value as they enabled META to catch up to TikTok’s recommendation algorithm.

For reference, ~30% of Facebook posts are delivered by META’s AI recommendation system, up 2x over the last 2 years, and >50% of Instagram content is now AI-recommended.

The company says it takes an ROI-focused approach to investments in the core bucket, seeking to drive improvements to engagement, ad performance, and revenues. META Advantage+ is a great example of an AI-enabled tool. The company estimates that:

Campaigns using Advantage+ audience targeting saw, on average, a 28% decrease in cost per click or per objective compared to using our regular targeting

Strategic Bets are more related to generative AI projects and advanced research efforts. These projects are years from monetization.

Longer-term monetization of its strategic bets would include, according to the company itself:

Introducing ads or paid content into AI interactions and enabling people to pay to use bigger AI models and access more compute

It is up to you to decide whether these bets will bring a meaningful tailwind to profits. Still, I am confident that the Core AI work has already generated significant value, if not only because it enabled META to gain share back from TikTok and drive app engagement.

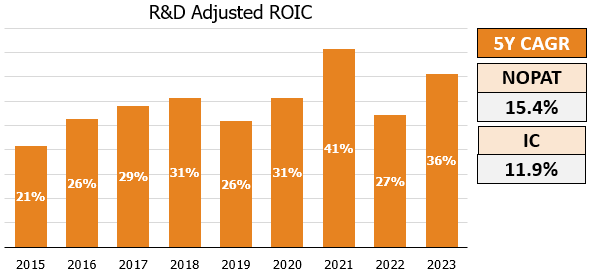

Stable ROIC Signals Valuable Investments

So far, META’s returns on capital have held up. Capitalizing R&D (treating it as an investment and depreciating it over 5 years), yields very high historical ROIC:

Company Filings formatted by author

Its currently elevated reinvestment rate is not an inherent negative; with incremental returns on capital holding up, perhaps its ability to fund these extremely capital-intensive projects is part of its moat.

In fact, even if they deteriorated to a long-term average of 15%, compounding incremental investments with those returns at a high reinvestment rate would generate immense value.

Therefore, I do not see immediate proof of value destruction by META, but with a lot of uncertainty, we all need to watch their incremental return closely to see whether their compounding story remains intact.

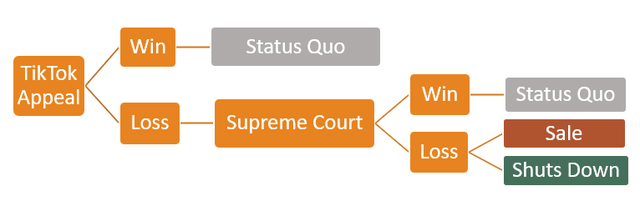

Potential TikTok Ban

Current Situation

Major governments are worried about sensitive user data being shared by Bytedance with the Chinese government or its algorithm being used to push propaganda.

President Biden signed legislation giving ByteDance up to January 2025 to either sell U.S. operations to an American company or shut down. 3 months additional if a sale is underway by then.

TikTok has appealed the law with a hearing set for September 16. If the appeal fails, the next and last opportunity to have the court invalidate the law is in the Supreme Court. In the meantime, they would likely file for an injunction to prevent enforcement until judgment.

Each Side’s Arguments

For its defence, Bytedance will focus on this being a First Amendment Breach. Past Supreme Court Decisions have affirmed that this right extends to foreign propaganda (See Lamont Decision)

It is also likely to focus on the fact that the law singles out TikTok while giving other platforms a review process. Further, Trump’s failed WeChat ban could serve as a precedent in their favour.

The DOJ will attempt to focus on Bytedance’s conduct as past judgements hold that the First Amendment does not protect illicit activities.

Potential Outcomes

Here is a graph showing where we go from here:

1. Status Quo

If this outcome occurs, I expect ~0% chance of a future TikTok ban without any tangible threats/misconduct. If advertisers already pulled some advertising from TikTok for fear of it being banned, this outcome could lead to some outflow back, negatively affecting META revenues.

2. Sale (Unlikely)

The Chinese government is likely to block the sale; it put recommendation algorithms on its export-control list in 2020.

Many sources have also reported that Bytedance would rather shut down TikTok than have it sold.

3. Shut Down (Positive)

After the ban takes effect, the app can no longer be downloaded, updated, or have bugs fixed. It would quickly become unusable.

I believe that META’s apps would be banned in China as retaliation. META’s 2023 Chine revenue represents $14B. While it would lose this higher-growth market, we can assume most of the advertising spend on TikTok would be redirected to META’s apps. TikTok’s 2023 U.S. revenue is estimated at $16B, so the net revenue lost would be minimal, if not positive.

It would certainly solidify META’s competitive positioning and essential nature to advertisers.

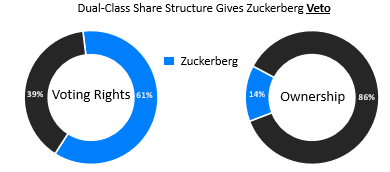

Corporate Alignment

META’s dual-class voting shares and Zuckerberg’s majority voting power are well known:

Economic and Voting Ownership (Company Filings)

This gives him uncontested power to go full steam ahead with whatever projects he wants. While his response to the market’s concerns in 2022 showed that he would not be unwavering, I expect his commitment to strategic goals will never be affected.

In terms of compensation, a quick item of note is that the performance incentive metrics are highly subjective and based on qualitative measures:

Incentive Compensation Metrics (Company Filings)

The 4 factors do not have any assigned weights and there is little transparency as to what is used to determine executives’ performance in each.

While the company is founder-lead and Mark has an amazing track record of successful visions and product launches, with 2022 demonstrating more Cost discipline, his veto power, and ventures into entirely new product categories weigh against him.

The bottom line is that you must trust Zuckerberg to invest in META.

Undemanding Valuation

At about 20x forward P/E, the valuation is undemanding.

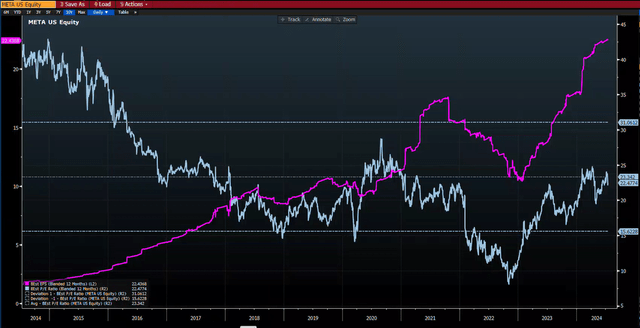

Blended Forward EPS and P/E (Bloomberg)

While the company trades near the mean of its historical range and 22x being much lower than its large tech peers, there is a certain discount given the RL/AI spending uncertainty, which is likely to subsist and limit a return to past valuation highs in the near term.

Growth Factors

META’s top-line growth is the combination of simple factors:

Revenue Growth Factors (Author)

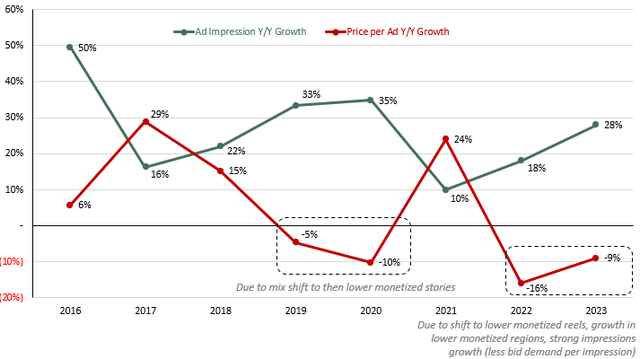

The company discloses the annual growth rate of impressions and price per ad:

Historical growth by factor (Company disclosures formatted by author)

Apart from moving traffic between its apps’ higher and lower monetized sections, META has two direct levers to drive ARPU higher.

1. Ad Volume

More ads shown increase bidding instances, which increases revenue. The company has recently struggled to monetize Reels because users scroll slower than on Feed or Stories, for example.

It must balance its ad load since showing too many ads can lead to user churn (closing the app when seeing an ad).

2. Ad Relevance

Suppose the ads META shows are highly relevant to their users. In that case, they are more likely to interact with them, which delivers higher value to the advertiser, increasing the ad value and bidding competitiveness, which translates into higher revenue for META.

We’ve seen how ad relevance has a direct and quickly measurable impact on revenue. This was essentially what Apple’s IDFA change targeted and which resulted in a 10% decrease in META’s revenue because of less accurate user tracking and targeting.

Going forward, the increased relevance and targeting also hinge on the success of AI products such as Advantage+, which attempt to drive higher ROAS for advertisers by better-targeting ads to relevant users.

Conclusion

The AI/Reality Labs spending overhang is given too much attention; CAPEX is not expected to rise materially as a percentage of revenue and margins have held steady with Mark having shown in 2022 that he can instill some cost discipline. Further proof is the company’s ROIC holding steady.

Consensus forecasts EPS growth of mid-teens in 2025-2026, which makes a ~22x P/E undemanding.

META is a high quality free cash flow machine that is an indispensable part of the digital advertising landscape. Its core growth story is not in question unlike 2022, and its valuation is one of the lowest among its large tech peers.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.