Summary:

- The TikTok ban is becoming increasingly likely after the appeals court upheld the previous law requiring the company to divest.

- TikTok is expected to earn $12.3 billion in ad sales in the U.S. in 2024, but the impact on Meta would be bigger due to better monetization.

- Meta’s revenue per minute of user time spent on its platform is significantly higher than TikTok and any diversion of traffic to Meta could lead to a big revenue jump.

- Meta’s profit margin and EPS forecast could see a massive jump in the near term if the company can monetize some of the traffic from TikTok.

- Meta is trading at 21 times the EPS forecast for the fiscal year ending Dec 2026, which is quite modest when we look at the potential growth opportunity for the company.

Derick Hudson

Meta (NASDAQ:META) has seen a massive bull rally this year that has led to more cautionary voices for the stock. However, Meta could see a massive growth opportunity if the TikTok ban continues at the current timeline. Recently, the U.S. Court of Appeals in Washington, D.C., rejected TikTok’s argument unanimously. TikTok is expected to earn $12.3 billion in ad sales in the U.S. in 2024 according to an eMarketer report. This is relatively small compared to Meta’s revenue base of over $150 billion. However, Meta has been able to monetize user time at a much higher level compared to TikTok. Hence, any diversion of traffic from TikTok could lead to significant improvement in revenue and profit margin for Meta. In the previous article prior to the earnings, it was mentioned that we could see a beat in this quarter as new AI tools give the company a tailwind.

Meta stock is trading at a modest 21 times the EPS forecast for fiscal year ending Dec 2026. The expected EPS growth for the next two years is only 12%-13%. We could see a big EPS upgrade if the current TikTok ban moves ahead. The average price per ad increased by 11% YoY in the recent quarter. Higher AI spending has allowed Meta to target users with more efficient ads and charge a higher price from advertisers. This trend could continue in the next year as competitive pressure reduces on the company, making the stock a good buy despite the bull run of the last two years.

Higher monetization of time spent

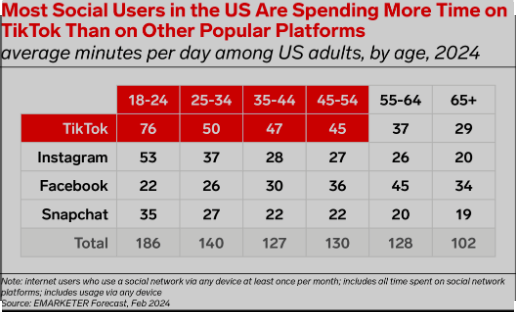

Many analysts focus on the total active user base of Meta and other platforms. However, we should also look at the monetization for every minute spent on Meta compared to other platforms. According to a recent eMarketer report, TikTok cornered the highest average minutes per day among a younger age group.

eMarketer

Figure: Average time spent on different platforms. Source: eMarketer

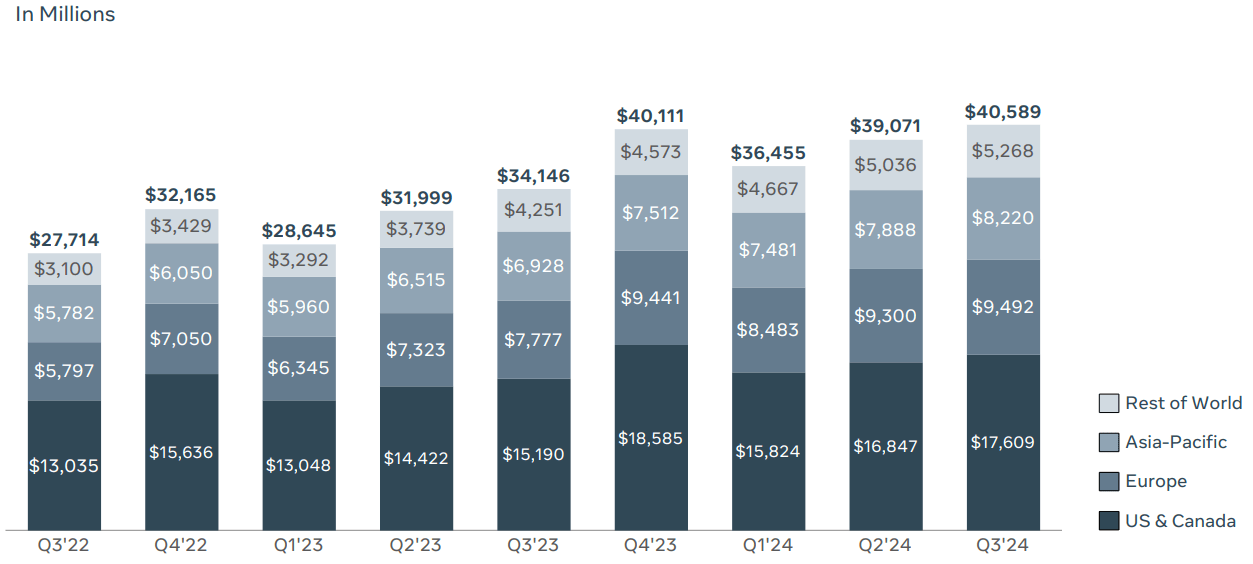

TikTok is estimated to earn $12.3 billion in ad sales in U.S. in 2024. On the other hand, Meta’s revenue in the U.S. & Canada should be over $60 billion, according to company filings. We can clearly see that Meta’s monetization of every minute spent by users on the platform is more than 4-5 times that of TikTok.

Meta Filings

Figure: Meta’s revenue contribution from different geographies. Source: Meta Filings

In Q1 2024 earnings, Meta mentioned that Reels cornered over 50% of the time spent on Instagram. This shows that the company has been able to achieve a good balance for advertising on the platform despite the massive increase in consumption of short-form videos.

Any TikTok ban in the U.S. will likely have an impact on the regulators in other regions, especially the European Union and UK. Recently, TikTok was at the center of a massive election controversy in Romania and the EU has ordered TikTok to freeze election data. This shows that headwinds for TikTok are increasing in other international regions, which could benefit Meta.

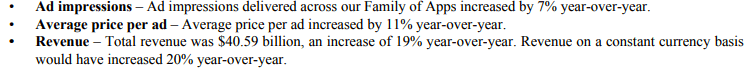

Expansion of profit margin

If TikTok ban moves ahead according to schedule, we could see at least 20%-30% of time spent on TikTok shift to Reels. This will have a massive impact on the total time spent on Meta’s platform. It will also reduce the competitive pressure on Meta and the company could charge a higher price for ad placement.

Meta Filings

Figure: Key metrics for Meta for ad prices. Source: Meta Filings

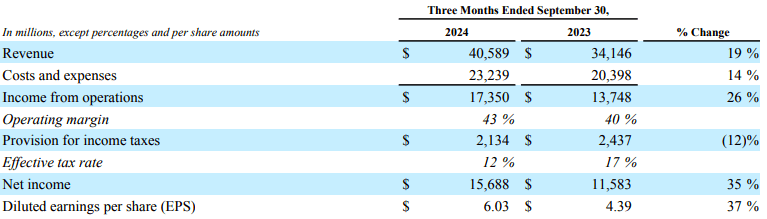

In the recent quarterly earnings, Meta reported 19% YoY revenue growth. This was possible due to 7% YoY growth in ad impressions and 11% YoY growth in average price per ad.

Meta Filings

Figure: Revenue and EPS of Meta. Source: Meta Filings

Improvement in operating margin helped Meta deliver a bigger EPS growth of 37% YoY. Any transfer of users from TikTok to Meta’s platform can have a massive impact on the amount of ad impressions delivered and the ability of the company to charge a higher price per ad.

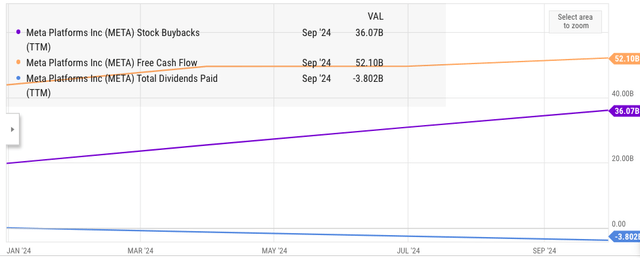

Meta’s massive buybacks

Meta has been losing billions of dollars on its Reality Labs segment. However, the company is still able to spend a significant amount on buybacks as its operating margin increased in the last few quarters. Meta’s buyback pace is now one of the highest in this industry. Meta has invested $36 billion in buybacks in trailing twelve months and another $4 billion in dividends. This investor return program is easily covered by over $50 billion in FCF.

Figure: Meta’s buyback and dividends in TTM. Source: YCharts

Meta’s buyback program adds around 2%-3% to the company’s EPS growth. As pointed out above, we could see an improvement in margin and revenue trajectory in Meta if the TikTok ban moves ahead according to schedule. This should increase the management’s ability to invest in other growth initiatives or increase the buyback pace, giving a stronger boost to EPS growth in the next few quarters.

Possible EPS upward revisions

The consensus EPS growth estimate for 2025 is 12% and for 2026 it is 13%. A TikTok ban will certainly have a positive impact on Meta’s ability to deliver higher revenue and EPS. The forward EPS growth estimates look quite modest when we take into account the tailwind due to buybacks and better monetization due to new AI tools.

Seeking Alpha

Figure: Meta’s forward EPS estimates. Source: Seeking Alpha

As shown in the above image, the gap in the low and high EPS estimate for the fiscal year ending Dec 2026 is very low. The high EPS estimate is only 30% higher than the low estimate. This shows the strong agreement within Wall Street analysts about the future EPS trajectory for the company. On the other hand, other peers like Nvidia (NVDA) and Tesla (TSLA) have a very wide difference in their forward EPS projection showing the uncertainty in their future margins and revenue.

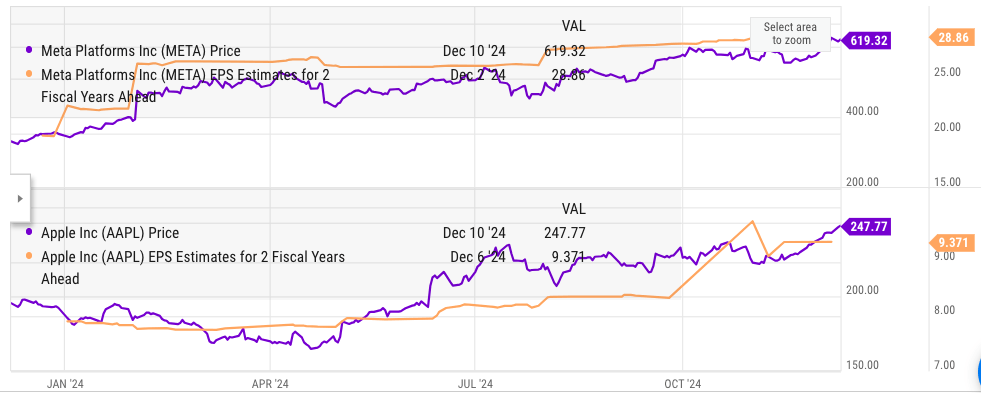

Ycharts

Figure: Comparison of Meta and Apple’s forward EPS estimates. Source: YCharts

Apple (AAPL) is trading at 27 times the EPS estimates for 2 fiscal years ahead compared to 21 times for Meta stock. If Meta gets any upward EPS revisions due to the TikTok ban, we could see a better valuation multiple for Meta. While one needs to be cautious after the massive bull run in Meta stock over the last two years, it is likely that we could see good bullish sentiment in 2025 as the company gains tailwinds due to a better competitive landscape.

Investor Takeaway

Meta stock should gain a big boost from TikTok ban. The Appeals Court has unanimously rejected TikTok’s argument, and we could see a similar result in the Supreme Court. It is highly likely that Meta should see an increase in the average time spent on its platform as customers move away from TikTok. Meta has demonstrated a much higher ability to monetize the customers compared to TikTok.

Hence, the overall improvement in revenue and EPS should be significant. Meta stock is trading at 21 times the EPS estimate for the fiscal year ending 2026. This is significantly below other big tech companies like Apple. Meta has invested heavily in AI capability, which has increased the monetization capability of the company. It is highly likely that we could see further bullishness in Meta stock over the next few quarters, making the stock a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.