Summary:

- Meta’s stock price has increased by 174% in the past year, reaching a market cap of $1.2 trillion.

- My fundamental analysis suggests that the bull run was fair, given the company’s unparalleled positioning in the digital advertising space.

- My target price is $541.

akinbostanci/iStock via Getty Images

Introduction

When I recall the market sentiment around Meta’s (NASDAQ:META) stock in autumn 2022, it is difficult to believe that its market cap is already far above a trillion USD. The stock price grew by several times over the last year and a half, and my valuation analysis suggests that there is still room to continue the bull run in the near future. Besides the attractive valuation, I am very bullish about the company’s future overall. Meta will highly likely sustain its stellar profitability from the core digital advertising business, which will allow it to reinvest substantial amounts into new ventures, especially its virtual (“VR”) and augmented (“AR”) projects. The company’s unparalleled user base is its major asset, which attracts businesses’ advertising budgets, and it is very unlikely that competitors will close the massive gap in audience anytime in the future. To summarize, META apparently merits a “Strong Buy” rating.

Fundamental analysis

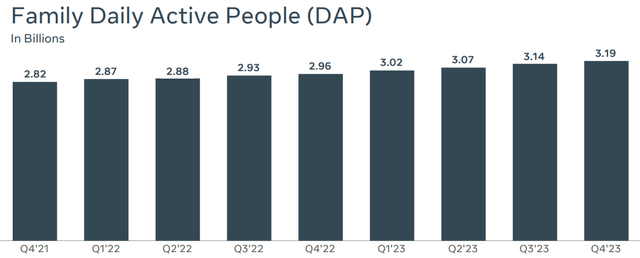

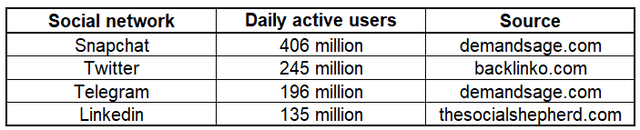

Meta is the largest player in the global social networking landscape. The company owns the most prominent social media platforms, including Facebook, Instagram, and WhatsApp, collectively called the “Family of Apps”. As per the Q4 earnings presentation, over 3 billion users engage with at least one of the apps on a daily basis.

Meta’s user base is unmatched. Below, we can see what the numbers of daily active users (“DAU”) look like for other widely known social media platforms. As we can see, none of them are even close to the Meta’s Family of Apps. Unfortunately, I could not find the DAU number for Pinterest (PINS). However, its monthly active users are also far below Meta’s. Surely, some might say that not demonstrating Chinese giants like TikTok and WeChat with a monthly active audience of over a billion would be unfair. However, both of the platforms have a massive concentration in China, where the Great Firewall does not allow for fair competition.

Thus, having such an unparalleled audience is a very strong asset for Meta. Having an unmatched Family of Apps ecosystem makes Meta a very attractive partner for digital advertising. To understand the scale of Meta’s power as one of the largest digital advertising providers is its $132 advertising revenue in 2023. The share of this revenue stream in the company’s overall annual sales is roughly 98%. I think that Meta’s massive gap between its number of users and competitors provides it with a wide moat.

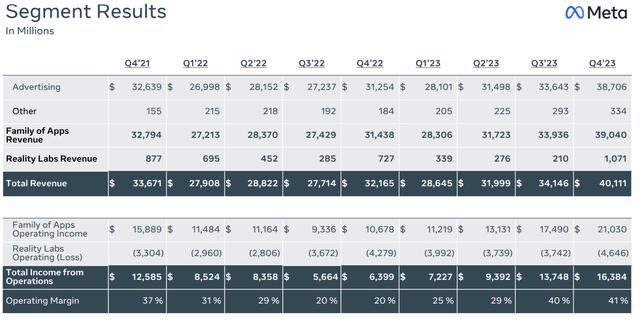

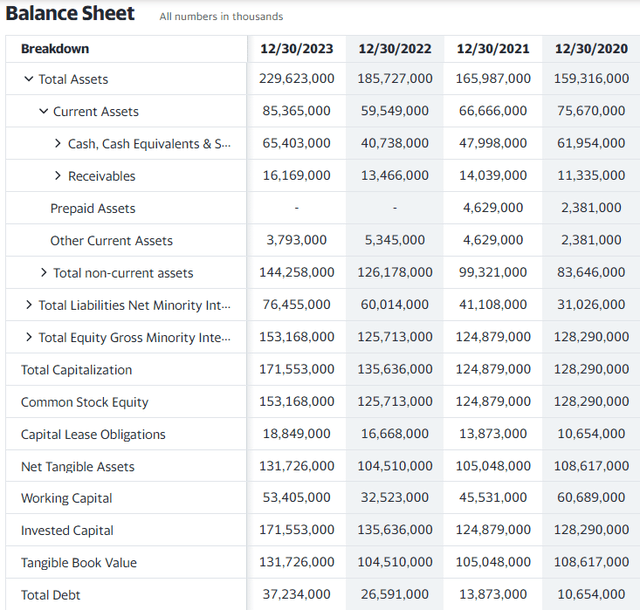

And this business is very profitable. As we can see above, the operating margin of the Family of Apps segment was almost 54% in Q4 2023. Having such massive profitability in its core business allows the company to invest heavily in the virtual reality industry, including the Metaverse, which is under the “Reality Labs” segment. Even after the company’s new segment’s loss, the operating margin is still stellar at around 40%. Therefore, Meta’s robust balance sheet with a giant $85 billion cash pile and much lower debt does not surprise me. By the way, in 2024, Meta announced its first-ever dividend, signaling the company’s robust financial position, which is capable of supporting continued investments in new ventures while also rewarding shareholders with spare cash.

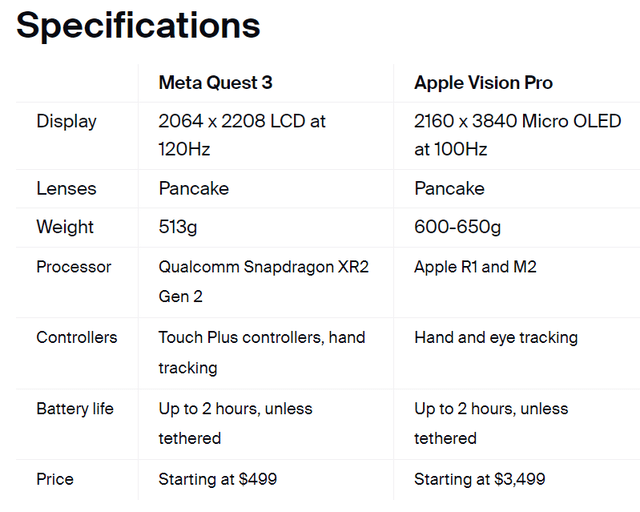

From the BCG matrix perspective, Reality Labs looks like an apparent “Question Mark” where vast resources have already been invested, and the level of uncertainty regarding the payback of these investments is high. On the other hand, there are a few moments that add optimism to me. First, Meta’s substantial profitability allowed the company to reallocate billions of dollars to develop its virtual reality business, meaning the company has gained massive expertise in its domain, providing a pole position. Second, the fact that Apple (AAPL) also bets big on virtual/augmented reality with its Vision Pro is another positive factor for the whole industry because Apple also has a large and loyal customer base, and Vision Pro will help people understand the benefits of VR. It’s crucial to recognize that Meta’s Quest VR headset and Apple Vision Pro are unlikely to compete directly, as they cater to vastly different market segments, with selling prices differing by a factor of seven. I believe that no direct competition with giants like Apple is good news for Meta. Third, the overall trend in the VR/AR industry is expected to be very favorable for Meta, as Precedence Research forecasts the industry to grow at a 25% CAGR up to 2032.

In conclusion, I firmly believe that Meta’s unmatched audience in the social media realm will enable it to maintain its substantial competitive advantage and exceptional profitability over the long term. The company’s profits are poised to be reinvested in its promising AR/VR venture, leveraging several positive factors that Meta is well positioned to capitalize on. Meta’s outstanding track record of delivering high returns on invested capital strongly bolsters my confidence in the success of the Reality Labs segment.

Valuation analysis

META trades at the higher end of the last 52 weeks as the stock price increased by 174% in the previous twelve months. As a result of a giant bull run over the last year, Meta’s market cap has surpassed a trillion dollar mark and now equals $1.2 trillion.

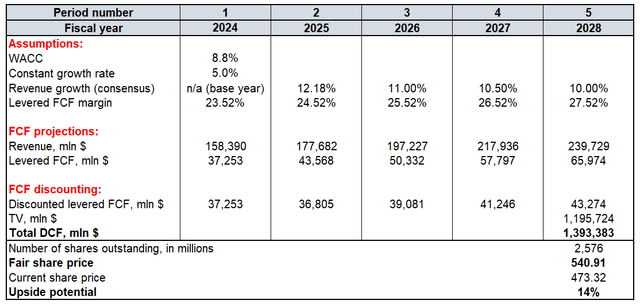

To assess whether META is worth its above-a-trillion market cap, I will run the discounted cash flow (“DCF”) model. All future cash flows will be discounted using an 8.8% WACC. As usual, I rely on consensus estimates for the closest two fiscal years and then apply a slight 50-70 basis points deceleration as comparatives are growing. The free cash flow (“FCF”) margin I use is the TTM levered 23.52% level with the expected 50 basis points expansion each year. Considering all of Meta’s strategic strengths and positive secular trends, I believe that a 5% constant growth rate is fair for the terminal value (“TV”) calculation. There are currently 2.576 billion META shares outstanding.

My DCF model shows that the stock’s fair price is $541, which is 14% higher than the current share price. The 14% discount for a wide-moat company like Meta looks like a compelling opportunity, in my opinion.

Mitigating factors

The valuation of Meta substantially depends on its revenue and profitability dynamics. Deteriorating trends in financial performance, even if temporary and explainable, might lead to massive investors’ disappointment and consequent stock sell-off. It was the case in late 2022 when the company’s profitability had been suffering from massive investments in a controversial Metaverse project. That has led to a huge stock sell-off, which bottomed at around $90 in late 2022, four times cheaper than its previous historical highs of Autumn 2021. Therefore, investors should know that big moves in Meta’s stock price over several months can go in either direction.

Despite the fact that Meta has a wide moat, it does not mean that the company is 100% protected from competition. The emergence of the Chinese social media TikTok in recent years revealed that a new strong player might appear, even in the field where Meta has 2-3 billion active users for each app. On the other hand, Meta has the ability to hire the brightest engineers in the industry, which allowed the company to respond to TikTok’s content format of short videos with the relatively rapid introduction of Reels.

Due to the fact that Meta stores vast volumes of personal and sensitive user data, the company often gets negative publicity because of the risk of potential data leakage or even potential use of data to make users addicted to social networking. There even was a Netflix (NFLX) documentary, “The Social Dilemma” which was released in 2020, revealing the “dangerous human impact of social networking”. While all these negative headlines are unlikely to affect the company’s fundamentals, the press around Meta’s social networking apps might also lead to downward pressure on the stock price.

Conclusion

According to my fundamental and valuation analysis, Meta’s stock is well-positioned to continue demonstrating impressive financial performance, which will highly likely lead to an appreciation of the stock price. The stock is still attractively valued, and I believe that the AR/VR bet is expected to become a solid driver of long-term business expansion. All these positive catalysts altogether make the stock a “Strong Buy”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.