Summary:

- Meta’s announcement of its inaugural dividend was a surprise to many, leading to a 20% increase in share price.

- The dividend reflects Meta’s focus on improving financial discipline rather than a slowdown in growth.

- Meta’s high-growth peers may consider implementing dividends following the positive market reaction.

PM Images

By John Baldi, ClearBridge Investments & Michael Clarfeld, ClearBridge Investments

Ample Room for Dividend – and Growth

Meta’s announcement of its inaugural dividend in early February was a surprise to many, and a welcome one, judging by its 20% gain in share price the day of its announcement. At the same time, it begs a few questions. Namely, what does it say about Meta’s future and will others follow suit?

There is a conception that dividend payers must be mature, slow-growth businesses, or why would they be returning cash to shareholders instead of investing in more growth? Does this mean growth is slowing for the parent of Facebook, Instagram and WhatsApp?

We believe Meta’s quarterly dividend of $0.50 per share, or a yield of a little less than 1% when it was announced, says more about improving financial discipline at the company than slowing growth. In late 2022, Mark Zuckerberg announced that 2023 would be the “year of efficiency” and proceeded to make sizable cuts to operating and capital expenditures and unveil a $40 billion share buyback program, helping set the stock up for a strong run in 2023.

A dividend initiation is consistent with this responsible approach to the business, and there is ample room for it as part of Meta’s overall shareholder return strategy. When announcing the dividend, Meta also authorized an additional $50 billion to be allocated toward buybacks. This is on top of $30.93 billion still available under its current repurchase program, giving the company ~$81 billion worth of money approved for additional buybacks. The company repurchased $20.03 billion of shares in 2023, finished the year with $65.54 billion in on-hand liquidity and had free cash flow of $43 billion in 2023. The dividend at present will cost Meta about $5 billion a year.

This is not happening amid signs of slowing growth. Meta’s revenues were a record $40 billion in the fourth quarter, up 25% year over year, after a previous record of $34 billion in the third quarter, a 23% increase year over year. Despite the recent price action in the stock, Meta currently trades at ~24x forward earnings, an appropriate premium to the broad market S&P 500 Index given Meta’s growth prospects, yet its forward earnings per share are expected to grow 20% per year over the next three to five years – well above the broader market. Impressively, this includes a nearly $20 billion annual investment loss as it invests in the metaverse.

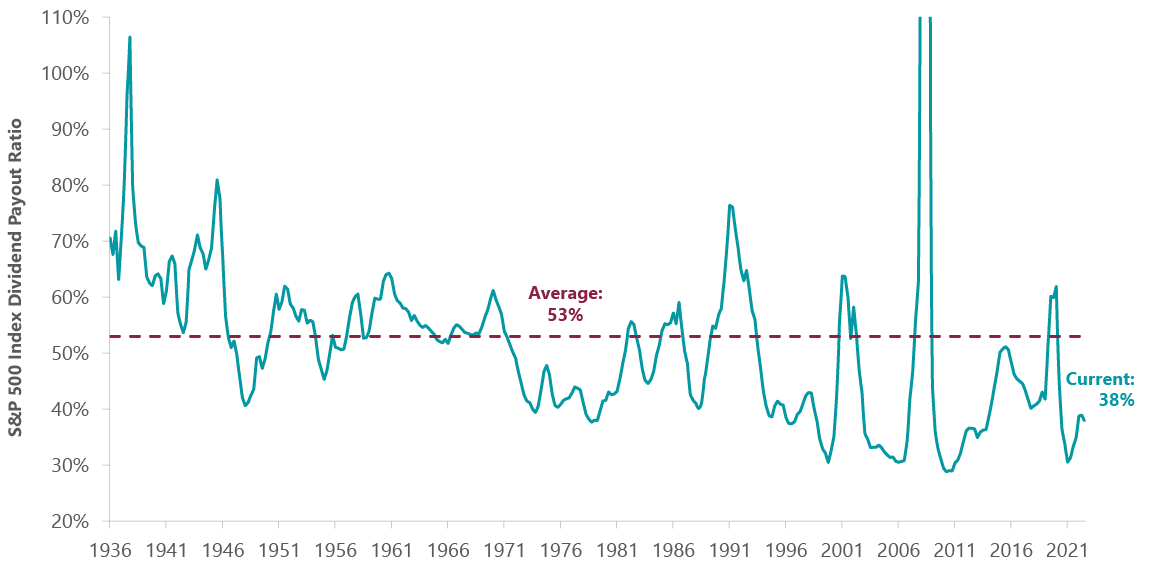

Meta’s new dividend comes at the end of a decade plus of ultra-low interest rates and a decrease in dividends as a percentage of total returns. Dividend payers broadly have capacity to increase dividends (Exhibit 1). Importantly, Meta’s payout ratio, about 10%, is neither trivial nor too big, suggesting there is a lot of room for it to compound over time. Given the magnitude of Meta’s free cash flow generation and its sales and earnings growth, the company looks aligned for strong dividend growth without any big claim on its buybacks.

Exhibit 1: Businesses Have Capacity to Increase Dividends

Robert J. Shiller (Yale School of Management)

As of June 30, 2023, latest available as of Dec. 31, 2023. Source: Robert J. Shiller (Yale School of Management); Online Data – Robert Shiller

With Meta’s robust growth profile and leading market position, we believe its dividend augurs sunny days ahead rather than presaging a slowdown. Given investors’ enthusiastic embrace of the stock post the dividend initiation, Meta’s high-growth peers not paying a dividend must wonder if they should do the same.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.