Summary:

- Meta’s ‘Year of Efficiency’ will lead to a leaner business model boosting DEPS to mid-teens levels.

- Coupled with a lack of creator engagement and a drop in ad pricing on iOS for Reels, Meta’s gross margin may decrease in the short term.

- In 2023, Meta will enjoy a more favorable outlook as it moves past its challenges a year ago due to Apple’s platform privacy changes.

- A US TikTok spin-off is the most probable scenario, the optimal outcome for all parties involved, but not the ideal for Meta.

- META’s DEPS can bounce back to $12, and with a 25.0x multiple, the stock can trade at around $300 in the next 12-18 months.

Kinwun

Investment Thesis

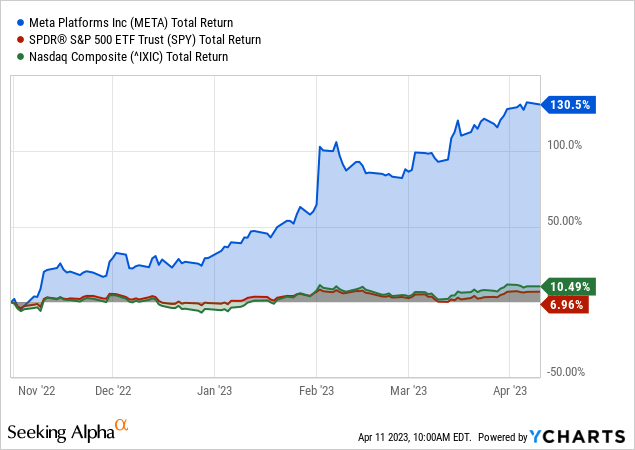

Meta Platforms, Inc. (NASDAQ:META) has substantially outperformed the market, returning more than 130% in the past five months, and while some investors might rush to book profits, I see a prolonged bull run for the stock throughout 2024.

I maintain a sizable position in META in my personal and model portfolios, with no plans to sell anytime soon as my strong bullish rating is reaffirmed. My target price for the stock is $300 for the next 12-18 months, supported by valuation tailwinds due to positive developments with the TikTok case, increased efficiency from the leaner business model, and the improving outlook.

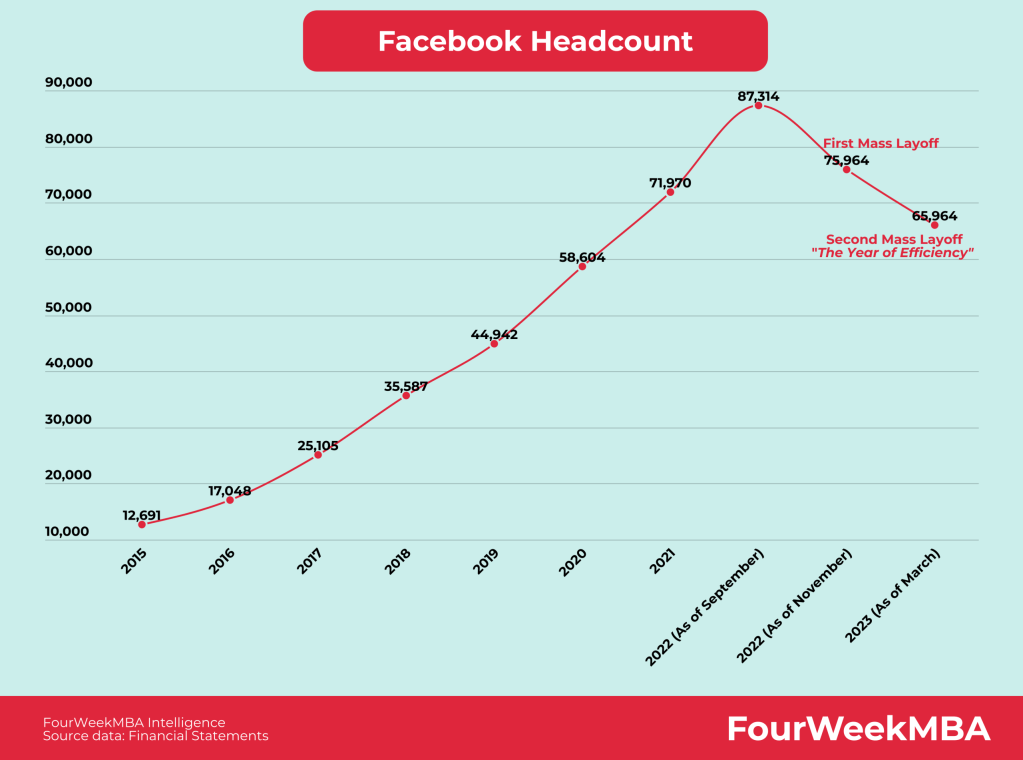

A Leaner Business Model

Meta has announced a second wave of job cuts, potentially leading to greater cost savings. The company plans to lay off about 10,000 employees, roughly 12% of its workforce, and eliminate around 5,000 open positions. This action aims to streamline Meta’s workforce and manage expenses. In addition, the company’s YoY headcount growth has decreased over the past three quarters as YoY revenue has shrunk.

This trend is expected to persist into Q1 2023, with a substantial decline in headcount growth compared to Q1 2022, when hiring was still robust, and headcount growth was 27%. In addition, although OPEX growth is also anticipated to fall, severance-related expenses will significantly affect this trend. In general, these cost-reduction measures are designed to assist Meta in coping with the current challenging economic landscape.

Meta has encountered numerous obstacles recently, such as platform policy changes, increased competition, and an unfavorable macroeconomic environment. As a result, the company has revealed plans to become more agile, streamlined, and technology-focused to tackle these issues. As a result, in addition to the previously disclosed 11,000 employee layoffs, Meta intends to lay off another 10,000 workers, concentrating on recruitment, business groups, and specific tech teams.

www.fourweekmba.com

The company aims to restore a more balanced ratio of engineers to other roles. While hiring and transfer freezes will be lifted after the layoffs are complete, Meta plans to maintain discipline in its hiring practices. Despite the job cuts, the company remains dedicated to investing in AI and developing the Metaverse. Meta believes these adjustments will better prepare it for the possibility of a continued challenging economic climate in the coming years.

Moreover, the company has pinpointed opportunities to optimize physical assets, such as consolidating office spaces and refining future data center construction plans. CFO Susan Li’s remarks indicate that the company will implement additional measures to control costs and boost efficiency, including reducing management layers and reassessing projects. Consequently, the company may achieve further cost savings, potentially decreasing Meta’s full-year OpEx guidance. Overall, the company’s commitment to increasing efficiency is expected to be a positive development for investors.

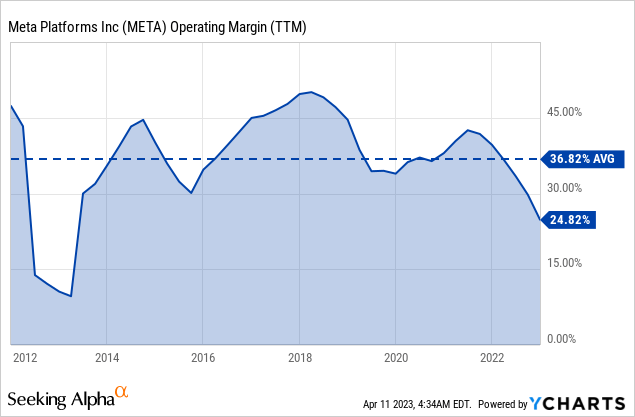

Structural Headwinds Despite Cost Cuts

Meta’s cost-cutting measures, aimed at enhancing free cash flow, do not tackle the fundamental problem of reduced user engagement on its primary Facebook app, which still accounts for half its revenue. While Instagram and click-to-message ads have somewhat mitigated these difficulties, the company’s shift to Reels for short videos has affected the higher-priced ad inventory on Facebook and Instagram feeds.

Coupled with a lack of creator engagement and a drop in ad pricing on iOS for Reels, Meta’s gross margin may decrease in the short term. Additionally, economic pressures and Apple’s privacy changes could weaken advertisers’ willingness to invest in social media advertising, limiting Meta’s overall ad pricing growth in the next two years.

More Favorable Growth Outlook In 2023

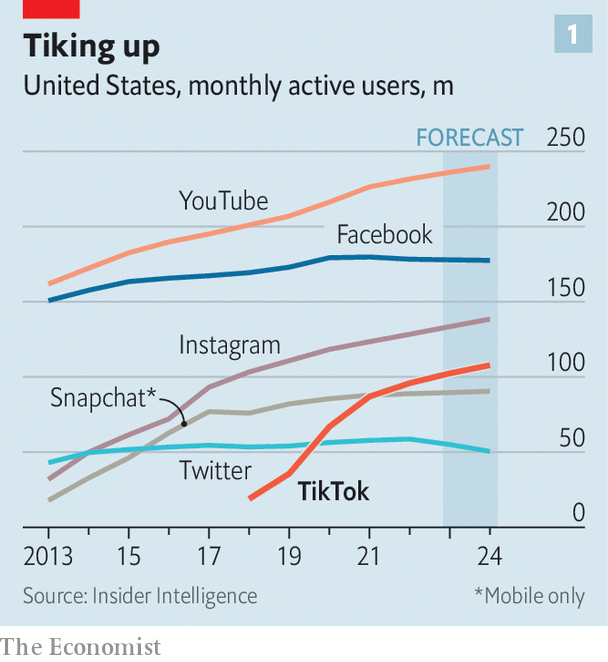

In 2023, Meta will enjoy a more favorable outlook, beginning in the first quarter, as it moves past its challenges a year ago due to Apple’s platform privacy changes and TikTok’s growth. Despite these obstacles, Meta has various emerging products and revenue sources.

Reels, for example, continue to boost engagement and reduce monetization headwinds. Over 40% of Meta’s advertisers now utilize Reels, and management expects Reels to generate revenue by late 2023 or early 2024. In addition, click-to-message ads are a rapidly growing ad product with a $10 billion revenue run rate. More than 50% of advertisers using these ads exclusively do so on Meta platforms, resulting in increased demand. Furthermore, Meta’s AI investments enhance ad ranking, relevance, and engagement, compensating for the loss of signal and measurement associated with ATT.

The Economist

Nonetheless, the Reality Labs segment’s contribution, accounting for about 2% of sales, continues to hinder Meta’s top-line growth, with the company now reducing the prices of its premium VR headset by around 33%. In addition, ad-pricing challenges stemming from Apple’s privacy changes are expected to persist, even though Meta has made recent platform adjustments to enhance targeting and measurement.

Instagram & WhatsApp Remain Catalysts

Meta’s valuation is under pressure due to decreasing sales and engagement on its core Facebook app and regulatory risks in the US and Europe. However, Instagram and WhatsApp are essential for enhancing monetization as Meta addresses ad pricing challenges through AI-based targeting.

Meanwhile, the company’s entry into payments and e-commerce is anticipated to generate revenue from its messaging apps, especially in emerging markets with greater monetization potential. For example, Meta’s recent collaboration with JioMart in India for in-app shopping has paved the way for increased e-commerce through WhatsApp. The company’s click-to-message ads already achieved a $10 billion run rate in 2022.

To further increase revenue, Meta plans to launch a Meta Verified feature for creators and influencers, primarily on Instagram, which could contribute materially to annual sales. Additionally, the company might explore a subscription offering, as most digital ads and social media peers already have one. Finally, despite the challenges, Meta’s large language model, Llama, will enhance user engagement and ad targeting to counteract headwinds.

Although Facebook Messenger may venture into fintech with peer-to-peer payments, it will likely face competition from rivals such as Apple’s iMessage. Meta’s success in monetizing its messaging apps and expanding its e-commerce initiatives will be crucial to its future revenue growth, particularly in emerging markets with more monetization opportunities.

Reels’ Ads (www.facebook.com/creators)

Improving Reels Monetization Efficiency

Since its global launch in early 2022, Meta’s Reels feature has been gaining traction, as the company reported during its earnings call that Reels plays on Facebook and Instagram have more than doubled over the past year. The short-video format has been prevalent throughout 2022, and Meta’s investments in AI and machine learning provide a long-term competitive edge for its platforms. The company’s AI/ML capabilities enhance Reels’ content ranking and recommendation algorithms, boost user engagement, and increase ad delivery efficiency, improving the service’s monetization. Although the shift from News Feed to Reels is still revenue dilutive, the platform’s monetization efficiency has doubled in the last six months.

Meta’s solid advertiser relationships and unparalleled audience position Reels to potentially become a high-impact ad product for the company. Meta aims to bridge the revenue gap between News Feed and Reels by late 2023 or early 2024. In addition, the company’s ongoing investments in AI/ML and advancements in Reels’ monetization efficiency could help the platform realize its potential as a significant source of ad revenue.

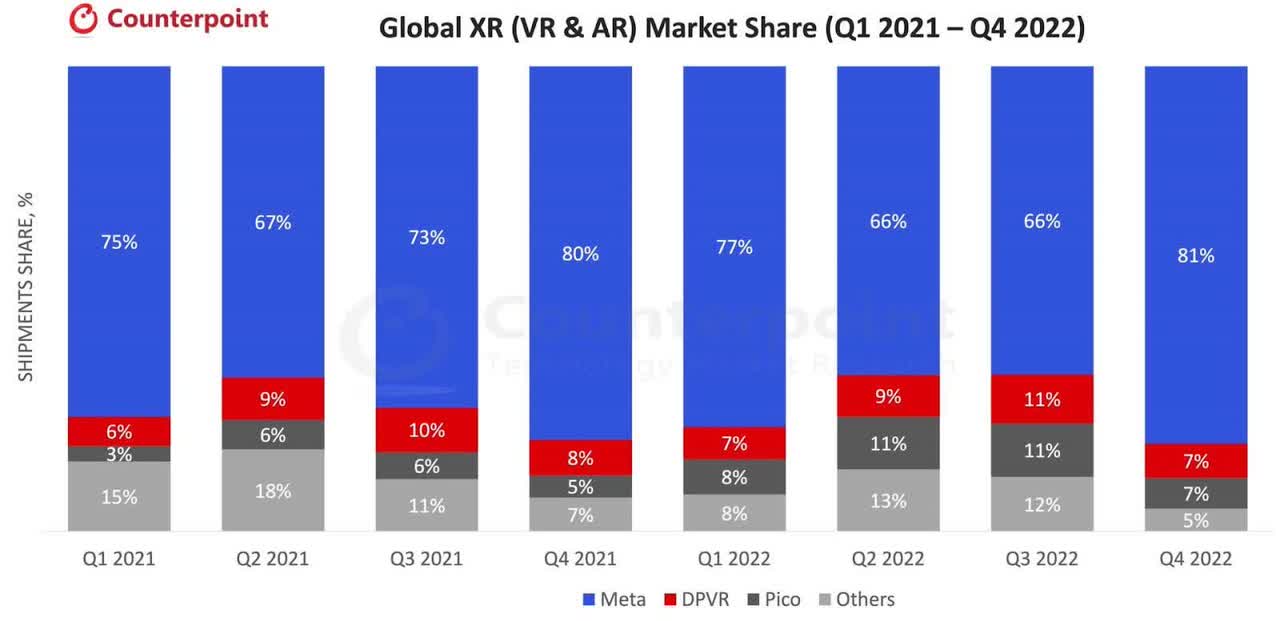

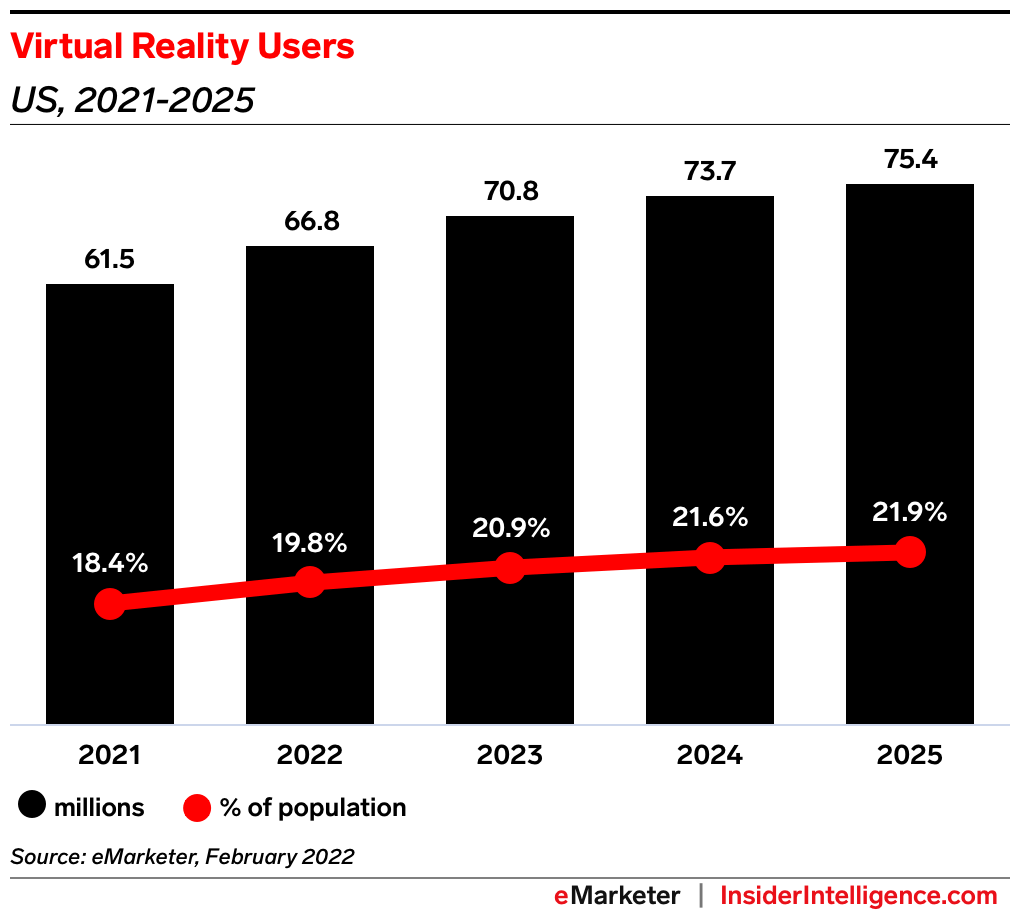

VR Installed Base Helps Category Leadership

For a long time, virtual reality (VR) technology remained on the periphery of the video game industry, but it is now gaining more traction. The availability of affordable equipment, simpler setup processes, and engaging software have increased interest in VR, resulting in a rise in VR-focused influencers and content creators. Meta envisions a future for the internet known as the Metaverse, where virtual reality plays a central role. The Metaverse consists of an interconnected network of digital worlds experienced through screens or immersive technologies.

Meta does not disclose its sales figures for VR headsets, but Qualcomm, the company producing the processing chip for the Quest 2 headset, estimated in November that 10 million units had been sold. This number may have increased since then, as on Christmas day, the Oculus app, used for buying games, became the most downloaded free app on the iPhone.

Meta’s Oculus virtual reality headsets may not be as profitable as its core ad business. Still, partnerships with major tech companies like Microsoft and Tencent could expand their user base and bring them closer to mainstream adoption. Although short-term revenue growth expectations for Meta’s Reality Labs have decreased, it may contribute more to Meta’s overall revenue in the medium term as the VR content ecosystem expands. Meta’s Oculus headsets have played a vital role in VR adoption, and their applications are expected to extend beyond gaming. With control over hardware and the operating system, Meta’s dominance in VR unit shipments could help mitigate the risks its advertising sales face.

VR Users

Is A TikTok Ban Really Happening?

To prevent TikTok app downloads in the US, then-US president Donald Trump issued administrative orders in 2020 and planned to pressure ByteDance to sell its US TikTok operations. Still, after President Joe Biden took office, CFIUS and ByteDance failed to persuade Washington that TikTok does not endanger American national security.

Recently, Australia joined the growing list of countries concerned about the security risks posed by the Chinese-owned social media site by banning TikTok from devices provided by the government. The US, Canada, the UK, and New Zealand, four of Australia’s major intelligence allies, along with European governments like France and the Netherlands, have taken action against TikTok recently. Many have referred to TikTok’s capacity to gather data from gadgets.

Legislators in the US, Europe, and Canada have recently intensified their efforts to limit access to TikTok. On February 27, the White House gave federal agencies 30 days to remove the software from government-owned smartphones. Additionally, the RESTRICT Act grants the US commerce secretary extensive authority to restrict or forbid technology from six nations, including China, was proposed by a bipartisan group of senators last month.

Such a ban would probably begin by prohibiting the app’s distribution through Apple and Google app shops. However, there are other ways to obtain and install apps for people determined to use them, albeit this may dissuade many users from using the platform.

ByteDance – TikTok US Spin-off Scenario

My best estimate is for ByteDance, the parent firm of TikTok in China, to spin off its US operations, which appears to be the optimal outcome for all parties involved, but not the ideal for Meta. Users will not notice a difference, and TikTok-US will avoid a prolonged political and legal battle over a ban. Even though a spin-off is not the best outcome for Meta, the news is expected to have a negligible effect on Meta’s stock.

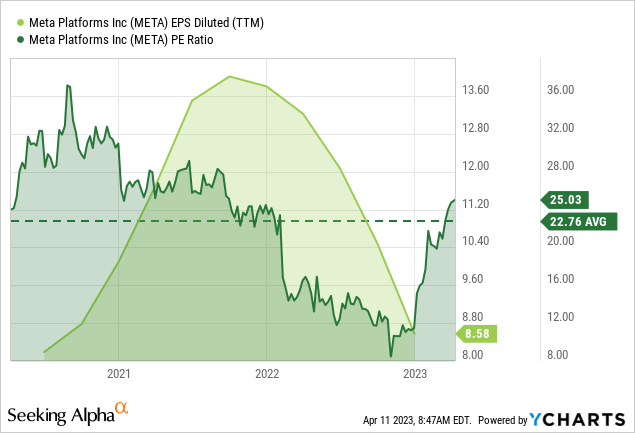

Valuation – A Conservative Approach

I expect significant savings from the efficiency efforts reflected in META’s earnings in the next quarters. In addition, despite the recent drop in DEPS, the market assigns a higher P/E multiple of 25.0x than the company’s 3-year average of 22.8x, suggesting an improving sentiment for the stock.

However, provided the restructuring plan is successful and a recovering economy in 2024, META’s DEPS can bounce back to around $12, and with a 25.0x multiple, the stock can trade at around $300 in 12-18 months from now, suggesting a nearly 40% upside potential.

Takeaway

META’s risk/reward profile is improving. At current levels, it provides a compelling case where the worst-case scenario, investors don’t lose, but the best-case suggests a decent return.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.