Summary:

- Meta Q2 report showed how the company is leveraging AI to optimize ad spending and user engagement in an exceptional way, leading to strong financial performance and exceeding market expectations.

- The company’s advanced AI capabilities, including Meta Lattice ad ranking architecture and a new AI model, position them as a leader in the AI space with the tools deployed internally.

- Despite legal challenges and the risks of a recession, META’s strong financial foundation and proactive measures make it a strong buy with resilient upside potential in the long run.

Derick Hudson

Investment Thesis

While the market gave Meta Platforms (NASDAQ:META) a slight bump in shares after their most recent earnings, I believe the key takeaways warrant further upside. The company confirmed on this conference call the extent they’re leveraging AI to improve performance across multiple areas. I think such an improvement is key to allow the company to fight off growing concerns that a recession in the US may be imminent based on recent jobs figures.

Within Meta, the company is using AI to optimize their customers’ Ad spending along with increasing user engagement with the platform, both of which will increase key metrics in strong secular trends that’ll buck any ad market recession.

One of these standout features highlighted during the call was the company’s Meta Lattice ad ranking architecture, which uses advanced AI algorithms to improve ad targeting. Meta’s management has shown that this AI-driven approach has allowed the social media giant to significantly increase the average price per ad, even in what appears to be a slowing economy.

Just about every metric from the Q2 earnings report was better than I, personally, expected. To this point, the company’s implied growth by guidance was also much higher than street estimates, which I’ll expand on what this means in a second. Meta reported an EPS of $5.16, which exceeded analyst expectations by $0.38. Powering this was the strong revenue of $39.07 billion, marking a 22.10% year-over-year increase and surpassing estimates by $760.88 million.

Looking forward, Meta’s robust growth is predicted to continue. Management’s revenue guidance for Q3 ranges from $38.5 billion to $41 billion, implying over 20% growth at the high end and well above market expectations of only 15.67% year-over-year growth that were predicted right after earnings dropped.

Meta’s AI capabilities extend beyond just ad optimization. The social media giant’s introduction of Llama 3.1, considered by many the best AI model currently available, demonstrates their strong position within this competitive market. According to Meta:

[This new model will be able to] ignite new applications and modeling paradigms, including synthetic data generation to enable the improvement and training of smaller models, as well as model distillation – a capability that has never been achieved at this scale in open source.

With the company’s near seamless integration AI to optimize ad spending and enhance user engagement, Meta positions themselves, at least in my eyes, as the AI winner in this earnings season. I think the stock continues to be a strong buy.

Why I’m Doing Follow-Up Coverage

Following Meta’s earnings announcement on July 31st, shares experienced an initial rally but has since cooled off slightly due to broader market conditions. Since my pre-earnings coverage, the stock has increased by roughly 4.82%, while the market has dropped by 2.14%.

Despite the share price cool off, I think this past quarter was game changing for Meta, as it demonstrates how far ahead in the AI race they really are. This quarter showcased Meta’s practical leadership in the AI space. I say practical because I think they are using their in-house AI models better than anyone else to generate a return on capital. While Wall Street is increasingly questioning AI spend at major big tech companies, Meta seems to have their metaphorical ‘ducks’ in a row here.

This follow-up coverage aims to dive deeper into the broader implications of Meta’s advancements in AI that were showcased on the call, exploring how these innovations will drive long-term growth. I think the market selloff dampened the bump shares would have naturally gotten from such a bullish quarter. I think this presents a unique opportunity.

Earnings Recap

Meta’s Q2 earnings report delivered exceptional results. As I mentioned above, the company reported EPS of $5.16, which significantly surpasses the consensus estimate of $4.78 by $0.38.

Revenue for the quarter followed a similar trend, coming in at $39.07 billion. This number exceeded expectations by $760.88 million and marked a 22.10% year-over-year growth. This impressive revenue and EPS performance was driven by the combination of Meta’s enhanced ad targeting capabilities I touched on before. I mentioned previously that Meta was able to increase average ad prices, which based on the metrics from Q2, has proven successful.

Touching on guidance again, Meta’s guidance for Q3 is promising. During the earnings call, the company projected revenue between $38.5 billion and $41 billion, indicating possible growth of around 20% from the previous year of $34.15 billion. Historically, Meta has often lowballed their financial outlook. I think we could see revenue exceed $41 billion, meaning growth continues to be strong going into the second half.

What’s key to this report as well is that Meta also demonstrated disciplined capex management, reporting CapEx of $8.5 billion for the quarter. Much like the other big tech names that have reported over the last two weeks, this figure was largely allocated to investments in AI infrastructure and data centers, essential for supporting the company’s AI growth and maintaining their competitive edge in the digital advertising market. Unlike some of their peers, however, such as Microsoft (MSFT), Meta’s ability to keep CapEx under control while still investing heavily in AI technology really positions the company well for future growth.

CEO Mark Zuckerberg touched on how AI was going to start to compound and benefit, stating:

AI is also going to significantly evolve our services for advertisers in some exciting ways. It used to be that advertisers came to us with a specific audience they wanted to reach, like a certain age group, geography, or interests. Eventually, we got to the point where our ad systems could better predict who would be interested than the advertisers could themselves – Q2 Earnings Call.

Susan Li, Meta’s CFO, touched on this too and went on to state:

We’re also making it easier for advertisers to maximize ad performance and automate more of their campaign setup with our Advantage+ suite of solutions. We’re seeing these tools continue to unlock performance gains, with a study conducted this year demonstrating 22% higher return on ad spend for US advertisers after they adopted Advantage+ Shopping campaigns – Q2 Earnings Call.

In this, she also discussed one of the successful advertisement projects currently underway:

…to that end, I’d say that we feel quite happy with also the investments we’ve been making in Shops ads. Shops ads revenue is growing at a strong year-over-year pace. We are seeing Shops ads drive incremental performance for advertisers, and it’s also working well in combination with some of our other products like Advantage+ shopping – Q2 Earnings Call.

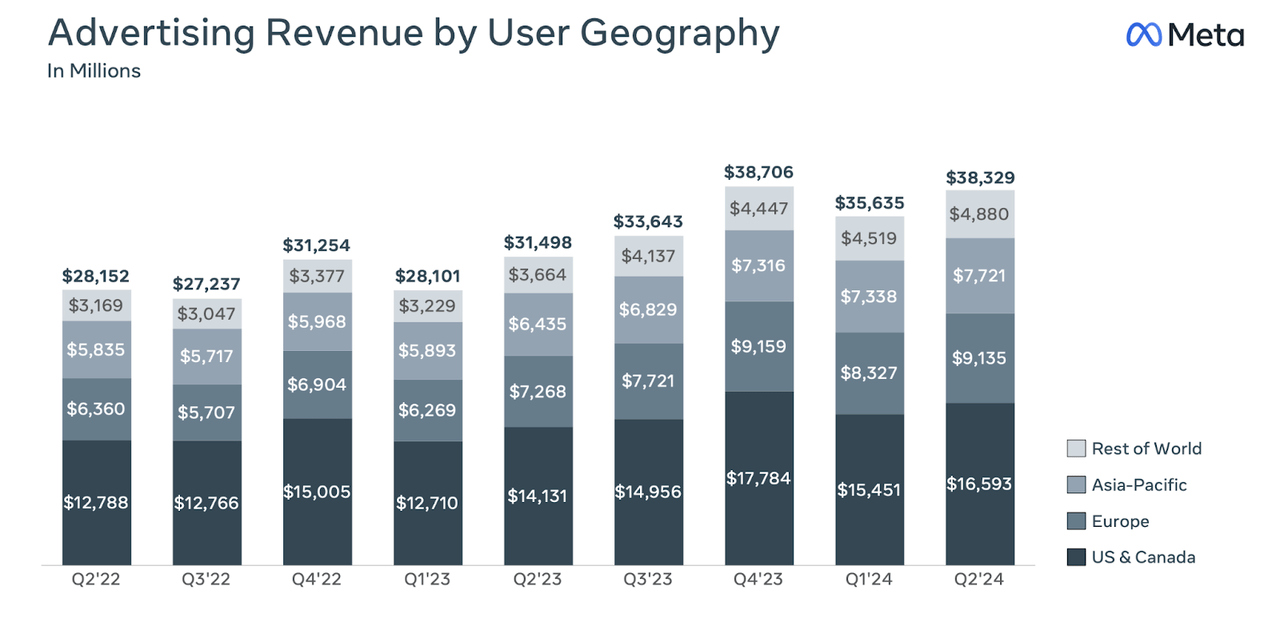

AI is clearly helping Meta and their advertisers improve ad efficiency. This should cause revenue to begin to exponentially increase as the innovations spread through their ad placement network. Advertisement revenue has already been increasing, as seen below. This is largely what is powering the stronger than expected guidance.

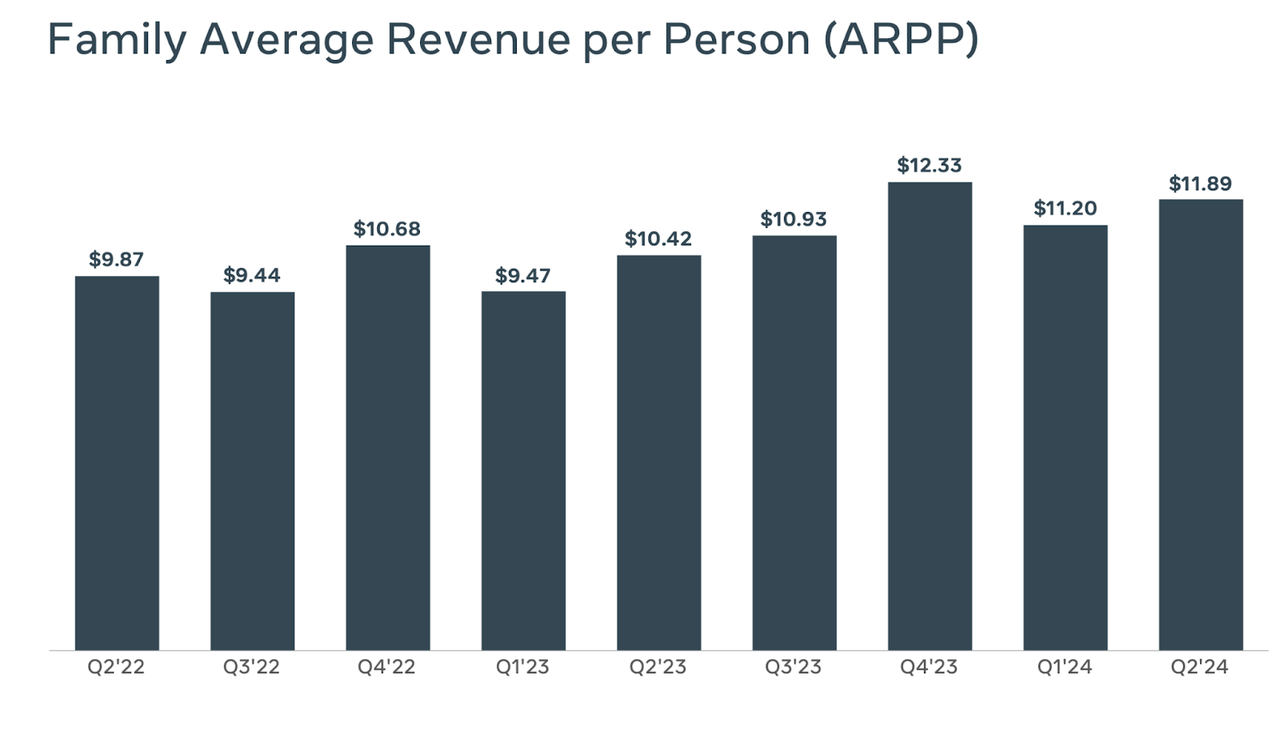

As overall advertisement revenue increases, so will revenue per user. We’re already seeing this too.

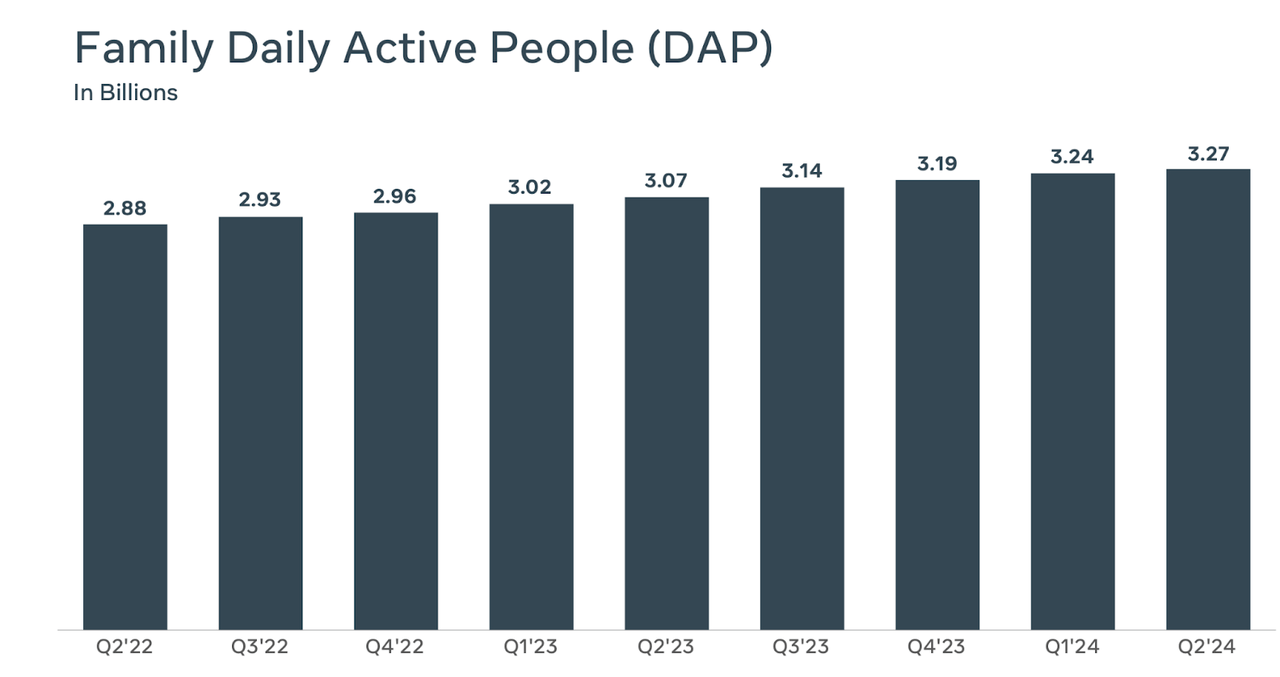

This metric increase is very promising for Meta, considering their Family Daily Active People has been steadily increasing for the last two years.

Why this matters for me: recent market pressures have led investors to believe that the US could be entering a recession soon, with Goldman Sachs upgrading their 12-month recession likelihood to 25%. Meta is showing that, heading into any slowdown, they are playing from a position of strength. I like it.

Valuation

Even with Meta’s impressive Q2 performance, and exceeding expectations, I believe the company is still under-appreciated by the market. The selloff Thursday and Friday was a big part of this.

Meta’s forward non-GAAP P/E ratio reflects an attractive valuation compared to their peers, especially when comparing the P/E to the PEG ratio. The forward P/E ratio is 23.37, while the sector median is 16.76. Although this premium may appear high, it’s not actually that high when considering the company’s undervalued forward PEG ratio.

Diving into Meta’s forward PEG ratio, this stands at 1.21, which is significantly lower than the sector median of 1.33. I think this really shows that the market is expecting some of the forward expected EPS growth to not materialize, which would push the PEG ratio up to the sector median. This appears completely misguided given what we know about their AI push. I think the more likely outcome is shares appreciating to close this gap.

In my pre-earnings coverage, I estimated the upside potential of 22.41% if this PEG were to converge to the sector median. However, given that Meta’s projected EPS diluted growth is now projected to land at 422.93% above the sector median, I believe their upside potential should be an additional 20% above the sector median (meaning their NEW PEG ratio should land at about 1.60). From here, this represents an additional 31.9% upside.

Risks

As I mentioned before the quarterly call, Meta’s biggest risk remains government action on the business model. Historically, antitrust issues have posed significant challenges for Meta, but I think they’re starting to get ahead of these risks, which, I think, is proactive and productive.

Recently, Meta agreed to pay a $1.4 billion settlement to resolve a biometric data lawsuit filed by the state of Texas. I think it’s a great example of where the company made mistakes and now is looking to right their wrong. It’s a lot easier to pay the fine and move on than fight it (unless it’s existential). Meta has a great business model, they should waste as little time fighting legal battles as possible and maximize time on their strategy to increase engagement and ramp up ad dollar spend on their platform by advertisers.

Bottom Line

Despite what I believe to be a relatively muted response by the market post earnings, Meta remains a strong buy, driven by their advanced AI integration, excellent financial performance, and key initiatives to enhance ad effectiveness and user engagement. The Q2 earnings report really highlighted Meta’s ability to exceed market expectations, maintain strong growth, and manage capital expenditures effectively (they did not spook the market like other big tech companies). Despite ongoing legal challenges, Meta’s proactive measures, combined with their strong financial foundation, means I think this positions the company for more room to run. While many are concerned about a recession and what this macro risk could do for the tech giant, I think we are at the beginning of a secular innovation cycle that will allow them to avoid much of the traditional boom and bust cycles of advertising spend. I remain optimistic about the company and the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.