Summary:

- Meta earnings were great and the stock rallied 6%.

- There’s a lot to be excited about when it comes to products and growth.

- Despite great earnings, the stock looks overbought.

Kira-Yan

Thesis Summary

Meta Platforms, Inc. (NASDAQ:META) has surprised investors, and the stock is up near 6% following its Q2 results.

Demand for ads is recovering, and the company continues to increase its efficiencies, which is translating into higher margins and EPS.

There are also a lot of things to be excited about, with AI innovation and new products.

However, the stock is overstretched from a technical perspective. I believe it is time to take some profits and buy back lower.

Q2 Overview

META has surprised investors with an EPS and revenue beat, with the recent results showing a promising trajectory.

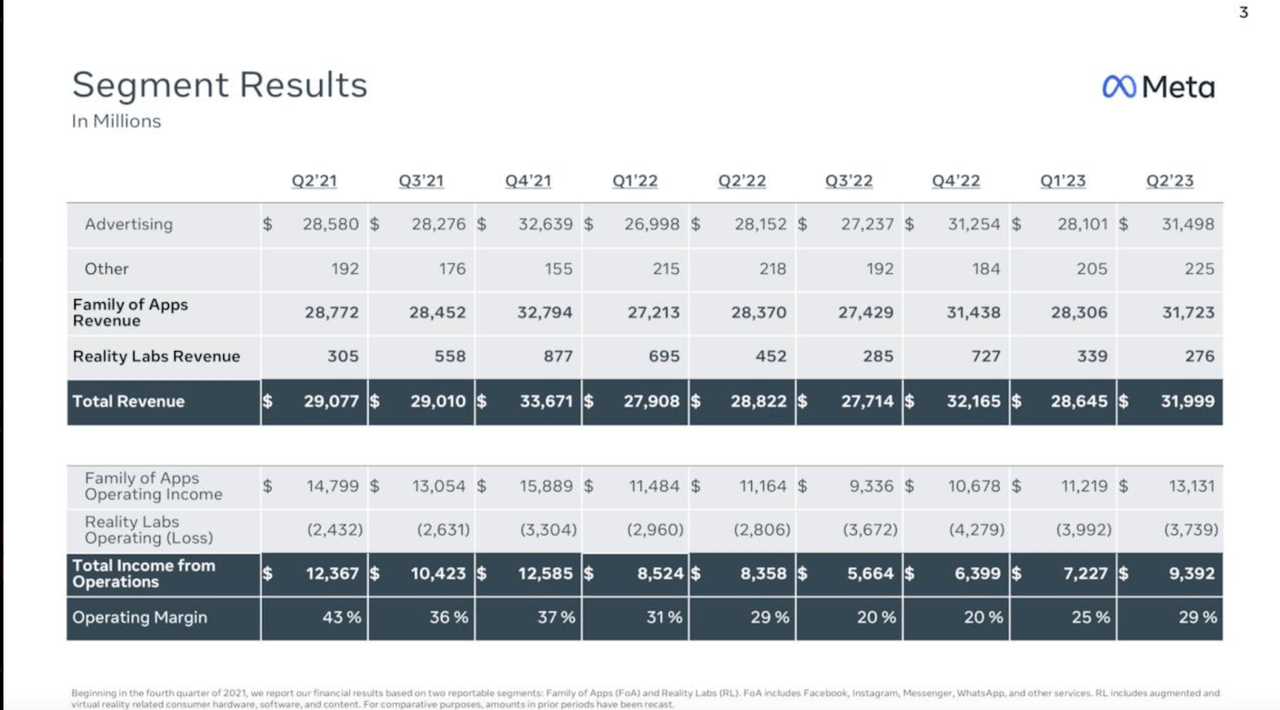

Q2 Meta Segment Overview (Investor Presentation)

As we can see, advertising revenue grew by 12.8% QoQ, and over 17% YoY. This translates into substantially higher OI, as the margin expanded to 29%.

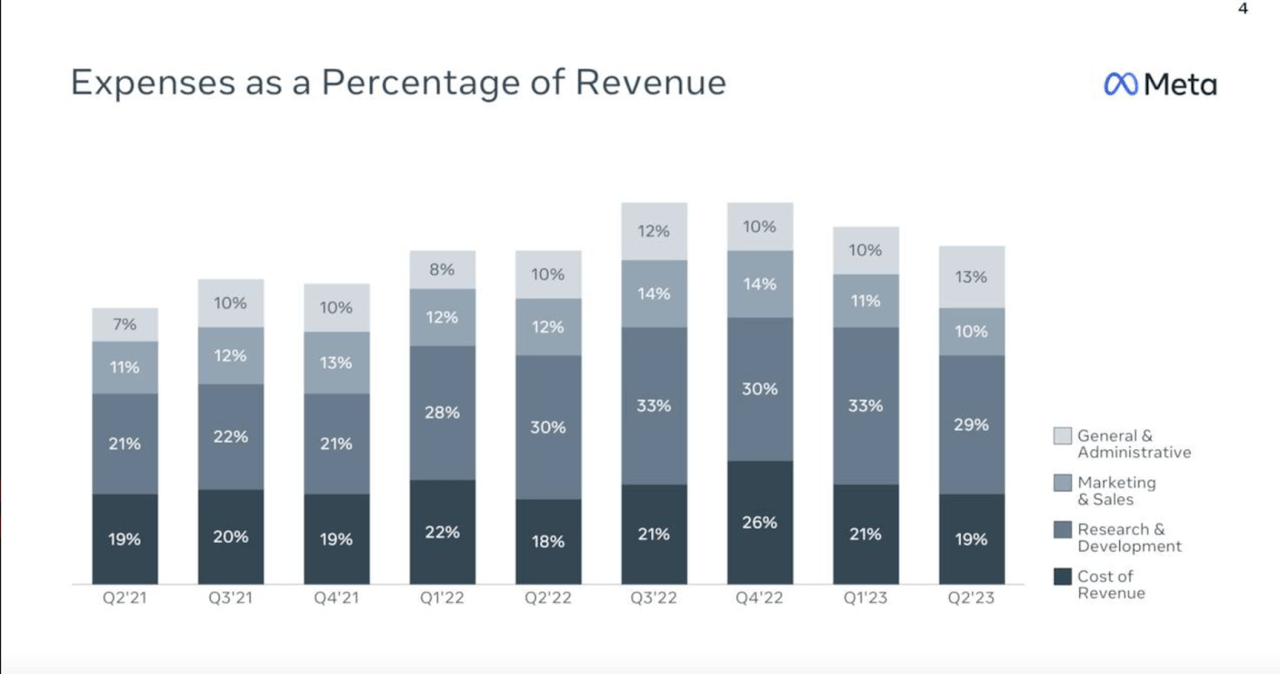

This has been possible thanks to significant cost-control, which we can see reflected in the chart below.

Expenses as a percentage of revenue (Investor Presentation)

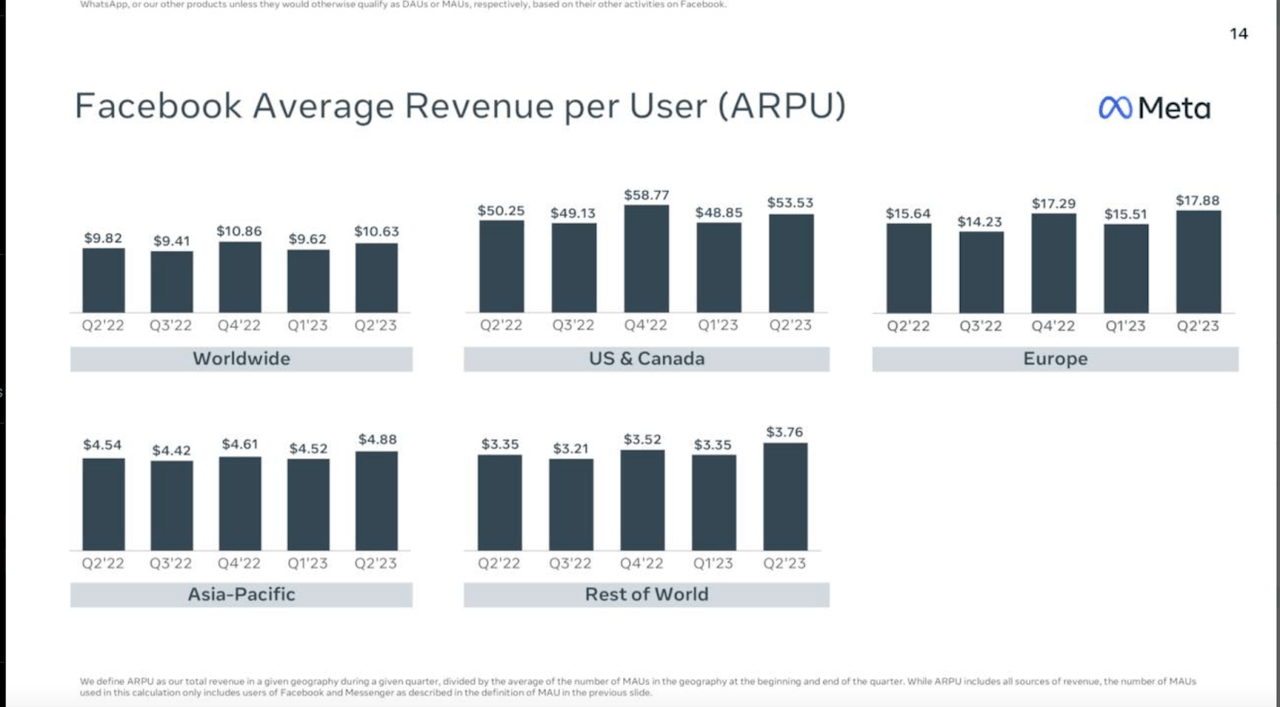

This increase in profitability was also possible thanks to improving Average Revenue Per User across all geographies:

ARPU (Investor Presentation)

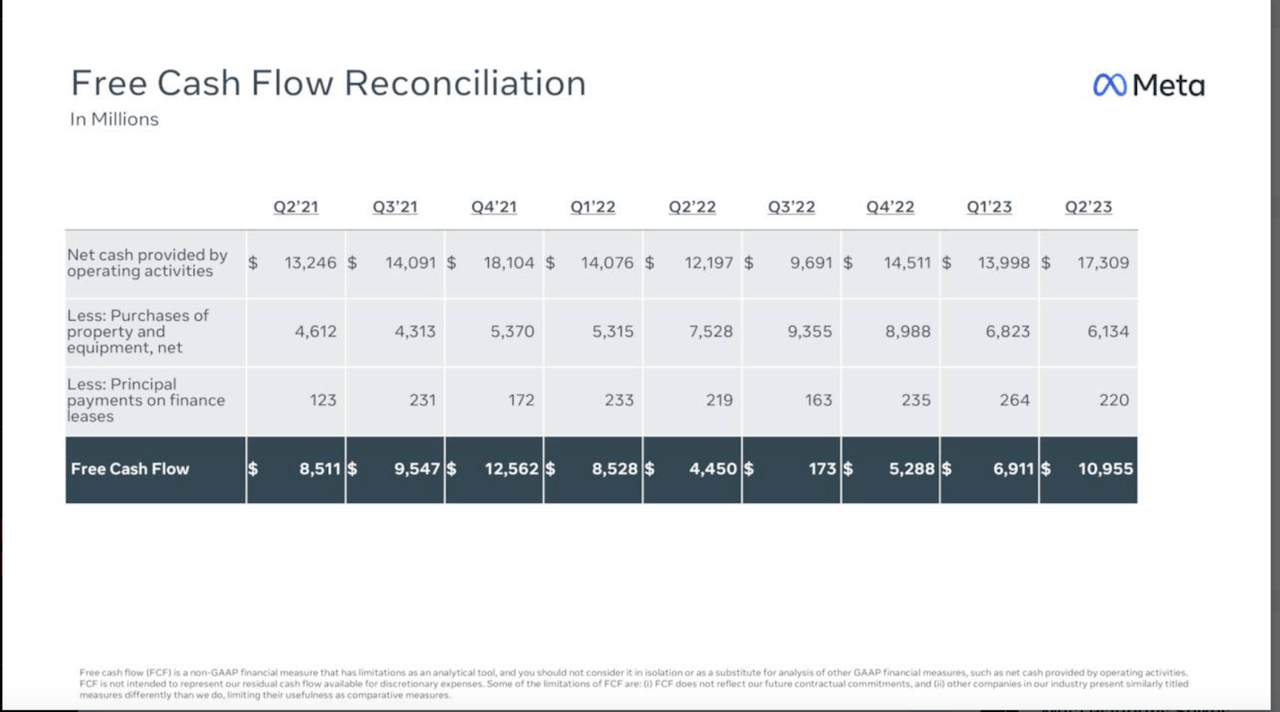

Lastly, it’s worth mentioning that META achieved nearly a record $11 billion in FCF over the quarter:

FCF (Investor Presentation)

All in all, a great quarter for META and Mark Zuckerberg. The company is delivering in its core business, and also has many exciting opportunities on the horizon.

This was discussed in the earnings call.

Insights From The Earnings Call

Of course, one of the latest developments was the launch of Threads, and investors are curious to see how this will pan out. While growth has “surprised” Zuckerberg, monetization is still a ways away.

On Threads briefly, I’m quite optimistic about our trajectory here. We saw unprecedented growth out-of-the-gate. And more importantly, we’re seeing more people coming back daily than I’d expected. And now we’re focused on retention and improving the basics. And then after that, we’ll focus on growing the community to the scale that we think is going to be possible. Only after that we are going to focus on monetization…

-Source: Mark Zuckerberg, Earnings Call

But there’s a lot more on the pipeline than threads. According to Zuck, AI is the present, and Metaverse is the future.

Now moving on to our product roadmap, I’ve said on a number of these calls that the two technological waves that we’re riding are AI in the near-term and the Metaverse over the longer-term.

…AI recommended content from accounts you don’t follow is now the fastest-growing category of content on Facebook’s feed.

-Source: Mark Zuckerberg, Earnings Call

It’s great to hear that META is making the most out of AI, and that this is having an impact on the bottom line.

Business messaging is another key piece of our monetization strategy and we recently announced that the 200 million users of our WhatsApp Business app will now be able to create Click-to-WhatsApp ads for Facebook and Instagram without needing a Facebook account. This is a pretty big unlock, particularly in countries where WhatsApp is often the first step to bring their business online. Paid messaging is a bit earlier, but it’s also showing good adoption. The number of businesses using our paid messaging products has doubled year-over-year.

-Source: Mark Zuckerberg, Earnings Call

Yet another great example of how META is making the most of AI to help advertisers and increase monetization

And in terms of the Metaverse, Zuckerberg admitted that adoption is not as fast as expected, but he remains fully convinced by the long-term view

So I don’t think there’s much change there except that it’s sort of signals that we’re getting from the market are it certainly not getting adopted a lot faster than we expected. That’s sort of the somewhat sobering signal, but on the other side, I think a lot of companies that otherwise are doing, we respect and do great work. We don’t necessarily view is building things that are ahead of where we are, which gives us confidence that we think the long-term thesis still will hold there. We think that we’re going to be the leaders in it and nothing that we’re seeing from the market makes us rethink that in a fundamental way.

-Source: Mark Zuckerberg, Earnings Call

When all is said and done, META has had a great couple of quarters, and I am bullish long-term. However, in the next few months, I’d expect the stock to give back some of its outstanding gains over the year.

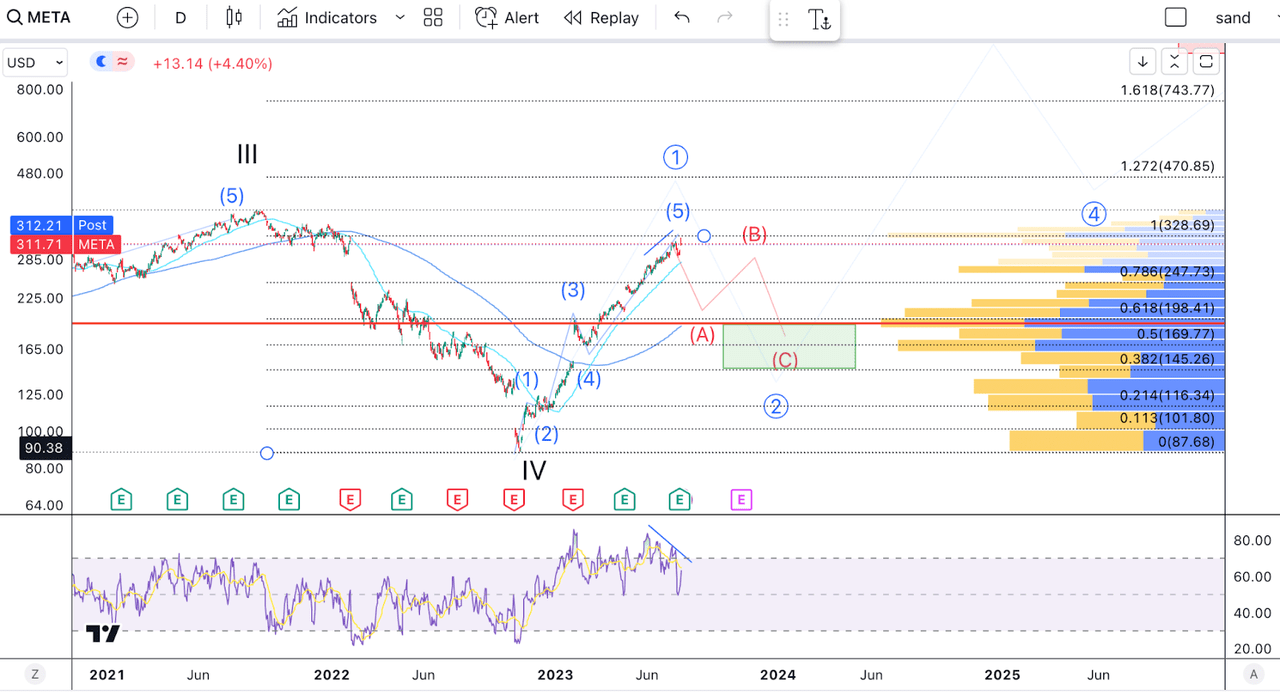

Technical Outlook

META stock looks more than ready for a pull-back at this point:

TA (Author’s work)

We can now easily count five waves up off the low in November. META is up over 260%, and I think we are running out of steam. There are two key reasons for this.

Firstly, we have now reached a natural point of resistance as shown by the VRVP. The $300 area was a point of consolidation before the correction of 2022.

Secondly, we can see a clear bearish divergence in the RSI, which has been making lower highs, while the price makes higher highs. This shows we are running out of steam.

Based on this assessment, META should now retrace to around $200. We have various points of confluence here. This is more or less where we find the 38.2% retracement. It is also where the 200-day MA is offering us support, and it is also a natural point of volume support, as shown by the red line in the VRVP.

With that said, let’s remember that in the long-term, META should head much higher. This sell-off I am predicting should be a wave 2 in our EW count, and the next leg up in wave 3 should take us well above the all-time highs.

Takeaway

I am a META bull, don’t get me wrong, and this has been reinforced by the latest earnings report. However, I also like to guide my decision using technical analysis, and technicals are screaming sell right. I have already taken some profits in my META position but will be looking to redeploy as we head towards my target area.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is just one of many exciting and fairly priced tech stocks you can buy right now!

Join The Pragmatic Investor to stay ahead of the latest news and trends in the tech space and you will receive:

– Access to our Portfolio, which features “value tech stocks”.

– Deep dive reports on tech stocks.

– Regular news updates

Technology is changing the future, don’t just watch it, be a part of it!