Summary:

- Meta Platforms has demonstrated resilient growth, strong financial performance, and a large user base in Q2, crossing 3.88 billion monthly users, signifying its position as a global powerhouse.

- The company’s focus on innovation, including Threads, Reels, Llama 2, and Quest 3, sets the stage for long-term value growth.

- Meta’s strategic embrace of AI has yielded pushes in engagement, ranking, and monetization.

- Quest 3’s arrival with mixed reality capabilities exemplifies Meta’s Metaverse focus, and the integration of Roblox underscores the company’s pioneering steps into the next technological wave.

Vertigo3d

Investment Thesis

Meta Platforms, Inc. (NASDAQ:META) has performed well in Q2 2023, presenting an array of bullish catalysts. The company has demonstrated resilient growth with a staggering user base engaging monthly and Facebook’s global growth spree.

META is a leading contributor in our portfolio and has returned nearly 242% in just nine months. There are no plans of selling anytime soon unless META hits our target price of $400.

The article explores the true dynamism that emerges from Meta’s recent developments in Threads, Reels, Llama 2, and Quest 3, setting the stage for prospective investors to harvest value growth over the long term.

Moreover, impressive figures related to Family Average Revenue per Person (ARPP) and the strategic dominance of Instagram and Facebook in average time spent (ATS) highlight Meta’s robust position.

Yiazou Model Portfolio

Q2 Performance: Strong Growth Amid Challenges & Strategic Focus

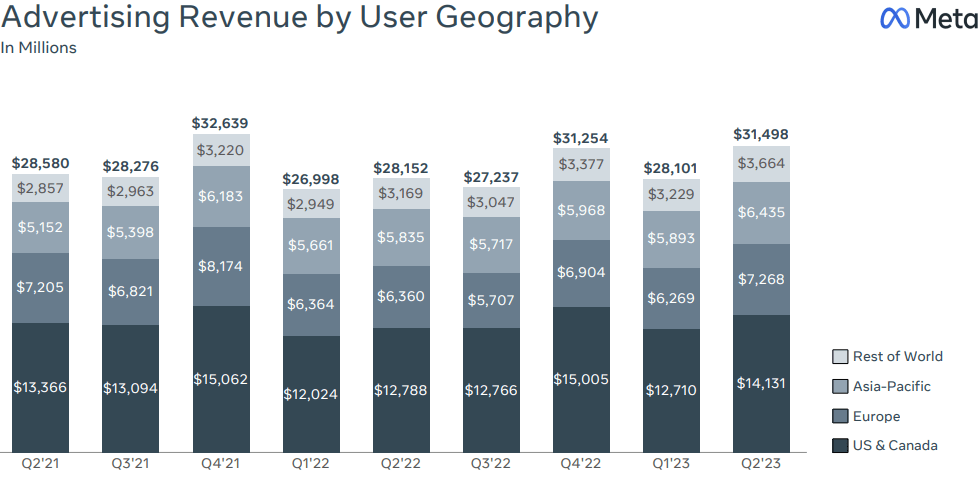

Meta has demonstrated strong financial performance in Q2, showcasing growth in key areas while facing challenges. The company’s consolidated results reveal a total revenue of $32 billion ($31.5 billion from Ads), marking an 11% YoY increase or 12% when adjusted for constant currency fluctuations. The growth is underpinned by the consistent expansion of its user base, engagement metrics, and ad revenues across its Family of Apps (FoA) segment.

Further, Revenue generation within the FoA segment is impressive, with Q2 revenue totaling $31.7 billion, marking a 12% YoY increase. Ad revenue constitutes a substantial portion of this revenue, amounting to $31.5 billion, demonstrating a growth rate of 12%, or 13%, when accounting for currency fluctuations.

Also, Ad impressions served across Meta’s services rose by 34%, driven by growth in the Asia-Pacific and Rest of the World regions. However, the average price per ad saw a 16% decline, attributed to a mix of lower-monetizing surfaces and regions. Despite this, ongoing ad targeting and measurement improvements aim to mitigate the pricing pressure and deliver enhanced results for advertisers.

Notably, the online commerce vertical drove significant growth, benefiting from strong advertiser interest in China and cross-market outreach. Ad revenue growth was particularly robust in the Rest of the world (16%), followed by Europe (14%), North America (11%), and Asia-Pacific (10%).

Earnings Presentation (Meta)

Strategically, Meta’s focus remains on developing and operating its FoA, with approximately 82% of its expenses allocated to this segment. In Q2, expenses totaled $18.6 billion, reflecting an 8% YoY increase. Legal-related expenses and restructuring charges impacted expenses, but a reduction in non-headcount-related operating expenses, including marketing, helped offset these costs.

A significant challenge area is the Reality Labs segment, which experienced a 39% YoY decline in Q2 revenue due to lower sales of the Quest 2. Despite this, the company remains committed to this segment, investing heavily in research and development to enhance its augmented and virtual reality offerings. Expenses in the Reality Labs segment rose by 23%, primarily due to adjustments in loss reserves and employee-related costs. Consequently, the segment reported an operating loss of $3.7 billion.

Meta’s financial outlook is promising, with a diverse revenue stream, an expansive user base, and ongoing investments in innovation. Adapting to changing market dynamics and effectively capitalizing on its augmented and virtual reality ventures will be crucial to sustaining its growth trajectory. With consistent revenue growth, a massive user base across its FoA, and robust ad revenue, Meta’s dominance in the social media landscape is evident.

Despite challenges in the Reality Labs segment, Meta’s commitment to research and development in augmented and virtual reality holds promise. By optimizing expenses and maximizing revenue potential, Meta may sustain its growth trajectory, adapt to market changes, and leverage innovation to secure its position as a tech leader.

Robust Growth, User Engagement, And The Path To The Metaverse

In Q2 2023, Meta demonstrated robust growth and prospects across its suite of apps. The FoA segment, a cornerstone of Meta’s business, has witnessed significant user engagement.

With an estimated 3.07 billion daily users and approximately 3.88 billion monthly users across its apps, the company remains a dominant player in the social media landscape. Facebook, in particular, reached a milestone by crossing 3 billion monthly active users, reflecting 3% YoY growth, with daily active users reaching 2.06 billion, up 5%. These metrics underscore Meta’s ability to attract and retain users across its platforms.

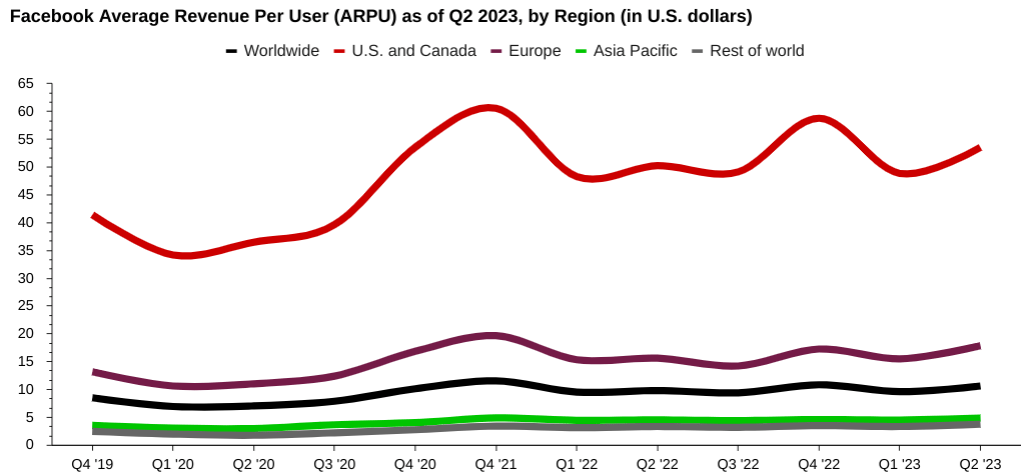

Family ARPP has reached $8.32, signifying 9.62% QoQ growth. For Facebook, Average Revenue Per User (ARPU) experienced 10.50% QoQ growth Worldwide, specifically 15.28% in Europe, 9.58% in the US and Canada, 7.96% in Asia Pacific, and 12.24% in the Rest of the world.

Author’s compilation (statista.com)

Also, Meta’s innovative roadmap outlines a trajectory that holds immense potential. Noteworthy projects include Threads, Reels, Llama 2, and groundbreaking AI products. The imminent launch of Quest 3 in the fall adds another layer of excitement. The positive outcomes of management’s decisions and investments reaffirm the commitment to executing these initiatives.

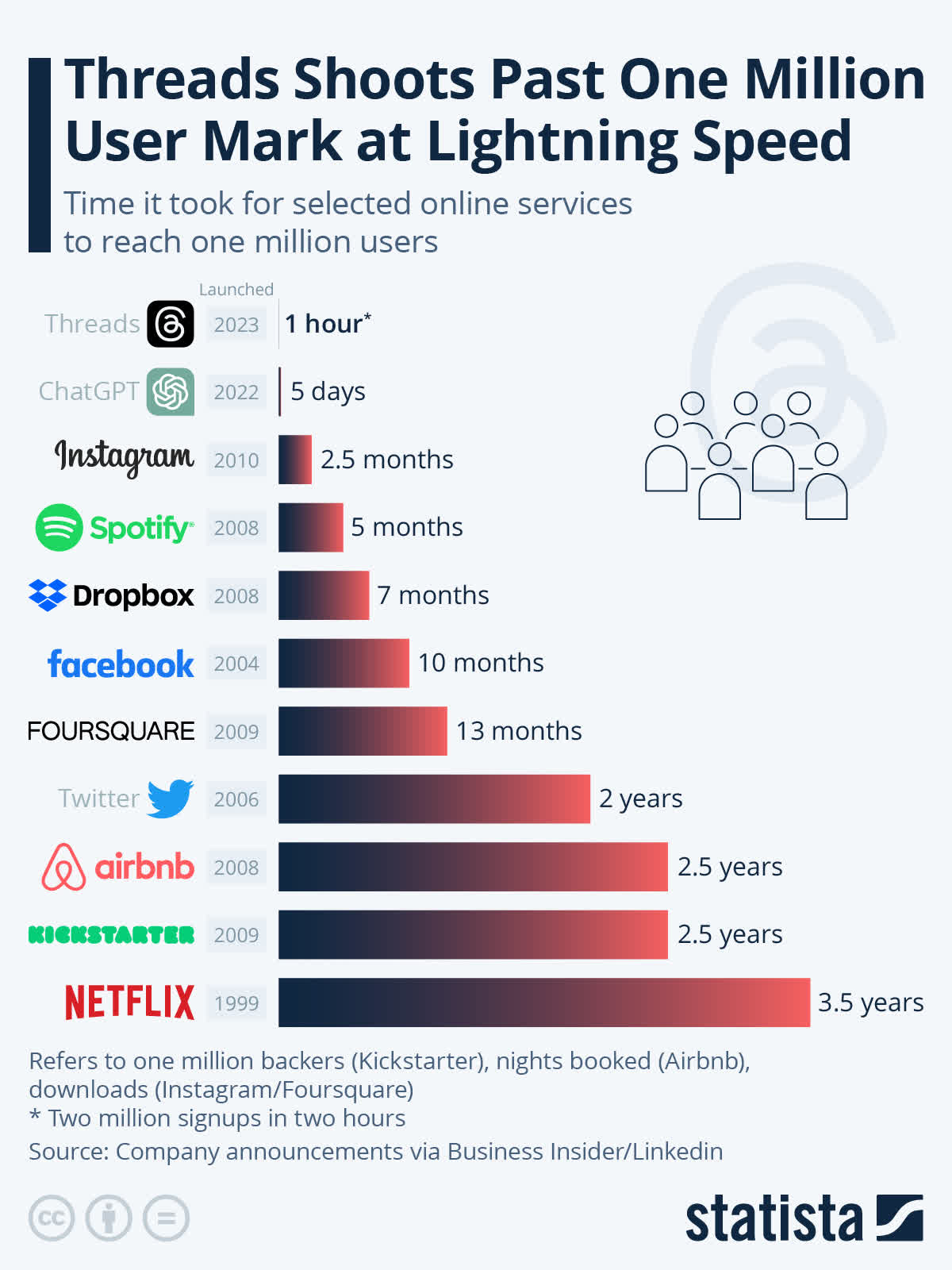

Threads, having witnessed remarkable initial growth, is now focused on enhancing user retention and basic functionality before scaling its community. Similar to past successes like Facebook, Instagram, and WhatsApp, this strategic approach establishes a strong foundation for sustainable growth and monetization.

In general, it has taken far longer for other well-known online services to reach the one million user milestone than Threads, which achieved it in one hour. Spotify and Dropbox, two businesses that, like ChatGPT, offer an immediate practical utility, also accomplished the feat swiftly in five and seven months.

statista.com

Further, the company’s pursuit of efficiency bore fruit during the Thread launch, showcasing the benefits of a leaner organization and cultural shifts. This initiative, part of the “year of efficiency,” serves dual purposes: reinforcing technological prowess and bolstering financial performance. Meta’s ongoing dedication to efficiency aligns with its ambition to invest assertively in its ambitious long-term roadmap.

As Meta navigates the remainder of 2023, priorities encompass fostering employee stability, eliminating operational impediments, and introducing AI-driven tools for optimization. A lean operational mindset, despite improved financials, will persist, although headcount growth will be relatively restrained. However, the ripple effects of 2023’s layoffs will extend into 2024, driven by team-specific talent acquisition.

Additionally, Meta’s product roadmap centers on capitalizing on two technological waves: AI in the short term and the Metaverse in the long term. AI-driven content recommendations from non-followed accounts have fueled a 7% increase in platform engagement. Reels, a key component of content discovery, achieved daily play counts exceeding 200 billion, contributing to an annual revenue run-rate surpassing $10 billion across Meta’s apps. AI’s influence extends to monetization tools, as exemplified by Meta Advantage’s automated ad products. Meta Lattice’s introduction and AI Sandbox’s innovative features underscore the company’s commitment to AI-driven advancement.

Moreover, business messaging, another monetization avenue, gains traction, with 200 million WhatsApp Business app users empowered to create Click-to-WhatsApp ads for Facebook and Instagram. Paid messaging adoption has doubled year-over-year, reflecting promising early results. Additionally, messaging services are leveraged for business interactions, with progress seen in WhatsApp’s paid messaging solution. The company concentrates on AI and onsite conversions to enhance advertiser performance. AI is used to power advanced ad products, driving conversion growth. Lastly, click-to-WhatsApp ad revenue is growing rapidly at over 80% YoY.

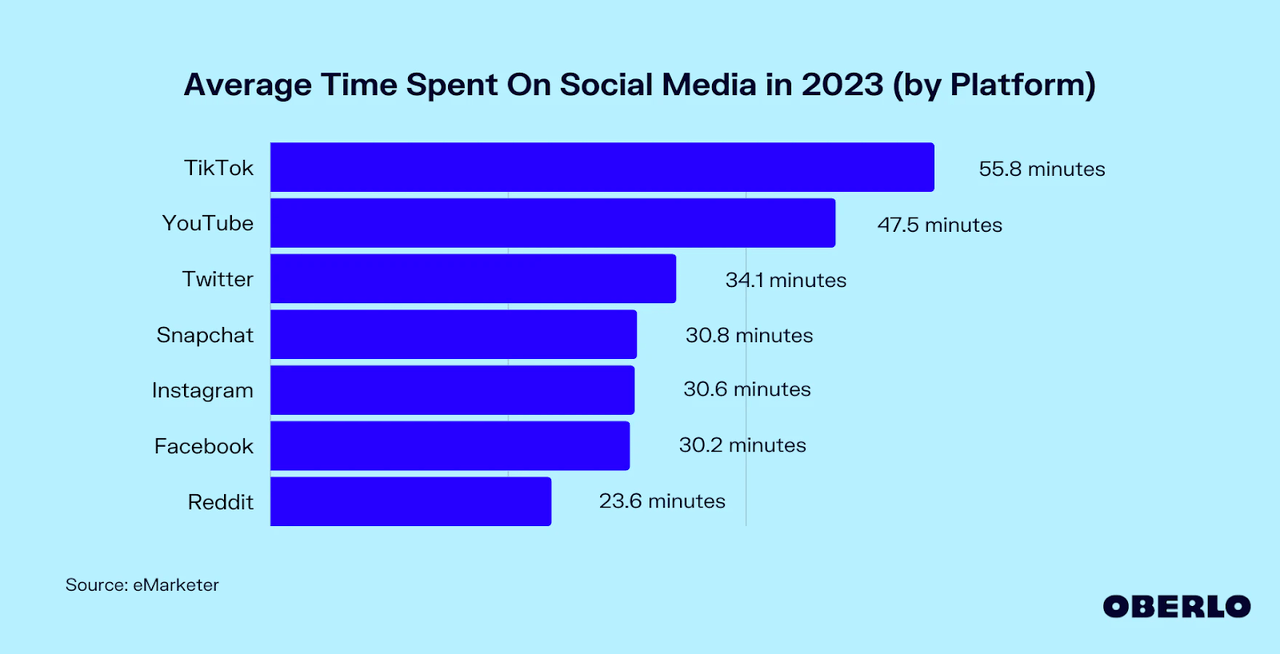

Considering that TikTok only debuted in the US in 2017, the ATS on TikTok of 55.8 minutes has increased over the past several years, and as a result, the platform has gradually surpassed each of its rivals. It overtook Instagram in 2019 before doing the same to Facebook the following year and YouTube for the first time in 2022. With 47.5 minutes each day, the video-sharing platform places second this year. Nevertheless, Meta’s two leading apps, Facebook and Instagram, have a combined ATS of 60.8, higher than TikTok without counting WhatsApp and Threads.

oberlo.com

Furthermore, Meta’s focus on the Metaverse is epitomized by Quest 3, set to launch with enhanced features, better displays, and mixed reality capabilities. This product offers a pioneering mixed reality experience, uniquely blending the physical and virtual realms. The upcoming integration of Roblox on Quest underscores the Metaverse’s progress.

Fundamentally, Meta’s robust user base, growing ARPU, and efficient operational approach underscore its long-term potential. Innovative products like Threads and AI-driven tools enhance user engagement, retention, and monetization. The Metaverse focus, exemplified by Quest 3 and Roblox integration, positions Meta at the forefront of the next technological wave. Finally, as efficiency remains a priority and AI investments yield dividends, the company’s strategic roadmap fuels sustainable growth, fosters financial performance while navigating evolving trends, and cements Meta’s position for enduring value creation.

Advancing Engagement, Monetization, And Growth Initiatives

Meta’s operational outlook revolves around two main revenue drivers: delivering engaging experiences for the community and effective monetization of that engagement.

Engagement within Facebook and Instagram remains strong, with Reels contributing to incremental engagement. An important focus is improving value by leveraging advanced AI techniques to enhance content recommendations. New AI-powered products are being developed to expand self-expression and connections.

Fundamentally, monetization is another significant driver. While products like Reels and messaging services monetize at lower rates, efforts are underway to improve their efficiency and performance. Reels monetization is progressing, with over three-quarters of advertisers using Reels ads. The aim is to narrow the monetization gap with more mature surfaces like Stories and Feed.

Regarding the financial outlook, Q3 2023 is projected to have total revenue between $32 billion and $34.5 billion, showing potential for substantial growth. The midpoint of this guidance suggests a 20% YoY growth rate. Investment prioritization and resource shifting are emphasized. While Meta expects regulatory challenges in the EU and the US, it has a positive outlook for providing services in Europe following an adequacy decision.

Regarding expenses, a 2023 full-year estimate ranges from $88 billion to $91 billion, which includes restructuring costs and Reality Labs’ increased operating losses. The company expects to evolve its workforce composition toward higher-cost technical roles.

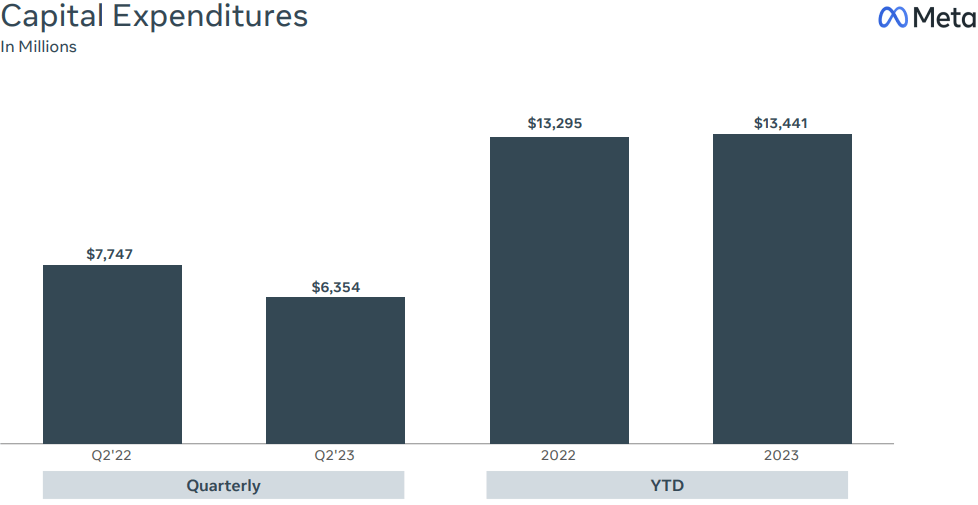

On the CapEx front, the 2023 forecast is between $27 billion and $30 billion lower than the previous estimate due to cost savings and project delays. However, CapEx is anticipated to grow in 2024, driven by AI investments, data centers, and servers.

Earnings Presentation (Meta)

Consequently, Meta’s focus on enhancing user experiences through AI-driven content recommendations and innovative products fosters a strong user base. The push for improved monetization, particularly in emerging avenues like Reels and messaging services, promises increased revenue potential.

Despite expected expenses and challenges, Meta’s strategic allocation of resources and investment in AI, data centers, and servers position it for sustained growth. Finally, anticipated revenue growth and a positive outlook for services in Europe further solidify Meta’s potential for long-term growth.

Strategic Focus On AI

Meta’s strategic focus on AI is a significant driver for its further growth and innovation. The company is committed to building leading foundation models to support a new generation of AI products. This includes their partnership with Microsoft to open-source Llama-2, the latest version of their large language model, for research and commercial use. Open-sourcing their AI work has been a longstanding practice for Meta, enabling the industry to benefit from diverse innovations that emerge from multiple sources.

By making their work open-source, Meta expects improvements in safety and security through community scrutiny and participation in identifying and fixing issues. Efficiency gains are also anticipated, reducing the infrastructure investment required to run these models. Meta’s investments in AI extend beyond open-source efforts; they are developing various new products leveraging Llama to enhance user experiences across their services.

In detail, the company’s AI-driven initiatives encompass recommendations, safety mechanisms, generative AI features, and building AI agents that serve different purposes. Meta’s vision includes AI agents aiding users in connecting with others, enhancing creative expression, and assisting with interactions between individuals, businesses, and creators. They envision these agents transforming user interactions with businesses, ultimately addressing messaging monetization challenges and improving business-to-customer communication.

Regarding the Metaverse, Meta maintains its focus on realizing this vision while continuing AI advancements. The Metaverse vision involves creating immersive online spaces where users interact, socialize, and engage in various activities. Meta acknowledges the long-term nature of these ambitious projects and the potential overlap and synergy between AI and the Metaverse initiatives.

Adopting AI agents, generative features, and other AI-powered elements exceeds expectations. While Meta emphasizes AI and Metaverse development, the company’s priorities remain consistent, focused on enhancing user experiences and addressing emerging challenges.

Meta’s Open-Source AI & Metaverse Strategy

From a financial perspective, Meta’s exploration of open-source AI models is not expected to create separate enterprise revenue streams. The company’s operating losses in Reality Labs are attributed to ambitious R&D efforts addressing technical challenges to enable future products. While these efforts may initially contribute to losses, Meta believes in the long-term potential and market leadership of its VR, AR, and Metaverse initiatives.

Strategically, Open-sourcing their AI models, like Llama-2, fosters innovation, safety, and security by inviting community contributions. This approach enhances efficiency and reduces infrastructure costs, while AI-driven products and agents improve user experiences. This positions Meta to transform interactions between users, businesses, and creators, tackling monetization challenges.

Lastly, the synergy between AI and the Metaverse vision aligns with their commitment to immersive online spaces. Although open-source AI might not create separate revenue streams, Meta’s investments in AI, VR, AR, and the Metaverse set the stage for future market leadership and growth despite initial operating losses.

Takeaway

In conclusion, the company’s trajectory offers bullish momentum for META investors. The foundation of a colossal user base, an expanding ARPU, and efficient operations build a favorable fundamental base for a further rise in market valuations, while Threads, AI innovations, and the Metaverse-focused Quest 3 add layers of potential. As a long-term investor, the focus should be on the company’s strategic execution, remaining attentive to AI investments, and considering the Metaverse’s progress.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.