Summary:

- I’m downgrading Meta to a sell rating after the stock’s sharp ~80% YTD rally. The stock’s ~24x forward P/E multiple is at risk of a downward correction.

- Meta is expecting a step-up in capex spending in 2025, even after capex grew substantially in 2024 to support AI innovations.

- The company can no longer be considered a capital-light internet business, and its premium valuation multiples may correct downward to reflect that reality.

- Ad impressions growth is also slowing, and alongside possible regulatory retaliation from the Trump administration, Meta has more downside risk than upside for 2025.

The Good Brigade

The end of 2024 is almost upon us, and with the S&P 500 gaining nearly 30% this year powered by large-cap tech stocks, it’s a good time for us to take stock of our positions and make a tough decision about which names still have upside left in 2025. For me, that means letting go of a lot of winners that no longer have specific catalysts to drive outperformance in 2024.

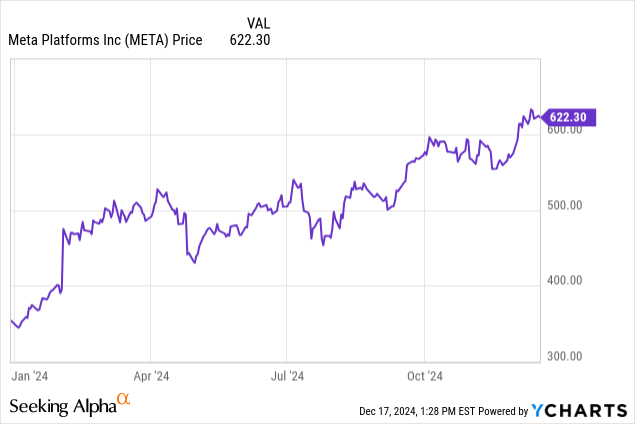

In my view, most of 2024’s stock market gains were driven more by multiples expansion (euphoria over Trump’s re-election and the prospect of interest rate drops) than by underlying earnings performance. Stocks like Meta (NASDAQ:META) have benefited, and the social media giant is up 80% year to date: but in my view, many of these large-cap names are set up for a correction from peak levels in the style of 2022.

I last wrote a bullish note on Meta in August, when the stock was still trading below $520. At the time, I had set a price target of $600 for the stock, based on a 24x ex-cash P/E multiple against expected FY25 earnings. Now that Meta has blasted past my price target, I’m giving the stock a two-notch downgrade to sell. In my view, it’s time to lock in gains on this position and invest elsewhere in more value-oriented names.

Heightened capex spending

It’s not just an overbloated valuation that is driving my concern on Meta and causing me to lock gains on my position. In my view, the market is largely ignoring the fact that Meta continues to spend aggressively on capex to support its buildout of AI infrastructure.

The revolutionary benefits of AI have been one of the most powerful driving forces in the market this year, but many investors ignore the fact that AI models require huge troves of data to run: and especially for companies like Meta, supporting this is becoming increasingly expensive.

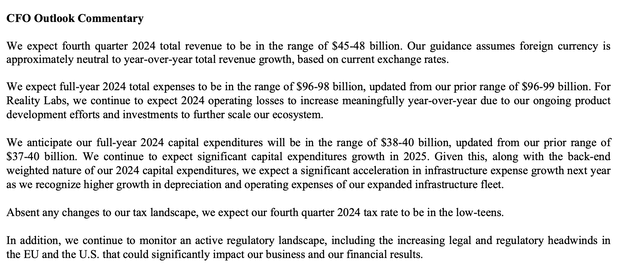

For FY24, Meta recently boosted the lower end of its capex spending range to $38 billion, from a prior range of $37-$40 billion.

Meta outlook (Meta Q3 earnings deck)

It’s also warning us, as shown in the outlook language above, to “expect a significant acceleration in infrastructure expense growth next year as we recognize higher growth in depreciation and operating expenses.” Pro forma earnings metrics will obscure the impact of higher depreciation of capex (as well as stock-based comp), but maintaining this equipment and depreciating it over time certainly isn’t “free.” And we note that the company is still expecting capex to grow significantly in 2025.

Here’s my concern: at the moment, Meta is able to maintain the premium valuation multiples that are typical of capital-light internet stocks. But increasingly over time, Meta is becoming very capital-intensive as it requires giant amounts of annual capex to sustain its pace of innovation. In a more conservative market environment, investors may start to penalize Meta’s valuation multiples as a result.

Deceleration in ad impressions, particularly in the U.S.: how long can Instagram hang on to its dominance?

Here’s another pressing concern for Meta: how can it overcome the fact that its products, like Facebook and Instagram, are already saturated in most developed markets?

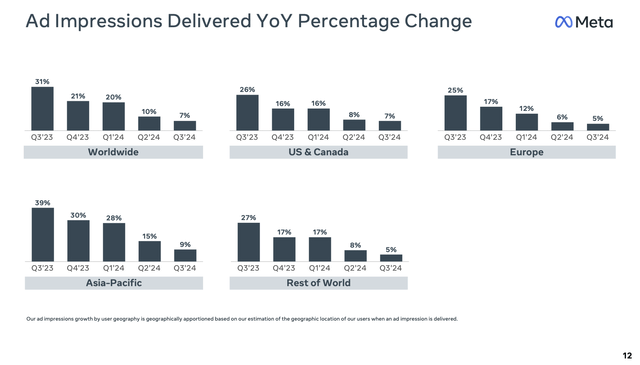

Meta ad impressions trends (Meta Q3 earnings deck)

The U.S. & Canada, in particular, is worth noting: the domestic region delivered 44% of Meta’s overall revenue in Q3. But ad impressions in the region are quickly decelerating, down to a 7% y/y growth pace in Q3: whereas in Q3’23-Q1’24, ad impressions had grown at a double-digit pace.

The reality is that the social media industry is very prone to new trends taking root quite quickly, as has been the case over the past two years with younger generations’ increased infatuation with TikTok. Topical discussion-based social media companies, like Reddit (RDDT), are also gaining share. In Q3, Reddit achieved 47% y/y growth in DAUs (daily active users). Meta’s equivalent metric, “daily active people” or DAPs, grew only 5% y/y in the most recent quarter to 3.29 billion (we note that this is already a significant chunk of the global population). How long can apps like Facebook and Instagram maintain their hold?

We should also not ignore the threat of increased regulation during the incoming Trump administration. While most industries are expected to benefit from deregulation amid the Department of Government Efficiency’s (DOGE) push to eliminate overlapping regulatory bureaus, Big Tech may be the one exception. The media has widely interpreted Trump’s selection of Big Tech hawk Andrew Ferguson to replace Lina Khan as chairman of the FTC as a signal that the president-elect intends to be very aggressive on Big Tech and especially social media, which he has repeatedly lambasted as censoring conservative viewpoints.

The risk of increased regulatory scrutiny in the U.S., plus potential actions overseas (Australia just banned social media for under-16s) may pose as an unquantifiable risk for Meta, and further drive downside in the stock’s already-rich valuation multiple.

Valuation and key takeaways

For next year (FY25), Wall Street analysts are expecting Meta to generate $186.8 billion in revenue (+15% y/y) and $25.35 billion in EPS (+12% y/y). To me, these estimates are quite bullish especially when we consider that impressions growth has slowed to just 7% y/y (with sequential declines each quarter in the U.S.). This means that, without any pickup in user growth and impressions, Meta will have to rely on increased ad pricing to bridge the difference to mid-teens revenue growth – which may be tough to bank on in a tough global macroeconomy.

Nevertheless, even if we take these estimates at face value, Meta’s current price at $622 implies a 24.5x FY25 P/E multiple (or 23.8x ex-cash after netting off the $48.2 billion of net cash on Meta’s latest balance sheet).

To me, this is the upper threshold for Meta’s valuation: especially when risks like substantially higher capex, slowing global growth due to competition and oversaturation, and potential regulatory risks continue to hang over Meta’s near-term future. Steer clear here and invest elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.