Summary:

- It seems that Meta Platforms is more determined to achieve better profitability than expected, given the intensified efforts toward its “Year Of Efficiency.”

- We shall discuss the five key strategies that the social media giant has adopted to deliver sustainable results efficiently.

- However, it remains to be seen how these may turn out for META, given market analysts’ unimpressive projections thus far.

- Due to the minimal margin of safety, META is not a buy here, attributed to its overly optimistic rally thus far.

macida/E+ via Getty Images

This Is Why META’s Aggressive “Year Of Efficiency” Proves Critical

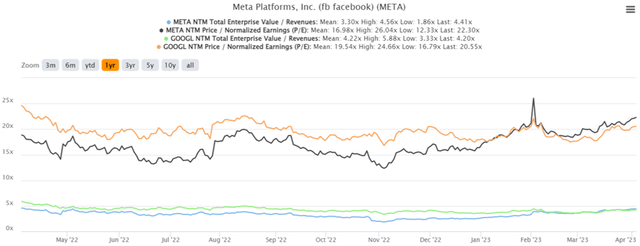

META/ GOOG 1Y EV/Revenue and P/E Valuations

Meta Platforms, Inc. (NASDAQ:META) is currently trading at an EV/NTM Revenue of 4.41x and NTM P/E of 22.30x, lower than its 3Y pre-pandemic mean of 8.05x and 24.68x, respectively. Otherwise, it is slightly higher than its 1Y mean of 3.30x and 16.98x, respectively.

The same pessimism is observed with Alphabet (GOOG) (GOOGL), trading relatively in line with its 1Y means, due to the two advertising giants’ exposure to the weakening advertising environment in FY2023.

Oberlo estimates that global ad spending growth may decelerate to +13.1% in 2023, compared to +15.6% in 2022 and +29.9% in 2021, attributed to the peak recessionary fears. Within the US, Magna also projects that the growth for ad spending may decelerate to +3.7% YoY in 2023, compared to the 2022 levels of +8% YoY.

Therefore, it is unsurprising that we may see a corresponding deceleration in META’s top-line growth. We estimate its FY2023 revenues to be at $113.08, relatively in line YoY with FY2022 levels of $116.6B. This is based on the company’s annualized FQ1’23 guidance of $27.25B at the midpoint, and a typical seasonal bump of +15% in Q4.

Therefore, it makes sense that META has to embark on a “Year Of Efficiency” to drastically improve its top and bottom line growth, as discussed in the FQ4’22 earnings call and in the open letter to its employees on March 14, 2023.

1. Headcounts On The Chopping Block

Firstly, META has decided to lay off another 10K headcounts through late May 2023, on top of the 11K announced in November 2022. These suggest a drastic reduction of up to -24% from its FQ3’22 headcount of 87.31K.

The company’s average annual wage is estimated at around $232.5K, including base pay, bonus, and stock-based compensation. Based on this number, the company may potentially report annual savings of up to $4.88B or the equivalent of 8.2% of FY2022’s operating expenses of $59.3B.

However, our numbers may be overly prudent, since most of the lay-offs are reportedly at the “middle management” in order “to flatten its organization structure.” Therefore, it is possible that the actual sum may be higher than our projection.

The social media giant has also released new guidance for FY2023 total expenses at $86B – $92B, down by -14.8% from the original guidance of up to $101B and nearer to FY2022 levels of $87.8B, suggesting sustained profitability for the fiscal year.

2. Optimizing Results Through AI Tools

Secondly, META also increases its investment in AI tools to improve its work efficiency. The company has been testing Buck2, a new open-source developer platform, to speed up its engineers’ coding builds by up to +50%, as highlighted by Colin Sebastian, an analyst from the investment firm Baird:

What we are seeing now is the realization that AI can automate at least some day-to-day workflows. (Seeking Alpha)

This is on top of the aggressive increase of the company’s R&D expenses, from 20.9% of its revenues/ $7.04B in FQ4’21 to 25.7%/ $8.28B in FQ4’22, implying its “increased costs of innovation.” Part of this may be attributed to its increased investments in AI tools to improve its monetization rates for ads and Reels, due to the impact of Apple’s (AAPL) privacy changes. This will be discussed further in our next point.

3. Prioritizing Profitable & High-Growth Projects

META also decides to cancel or delay “lower-priority projects.” These include the NFT features on Instagram and Facebook, which have only been launched for a year. The company had originally hoped to tap into the booming decentralized Web3 ecosystem, one that naturally supported its Metaverse ambitions.

However, given the ongoing crypto winter and bear market, many cryptocurrency exchanges and bitcoin miners have filed for bankruptcy, with Bitcoin (BTC-USD) similarly plunging by -61.3% from its peak to $24.88K at the time of writing.

Therefore, it makes sense that META is rationalizing projects to focus on more profitable monetization opportunities, such as Meta Pay and WhatsApp Pay (as discussed in our previous article here). In addition, the company is expanding its Reel monetization opportunity by allowing creators to earn ad revenues on the platform, similar to TikTok’s (BDNCE) strategy thus far.

The Chinese-based social media company had successfully commanded up to $1.5B in in-app purchases and reportedly up to $13B in video ad revenue in 2022, with a global market share of 22%.

Furthermore, Omdia projects that TikTok’s international video ad revenue may continue growing at a CAGR of 27.62% to $44B by 2027, with domestic revenues expanding by 22.1% to $76B at the same time. This could help trigger an accelerating global market share of a projected 37% by then.

On the other hand, Omdia projects that META may only grow its video ad revenue at a CAGR of 5.39% to $39B at the same time, with a declining market share from 16% in 2022 to 12% by 2027.

Given the impressive rate of growth and app popularity amongst young adults, it was unsurprising that users also spent a daily average of 96 minutes on TikTok, nearly twice as much on Facebook and Instagram.

Therefore, it is apparent that META needs to aggressively improve its market penetration by building up its Reels capability and video ad monetization rate, as highlighted by Susan Li, CFO of META, in the recent Morgan Stanley’s Technology, Media, and Telecom conference:

In terms of our AI investments, right now basically all of our capacity is going towards ads, feeds and Reels. (CFO Dive)

On the other hand, the company may simply acquire TikTok, due to the potential divestiture by BDNCE, attributed to the immense accretive value it may bring to the social media giant. Why not? Though we do note it may also come with another round of legal scrutiny.

4. Back To Office

In Mark Zuckerberg’s letter, we are also seeing a lot of hints at the future restructuring of META’s distributed work strategy, despite the previous flexible remote work opportunities. Particularly, the CEO encourages its employees to “find more opportunities to work with your colleagues in person.”

While this turn of events is interesting, attributed to its lease reductions thus far, we reckon part of the return-to-office work may be attributed to the corporate tax breaks the company may enjoy.

Many mayors had previously granted corporations tax breaks to establish offices in their states, allowing the latter’s employees to support local businesses while paying state taxes, one that had been upended by the pandemic and remote work.

For now, META’s motivation seems to stem from “building the necessary connections to work effectively.” This is likely attributed to its headquarters located in California, where there is minimal impact on tax breaks, only limiting health benefits to state-based employees.

However, the same may not be said in New Jersey and Texas, where tax programs require workers to be in office for 80% and 50% of the week, respectively. While some flexibility has been offered through December 2023, we reckon things may change from 2024 onwards, potentially triggering META’s restructuring in the distributed work strategy.

The same has been highlighted by John Boyd, a corporate site selection consultant:

If they (corporations) feel they’re in jeopardy of losing a tax incentive, yes, that will be a motivating factor — along with productivity — to get workers back in the office. (Bloomberg)

While META did not break down detailed numbers, it recorded gross unrecognized tax benefits of $7.86B in FY2019 and $10.75B in FY2022. Therefore, given the potential contribution from the corporate tax breaks, we believe we may see the social media giant impose stricter return-to-office requirements, as witnessed with Amazon (AMZN), Snap (SNAP), and Walt Disney (DIS) thus far.

5. New Economic Reality

Lastly, the macroeconomic outlook remains highly uncertain, worsened by the recent banking failure and rising inflationary pressures, as witnessed in the February CPI. These headwinds suggest an unbalanced push and pull factor between the tough monetary policies and pessimistic market sentiments, potentially triggering further volatility in META’s advertising demand.

Given his deep insights into the tech and advertising industry, we reckon Mark Zuckerberg’s concerns about a “new economic reality” may be warranted, suggesting a possibility of elevated interest rates, increased regulatory scrutiny, and geopolitical instability over the next few years.

Particularly, market analysts expect META to only report a top-line CAGR of 8.9% and bottom-line CAGR of 18% through FY2025, against its pre-pandemic levels of 36.8%/ 26.5% and hyper-pandemic levels of 29.2%/ 26.8%, respectively. This suggests a maturing growth rate as well.

Therefore, we are certain that META may continue optimizing its operational costs through AI tools while improving its ROI over the next few years, while similarly restructuring its operations as highlighted by Mark Zuckerberg, CEO of META:

Given this outlook, we’ll need to operate more efficiently than our previous headcount reduction to ensure success… So we put together a financial plan that enables us to invest heavily in the future while also delivering sustainable results as long as we run every team more efficiently. The changes we’re making will enable us to meet this financial plan.

So, Is META Stock A Buy, Sell, or Hold?

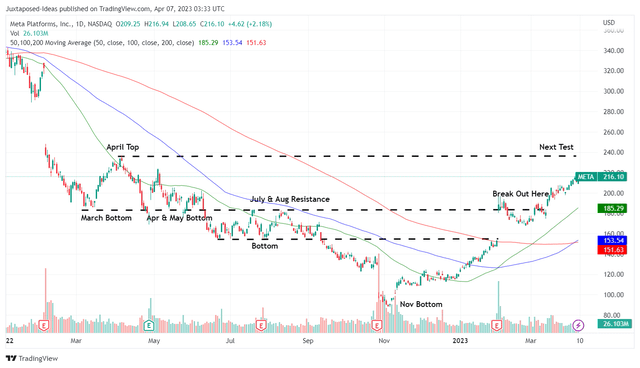

META 1Y Stock Price

For now, META has already recorded an impressive rally of 143.7% from its November 2022 bottom to $214.72, breaking through its previous July and August resistance levels. Assuming that the optimism is sustained, we reckon the next test may be at its previous April 2022 top of $225.

However, we prefer rating the META stock as a Hold here, due to the potential volatility in the short term. The recovery has also caused the stock to trade way above its 50-day moving averages, suggesting a reduced upside potential to its next resistance level. Do not chase this rally.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, META, AMZN, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.