Summary:

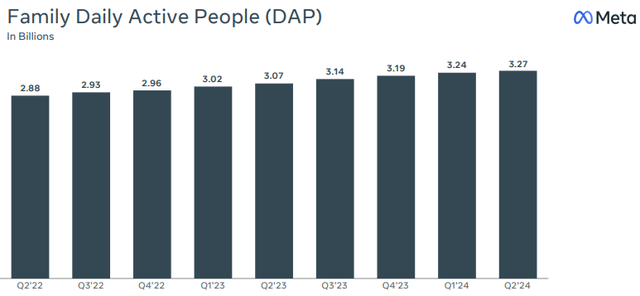

- DAPs continue to increase, reaching 3.27 billion, while the new social app Threads aims to attract more users and engagement.

- Meta’s Q2 2024 results were positive, with the FoA segment generating high revenues and profitability, driven by AI integration.

- Reality Labs segment showed losses, but demand for Ray-Ban Meta Glasses is high, hinting at future growth potential.

COM & O

In my last article on Meta (NASDAQ:META), I expressed all my optimism toward this company and described it as the tech company with the greatest potential. Having billions of users and one of the best AI around are a winning combination in the long run. In addition, people often tend to underestimate WhatsApp’s potential, which is why I wrote another dedicated article about it.

The results released yesterday regarding Q2 2024 were very positive and are giving new confirmation to my long-term bullish thesis. The price per share has returned well above $500 and for this reason, I no longer consider Meta as a buy but as a hold. As stated two months ago, I believe the fair value of this company stands at $475 per share.

However, I strongly believe in its long-term potential, and since the valuation multiples are still reasonable, I do not find it so wrong to buy it even at the current price. Personally, I have already bought a lot in the past, and I simply prefer to maintain my position rather than increase it.

Highlights Q2 2024

The results for Q2 2024 were quite positive, particularly in the core business focused on Family of Apps (FoA). On the other hand, Reality Labs did not show exciting growth, but we expected it.

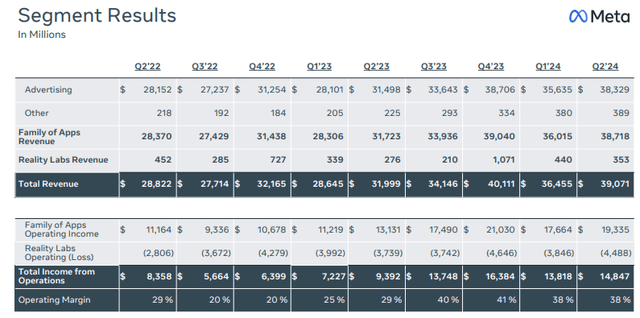

FoA generated revenues of $38.71 billion, up 22% from the same quarter last year and 7.50% from the previous quarter. In any case, the most positive news concerns the increase in profitability of the core business. This quarter, FoA’s operating income was $19.33 billion, up 47% from the same quarter last year. Basically, we are talking about an operating margin of 50%.

This improvement was possible due to the large investments related to the integration of AI into the FoA segment:

AI is also going to significantly evolve our services for advertisers in some exciting ways. It used to be that advertisers came to us with a specific audience they wanted to reach, like a certain age group, geography, or interests. Eventually, we got to the point where our ad systems could better predict who would be interested than the advertisers could themselves. But today, advertisers still need to develop creative themselves. And in the coming years, AI will be able to generate creative for advertisers as well. And we’ll also be able to personalize it as people see it.

CEO Mark Zuckerberg, conference call Q2 2024.

In a nutshell, Meta’s ads are increasingly targeting since AI can figure out what we need; in the future it may figure it out even before we do. So, when a company pays to advertise its product, it will have a greater return on investment since its product will be shown primarily to those who may actually be interested in buying it. Obviously, the more efficient the advertising service is, the higher the cost advertisers have to pay.

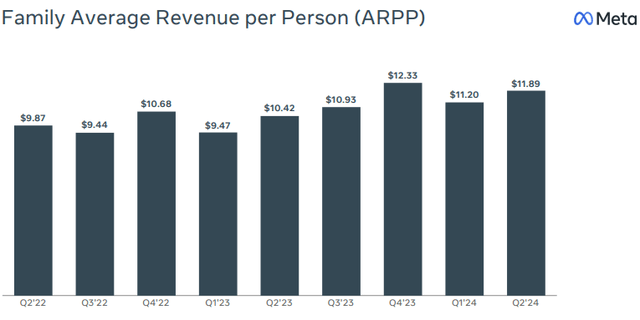

In fact, the ARPP reached $11.89, up $1.47 from Q2 2023. The AI trend will most likely drive this figure higher in the coming years as ads are increasingly more efficient.

To help the millions of creators who use Meta’s apps, starting this week, the AI Studio will be available, a key piece to support the company’s long-term vision. As you probably already know, Meta does not want to create a closed system, but it does want to make its AI innovations available to everyone so that they can spread their use widely. With the AI Studio, creators will be able to create their own AI agents, with which they can perform a variety of tasks automatically. For example, talking to members of their community, answering questions and creating new content.

The AI Studio will be the basis for a new type of interaction needed, especially for many companies that are large and cannot meet the demands of all its customers in a short time. Through an AI agent, it will be possible to solve some consumer doubts and problems immediately, and this will be a turning point:

Anyone is going to be able to build their own AIs based on their interests or different topics that they are going to be able to engage with or share with their friends. Business AIs are the other big piece here. We’re still in Alpha testing with more and more businesses. The feedback we’re getting is positive so far. Over time, I think that just like every business has a website, a social media presence, and an email address, in the future I think that every business is also going to have an AI agent that their customers can interact with. And our goal is to make it easy for every small business, eventually every business, to pull all of their content and catalog into an AI agent that drives sales and saves them money.

CEO Mark Zuckerberg, conference call Q2 2024.

Some of you might think that there are already some companies with chatbots that can respond automatically, but what Mark Zuckerberg is thinking about is on a totally different level. Keep in mind that underlying these innovations will be the Llama family of basic models, one of the most innovative in the world, on which Meta is investing billions to improve it further. When you talk to an AI agent, you will probably not even realize that it is not a real person.

This kind of innovation is closely related to business messaging revenue. Once implemented on a large scale, it can trigger strong revenue growth and definitely unlock WhatsApp’s potential. In the last quarterly report we already got a taste of this potential in fact, FoA other revenue was $389 million, up 73% from last year due mainly to improved WhatsApp Business messaging revenue. Among other things, it seems that WhatsApp adoption is finally spreading like wildfire in the U.S., where total users exceeded 100 million for the first time. In the rest of the world, WhatsApp has already been an essential everyday app for several years.

Returning to the Reality Labs segment, its losses (-$4.48 billion) brought the operating margin down to 38%, but it is still a great result. From this point of view, we expected that this segment was not yet ready to register major growth, although Quest 3 sales were higher than usual.

At the same time, Ray-Ban Meta Glasses are getting popular; demand has far exceeded supply, and the companies (Meta and EssilorLuxottica) are already working on second-generation glasses. This new market is attracting more and more people, which is why there has been talk of a larger-scale collaboration in recent weeks. Meta seems intent on buying 5% of EssilorLuxottica (OTCPK:ESLOF), but management has stated that there will be no dedicated capital increase for Meta. So, if the Menlo Park giant is going to increase its influence over the French-Italian company, it will have to buy the 5% directly on the market, which amounts to a not insignificant investment, about $5.20 billion. We will see in the coming months how the situation develops; personally, I would be happy if this investment goes through since Meta is currently unable to create enough Ray-Ban Meta Glasses; it could also spur “smart glasses” collaboration with other EssilorLuxottica brands.

Overall, the outstanding results of the FoA segment offset the losses of Reality Labs once again. The former is the present and the future of the company, the latter mainly represents the future since it will not be profitable in the short to medium term. Generative AI will not be the main driver of revenue growth in 2024 and most likely not even in the next few years. At the moment, just as it has been for social networks in the past, it is crucial that consumers get used to using Meta’s AI innovations, and only then Meta will work on how to make them profitable.

From this point of view, Meta’s strategy differs from that of some of its competitors in the challenge of who will better exploit the potential of AI:

The reason why open sourcing this is so valuable for us is that we want to make sure that we have the leading infrastructure to power the consumer and business experiences that we are building. But the infrastructure, it’s not just a piece of software that we can build in isolation. It really is an ecosystem with a lot of different capabilities that other developers and people are adding to the mix, whether that’s new tools to distill the models into the size that you want for a custom model, or ways to fine-tune things better or make inference more efficient or all different other kinds of methods that we haven’t even thought of yet, the silicon optimizations that the silicon companies are doing, all the stuff. It is an ecosystem. So we can’t do all that ourselves.

CEO Mark Zuckerberg, conference call Q2 2024.

Finally, let’s take a look at the Daily Active People.

For the umpteenth quarter, DAPs continue to increase and have reached 3.27 billion. I still remember when a few years ago some people considered Meta as a dead company and Facebook as a social media company in steep decline: the data has disproven these claims again.

Frankly, I don’t know how much more DAPs can increase because of a demographic issue; after all, there are 8 billion of us in the world and almost half use one of Meta’s apps (consider that in China they are banned). In North America and Europe there is not much room for growth, but in the rest of the world and India especially, the market is not yet saturated.

In addition, the new social Threads is on its way to becoming another major social app. Monthly active users have exceeded 200 million and engagement is improving dramatically. The goal is to bring users above 1 billion; it will not be easy, but it is certainly a possible target for a company like Meta. Some posts on Threads are often sponsored on Instagram and Facebook, and this will attract new users to the platform.

Conclusion

Overall, this quarterly report was quite positive, as it gave new confirmation to investors about the effectiveness of the investments made by the company in previous quarters.

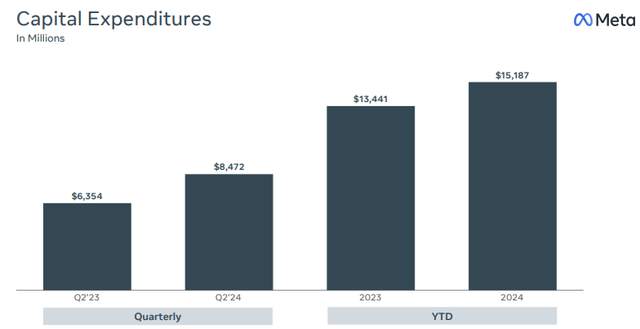

CapEx has increased and will continue to do so in 2025, but I am confident that this capital allocation will further fuel revenue growth; so far it has and management is lucid about how to continue to capitalize on the AI trend. Although the Reality Labs segment is still at a net loss, I am pleased with the strong demand for Ray-Ban Meta Glasses and the Meta Quest 3; moreover, I am hopeful about the billions spent to improve Llama to sustain the very long-term growth of this company.

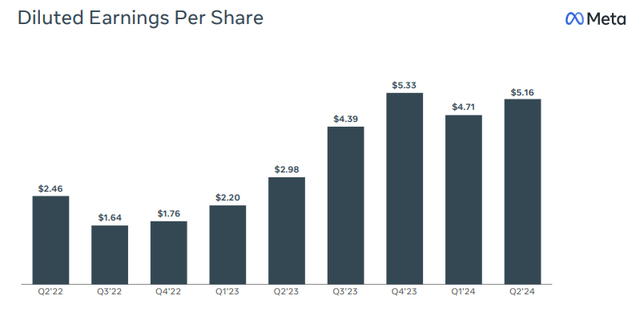

The FoA segment is terrific and has brought EPS to $5.16, up a whopping 73% from last year. Think of how much they will increase once Reality Labs is profitable. Supporting EPS was a strong buyback of $6.32 billion in Q2 2024; in addition, dividend payments reached $1.27 billion.

The only downside to this quarterly was that the market was thrilled and the price per share jumped above $500. I was ready to increase my position around $400 per share, but I guess I will have to wait.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.