Summary:

- Meta Platforms is currently focusing on monetizing engagement, as revenue per ad impression has increased over the past quarters.

- Successful AI monetization from the previous capex cycle in FY2021 has significantly boosted advertising revenue and margins.

- META is entering another capex cycle to strengthen its AI innovation in FY2024, forecasting a 40.5% YoY growth in capex and a 380-bps YoY increase in capex % of revenue.

- Despite significant capex increases, Meta’s FCF profile is expected to remain resilient, supported by significant growth in OCF.

- The stock is currently trading at 26.9x non-GAAP forward P/E and 1.47x non-GAAP forward PEG, making it the second cheapest stock in the “Magnificent 7” after Google.

Galeanu Mihai

Investment Thesis

Despite rallying 56% YTD, Meta Platforms (NASDAQ:META) remains relatively cheap among the “Magnificent 7” group. The company has heavily invested in Generative AI, resulting in successful AI monetization that has significantly boosted advertising revenue and margins. In my previous article from July 2023, I maintained a buy rating on the stock, due to its attractive valuation and substantial improvement in its FCF profile. Since then, the stock has achieved a 66% return, significantly ahead of the 21% return of the S&P 500.

In 1Q FY2024, Meta achieved a 75% YoY growth in FCF, following over 100% YoY growth in the previous three quarters. Currently trading at 26.9x non-GAAP forward P/E, I believe META still has plenty of room to expand its valuation multiple. Therefore, I reiterate a buy rating on the stock, as another capex cycle in FY2024 is expected to further accelerate its growth trajectory.

AI Features Significantly Boost Advertising Revenue

The company model

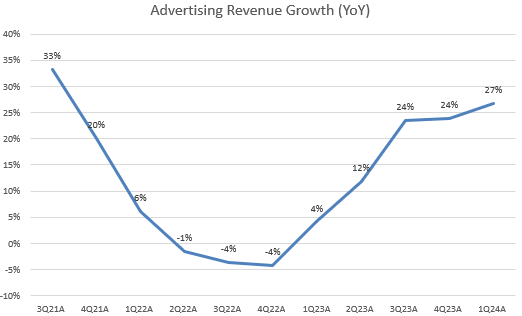

Although META’s light revenue guidance in 2Q might have disappointed some investors, the company’s advertising revenue experienced a strong growth rebound over the past year. This growth trajectory is not only due to increased AI investments driving total ad impressions but also strong AI monetization across its family of apps. For example, Threads now reached over 175 million monthly users and has started focusing on ads monetization. In addition, the company updated a new version of Meta AI that is powered by the latest model, Llama 3, which helps users explore topics they’re interested in more effectively.

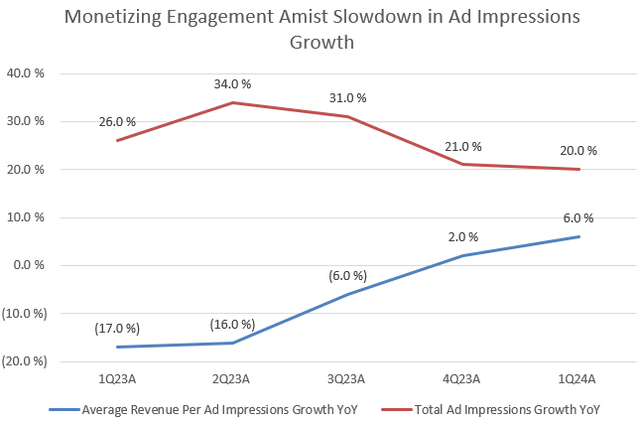

According to the 1Q FY2024 Press Release, total ad impressions grew by 20% YoY, while advertising revenue increased by 27% YoY, indicating that the average price per ad impression has risen, driven by AI monetization. The company reported that this growth rate was 6% YoY. I have created a chart below to demonstrate this trend.

As we can see from the chart, the growth rate in average revenue per ad impression turned positive in 4Q FY2023 and continued accelerating in 1Q FY2024. The management, in the 1Q FY2024 earnings call, highlighted two major factors that drive the revenue growth: delivering engaging experiences and effectively monetizing that engagement. With total ad impressions growth decelerating to 20% YoY in 1Q FY2024 from 26% in 1Q FY2023, I think META has shifted its focus towards monetizing engagement. By leveraging AI-driven features across its family of apps, it has significantly boosted monetization efficiency.

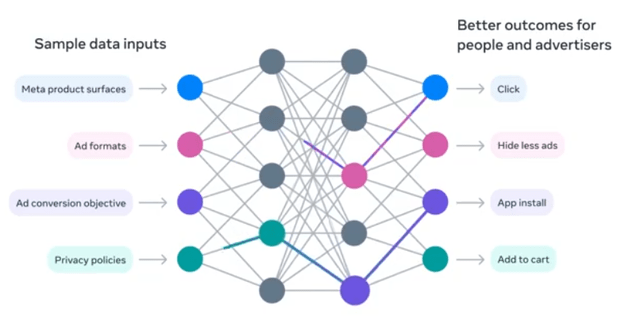

According to the management, improving monetization efficiency is enhancing marketing performance, which is heavily supported by AI models such as using META Lattice. Recently, META released a research paper on Multi-token prediction models, which markedly reduce training times and enhance prediction quality compared to traditional Large Language Models. In other words, META will most likely continue to accelerate its advertising revenue growth using AI.

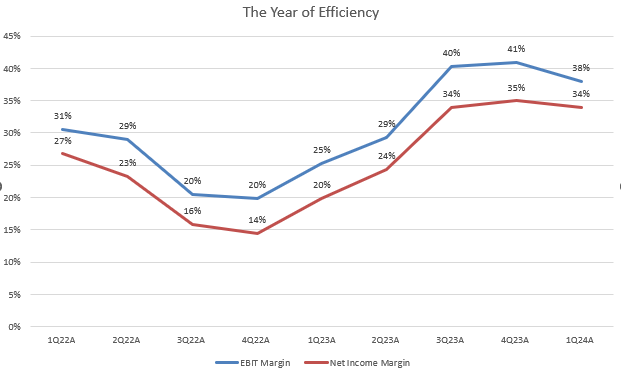

Significant Expansion in Margins

The company model

It’s encouraging to see that META not only has achieved a strong growth in its advertising revenue, but also has significantly improved its operating efficiency. As I mentioned in my last analysis of the 2Q FY2023 earnings results, Meta’s “Year of Efficiency” has demonstrated tremendous success, with cost reduction resulting in a positive trend of margin expansion. This was largely driven by a significant cut in marketing and sales expense, showing 5 quarters of YoY decline since 1Q FY2023. Lastly, its Reality Labs segment continues to operate with a significant loss and shows no indication of improving margins in the near future.

Elevated Capex with Improvement in FCF

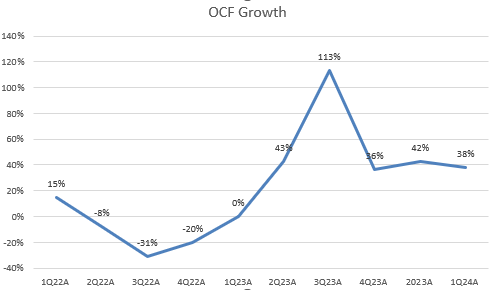

Back in FY2022, META increased its capex by 68% YoY to build up AI infrastructure amidst the GenAI boom. This significant investment impacted its FCF, which declined by 50% YoY. Consequently, the stock plummeted nearly 73%, dropping from $331 to $91 in less than 11 months. However, a strong ROI subsequently boosted the company’s fundamentals, as reflected in the FY2023 earnings results.

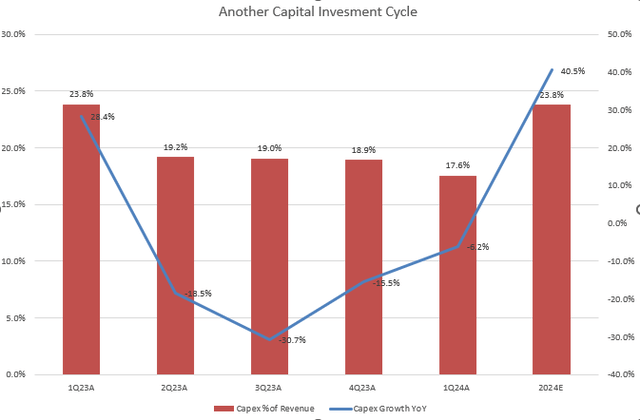

Now, META is entering another capex cycle to strengthen its AI research and development. As shown in the chart, after a decline in capex growth over the past four quarters, the company raised its capex outlook during the recent earnings call. META now anticipates FY2024 capex to be in the range of $35 billion to $40 billion, up from the prior range of $30 billion to $37 billion. This implies a 40.5% YoY growth and a 380-bps YoY increase in “capex as percentage of revenue” in FY2024.

The company model

However, I do not see this capex cycle creating a significant headwind in the FCF profile as we saw in the previous cycle, due to strong growth in OCF as shown in the chart above. Therefore, despite an anticipated 40% YoY increase in capex, I believe META’s FCF margin in FY2024 will be significantly higher than the FY2022 level.

Based on META’s previous strong ROI track record, I believe that these AI investments will generate substantial returns in FY2025. Improvements in both engagement and ad performance should translate into revenue and earnings growth, which can further boost its valuation multiple, especially given its relatively cheap level among the “Magnificent 7” group.

Valuation

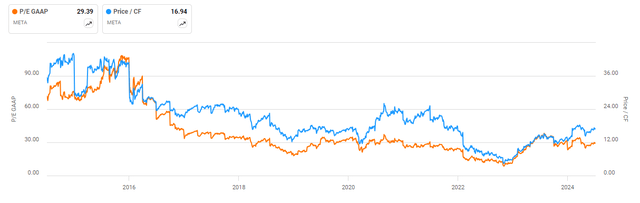

Let’s look at META’s valuation, since it’s clear that the stock’s current multiples are not lofty despite a significant rally in price this year. The company is currently trading at 29.3x GAAP P/E, which is higher than the 5-year average but still below the 10-year average. If we factor in its non-GAAP EPS consensus for the forward 12 months, the multiple will come down to 26.9x, which is 8.8% below the Nasdaq 100 index’s forward P/E. According to Seeking Alpha, META’s non-GAAP PEG forward is only 1.47x, which is even 2.9% below its 5-year average. This indicates that the market may have underappreciated META’s earnings growth potential regarding its long-term GenAI growth story. Meanwhile, its forward P/OCF is currently at 17x, which is considered attractive, as META has significantly improved its OCF growth over the past quarters. Therefore, I believe the stock still has significant upside potential, as META currently ranks as the second least expensive stock after Google (GOOGL) among the “Magnificent 7” group based on non-GAAP P/E fwd metrics.

Conclusion

In conclusion, META’s heavy investment in GenAI during the previous cycle has not only improved its ad engagement but also successfully monetized that engagement, thereby boosting advertising revenue and margins. Despite another round of capex increases throughout FY2024, the company’s FCF profile is anticipated to remain resilient, supported by strong growth in OCF. Despite a strong rally this year, the stock continues to trade at a relative cheap valuation compared to other peers. With attractive non-GAAP PEG fwd and P/OCF fwd multiple indicating potential for further expansion, I reiterate a buy rating on the stock. I believe META is well positioned to navigate through the next phase of capex and further accelerate growth.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.