Summary:

- Meta has entered into correction territory after it announced a higher expense outlook for FY24 alongside its Q1 earnings.

- Meta’s increased spending and boosted capex forecast are necessary for its growth in AI and metaverse platforms.

- At the high end of its ranges, Meta has guided to 12% opex growth, which pales in comparison to its most recent quarter in which revenue grew at 27% y/y.

- Ad impressions served are growing across all regions, and average pricing per ad is also increasing globally.

- The company trades at a very reasonable 21x FY25 P/E.

grinvalds/iStock via Getty Images

Q1 earnings season is now winding down, and for the most part, it’s been a disappointing quarter as investors have found few reasons to keep chasing all-time market highs. A number of tech powerhouses, in particular, have seen dents in their year-to-date rallies, though the tech mega-caps continue to dominate and outperform virtually all other sectors.

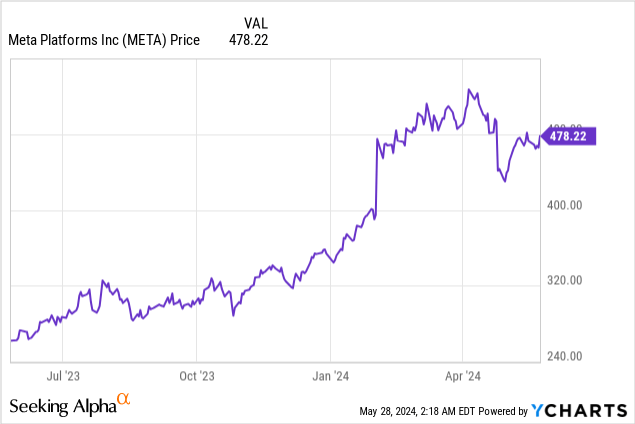

Meta (NASDAQ:META) is one of the stocks that has taken a giant breather post-Q1 earnings. Investors panned the company’s revised outlook, which called for higher operating expenses and spending this year than initially anticipated.

It’s a classic example, of course, of Wall Street’s ever-present short-termism. In spite of the double-digit earnings drop, Meta remains up nearly 40% year to date; still, this dip provides an ample opportunity for investors to buy into the Meta rally if they haven’t yet.

To be blunt: we shouldn’t care about near-term spending

Let’s start with something most investors don’t fully recognize: even though Meta is undoubtedly one of the tech mega caps with a market cap of over $1 trillion, unlike many of its peers, the company is still growing revenue at a 20%+ clip. Meta is still a growth stock: and hence, it makes sense that the company continues to plow more of its resources into added growth.

I last wrote a bullish opinion in early April, when the stock was trading closer to $530 and before the Q1 earnings dip. I remain bullish on Meta and encourage investors to pick up more of this stock on the recent dip.

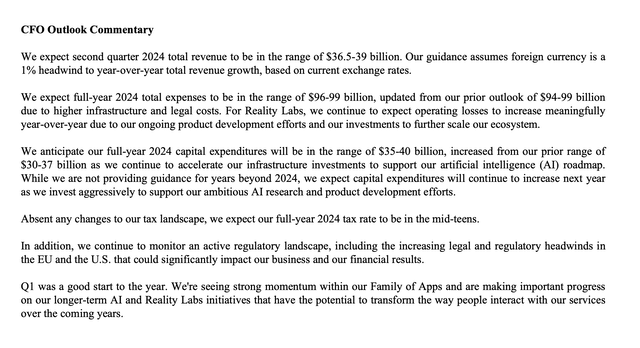

For investors catching up on earnings cycle news, we’ll cover the elephant in the room first. The big cause behind Meta’s drop was its expectations of increased spending for the year. Opex is now set to be $96-$99 billion, which is a $2 billion increase at the low end of the prior range of $94-$99 billion. The low end of that range represents a 9% y/y increase in opex versus $88.2 billion in FY23.

Meta outlook update (Meta Q1 earnings deck)

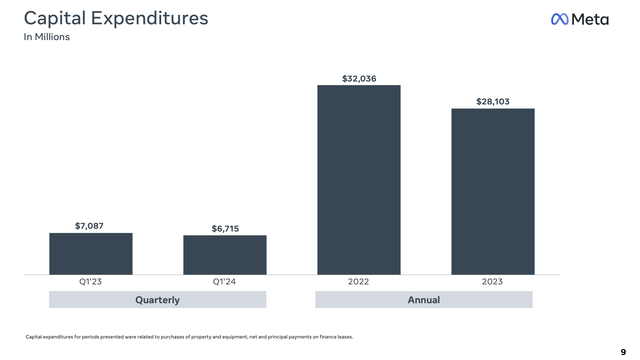

The bigger news, however, was the boosted capex forecast. The company is now expecting $35-$40 billion in Capex, significantly boosted from a prior view of $30-$37 billion. It’s also significantly higher than the ~$30 billion spent on capex on average in the prior two years:

Meta capex history (Meta Q1 earnings deck)

The nutshell here: it’s clear that AI is becoming a bit of an arms race among the major tech players, and Meta is in a play-to-win situation. The company is investing in datacenters and hardware necessary to power its next-gen AI and metaverse platforms (benefiting vendors like Arista Networks (ANET), by the way)

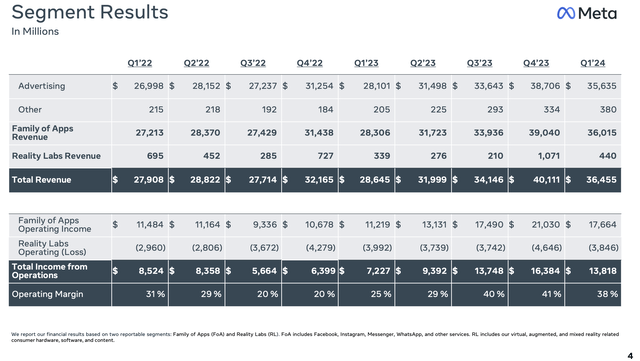

But at the same time: Meta has plenty of resources to invest. Even with boosted spending, Meta is vastly boosting its operating margins. In Q1, its $13.8 billion of operating profit nearly doubled y/y, while operating margins soared from 25% in the year-ago quarter to 38% in the most recent Q1. On a “Rule of 40” basis, Meta is in a stratosphere of its own, with a Q1 “Rule of 40” score of 65% (27% revenue growth plus 38% operating margins).

Meta operating margin results (Meta Q1 earnings deck)

And speaking of revenue growth: when Meta’s revenue growth pace is nearing 30% y/y, I’d argue that the ~9-12% expected growth in opex is actually quite restrained.

We note as well that over the trailing twelve months, Meta has generated $48.6 billion in free cash flow – more than enough consistent liquidity generation to power an extra ~$5 billion in capex spend (the rough increase at the midpoint of the company’s previous to current Capex range). It’s also still more than enough to cover Meta’s ~$0.50/quarter dividend which it initiated in Q4; with ~2.6 billion shares outstanding, this program “only” costs Meta ~$5.2 billion on an annualized basis, or roughly 10% of its free cash flow.

The bottom line here: when we put Meta’s planned spending increases in the context of its revenue growth and already-present operating margin expansion, we find there’s little to be concerned about. Stay long here and buy the dip.

Ad impressions growth continues to power revenue acceleration

We absolutely need to counterbalance the fact that Meta’s news of boosted spending also comes on top of a Q1 earnings cycle in which revenue growth accelerated two points sequentially to 27% y/y, from 25% growth in Q4 – a rare feat for a company of Meta’s scale.

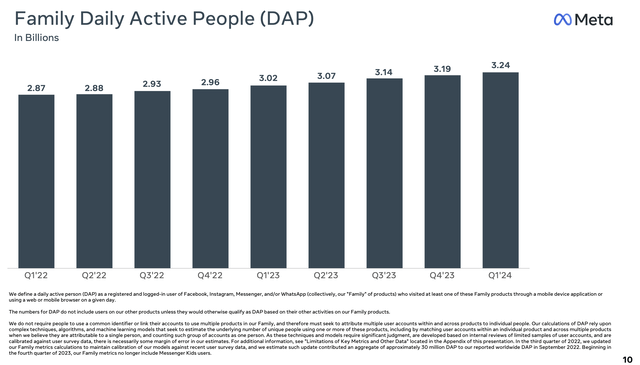

The company continues to grow its daily active people across the globe, up by another 50 million in Q1 to 3.24 billion.

Meta DAPs (Meta Q1 earnings deck)

One note here: though Meta continues to report total company DAPs, the company stopped reporting daily active user counts for Facebook, which I relied on as a barometer for the company’s user growth in the U.S. and Canada (the highest ARPU region). This seems to be an ongoing trend in the tech sector, especially after Netflix (NFLX) stopped reporting subscriber counts.

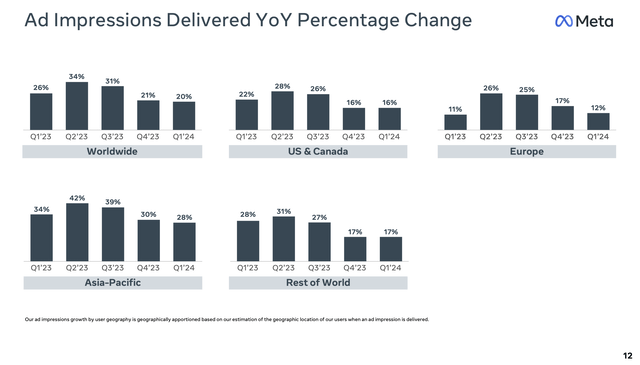

Yet we still are getting information on ad impressions delivered by region. And as shown in the chart below, ad impressions in the U.S. and Canada saw consistent 16% y/y growth (in line with Q4), while Europe and Asia softened somewhat:

Meta ad impressions (Meta Q1 earnings deck)

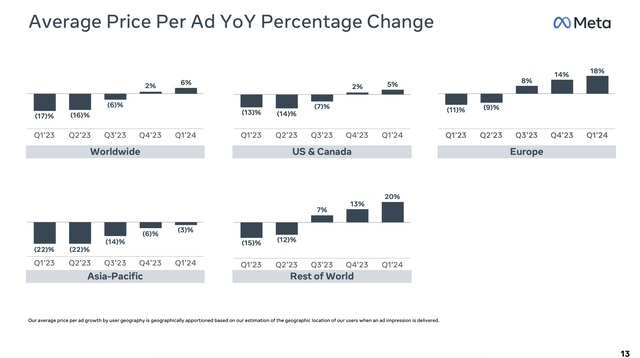

Impressively, however, average prices per ad accelerated to 6% y/y growth in Q1, versus 2% y/y growth in Q4, driven by acceleration across all regions. We in particular note the 20% y/y growth in average price per ad in the “Rest of World” segment, which has long lagged the U.S. and Europe in terms of ARPUs.

Meta average prices per ad (Meta Q1 earnings deck)

We note that AI (the big thing that Meta is investing Capex into!) is a big driver behind boosted user engagement (driving higher ad impressions and average prices) in English-speaking countries, where the company has launched its “Llama” AI virtual assistant (AI-assisted search is now seamlessly integrated into the company’s core applications, including Facebook and Instagram). Per CEO Mark Zuckerberg’s remarks on the Q1 earnings call:

The initial rollout of Meta AI is going well. Tens of millions of people have already tried it. The feedback is very positive and when I first checked in with our teams, the majority of feedback we were getting was people asking us to release Meta AI for them wherever they are.

So we’ve started launching Meta AI in some English speaking countries and we’ll roll out in more languages and countries over the coming months. You all know our product development playbook by this point.

We release an early version of a product to a limited audience to gather feedback and start improving it. And then once we think it’s ready, then we make it available to more people. That early release was last fall and with this release, we are now moving to that next growth phase of our playbook.

We believe that Meta AI with Llama 3 is now the most intelligent AI assistant that you can freely use and now that we have the superior quality product, we are making it easier for lots of people to use it within WhatsApp, Messenger, Instagram and Facebook.”

The release of languages other than English may be a catalyst to further ad impressions/ad pricing growth in international markets once launched.

Valuation and key takeaways

I continue to anchor on Meta’s very reasonable P/E and PEG valuations in light of its fantastic earnings/revenue growth. For FY25, Wall Street analysts are expecting Meta to generate $179.1 billion in revenue (+13% y/y) and $23.08 in pro forma EPS (which is 14% earnings growth versus this year’s $20.18 in pro forma EPS expectations, in turn up 36% y/y versus FY23).

At current share prices near $480, the stock trades at 21x FY25 P/E; when applying current-year EPS growth of 36% y/y as the denominator, Meta’s PEG ratio is just 0.6x (where an indicator below 1x is typically considered cheap). We note as well that Meta carries $58 billion of cash and $40 billion of net cash (stripping out $18 billion of debt) which represents ~3% of its market cap on a net cash basis; so from an “ex-cash” standpoint, Meta’s P/E and PEG ratios are also 3% lower.

None of this is to say Meta is without risks. The company is certainly making long-term bets across AI, AR/VR, and the so-called metaverse. Needless to say, a number of these bets may not play out (as has been amply demonstrated by the company’s Reality Labs segment, where performance of the Oculus VR headset has been underwhelming); and in addition, the fact that Meta generates all of its revenue from social media advertising puts it at risk of being upstaged by newer entrants (as upstarts like TikTok have amply demonstrated).

This being said, I continue to view Meta as having far more long-term opportunities than risks, and the opportunity to buy the stock at a ~21x P/E ratio against next year’s earnings is appealing. Stay long here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.