Summary:

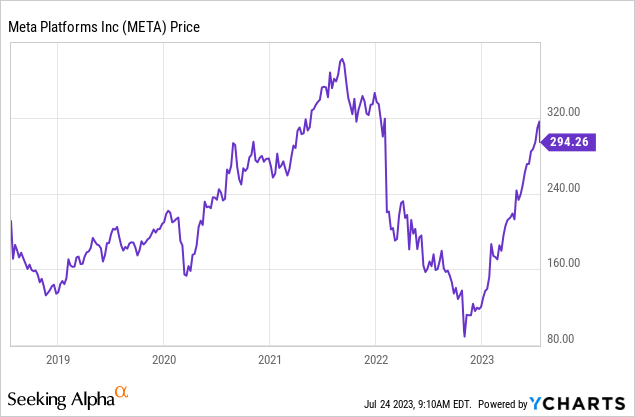

- Meta has seen its stock price increase by 136% in 2023, despite a crisis that saw its share price drop by over 75% from its 2021 high.

- The company’s stock has been highly volatile over the past five years, with periods of huge rallies and steep declines, despite reasonably consistent revenue growth and positive net income.

- Meta currently trades at around 30 times earnings after a huge run-up in the past few months.

- I suggest a fair value estimate of 17 to 20 times earnings, as current valuations seem to require unrealistic assumptions about the company’s future growth.

- Meta near $300 is a close call between a hold on momentum and a sell. This week’s earnings will provide more clues for valuing the company.

Luis Alvarez

Meta Stock: No Brakes

Perhaps no stock better sums up 2023’s market than Meta (NASDAQ:META), the company formerly known as Facebook. As of my writing this, Meta is up by an astonishing 136% for the year and over triple the price it traded for at the November lows. This happened after the company weathered a crisis that sent its share price tumbling over 75% from its 2021 high. This begs the question – was Meta too cheap in November 2022, too expensive in 2021, or both? And with Meta set to report earnings after the bell on Wednesday, July 26, should investors cash in, stay put, or buy more?

Meta stock had two modes over the past five years – the stock is almost always either crashing or soaring. This is actually somewhat of a new development for the company after the highly-publicized IPO debacle the company grew steadily and delivered great shareholder returns until mid-2018. Then the rollercoaster started, with the 2018 bear market, COVID, bulls firmly taking charge in 2021, and a mass panic in 2022 on fears that Mark Zuckerberg would drive the company into the ground. Zuckerberg pivoted quickly and quietly, and Meta’s status as a moneymaking machine was soon restored. Of course, the world is waiting with bated breath for whether Zuckerberg and Elon Musk will actually fight in the Octagon. I’d love to see it, but I’d imagine their respective boards of directors and lawyers aren’t as keen.

As a quick reality check, pulling up Meta’s financial statements (read them for yourself) tells a somewhat different story from the stock price chaos that I believe is instructive for investors. Revenue grew every year like clockwork until 2022, and net income is always positive and volatile but mostly growing. Ditto for EPS. Meta’s business is actually decently run, but the stock is a bona fide roulette wheel.

What Should We Consider When Valuing Meta?

For my first decade in the markets, I didn’t have much of a formal framework for how to take advantage of volatility. There are a lot of short-term strategies that you can potentially employ, but the strategy that I believe is most effective is to use volatility to buy assets below their fair value and sell assets that are above their fair value. This might not be super obvious with the S&P 500 (SPY) or the Nasdaq (QQQ) move, but it’s incredibly obvious when stuff like preferred stocks and corporate bonds are trading at big discounts to their contractual value during big market selloffs.

For single stocks, I think investors are best off employing a similar strategy, which is to buy/sell stocks when changes in their stock price (panic/euphoria) don’t reflect changes in the underlying business. Generally, on big moves in short periods of time, the market is going to tend to overreact.

- Companies that show a lot of variability in earnings don’t deserve as high of a multiple as companies that are more stable. The fact that Meta’s earnings peaked at about $14 in 2021 and are at $8.08 for the TTM means you may want to avoid paying up too much for the stock. This same fact, however, meant Meta was a screaming deal for ~10x earnings in November.

- Now Meta is trading for ~30x earnings. There hasn’t been a huge change in the company’s actual earnings at this point, analysts expect about $2.91 for the quarter. This compares with $2.47 in the same quarter in 2022 but $3.67 in 2021. Analysts expect continued big earnings growth back to what the company was earning in 2021, but will that actually happen? So far, the company is driving income gains by cutting costs, but the investor fear here is that PPP money and stimulus in 2021 drove a once-in-a-lifetime ad-spending boom, so those earnings will be hard to match for quite some time.

- For the company to continue trading at ~30x earnings, there needs to be a lot of consistent, sustained growth in the future. But this idea of consistency has already been busted. Getting back to peak 2021 earnings will likely be an uphill battle for big tech at large, and the situation is worse for Meta than some others because the ad market is more correlated with the broader economy than say, cloud computing. Over the past year, Meta has gone from panic to euphoria, and it seems likely that the euphoria has overshot.

2023 Fair Value Estimates For Meta Stock

Figuring earnings of roughly $11 and given the factors discussed prior, I’d be inclined to value Meta somewhere from 17x ($187) to 20x earnings ($220), which is a lot higher than it traded last fall but a lot lower than it trades for now. This is giving Meta credit for higher earnings after shifting away from pumping billions into the Metaverse debacle. Valuing the stock higher than the present valuation requires some mental gymnastics in your assumptions such as:

- Threads taking all of Twitter’s business. Twitter doesn’t have that much business to take anyway, and Meta’s launch of threads was helped by an incredibly slick signup funnel that generated tons of signups but isn’t likely to lead to a ton of actual users. Remember when Facebook launched Instagram stories? It’s a good product, but it didn’t exactly crush Snapchat (SNAP).

- AI hegemony. The market is seemingly pricing every AI-adjacent stock as if they’ll have a monopoly when in actuality they’re all competing with each other. We see some analysts predicting large earnings gains already from AI for Meta, and it will be interesting to see whether this comes to fruition. Other analysts have questioned how companies intend to foot the bill for AI-server costs, given that the products are largely being given away for free so far and will likely be bundled in the future.

- The startup-driven spend-whatever ad market in 2021 being secular rather than cyclical. I don’t see this either.

Although caution is warranted, I’m curious to follow this week’s earnings and conference call for clues about where the company is looking to drive growth going forward.

Bottom Line

As a general rule, when a stock triples in less than a year it’s going to be an overreaction. There are some exceptions to this with companies near bankruptcy, but if we think of stock moves as signal + noise, then the largest moves in the shortest periods of time are likely to contain more noise. For example, if you had the foresight to go all-in on Microsoft (MSFT) at its 1986 IPO, you’d have earned about 26% per year. That’s good enough to make you filthy rich if you’d held, but a lot less than 100% every six months. Meta tripling here feels overdone, and while the stock has some momentum, it’s a close call between holding until the momentum breaks or selling now and cashing in. That’s my opinion, but feel free to share yours in the comments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.