Summary:

- Meta’s stock has surged 88% over the past year, outperforming the broader U.S. market, with a 63% YTD rally in 2024.

- Despite high profitability and revenue growth, Meta’s current valuation ratios are higher than historical averages, indicating potential overvaluation.

- Meta’s market cap aligns closely with its fair value, suggesting limited upside potential and a slight premium over fair value.

- The stock currently appears significantly overbought, which justifies my cautious stance despite its strong secular fundamentals.

kenneth-cheung

Investment thesis

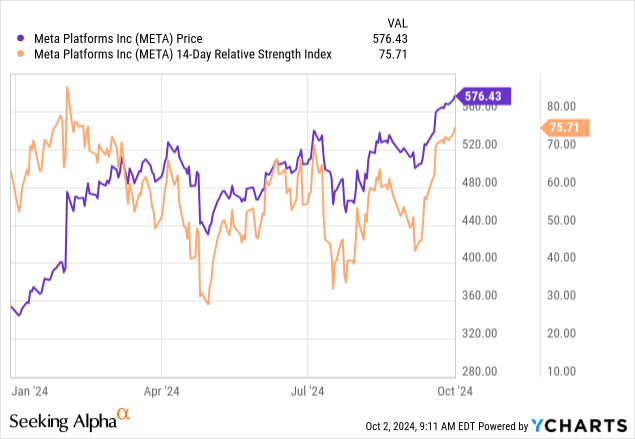

My previous rating downgrade to “Hold” for Meta (NASDAQ:META) did not age well as the stock grew by around 15% since early July, notably outperforming the broader U.S. stock market.

Meta’s fundamentals remain rock-solid, and that is the reason why the stock is one of my largest holdings. Meta’s financial performance is improving and its image as a company that is one of the biggest AI champions is becoming stronger. The company is poised to continue rolling out new profitable offerings and features, but my valuation analysis suggests that all these positive catalysts are already priced in. Moreover, the RSI indicator suggests that there will likely be a healthy correction soon. All in all, I reiterate a neutral “Hold” rating for META.

Recent developments

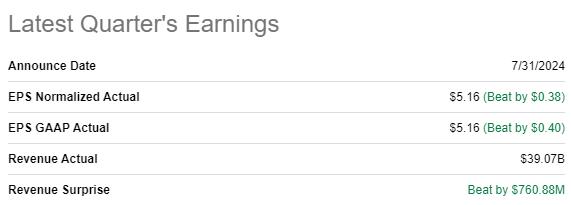

META reported its latest quarterly earnings on July 31 when the company topped revenue and EPS consensus estimates. The top line was up 22.1% YoY. The adjusted EPS grew much faster on a YoY basis, from $2.98 to $5.16.

Seeking Alpha

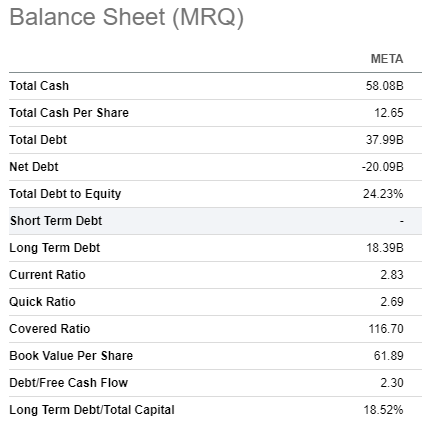

Meta continued exercising operating leverage in Q2. The YoY operating margin improvement was notable, from 29.9% to 38.1% on a YoY basis. On the other hand, there was a slight pullback in operating margin sequentially. Nevertheless, solid operating leverage ensured strong cash flow. The company’s free cash flow [FCF] in Q2 2024 was $6.8 billion, which contributed to the company’s financial position. Meta ended Q2 with a $58 billion cash pile and in a $20 billion net cash position.

Seeking Alpha

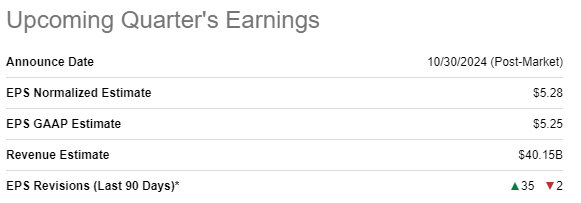

The upcoming quarter’s earnings publication is planned for October 30. According to consensus estimates, Q3 revenue is expected to be up 17.6% on a YoY basis. The adjusted EPS is expected to outpace revenue growth by expanding from $4.39 to $5.28. Analysts’ sentiment around the upcoming earnings release is extremely bullish with 35 upward EPS revisions over the last 90 days.

Seeking Alpha

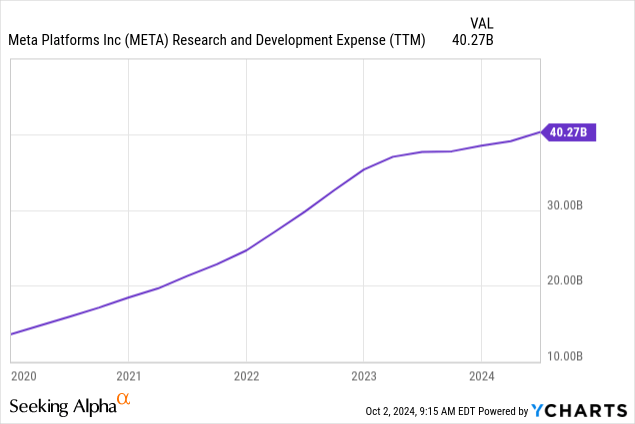

Meta’s healthy balance sheet together with expanding profitability will likely help the company to continue aggressively ramping its R&D spending. According to the below chart, Meta’s R&D spending has more than doubled over the last five years. This means that the company aims to maintain its aggressive revenue growth, which is a sign of fundamental strength.

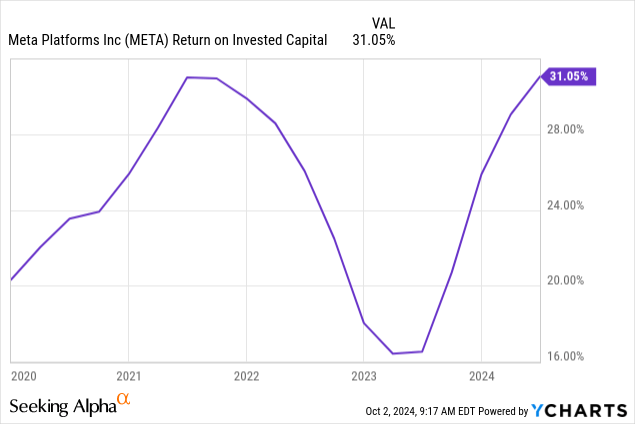

Moreover, Meta’s return on invested capital [ROIC] returned to its stellar above 30% levels after a dip related to aggressive spending on the Metaverse in 2022 and early 2023. Such an exceptional ROIC level suggests that Meta’s new R&D projects and endeavors will highly likely result in releasing new profitable features and offerings.

Moreover, the company succeeds in the hottest industry at the moment, the artificial intelligence [AI]. AI was the central topic of the company’s recent “Connect 2024” event, and investment firm Baird said that the event brought Meta “one step closer” to being an AI company. A crucial release is that Meta’s Llama 3.2 LLM is now available on edge and mobile devices, which significantly expands the offering’s footprint and reach.

Meta remains fundamentally strong, and it is the main reason why the stock remains one of my largest holdings. However, it is likely that the optimism around Meta and its “Magnificent 7” peers has cooled down notably this bunch of superstar stocks trailed the S&P 500 in Q3 which was the first time since Q4 of 2022.

Moreover, the stock appears to be significantly overbought as its RSI indicator is currently close to 76. The above chart suggests that peak RSI levels frequently mean that the share price has also reached its local peak and there is a substantial probability of a correction.

To sum up, I remain extremely bullish from the secular perspective. However, the market’s sentiment around Meta is likely cooling down, and the RSI indicator suggests that the time for a healthy correction may be approaching.

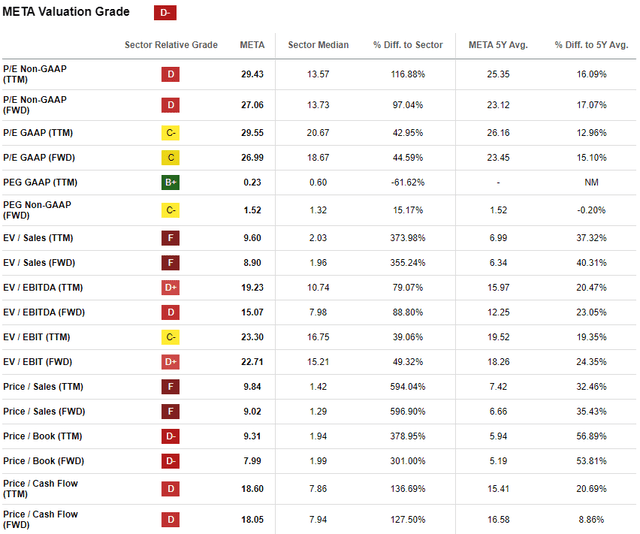

Valuation update

The stock gained 88% over the last twelve months, substantially outperforming the broader U.S. market. The stock’s performance in 2024 is also ahead of the S&P 500 with a 63% YTD rally. Meta’s valuation ratios are inherently high compared to the sector median due to the company’s unparalleled profitability and revenue growth. However, I want to emphasize that Meta’s current valuation ratios are higher than historical averages across the board. This indicates notable overvaluation, in my opinion.

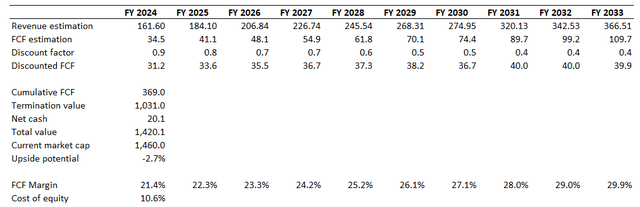

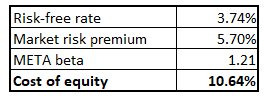

The discount rate is calculated by figuring out Meta’s cost of equity. The classic CAPM approach is implemented in the table below. All variables are easily available on the Internet. Meta’s cost of equity is 10.64%, according to the CAPM formula below.

Author’s calculations

A 9.5% revenue CAGR for the next decade projected by consensus is a conservative assumption for a company like Meta, and I am using it for my DCF. The TTM FCF margin is 21.4%, and I incorporate a 95 basis points yearly expansion. The FCF margin expansion by 0.95 percentage points correlates with a 9.5% revenue CAGR.

Meta’s current market cap is very close to the business’s fair value. This indicates that not much upside potential is left, and the DCF’s outcome aligns with current valuation ratios compared to historical averages. Thus, Meta’s stock looks approximately fairly value with a slight premium over the fair value.

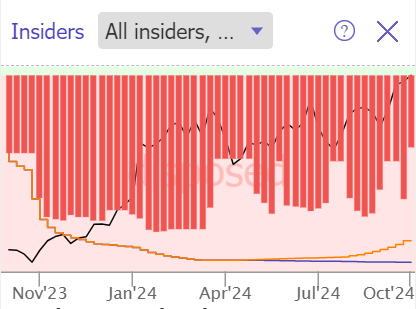

TrendSpider

Another evidence that supports the idea that no upside is left is the above bar chart. It demonstrates that insiders were only selling META over the last twelve months, with no buys. This might indicate that insiders see current share price levels as attractive to sell the stock.

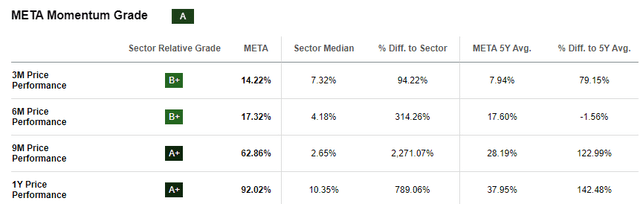

Risks to my cautious thesis

The stock market is a voting machine over the short-term, and my previous cautious thesis did not age well. I preferred not to buy more shares, and there was a notable opportunity cost as I have lost a 15% gain that happened over the last three months. We see below that META’s momentum is quite robust, which is always a high-quality fuel for fundamentally strong companies like Meta.

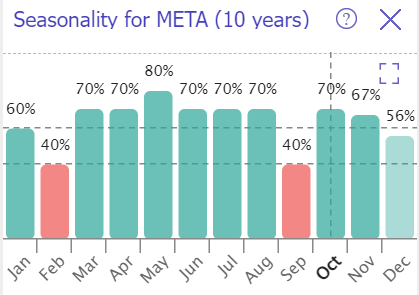

Seasonality trends are also not in line with my cautious thesis. According to the below bar chart, September has been historically the weakest month for META. The Autumn’s first month is over, and seasonality trends for the remained of the year look quite favorable for Meta’s investors.

TrendSpider

Bottom line

To conclude, Meta remains a “Hold”. The valuation is quite generous, and the stock looks overbought, which increases chances of a temporary correction. Meanwhile, Meta remains rock-solid fundamentally.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.