Summary:

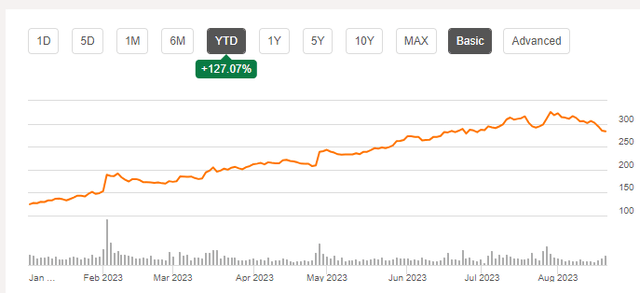

- Meta Platforms, Inc. is the second-best performing stock in the S&P 500 index for 2023 after losing two-thirds of its value in 2022.

- The stock has experienced its longest rally since going public in 2012, but the streak is in danger.

- The recent run-up in Meta’s stock was driven by expense reduction and undervaluation and neither apply to it anymore in my view.

Kira-Yan

At the risk of making a hyperbole, it looks like Meta Platforms, Inc. (NASDAQ:META) stock wants a top 3 finish each year, irrespective of whether that is from the top or bottom-up. After closing 2022 among the worst performing stocks, losing two-thirds of its value, Meta is 2023’s 2nd best performer in the S&P 500 index.

My most recent coverage on Meta Platforms was in May, analyzing the company’s Q1 numbers. I had rated the stock a “Hold” on valuation concerns. Since then, the stock has run up a further 22% against the market’s 6%, despite pulling back from its recent high of $326. However, despite the stock’s recent pullback, I present 5 reasons to be wary of buying here. Let us get into the details.

Longest Rally Since IPO, Profit Taking Inevitable

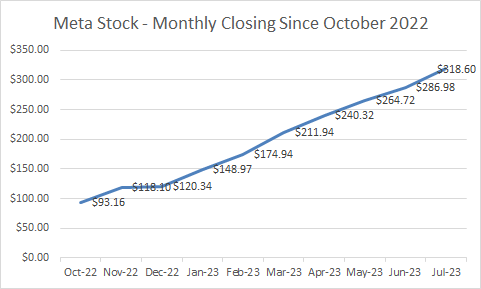

It’s an understatement to say Meta stock has been on a run since bottoming at the end of 2022. It has been on a fast-paced marathon (!) lasting 9 months as the stock has recorded 9 straight monthly gains, which is its longest run since going public in 2012. During this run, the stock went from $88 to $326, nearly quadrupling in the process before the recent pullback to $280 range. It appears like the 9-month streak is finally about to be snapped as the stock is more than 12% away from July 2023’s closing price with less than two trading weeks left in August.

This is significant for momentum stocks like Meta from both psychological and technical perspective, which is covered below. Also, with the run starting in October last year, I expect profit-taking to come into effect more prominently once investors can take advantage of the long-term capital gains tax effect (>1-year holding period).

Meta Monthly Closing Price Since Oct 2022 (Author)

Old Habits Die Hard

When I made a call for the stock’s bottom in November 2022, the biggest reason I pointed out was that I thought the company’s ego was finally in line with reality. Meta had implicitly admitted it over-expanded and over-spent on many categories by announcing a large lay-off.

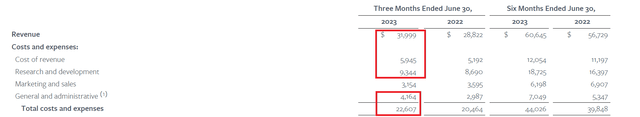

However, both Q1 and Q2 showed a significant jump in expenses YoY. Cost of revenue went up 15% YoY in Q2 and that likely means the direct cost of doing business (primarily employees in this case) has gone up significantly. Research & Development cost went up nearly 8% YoY in Q2 and this too is surprising in what is supposed to be the “year of efficiency”.

Q2 2023 Expenses (investor.fb.com)

With statements like the following, in the Q2 report, I believe Meta has quickly forgotten its “year of efficiency” because the stock has recovered:

“We anticipate our full-year 2023 total expenses will be in the range of $88-91 billion, increased from our prior range of $86-90 billion due to legal-related expenses recorded in the second quarter of 2023.“

“We expect Reality Labs operating losses to increase year-over-year in 2023.“

This increase in costs is now being projected into 2024 as well, as the CFO said:

- Infrastructure cost will be higher.

- Payroll expenses will be higher.

- Reality labs’ losses will increase meaningfully YoY.

Valuation

In addition to the company reigning in on expenses, another primary driver behind the stock’s recent run was its undervaluation. As recently as during my May article, Meta’s stock was trading at a forward multiple of 16, which was 2/3rd’s the then market-multiple of 24. The market’s multiple has since slightly expanded to 25 while Meta’s has expanded all the way to 21.

However, a few things are still in favor of the stock when it comes to valuation:

- Based on 2024’s expected EPS of $16.79, the stock is trading at a 2024 forward multiple of 17. While this looks reasonable, I’d be wary of the increasing expenses and distractions (covered below).

- Based on the average 5-year expected growth rate of 30%/yr, the stock has a Price-Earnings/Growth [PEG] of 0.70, which is quite attractive.

Too Many Threads

I was really nervous when CEO Mark Zuckerberg started touting Threads like it is 2005. But luckily, I didn’t have much to worry about because the signs are already clear that this is not going as planned.

It is beyond me why Zuckerberg would try to make a competitor to Twitter (or X) when the original has been on a well-publicized downward spiral. I don’t know who to bet on should Zuckerberg and Musk get inside a cage/ring, but I think my choice is clear in the business world. I am personally willing to bet that even a distracted Elon Musk running X will be more successful than a fully-focused Zuckerberg on Threads. Why? Because, so far, Musk has shown that when he sets his eyes on something, he’d make an impact. In the same time, Zuckerberg has gone from Metaverse to hopping on the AI bandwagon [good, at least it is the trend] all the way [down] to imitating X.

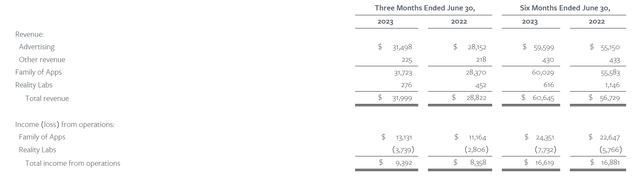

Make no mistake about it, Meta Platforms’ stock rebounded due to strength in advertising, the company’s core business which still represents 98.43% of the company’s overall revenue as shown below. And reality labs are not just “not making profits yet” but is also not bringing in the revenue. Q2 showed a 39% decrease in revenue YoY while H1 2023 has shown a 37% decline YoY.

In short, I believe the company is back to being distracted and is not really sure where to look next for the next growth driver.

Meta Revenue by Segment (investor.fb.com)

Losing Momentum Technically

Finally, mostly as a coincidence, the stock is losing its technical momentum just as the company is showing signs of returning to its bad habits. Meta is a momentum stock as we saw in its 2021 run-up, 2022 beat-down, and again in 2023 run-up. However, in the last month or so, the stock has started cooling off and is down 13% from its recent high.

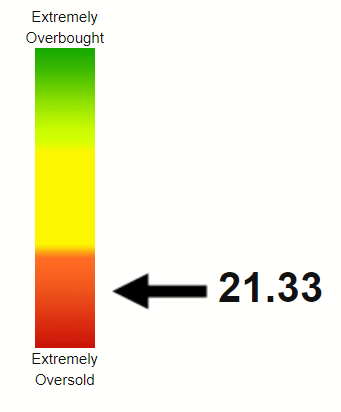

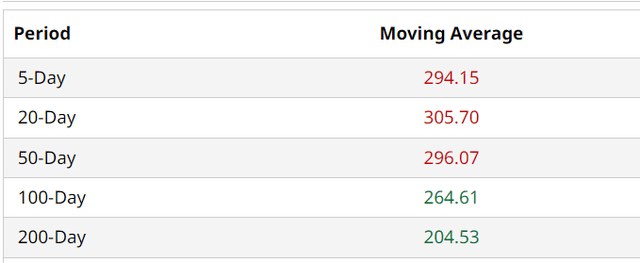

As I explained in an earlier article, the problem with momentum stocks making too many new highs, too quickly is that they leave many technical gaps to be filled out, and a close base can be hard to find if and when the stock slips. Meta’s 100-Day average is another 7% down from here and the all-important 200-Day moving average is nearly 30% away. This makes me believe the stock will find it a little hard to find a solid footing until the mid-to-low $200s in case the market sours further.

META RSI (stockrsi.com) Meta Moving Avgs (Barchart.com)

Conclusion

A near 130% run YTD has certainly taken the gloss off the undervaluation story. What I believe are distracted and confusing messages the company sends out to the market are also not encouraging. I rate the stock a “Hold” and believe its advertising clout is significant enough to carry it for the next few years, if not a decade. However, I’d be paying close attention to the company’s distractions and expenses so that this does not become a case of “robbing Peter to pay Paul” where the advertising recovery is just wasted on projects that are not vetted out properly. I believe Zuckerberg showed promising signs of maturity before the stock’s recovery and I hope the stock’s recovery does not lure him into running projects as he pleases going forward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.