Summary:

- Meta Platforms experienced a significant rise in revenue, profits, and cash flows in the 2023 fiscal year.

- The company’s growth was driven by an increase in daily active users and average revenue per user.

- Despite the impressive performance, the stock is approaching fair value, and a downgrade may be justified if it continues to rise.

JOSH EDELSON/AFP via Getty Images

It’s amazing how much can change in such a short window of time. A little over a year ago, toward the end of 2022, many in the investment community were saying that Facebook parent Meta Platforms (NASDAQ:META) was on the decline. Significant investments being made into things like virtual reality/augmented reality, combined with a decline in advertising revenue, was causing shareholders to rebel against the business. But it was at that time that the value investor in me recognized a golden opportunity.

Around the end of October of 2022, I ended up writing a very bullish article wherein I described the company as a ‘strong buy’. I acknowledged at that time that I had finally pulled the trigger on chairs. Truthfully, that was something I never thought I would do given how expensive shares of the enterprise had been in prior years. But the stock had gotten so low that it did not make sense anymore. Even in the worst-case scenario that management decided to continue blowing money on unfruitful ventures, I believed that shares were cheap enough to justify meaningful upside.

The first purchase of units that I made was at an average price of $99.42. But I ended up buying shares as cheap as $93.38 as they continued to drop. By the time I stopped building my position at the end of November, I had a weighted average price of $98.45. After seeing shares spike another 20.3% on February 2nd of 2023, closing at $474.99 apiece, you might think that I made it rich. Unfortunately, I made an awful mistake in early 2023, electing to slowly unload my position in the business. The weighted average selling price for me came out to $186.62 for a short-term gain of 89.6%.

Most investors would be ecstatic for such a meteoric rise over such a short window of time. But clearly, I underestimated the business and its ability to continue growing. The latest example of that growth was demonstrated in the firm’s fourth quarter earnings release for the 2023 fiscal year. Revenue, profits, and cash flows, all rose materially year over year. And based on management’s guidance, shares are still trading at levels that don’t look unreasonable. Having said that, the stock is getting perilously close to being fairly valued. At this time, I am keeping the business rated a very soft ‘buy’, which was what I downgraded it to exactly one year ago from the most recent earnings release. But if we see the stock rise another 10%, it is highly probable that a downgrade will be justified.

The picture keeps getting better

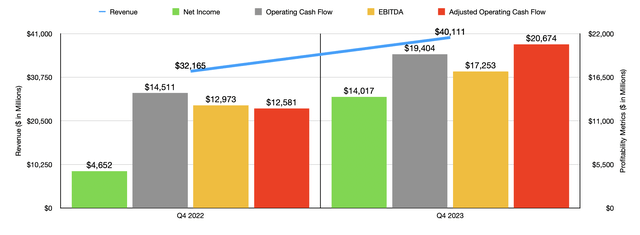

Author – SEC EDGAR Data

Forgive me, if you will, for my sulking. It’s rare to double your money only to find out later that you could have more than quadrupled it. These kinds of opportunities come around a couple of times a decade if you’re lucky. For those who held on longer, the ride has been amazing. And that has not been by chance. It has been through the hard work of management. Consider, for instance, how the company has performed recently. For the final quarter of the 2023 fiscal year, management reported revenue of $40.11 billion. That’s 24.7% higher than the $32.17 billion generated one year earlier. Revenue also ended up being about $940.6 million above what analysts had anticipated.

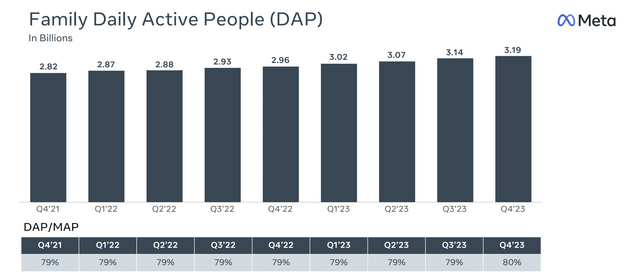

Meta Platforms

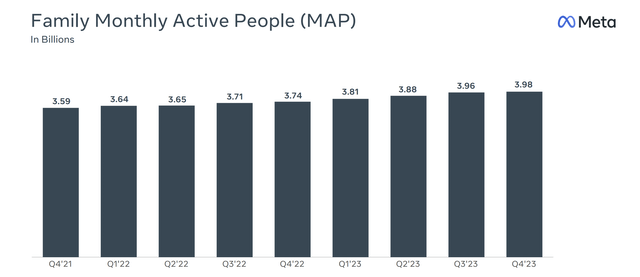

Meta Platforms

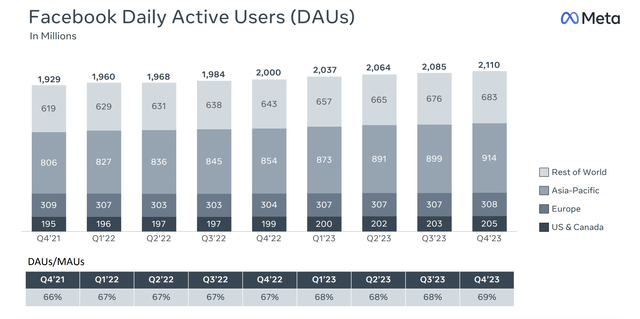

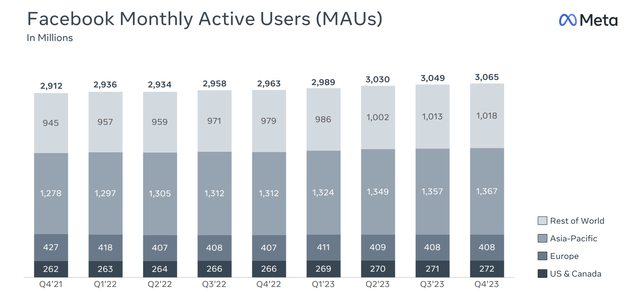

There have been a couple of drivers behind this surge in sales. For instance, for the company’s Family of Apps, the number of daily active users totaled 3.19 billion. That’s 7.8%, or 230 million, more than the 2.96 billion reported one year earlier. On a monthly basis, the number of users jumped by 6.4%, or 240 million, from 3.74 billion to 3.98 billion. As the two images below illustrate, similar year over year growth can be seen when it comes to just Facebook on its own. Clearly, more people than ever are now using not only Facebook, but the entire ecosystem of solutions that the parent company has, than ever before.

Meta Platforms

Meta Platforms

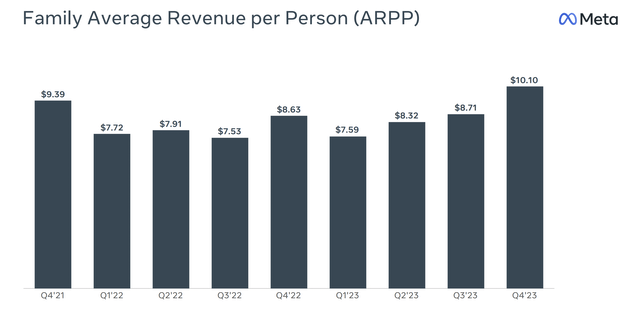

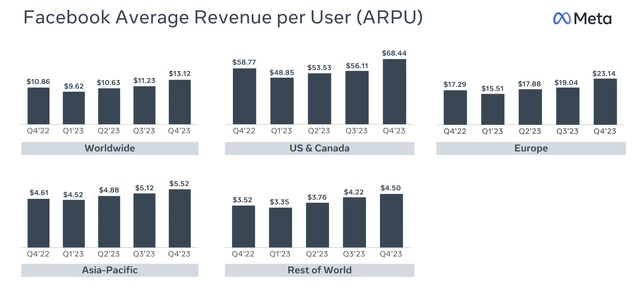

An increase in the number of users has certainly been instrumental in pushing revenue higher. But there have been some other factors as well. One has been a nice increase in average revenue per user. For the Family of Apps the company has, this total hit $10.10 per quarter. That was up from $8.71 seen in the third quarter of 2023 and it was up significantly from the $8.63 reported for the final quarter of the 2022 fiscal year. When it comes to Facebook, revenue was up as well in every major region in which it operated. Globally, ARPU came in at $13.12. That compares to the $10.86 reported one year earlier. The most significant increase, surprisingly, came from the US and Canada. For the quarter, the company reported average revenue per user of $68.44. That compares to the $58.77 reported for the final quarter of 2022.

Meta Platforms

Meta Platforms

Anybody who knows Meta Platforms understands that the overwhelming majority of the company’s revenue comes from advertising. In fact, during the final quarter of 2023, 96.5% of sales came from that particular activity. According to management, this was aided by a 21% increase in ad impressions year over year, combined with a 2% rise in the average price per ad on a year over year basis. So not only do we have more people using the company’s services than ever before. We have advertisers paying more than they were a year ago and we have the users on the platform glued to it more as well.

The rise in revenue achieved by the business has also been aided by some of its key growth initiatives. We don’t have specific numbers at this time. But we do know that Reels continues to attract eyeballs. In fact, during the most recent quarter, Reels experienced an average of 3.5 billion views per day. Combined, Reels and Video reported a 25% year over year increase in watch time. Management also has lauded Threads, which has been pitched as the Twitter killer. Although management has yet to roll out many features that it has planned for that platform, they claimed that it boasted over 130 million MAUs (monthly active users) during the quarter. By comparison, as of late October of last year, it boasted around 100 million MAUs. Add on top of this management’s goal to roll out various AI features in the future, and I can understand why investors are so energetic.

Author – SEC EDGAR Data

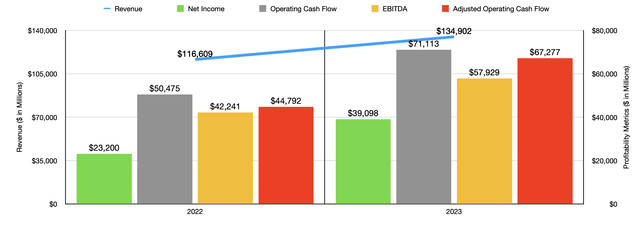

The growth in revenue achieved by the company has made possible a surge in profits and cash flows as well. Net income of $14.02 billion dwarfed the $4.65 billion generated one year earlier. This translated to an increase in profits per share from $1.76 to $5.33. This was $0.39 per share higher than what analysts thought it would be. Other profitability metrics improved as well. Operating cash flow grew from $14.51 billion to $19.40 billion. If we adjust for changes in working capital, the rise was even greater from $12.58 billion to $20.67 billion. And lastly, EBITDA for the company expanded from $12.97 billion to $17.25 billion. For reference, in the chart above, you can also see financial results for 2023 as a whole relative to 2022. Across the board, 2023 was stellar compared to the year prior.

Things have been going so well for the company that management bought back $6.32 billion worth of stock during the fourth quarter. That brought total purchases for the year up to $20.03 billion. That still leaves $30.93 billion available under the company’s prior share buyback plan. But as part of its fourth quarter earnings release, the company also announced a $50 billion increase to that share plan. Add on top of this the fact that the company has initiated, for the first time ever, a dividend, and there are more reasons for investors to celebrate. The dividend is small, coming in right now at $2 per share on an annualized basis. But that still translates to roughly $5.26 billion worth of cash being paid out to shareholders each year if we assume that no additional stock is repurchased. Considering that the company has cash in excess of debt that totals $40.18 billion, it’s not shocking to see a dividend paid out at this time. Although this is not terribly relevant to shareholders, I do find it interesting to note that Facebook founder Mark Zuckerberg owns around 350 million shares of stock in the company. This would translate to roughly $700 million worth of distributions paid to him each year. That’s a little under $2 million each day of the year.

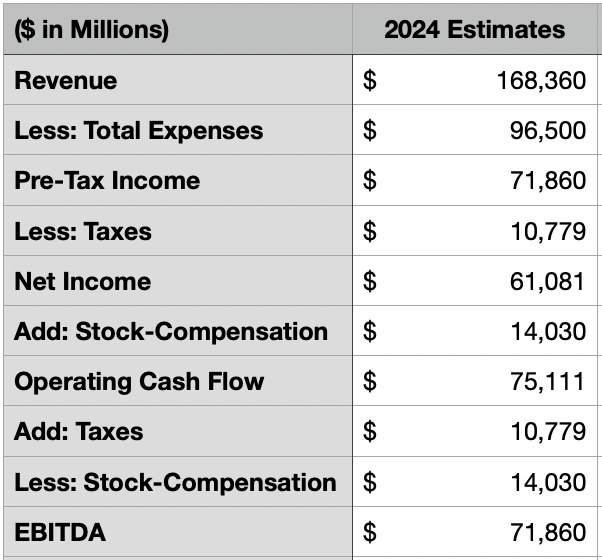

When it comes to the 2024 fiscal year, management has not provided that much guidance. They did say that total expenses will be somewhere between $94 billion and $99 billion. They did say that revenue for the first quarter will be between $34.5 billion and $37 billion. At the midpoint, that would be 24.8% above what the company generated the same time one year earlier. There’s no guarantee that that same kind of growth will continue year over year. But if it does and if we assume that management is correct about a tax rate that’s in the mid teens, then we would be looking at profits for the year of around $61.08 billion. Under the assumption that share based compensation matches what the company paid out in 2023, we can get some estimates here for some other profitability metrics. For instance, we should anticipate operating cash flow of around $75.11 billion and EBITDA of $71.86 billion.

Author – SEC EDGAR Data

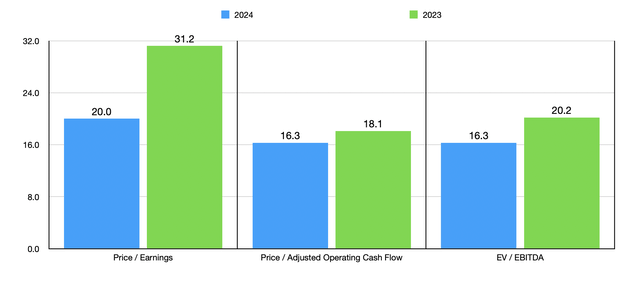

Running these numbers, we are able to easily value the firm. As you can see in the chart below, the stock is trading at a forward price to earnings multiple of 20. The forward price to adjusted operating cash flow multiple is 16.3, as is the forward EV to EBITDA multiple. All of these are a bit lower than what we get using the data from the 2023 fiscal year. For most businesses, I would say that these types of multiples place the stock in the fairly valued range, and may even put us close to being overvalued. But considering that this is an industry leader, that it has a fantastic balance sheet, that it continues to demonstrate strong growth even in spite of its large size and in an environment that is fraught with uncertainty, and that it is a cash cow, I believe that a higher price than what is typical is appropriate.

Author – SEC EDGAR Data

Takeaway

I am incredibly happy at the profits that I have made off of Meta Platforms, I am truly sad that I sold out when I did. Just as I could never have imagined shares of the company plunging as much as they did in late 2022, I never could have imagined them rising up so much and so quickly. Those who held on longer clearly deserve props. Having said that, the move higher cannot continue on at this impressive rate forever. Management has demonstrated tremendous skill in getting the company back to where it is today. In the long run, I suspect that the business will continue to thrive. And I even believe that some additional upside still exists from here. Because of that, I’m keeping the company rated a ‘buy’. But if the stock moves up much further, a downgrade will certainly be on the horizon to something more modest like a ‘hold’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!