Summary:

- Meta Platforms beat consensus expectations on both top and bottom lines in 2Q24, generating strong revenue growth and margin expansion.

- Family of Apps segment saw operating margin expand to 50%, due to solid revenue growth and discipline on expenses.

- Outlook for 3Q24 remains positive, with healthy advertising demand, revenue guidance exceeding consensus, and increased capital expenditure for AI research and development.

- Management expects spending on Llama 4 to be 10x more than that of Llama 3 and for 2025 capital expenditure grow significantly compared to 2024.

- Core AI investments will see strong near-term ROI but generative AI investments will only see ROI in the outer years through new and sizeable revenue opportunities.

J Studios

Meta Platforms (NASDAQ:META) continues to show why it should be a core holding within portfolios, with its core business thriving and growing profitably, enabling the company to have ample excess cashflow to direct towards future growth opportunities.

I have written extensively about Meta on Seeking Alpha, which can be found here. In the prior article, I highlighted that I saw that engagement trends continue to move in the right direction, contributed by the AI recommendation engine and Reels, and that I also believe that Meta is in a position of strength to invest today to become a leading player in AI in the future. In this article, I continue to have the view that Meta is moving in the right direction to become a leading player in AI in the future.

Review

Meta Platforms financials continue to be in a position of strength.

Total revenues in 2Q24 increased 23% on a constant currency basis to $39 billion, beating consensus by 2%

By contrast, total expenses only increased 7% from the prior year to $24 billion, expanding the margin profile of the company.

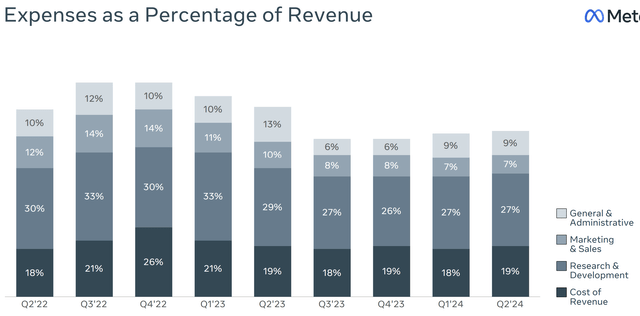

When looking at the expenses by specific line items, cost of revenue increased 23%, R&D increased 13%, marketing and sales decreased 14% and G&A decreased 12%.

The higher cost of revenue was due to higher infrastructure and Reality Labs inventory costs.

The higher R&D cost is due to higher headcount costs and infrastructure costs.

The lower marketing and sales and G&A costs were due to lower restructuring costs, headcount costs, and legal costs.

As can be seen below, cost of revenue as a percentage of revenue stayed the same at 19% from the prior year, while R&D, sales and marketing and G&A as a percentage of revenue fell from 29%, 10% and 13% to 27%, 7% and 9% respectively.

Expenses as a percentage of revenue (Meta Platforms)

Operating margin for 2Q24 increased from 29% in the prior year to 38% in 2Q24. 2Q24 operating income beat consensus by 3%.

Net income came in at $13.5 billion, representing EPS of $5.16 per share, beating consensus by 9%.

Capital expenditures for 2Q24 came in at $8.5 billion, largely due to the investment in servers, data centers and network infrastructure.

Free cash flow of $10.9 billion was generated in 2Q24.

Meta Platforms bought back $6.3 billion in shares and paid shareholders $1.3 billion in dividends in the quarter.

As of end 2Q24, Meta Platforms still had $58 billion in cash and marketable securities.

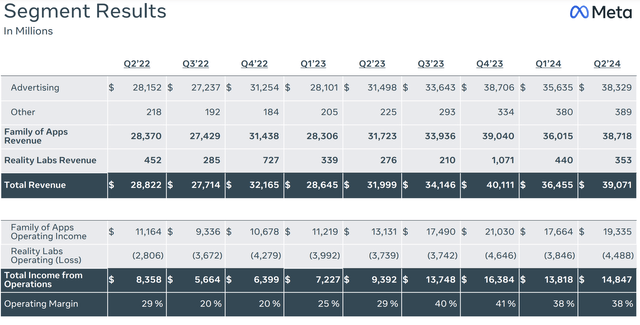

Segment results

Next, we look at the two segments of Meta Platforms.

Firstly, Family of Apps revenue grew 22% from the prior year to $38.7 billion.

Within Family of Apps ad revenue, the largest contributor to growth were the online commerce vertical and gaming and entertainment, and media verticals. From a geography perspective, ad revenue growth was the strongest in the Rest of the World and Europe, which saw ad revenue grow 33% and 26% respectively on a user geography basis. The number of ad impressions and average price per ad both increased by 10% in 2Q24. Ad impression growth was driven by Asia Pacific and Rest of World. The average price per ad growth was driven by strong advertiser demand due to better ad performance. Meta Platforms also reported Family of Apps other revenue grew 73% from the prior year to $389 million, which was driven by business messaging growth from WhatsApp.

Expenses for a Family of Apps were up 4% in 2Q24, up 4% largely due to higher infrastructure and headcount costs, offset by lower restructuring costs. That said, the strong revenue growth of 22% more than offset the 4% increase in expenses for a Family of Apps.

As a result, Family of Apps operating income came in at $19.3 billion, or a 50% operating margin, up from 41% a year ago.

Secondly, for Reality Labs, revenue increased 28% from the prior year to $353 million, largely due to sales of Quest headset. Reality Labs operating loss came in at $4.5 billion, as expenses for Reality Labs grew 21% from the prior year to $4.8 billion, largely due to headcount cost and inventory costs.

Outlook

For the third quarter, management continues to see healthy advertising demand on its platform as a result of growing engagement and improvements to ad performance.

Revenue for 3Q24 is expected to come in between $38.5 billion and $41 billion, ahead by consensus by 2% at the midpoint.

Expenses for 2024 were reiterated to be between the range of $96 billion to $99 billion.

The guidance for capital expenditures for 2024 has increased at the low end, from the earlier range of $35 billion to $40 billion to the new higher range of $37 billion to $40 billion.

In turn, management shared that in 2025, capital expenditures will grow significantly to support its AI research and product development efforts.

Management did not provide quantitative guidance for 2025, but they expect infrastructure costs to drive expenses growth in 2025 due to depreciation and operating costs of the AI infrastructure buildout.

CEO Mark Zuckerberg made it clear that the compute power needed to train Llama 4 is likely to be 10x more than what was used for Llama 3, which was trained on 16k H100s.

This does mean that capital expenditures are likely to remain elevated for the next few years, given that the future models are Llama 4 will likely require even more compute.

Family of Apps momentum continues

To drive the Family of Apps business going forward, Meta Platforms has two main levers it can pull to drive revenue growth: Delivering engaging experiences for its users, and effectively monetizing that engagement with time.

Firstly, to improve on engagement, Meta is focused on two areas in particular, the first is video and the second is to improve on in-feed recommendations.

Within Instagram, as Meta Platforms continues to make enhancements to its recommendation systems, Reels engagement continues to grow. This includes efforts to increase more discoverability within Instagram so that content from emerging creators can find its way to more users.

Within Facebook, the company has seen encouraging early results after rolling out its unified video player and ranking systems globally, which brings all video types into one viewing experience for the user, and Meta Platforms has intentions to increase the mix of shorter videos over time to improve engagement.

One encouraging sign for Facebook is the increase in Facebook usage for 18- to 29-year-olds in the US, led by Groups and Marketplace. I think it is good to see encouraging results after the company started to focus its apps more on this age group a few years ago.

Within WhatsApp, management also has seen encouraging signs of improving retention and engagement, which has coincided with some statistics for Meta AI, where India is its largest market for WhatsApp and also become its largest market for Meta AI usage. In addition, in the US, WhatsApp now has more than 100 million monthly active users.

Within generative AI, management highlighted that Meta AI has seen some encouraging momentum with engagement, as more than a billion queries have passed through Meta AI since it was first introduced. The company is launched more new features within Meta AI to improve engagement.

Within Threads, as the company improves on its content recommendation systems and launch new features, the Threads community continue to improve on engagement and grow. Threads is soon to reach 200 million monthly active users, another significant milestone for the very young app.

Secondly, to effectively monetize engagement, Meta Platforms continues to optimize the level of ads and enhance marketing performance.

On the former, there are still opportunities to grow the number of ads on lower monetizing surfaces like video. More importantly, it is not about the quantity of ads, but also the quality of the ads. Meta Platforms has increasingly been able to differentiate itself by becoming better at determining the best ads to show users and when to show them so that it leads to the best conversions.

On the latter, through improvements in AI, management is starting to see AI being increasingly useful to improve marketing performance, after adopting some advancements including its Meta Lattice ad ranking architecture, which led to improved ad performance in 2Q24. It is not just about improving marketing performance, but it is also about making it easier for advertisers to automate their campaign setup with its Advantage+ suite of products. In fact, US advertisers that used Advantage+ saw 22% higher return on ad spend, based on a study the company did. Meta Platforms continue to see advertisers adopt these tools, and it continues to add more features, including generative AI ad features. Since launching its first generative AI ad features, background generation, text generation and image expansion capabilities, Meta Platforms has seen more than 1 million advertisers use at least one of these new features in the last month.

Capex

The topic of capital expenditure efficiency remains a key one for all big tech companies, including Meta Platforms.

I have mentioned this before and I will state here again that Meta Platforms has two buckets of AI investments, core AI and generative AI.

Core AI is currently in a more mature stage where management can see strong returns on investment in terms of engagement and ad performance, and it continues to be an area of investment for Meta Platforms.

Generative AI is in a much earlier stage and given generative AI products are unlikely to generate meaningful revenues in the near-term, it is not possible to measure near-term returns on investment in this bucket. That said, the payoff from this investment in the generative AI bucket will be in the long-term and management expects this to not only be solid revenue opportunities but expects this to also open new revenue opportunities for the company.

As such, within the core AI bucket, the investments in this bucket are informed by the strong returns that are expected in the future as it helps improve engagement and ad performance of the Family of Apps business.

While the returns from the generative AI bucket will take time to materialize, the company is mapping the investments in capital expenditures in this bucket to the significant monetization opportunities they bring. This means that a dollar of investment into GPUs could be mapped to Meta AI, which is then expected to have a significant future payoff.

Another thing to note here is that there is flexibility in terms of the use of these investments. This means that the AI infrastructure that was meant for generative AI training can then be used for either generative AI inference, or even its core ranking and recommendation workloads.

Management also remains focused on improving the cost efficiency of its workloads as well.

The key for Meta Platforms is that having sufficient compute capacity will be key for the company in most of its current and future opportunities.

While Reality Labs has taken a backseat due to AI, it remains a long-term investment for the company.

While these investments are made, Meta Platforms is also focused on operating the business more efficiently.

At the end of the day, Meta Platforms is run by CEO Mark Zuckerberg, and what he says about AI spending will determine the trajectory of the spending in the area.

In particular, while Mark Zuckerberg admits it is hard to predict how this trend will continue after multiple generations of Llamas, at this point, he would rather “risk building capacity before it is needed rather than too late, given the long lead times for spinning up new inference projects”.

In essence, better to be early and spending more, rather than late and not having any capacity at all.

Valuation

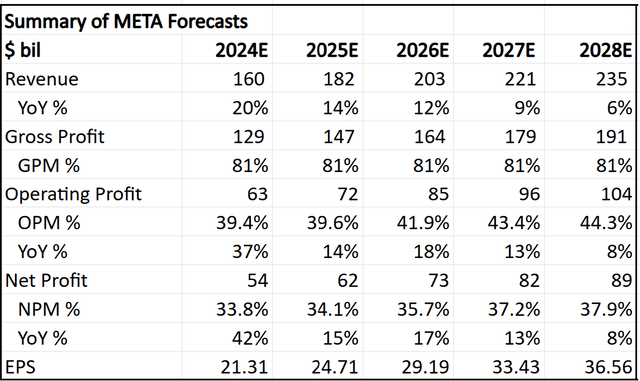

Before updating my valuation numbers, I am revising my financial forecasts for Meta, particularly in the near-term.

In 2024, I have revised the revenue and EPS figures marginally to reflect the beat in the quarter.

In 2025, I expect a smaller margin expansion than in 2026, in part due to the impact of the significant investments made in 2025 to grow its AI research and product development efforts.

As such, while I expect Meta to gradually expand operating margins to 45% in the long term, which is slightly below its pre-pandemic operating margin of between 45% to 50%.

My 5-year financial forecasts for Meta Platforms (Author generated)

Intrinsic value

My intrinsic value for Meta is $583, assuming a 25x terminal multiple and 11% cost of equity. For reference, Meta has a 5-year average P/E of 25x, and given that Meta’s competitive position and fundamentals are the best it has been and still improving, I think this multiple is justified.

My entry price is thus $432, based on a 20% discount to the intrinsic value to provide sufficient downside protection.

Price targets

My 1-year and 3-year price targets for Meta are revised upwards to $618 and $836 respectively.

The 1-year and 3-year price targets imply a 25x 2025 P/E and a 25x 2027 P/E, which, I think, is reasonable based on the historical P/E range of Meta. Meta has a 5-year average P/E of 25x, as highlighted above, which, I think, is reasonable given where its competitive position and fundamentals are today.

Conclusion

I think the 2Q24 quarter showed Meta Platforms continue to have a solid business model, seeing improvements in engagement across its platforms and ad performance improvements driving the business going forward.

Given the strong margin expansion as a result of operating leverage and strong revenue growth, free cash flows have been strong as well, meaning that the company has more than sufficient financial resources to invest in current and future business opportunities.

While the debate about capital expenditures will likely continue, I think the company showed that the investments in near-term core AI will continue to see high returns on investment, while the longer-term investment in generative AI will open up new revenue opportunities and sizeable business opportunities for the company in the future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, the AI deep dive report, and access to The Barbell Portfolio.

The Barbell Portfolio outperformed the S&P 500 by 50% in the past year through owning high conviction growth and contrarian stocks.

Apart from providing bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join Outperforming the Market before the 20% price hike next month.