Summary:

- Meta Platforms has excelled at utilizing AI for ad targeting and content recommendation, resulting in revenue growth while reducing headcount.

- The company plans to invest more heavily in AI infrastructure in 2025 to enhance its strategy further, but the timing comes as prior investments weigh on expenses.

- While the fundamental AI strategy is sound, the timing of increased expenses and depreciation may impact shares, leading to the stock consolidation at lower prices.

NanoStockk/iStock via Getty Images

If there’s one company I’ve talked about over the last year outside of Nvidia (NVDA) capable of capitalizing on the use of AI, it’s been Meta Platforms (NASDAQ:META). The company set course from the beginning to open source its LLM (large language model), immediately setting it apart from the other major players like Google (GOOG)(GOOGL) and Microsoft (MSFT), which both kept their LLMs closed source (OpenAI in Microsoft’s case). This strategy has allowed Meta to provide an advanced generative AI model capable of, first and foremost, enhancing its money-making product: Ads. This resulted in it taking digital advertising market share over the last year from Google, only bested by Amazon (AMZN), as the latter expands its ad business. With its Q2 report, Meta plans to increase its AI investments heavily in 2025 to further this strategy. The problem is the free run on expenses is ending as it laps those initial capex purchases through depreciation, and running all those Nvidia (NVDA) AI accelerators will add up in ongoing operational costs.

The Right AI Strategy

Make no mistake – Meta Platforms is one of the best major tech companies utilizing AI and not seeing it turn to vaporware as merely an AI chatbot or some search assistant for pure novelty. It’s pointing the firepower toward recommendation systems to keep its users more engaged with content, along with better targeting of its ads and, more importantly, ad results and metrics back to advertisers. It has only recently pushed out Meta AI for day-to-day users of its platforms, doing things in reverse of other major tech companies.

This has proven to be successful.

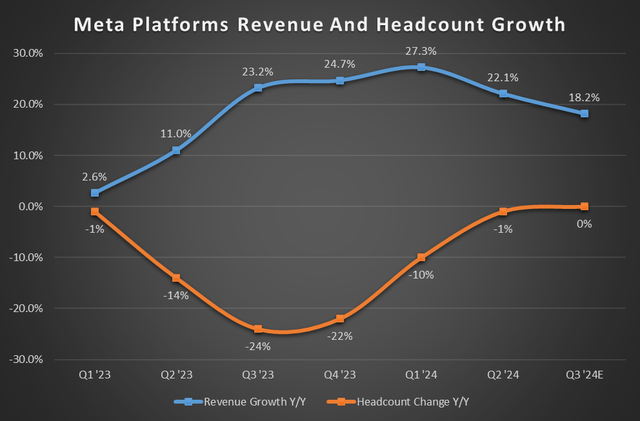

First, it has paid off in terms of revenue growth while reducing headcount by 8.2% from Q1 ’23 to Q2 ’24. While you can read into the chart below on many different levels – both rightly and wrongly – the idea is the company was able to grow revenue while doing it with fewer employees. This isn’t something you typically see. Generally, headcount reduction is to save on expenses while the company grapples to keep revenue growth existing – it comes at the cost of future product revenue. This is a different picture altogether from Meta because it had different reasons than most companies for executing layoffs (see: Intel (INTC)).

Company Filings

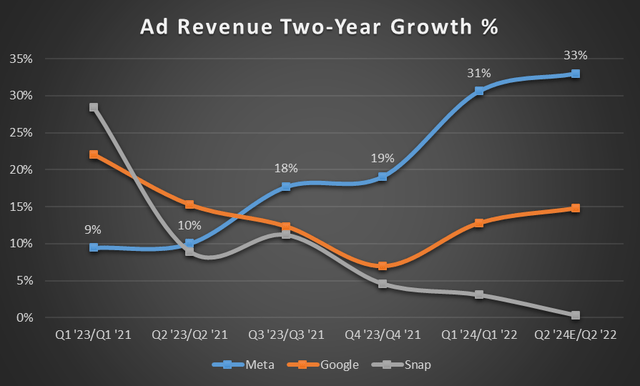

On a two-year revenue growth look (something I’ve been tracking for Google and Snap (SNAP) also), Meta comes out on top while Google continues to accelerate slowly, and Snap sees ad revenue flatline as Snapchat+ makes up the difference (these revenue numbers are actual ad revenue, not total revenue for each company).

Company Filings/Author Ad Rev Estimates

When investors and analysts ask about “seeing ROIC for AI,” these two charts should appear next to the answer. It’s early days, but there’s already a payoff for the investment Meta has seen in AI. Much of it has to do with its work pre-ChatGPT era, but it had the right solution when it came time to kick on the afterburners and install the H100s en masse. This was unlike many other large tech companies, where adding jet fuel to a broken engine didn’t make their products fly.

Continuing The Right AI Strategy

When you have this kind of success with a strategy, particularly with AI, growing those investments is the right one and is exactly what Meta shared on its Q2 call.

We expect that having sufficient compute capacity will be central to many of these [AI] opportunities, so we are investing meaningfully in infrastructure to support our core AI work, in content ranking and ads, as well as our generative AI and advanced research efforts.

Our ongoing investment in core AI capacity is informed by the strong returns we’ve seen, and expect to deliver in the future, as we advance the relevance of recommended content and ads on our platforms. While we expect the returns from generative AI to come in over a longer period of time, we are mapping these investments against the significant monetization opportunities that we expect to be unlocked across customized ad creative, business messaging, a leading AI assistant, and organic content generation.

– Susan Li, CFO, Meta Platforms’ Q2 ’24 Earnings Call

This is where the 2024 and 2025 dollar investments come in to maintain and advance the AI strategy.

We anticipate our full-year 2024 capital expenditures will be in the range of $37-40 billion, updated from our prior range of $35-40 billion. While we continue to refine our plans for next year, we currently expect significant capex growth in 2025 as we invest to support our AI research and our product development efforts.

– Susan Li, CFO, Meta Platforms’ Q2 ’24 Earnings Call

There are two things here – well, three, if you consider the strategy itself. The first is the investments to this point have come essentially “free” and haven’t materially impacted expenses. This is mainly because it has been able to use the tailwind of lower headcount while there’s a lack of infrastructure depreciation. The second is 2025 will now see these operational and depreciation expenses hit while also piling on even more significant expenditures toward it.

Obviously, there’s no getting around it: These significant investments require ongoing costs and will depreciate just like any other infrastructure. The difference is headcount has now moderated and may even tick up slightly for higher-skilled positions needed to support the investments. So while the company has been enjoying the “masking” (and I use that term loosely – this is just a natural part of the strategy of investing heavily while reducing headcount) of its additional AI expenses, it’s now going to not only see an increase in expenses but not have any expense reduction strategy to counter it with.

It essentially becomes a double whammy just through timing.

The Timing And “Cost” Of The Strategy

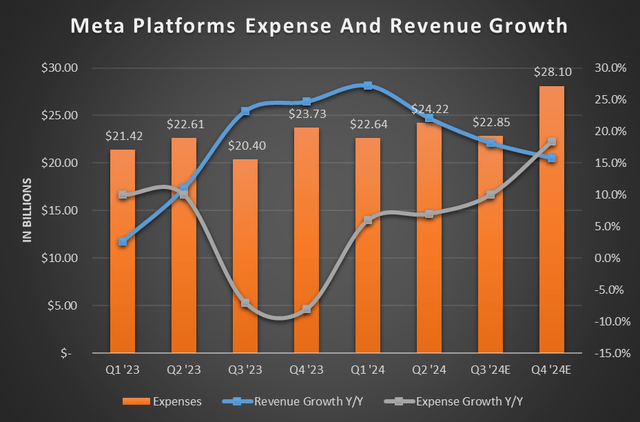

This sets up 2025 for a difficult comp in revenue growth and expenses after reducing them dramatically in 2023 and growing them lightly in 2024.

Company Filings/Author Estimates

You can already see expenses are set to grow faster than revenue by Q4 before starting the lapping of this year. This is based on the company’s guidance for expenses of $98B at the midpoint for FY24. This will pressure margins and be a headwind to bottom line growth, though it’s happening from a much better baseline than 2022’s bloated company structure. In this regard, the company is entering a higher expense season from a better position than it did previously while executing the correct strategy to keep it efficient with its ongoing AI development.

However, this may keep the thumb on shares (impact sentiment) and prevent them from seeing new highs over the next few quarters, even as the ROI has been proven through lowered headcount and greater revenue growth these last several quarters.

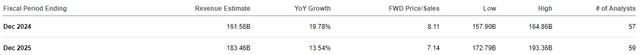

The upside potential comes in if the company can re-accelerate growth after lapping a strong 2024 through these continued investments. This mainly comes from ad impressions and ad pricing. If these metrics can remain strong year-over-year, revenue will follow. As of right now, revenue growth estimates for FY24 are for ~20% growth, with FY25 estimating 13.5% growth. If the company can see stronger growth, much closer to 18%-19% for FY25, the stock may fare better.

Seeking Alpha

Right Fundamental Strategy, But Time For Share Consolidation

This timing issue isn’t even in Meta’s control, really. It has to spend and then operationalize its AI strategy, so it’s going to feel a pinch at some point. But it’s better to do it from a leaned-out workforce than a bloated one. To make this continued AI spending worthwhile, it needs to continue seeing better efficiency improvements and further strength in its ability to target ads, surface content, and generate a positive feedback loop.

If it can do this, barring a recession in the next few quarters, it could be the best-positioned major tech stock in the market. However, this doesn’t preclude the stock from seeing a consolidation and perhaps another move down to the low $400s over the next few months, as the coming expense “weight” likely impacts sentiment. If it does, I’ll reevaluate the risk-reward and analyze the stock chart for signs of bottoming. For now, I keep it at a hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, META, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join The Top AI And Tech Investing Group

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Then sign up to be a free member of my investing group Tech Cache. You’ll get more free content from me, no paywall, and no credit card. If you want the trading strategy and technical chart analysis of the article you just read, step up to being a paid subscriber with a two-week free trial and read it immediately.