Summary:

- The introduction of the Apple Vision Pro made clear that the direction we are going is the metaverse. With a player like Apple, the whole industry will receive greater exposure.

- Meta is expected to own a significant market share of the mixed reality industry, generating $53 billion in revenues by 2032.

- Meta’s core business remains its social media platforms and ad revenues, with the metaverse helping the company to gain greater freedom in data collection.

PeopleImages/iStock via Getty Images

Investment Thesis

Meta Platforms’s (NASDAQ:META) bet on the metaverse has obtained greater credibility now that Apple, the largest technology company in the world, came out with its mixed-reality headset.

The introduction of the Apple Vision Pro made clear that the direction we are going is more and more the one of the metaverse. With a player like Apple actively investing in mixed reality, the whole industry can do nothing but benefit from the greater exposure the company will bring.

In my recent analysis of Apple (AAPL), I tried to estimate the total addressable market (TAM) for mixed reality headsets, and by analysing Meta Platforms (META), I will pose a greater focus on the fast-growing segment of gaming and the impact it will have on Meta Platforms valuation.

Metaverse Gaming Segment

With its Reality Labs business line, Meta develops and sells AR/VR headsets under the brand Meta Quest. Its main products comprise the Meta Quest 2 and the recently announced Meta Quest 3, two mixed reality headsets designed to deliver a full immersion gaming experience in the metaverse. With a price of around $500, they directly compete with traditional gaming consoles like the PS5, the Xbox Series X and the Nintendo Switch.

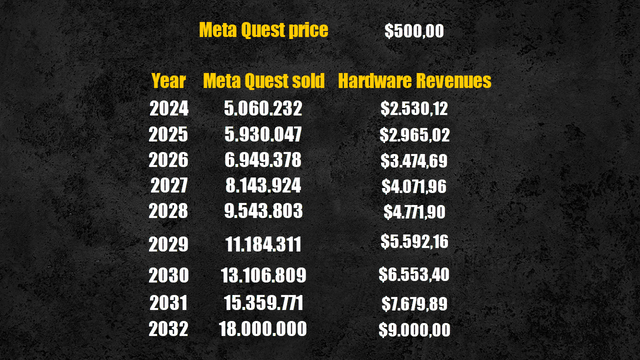

The major player in the old gaming console industry is Sony (SONY) with its PlayStation franchise which sold an average of 17 million consoles per year since 2014. I assumed Meta to establish itself as the main player in the gaming headset industry and mimic the success of PlayStation selling around 18 million Meta Quest by 2032.

Despite other gaming companies, like Sony itself, developing their headsets, Meta currently dominates the market, and with the billions of dollars it is pouring into R&D it will likely remain ahead of its competitors.

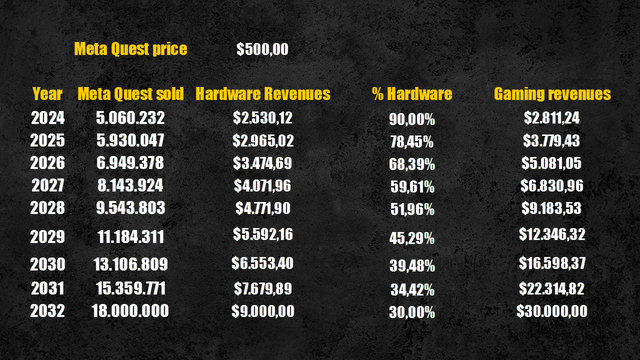

Assuming the price of Meta Quest remains around $500, with 18 million units sold by 2032, Reality Labs would generate $9 billion.

Meta Quest sold by 2032 (Personal Data)

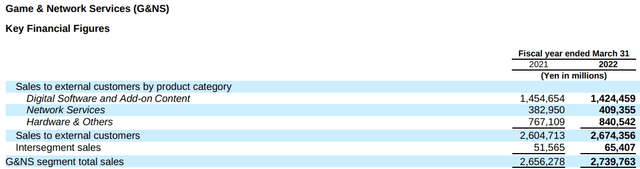

However, selling the hardware is not the main source of revenue for gaming console developers. Sony, for example, generates only 30% of its revenues from the sales of the PS5 while the remaining 70% is generated by the sales of software and content.

Sony gaming revenues breakdown (Sony)

Despite not being disclosed in detail, probably because not material yet, Reality Labs generates revenues in the same way selling hardware, software, and additional content.

Assuming Meta will achieve the same ratio as Sony 10 years from now, total revenues generated by the Reality Labs business line are expected to be $30 billion by 2032.

Reality Labs gaming revenues projection (Personal Data)

Metaverse Business Segment

But is not over yet, because other than developing gaming headsets, Meta launched the Meta Quest Pro, targeting the business segment of mixed reality. Despite the ambitious goal of creating the first headset usable in a working environment, the Meta Quest Pro turned out to be a flop, lacking major technological features to make it a desirable tool for productivity.

However, with Apple presenting their business-focused headset, the Apple Vision Pro, which promises to disrupt the way we work making mixed reality real, Meta can learn from it and come back with a better version of the Quest Pro.

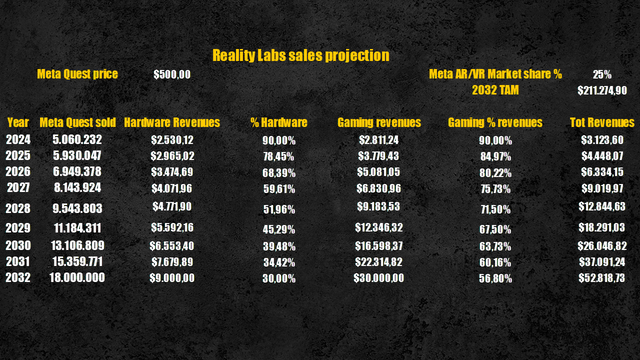

In my analysis of Apple, I valued the mixed reality TAM at around $210 billion by 2032, with Apple owning a 30% market share. I expect Meta to be another major player in the industry considering that it single-handedly created it and it’s investing billions every year.

With only the $30 billion in revenues expected from the gaming segment, Meta would achieve a market share of 15%, however, given its intent to expand to the business segment of the metaverse, I assume Meta to achieve a total market share of 25%, which would translate in Reality Labs generating nearly $53 billion in revenues by 2032, with an almost perfect 50%-50% ratio between the gaming and business segment.

Reality Labs total revenues projection (Personal Data)

While I expect Apple to conquer market share thanks to its superior technology and its already existing ecosystem, Meta will represent the best alternative for all non-Apple users who seek a great headset at a more affordable price.

Revenues Projection

Despite Meta burning billions to create its metaverse, ad revenues remain the foundation of its business model. The creation of the metaverse infrastructure is aimed to free Meta from the dependence on other hardware manufacturers which can limit the company’s ability to collect data to better target users with ad campaigns. When Apple strengthen its privacy policies to protect its user’s sensitive data, Meta’s stream of relevant data needed for its ad services witness a major interruption from one day to the other.

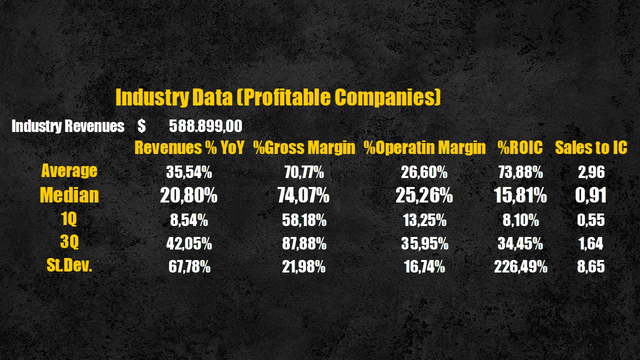

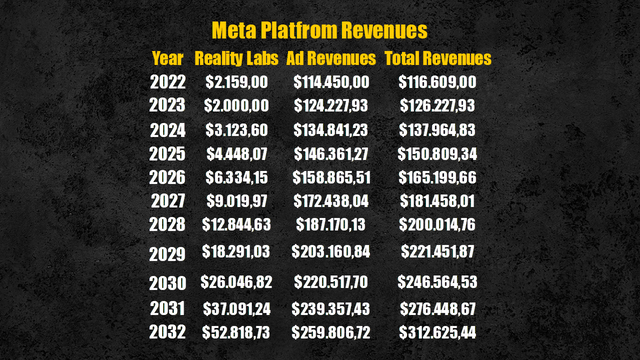

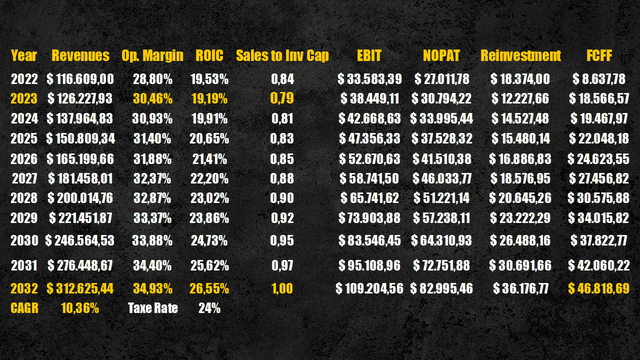

Meta generated $114 billion from ad revenues in 2022, and I assumed them to keep growing at a CAGR of 8.54%, equal to the first quartile value for revenue growth of the Interactive Media Industry, reaching $259 billion by 2032.

Interactive Media industry data (Personal Data)

Given the already huge size of Meta and the increasing competition from other social media like TikTok, I expect Meta’s ad revenues to grow at a significantly lower rate if compared to the CAGR of 36.8% they achieved in the past 10 years.

Adding the $52.8 billion expected from the Reality Labs segment, Meta’s total revenues are forecasted to reach $312 billion by 2032, with the mixed reality business line accounting for almost 17% of total revenues.

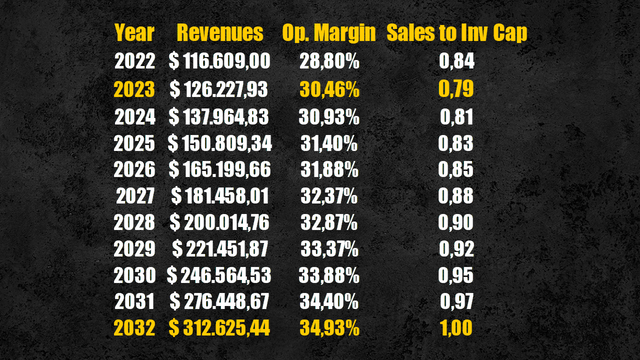

Meta Platforms revenues projection (Personal Data)

Efficiency & Profitability

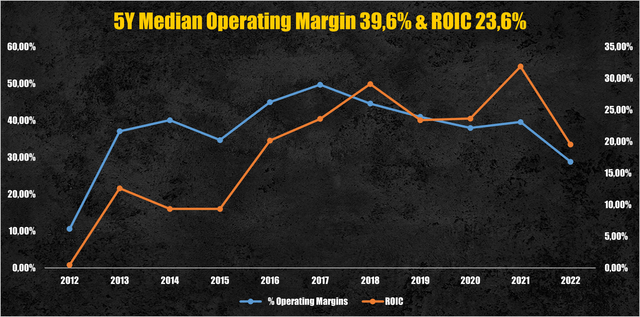

Moving on to Meta’s future profitability, its operating margin tumbled from a 5-year median value of 39.6% to 28.8% in 2022, as a direct consequence of the heavy investments made in the Reality Labs business line, which at the moment, is a huge cash-burning machine losing tens of billions of dollars every year.

Meta Platforms operating margin & ROIC (Meta Platforms)

By 2032 I expect Meta to partially recover its historical operating margin, sitting around 35%, as the company manage to turn the mixed reality segment positive. However, given the high investment required to support the R&D of new hardware technologies, is unlikely that Meta will ever achieve again an operating margin of 40%.

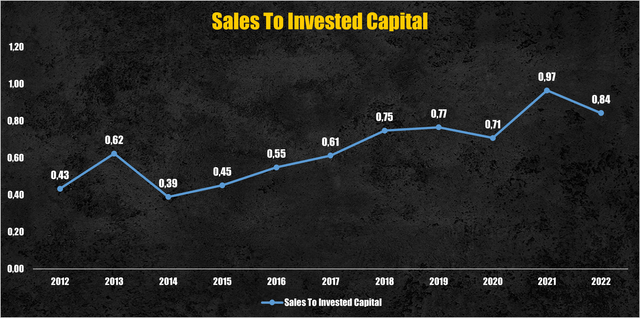

As regards future efficiency, using the sales to invested capital ratio as a proxy, Meta has shown an improving efficiency over the years, with the ratio going from 0.75 in 2018 to 0.84 in 2022. By 2032, as Meta enters the mature phase and reduces the investments made in R&D – on a relative base at least – I assumed the sales to invested capital ratio to improve to 1.

Meta Platforms sales to invested capital (Meta Platforms)

Meta Platforms future operating margin & sales to invested capital (Personal Data)

Cash Flows Projection

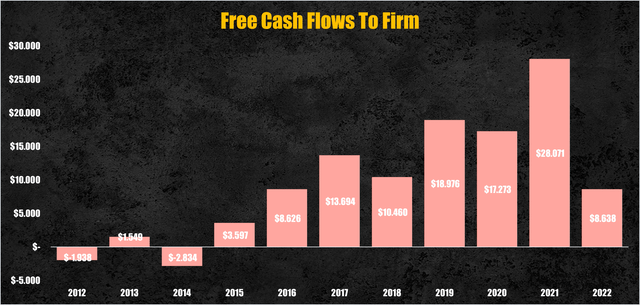

Despite burning billions with its bet on the metaverse, Meta has kept delivering solid free cash flows to the firm (FCFF) to its shareholders, showing how powerful its ad business model really is.

Meta Platforms FCFF (Personal Data)

With the assumptions made so far, Meta will still deliver solid and consistent FCFF which are expected to reach $46 billion by 2032.

Meta Platforms FCFF projection (Personal Data)

Valuation

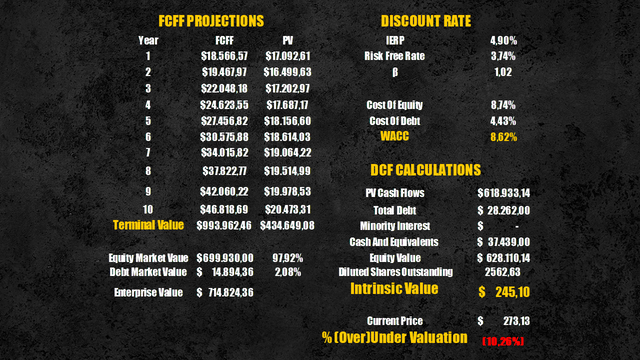

Applying a discount rate of 8.62%, calculated using the WACC, we obtain that the present value of these cash flows is equal to $628 billion or $245 per share.

Compared to the current prices, Meta Platforms’ stocks would result slightly overvalued by 10%, however, considering the numerous assumptions made and the possible errors, we can say the company is fairly valued.

Meta Platforms intrinsic value (Personal Data)

Conclusion

Despite the public opinion still thinking the metaverse is just a foolish bet of Mark Zuckerberg, the billions of dollars invested so far, and the entrance of major players like Apple, certainly should make the metaverse more credible in the eyes of investors.

There’s still a long way towards the metaverse success, but Meta Platforms, among all other companies, is sitting in the best place to benefit from the numerous opportunities it would bring. All in all, the core business of Meta will remain its social media platforms and ad revenues, with the metaverse helping the company to gain greater freedom in data collection, making its business model less vulnerable to external attacks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.