Summary:

- Meta Platforms, Inc. stock has outperformed the S&P 500 since my October 2023 update and is moving closer to re-testing its 2021 all-time highs.

- Meta has demonstrated its ability to capitalize on AI in driving its recovery, surpassing my expectations.

- However, the market has not fully recognized Meta’s growth optionalities and AI offerings, leading to a marked discount in its valuation compared to peers.

- I argue why Meta Platforms’ price action supports it grinding higher as it looks to regain its all-time highs. The time to sell Meta isn’t close, and don’t bail out too early.

Drew Angerer

Meta Platforms, Inc. (NASDAQ:META) stock has continued to defy the bearish prognosticators, outperforming the S&P 500 (SPX, SPY) since my last update in October 2023. As a result, the recovery has re-tested META’s November 2021 highs, setting the stage for an eventual re-test of its 2021 all-time highs at the $384 level.

I’ve learned my lessons on META. I was too cautious as it continued on its surging run since it bottomed out in November 2022. However, its continued outperformance has exceeded my expectations, as Meta demonstrated that no other social network could surpass its scale and market leadership. While TikTok (BDNCE) remains a significant threat, it has broadened its focus to compete on the US e-commerce front, taking on Amazon.com, Inc. (AMZN) in its most critical geographical region.

In addition, I believe investors have not given sufficient recognition to Meta’s efforts in leading the open-source generative AI efforts, notwithstanding the formidable partnership of Microsoft Corporation (MSFT) and OpenAI. However, META’s incredible recovery should inform investors why we were wrong to underrate CEO Mark Zuckerberg and his organization, given the advances made in AI over the past year.

While there are concerns about whether Meta’s most advanced LLMs are at the same level as OpenAI, I’m not unduly concerned. Meta’s products were intended to provide a competitive edge against its smaller social media peers. The increased engagement has led to a remarkable recovery in its operating performance, as demonstrated in the third quarter or FQ3. I have confidence that the market has priced in a further recovery in Q4, as the advertising market remains robust.

Given the cyclical nature of the advertising market, it should continue to bolster Meta’s thesis in 2024 as AI continues to sustain its operating leverage improvement. Moreover, Meta has not monetized its AI offerings, which have been used to boost its internal products. As a result, I assessed that the market hasn’t fully revalued the growth optionality as Meta leads the open-source alliance in competition with the proprietary clique. This AI alliance includes members who I believe are keen to disrupt the established order, such as Advanced Micro Devices, Inc. (AMD), International Business Machines Corporation (IBM), Hugging Face, Intel Corporation (INTC), and Oracle Corporation (ORCL). While the core mission is to “foster collaboration,” where are Alphabet Inc. (GOOG) (GOOGL), NVIDIA Corporation (NVDA), Microsoft, and Amazon? Why isn’t the market rewarding Meta for growth optionalities that it has yet to monetize (effectively)? Let’s not forget that Meta’s commercial license terms on its LLMs suggest that it’s “still a limited license.” As a result, it could open up opportunities for external monetization not baked into its current valuation.

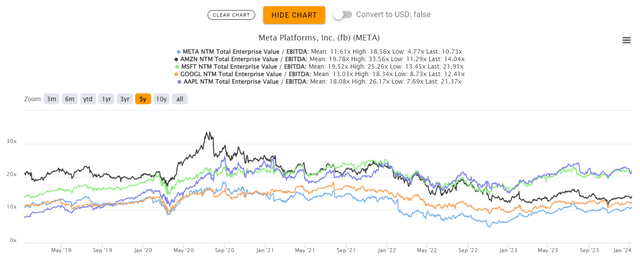

META Vs. Peers forward EBITDA multiples (TIKR)

Consider this. META still trades at a discernible discount against its peers listed above, with a forward EBITDA multiple of 10.7x. Despite that, Meta is still expected to generate an EPS growth of 15.4% between FY23-26. Considering its FY26 EPS multiple of just 16.5x, I believe it’s clear that the market has remained skeptical about Zuckerberg’s ability to monetize his AI offerings.

Furthermore, Meta is expected to raise its CapEx through FY25, reaching $36B before topping out. It’s a marked increase from the estimated $28B for FY23. However, it’s also important to consider that Meta has given investors clarity about its outlook at its Q3 earnings call. Hence, I don’t believe the market should be surprised with its CapEx spending, even as there could be worries about whether Meta would exceed those estimates. The high-margin fundamentals of Meta’s ad-driven business model provide the company with substantial free cash flow, or FCF, profitability. As a result, I believe Meta has convinced the market that AI can strengthen its best-in-class “A+” profitability moat and not weaken it.

Therefore, it’s justified to expect Meta’s FCF margins to continue trending upwards, provided its CapEx outlook remains consistent. Wall Street analysts project Meta’s FCF margin to increase from FY23’s 28% to 31% by FY26. Furthermore, the launch of Apple Inc.’s (AAPL) Vision Pro headset could spur a growth driver for Meta, leveraging on Apple’s demand drivers and circumventing Vision Pro’s high cost. As a result, I find it intriguing that META continues to trade at a marked discount against its peers, given its robust fundamentals, and growth optionalities.

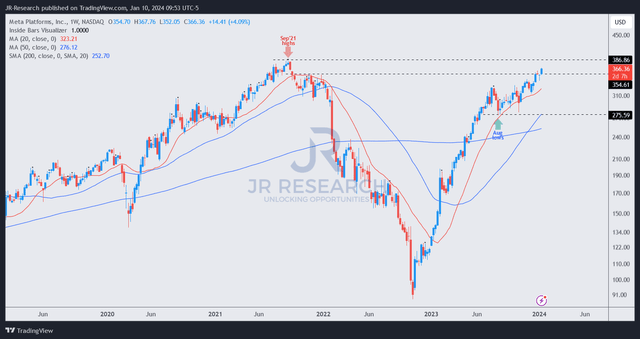

META price chart (weekly) (TradingView)

With META re-testing its November 2021 highs, it marks a pivotal development, suggesting that its next stop is likely its 2021 all-time highs.

I haven’t gleaned any bull trap along the way since it formed a robust bottom between August and October 2023 at the $275 level. That consolidation zone has helped form the base for the recent rally.

Could META take a break here and pull back? Why not, after all, it has recovered more than 180% over the past year. Some profit-taking isn’t unexpected. However, investors convinced about my thesis that Meta has growth optionalities not baked into its earnings, bolstered by its 15%+ EPS growth over the next three years, should consider buying more Meta Platforms, Inc. shares on pullbacks.

The time to sell META isn’t now, as it continues to grind higher from here. I would continue to hold on and avoid selling into a panic, as it looks to regain its 2021 highs.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOGL, AMZN, MSFT, NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!