Summary:

- Meta Platforms, Inc. plans a return to aggressive spending in 2024, eliminating the expected benefits from cost controls under efficiency goals.

- The company forecasts further boosting spending on Reality Labs after hitting an annualized loss rate of nearly $15 billion.

- Meta stock has upside to prior highs near $380, but Meta quickly gets expensive at 20x aggressive EPS targets for 2025.

Ildo Frazao/iStock via Getty Images

A big part of the very bullish investment thesis on Meta Platforms, Inc. (NASDAQ:META) was the company following through on the “Year of Efficiency” plan. The social media company appears to have turned away from this plan after cutting the workforce last year with further aggressive investing in the Metaverse and AI heading into 2024. My investment thesis is only slightly Bullish now after the stock has rallied aggressively and the reversal of the efficiency plans reduces the earnings upside in the near term.

Bad Habits

By all accounts, Meta reported a strong quarter last week when announcing Q2 2023 numbers. The social media company returned to strong growth and EPS is returning back towards peak levels from 2021 before aggressive spending began.

The issue here is whether Meta can reach the $20+ EPS target originally expected when the company started focusing on efficiency last year. The biggest issue is that heavy investing in the Reality Labs division expanded when the opportunity existed to contract expenses.

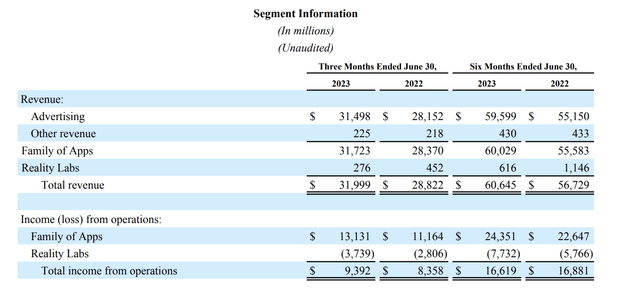

Source: Meta Platforms Q2’23 earnings release

Meta lost an incredible $3.7 billion from Reality Labs during Q2, up $0.9 billion compared to last year. In total, the social media giant grew income from operations by $1.1 billion YoY, but the excessive spending on Reality Labs continues to hide the total potential of the business.

In addition, the company rolled out the Threads app to compete with X (aka Twitter). Meta discussed limited costs for this short-form social site, but the company actually grew expenses 10% in the quarter compared to Q2 2022, when the goal was efficiency gains from cost controls.

On the Q2’23 earnings call, CEO Mark Zuckerberg mentioned the efficiency goal was much more about aggressively building better technology as much as about boosting profits from lowering costs as follows:

The year of efficiency was always about two different goals, becoming an even stronger technology company and improving our financial results, so we can invest aggressively in our ambitious long-term roadmap.

Zuckerberg even went further to suggest major spending is on the way for AI capex at an undetermined level as follows:

The other major budget point that we’re working through is what the right level of AI CapEx is to support our roadmap. Since we don’t know how quickly our new AI products will grow, we may not have a clear handle on this until later in the year.

As previously discussed, Meta has a massive opportunity to grow the business by focusing on Reels and the opportunity in the Metaverse. The company grew Reels annualized revenues to $10 billion, but Meta still has a great opportunity to lower the losses from Reality Labs without compromising a market lead in AR/VR and the Metaverse. Instead, the company appears set to grow spending in this category while WhatsApp has more immediate potential.

Meta discussed strong results from click-to-messaging ads on WhatsApp with over 80% growth. The amount is definitely off a low base, but the business opportunity is to focus on this area where the WhatsApp Business app has over 200 million monthly users and limited revenues.

Aggressive Targets

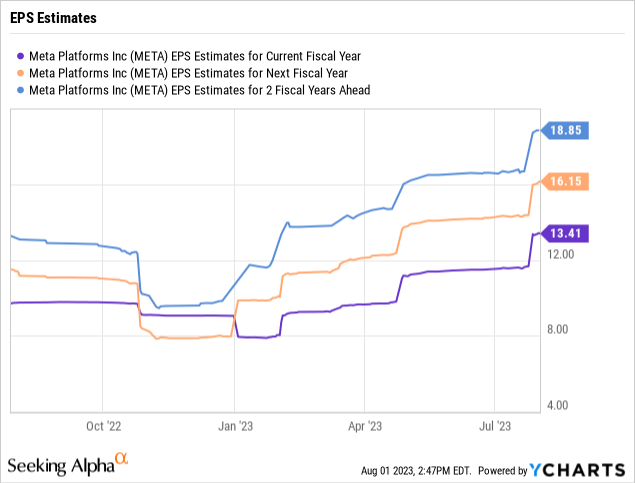

Analysts have hiked EPS targets for the next few years. The consensus estimates now have the 2024 EPS above $16 and the 2025 target near $19 per share.

The analyst targets are amazing considering the company is back to talking about aggressive spending. Meta forecast a meaningful boost in expenses next year with the following plans:

- Deprecation – higher costs due to increased capex spending.

- Payroll – expect to shift workforce composition toward higher cost technical roles.

- Reality Labs – forecasts meaningful spending increases due to ongoing AR/VR development costs.

The guidance from management doesn’t appear accurately factored into analyst EPS estimates. Meta is guiding to an end to the efficiency goals as this year progresses into 2024.

Our prior targets made assumptions Meta would improve the Reels monetization and use efficiency goals to lower the losses from Reality Labs. The normalization of spending could provide up to a $20+ EPS total by 2025. Now, management suggests meaningful boosts to spending next year questioning how Meta reaches 20% EPS growth rates over the next couple of years to achieve this goal.

Takeaway

The key investor takeaway is that Meta appears to be returning to bad habits of aggressively overspending. The social media giant is already producing $15 billion annualized losses in Reality Labs, yet the company forecasts spending even more next year while ramping up costs on AI.

Investors should look for a rally back to the previous highs near $380 where the stock is likely to top out at close to 20x EPS targets for 2025. Meta Platforms, Inc. will face a hard time reaching the current analyst EPS targets needed to warrant a higher stock price with the return to the bad habits of aggressive spending.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.