Summary:

- Meta Platforms (formerly Facebook) shares have seen significant growth, up 340.5% since October 2022.

- Despite a recent drop in stock price, the company’s financial results show strong growth on both the top and bottom lines.

- Meta Platforms’ growth initiatives, such as Threads, suggest further upside potential and make it an attractive investment.

- This is especially true when you consider how attractively priced shares are.

Kenneth Cheung

I have an interesting history when it comes to Facebook parent Meta Platforms (NASDAQ:META). For several years, I could never imagine myself owning the stock because of how pricey shares were. But then, when everybody hated the firm in late 2022, I found that shares were finally cheap enough to warrant an investment. I dove all in and things turned out quite well. But they didn’t turn out as well as they could have. In the span of only a few months, I ended up nearly doubling my money on the business. But I sold out too soon. For context, from the time I wrote my bullish thesis on the company in October of that year, through the present moment, shares are up 340.5% compared to the 31.7% increase seen by the S&P 500 over the same window of time. So although I made out like a bandit, I continue to kick myself for not holding on longer.

All those shares have seen tremendous upside in a relatively little window of time, this doesn’t mean that the ride higher has been pleasant at all times. In fact, in just the past few days since the company reported financial results covering the first quarter of its 2024 fiscal year, the stock has dropped quite a bit. On the day the earnings came out, shares closed down 10.6%. For those who follow my work closely, this might beg the question of my thoughts regarding my most recent article, published in early February of this year. In that article, I mentioned that a downgrade for the company was on the horizon because of how pricey shares were becoming. But between the stock now being down 5.6% from the time I wrote that article through now, and a different perspective I am now taking of the company, I would actually argue that it still remains a pretty solid ‘buy’ candidate at this time.

The market’s overreaction

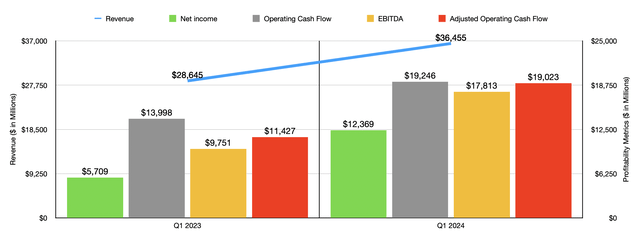

The purpose of this article is not to act as an earnings review of the company. But it is impossible to understand the full health of the business and what is going on with it without touching on the most recent data that is available. It’s also interesting to note why shares took such a beating after announcing first quarter earnings. You see, revenue actually came in $231.9 million higher than expected, with sales of $36.46 billion dwarfing the $28.65 billion generated one year earlier. Earnings per share, meanwhile, totaled $4.71. That was more than double the $2.20 per share reported for the first quarter of 2023, and it was $0.39 per share above what analysts thought it would be.

By every measure, Meta Platforms is doing significantly better than it was even one year ago. Operating cash flow has skyrocketed from about $14 billion to $19.25 billion. If we adjust for changes in working capital, we get an increase from $11.43 billion to $19.02 billion. And lastly, EBITDA for the company expanded from $9.75 billion to $17.81 billion. Despite repurchasing 34 million shares in exchange for $14.64 billion during the first quarter of this year, the company still has net cash on its books of $39.73 billion. This makes the company incredibly safe from a fundamental perspective and makes it one of the true cash cows on the market.

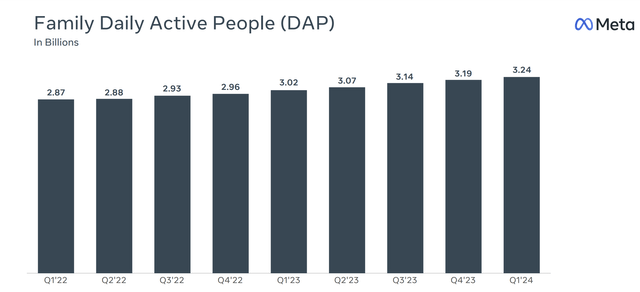

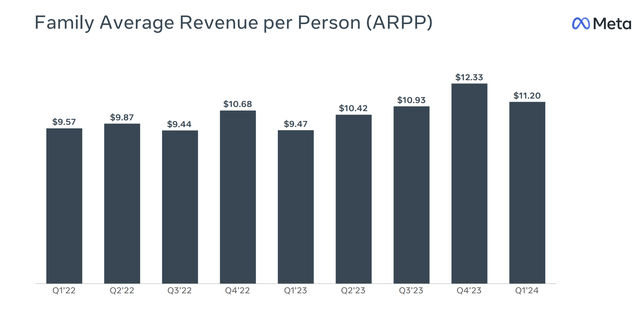

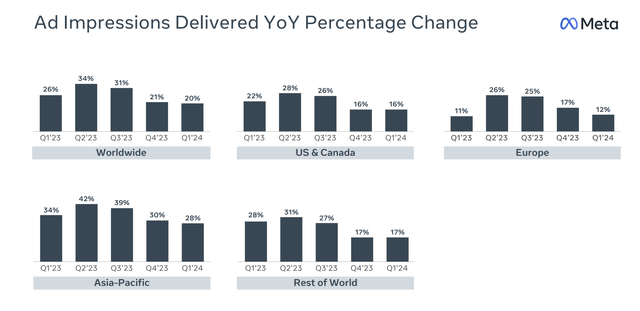

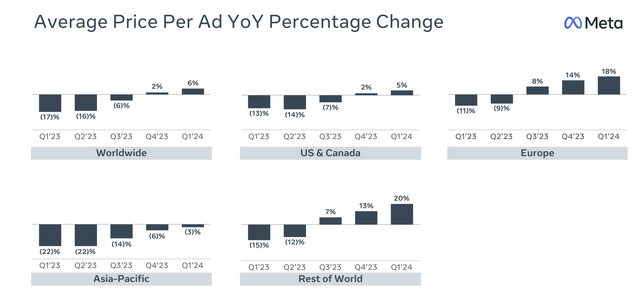

Such strong growth and robust results can be attributed to what I would consider to be a surprising growth trend for the company. You see, the company, despite already being so large, continues to benefit from rather attractive growth. For the Family of Apps that comprises all of its operations, the company totaled 3.24 billion daily active users in the first quarter. In addition to being up from the 3.19 billion reported for the final quarter of last year, it translated to a year-over-year increase of 7.3% from the 3.02 billion reported for 2023. Average revenue per user during this time came out to $11.20. That’s an 18.3% surge from the $9.47 reported one year earlier. Add impressions delivered jumped 20% year over year on a global scale, with the US and Canada posting a strong 16% increase. And the average price per ad managed to grow by 6% because of increased demand and better monetization from new features.

To be honest, I would not expect such a large company to be achieving this kind of growth. But here we are. The world can be a surprising place. You would think that, with numbers like these, the market would be optimistic as opposed to pessimistic. But there were some downsides reported. For starters, management said that they now expect total expenses this year to be between $96 billion and $99 billion. That’s up from the $94 billion to $99 billion previously anticipated. The company intends to invest heavily in growth initiatives. And this includes Reality Labs, which is the firm’s metaverse business. Although management has not provided guidance for this particular set of operations, management did say that they expect operating losses to ‘increase meaningfully’ compared to last year. And in all likelihood, that trend will continue into 2025 as well, considering that the company said that they expect capital expenditures to rise next year as the firm invests ‘aggressively’ to support AI research and other product developments.

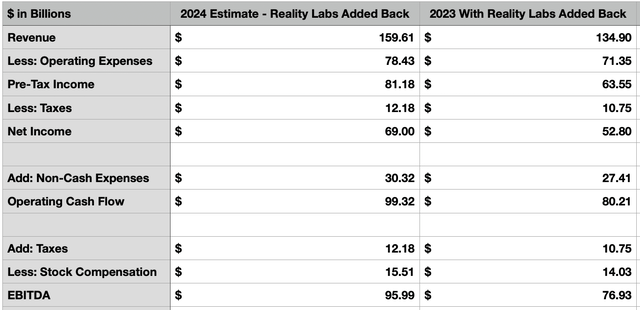

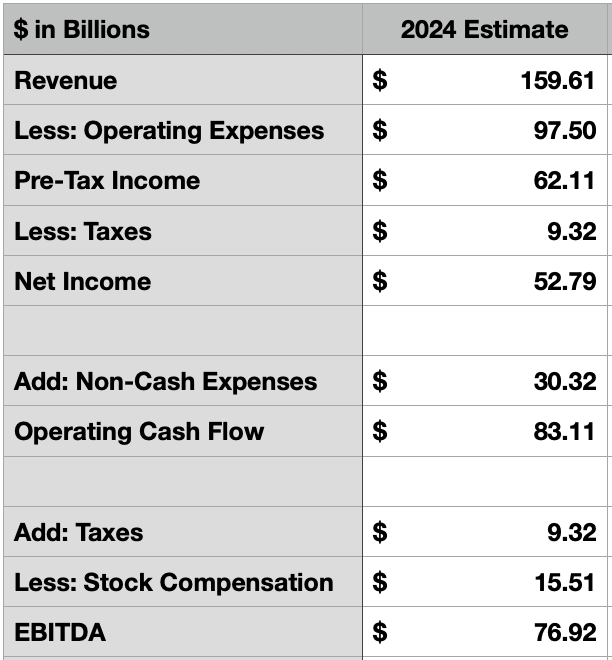

This spending is what has investors concerned. However, I’m not terribly worried. As a value investor, I like to use a set of conservative assumptions in evaluating opportunities. The idea here is that if a company is attractive with conservative assumptions priced in, then it should be very attractive if anything better than that comes to fruition. For the first quarter of this year, revenue came in 27.3% above what it did the year prior. And for the second quarter of the year, if we use midpoint guidance provided by management, we can expect a year-over-year increase of 18%. Management has not provided guidance beyond the second quarter. But for the purpose of conservatism, I’ve decided to assume that the third and fourth quarters of the year see 15% increases compared to the same time in 2023. This is actually a more conservative approach than what I used in my prior article on the company. Currently, I am operating under the assumption that revenue for 2024 will end up being $159.61 billion. In my prior article, I assumed this to be $168.36 billion. While I am being more conservative on this front, I am assuming that non-cash expenses are rising at the same rate that revenue is, as opposed to sticking with what the company achieved in 2024.

Author – SEC EDGAR Data

In the table above, you can see how much in net income, adjusted operating cash flow, and EBITDA I have calculated for Meta Platforms for this year. But keep in mind that everything the company is doing when it comes to Reality Labs is completely voluntary. Management does not need this part of the business to be a success. They could stop everything that they are doing there tomorrow and cash flows would increase significantly. It was this realization that caused me to ultimately pull the trigger on the company in October of 2022. So it would only be appropriate to factor in this kind of scenario into the equation. In the table below, you can see these figures added back into the picture. This would be the $16.12 billion in losses that the company generated in 2023 and, for this year, $19.07 billion in losses that I am estimating based on the assumption that losses might rise this year at a rate that is commensurate with the revenue increase for the business.

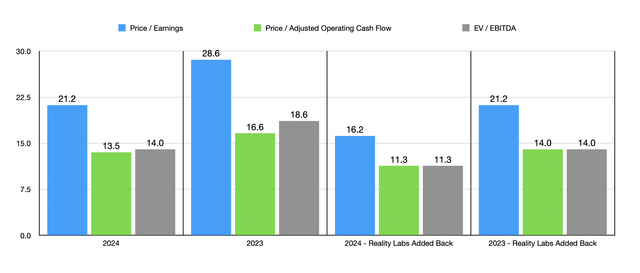

Using these results, I was able to create the chart below. That chart shows how shares are priced using 2023 data and projected results for 2024, as well as for both years if we remove the Reality Labs losses from the equation. Even with the losses, shares of the company look relatively attractive for a firm that is as high quality, large, and fast-growing as Meta Platforms. But if we remove those losses under the assumption that management could cut those operations at any point in time, the stock does turn to look cheap, particularly on a forward basis for 2024. This suggests additional upside from where shares are at this time.

A key growth initiative

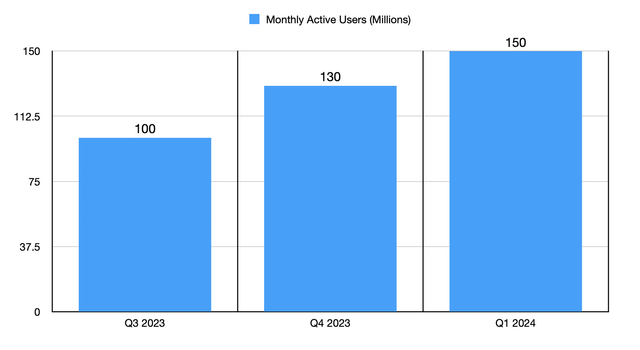

One thing that has attracted me to Meta Platforms over the past several months has been the potential that it has with Threads. If this name doesn’t sound familiar to you, it’s worth mentioning that the platform has been pitched as Meta Platforms’ answer to Twitter (now known as X). Growth achieved by that service alone has been quite strong in recent quarters. In the third quarter of 2023, the company boasted just over 100 million monthly active users for it. This number grew to 130 million by the end of last year before climbing to roughly 150 million by the end of the first quarter of this year.

This is noteworthy because, based on the data that I have seen, Twitter continues to decline. According to one source, Twitter experienced a roughly 30% drop in usage from 2023 to 2024. An article from March of this year, citing third-party mobile analytics firm Sensor Tower, estimated that the number of daily active mobile app users on the platform from the US dropped 23% from November of 2022 through the time that data was collected. And approximately 1 year following the acquisition of Twitter by controversial billionaire Elon Musk, the number of monthly active users on the platform had dropped by roughly 15% globally, with an 18% drop in the US. The growth seen by Threads during this window of time suggests to me that users are finding alternative sources to express themselves. And that is clearly proving to be a benefit for shareholders of Meta Platforms.

Takeaway

From all that I can tell, Meta Platforms is doing quite well. I understand that investors are unhappy with increased cost guidance. But when we look at how shares are currently priced, and we look at growth from initiatives such as Threads, it becomes clear to me that the stock’s upside is not over yet. To be clear, I do think the easy money has been made by this point. But I do think that additional upside that should exceed with the broader market will experience is warranted. Because of this, I’m keeping META stock rated a ‘buy’ for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!