Summary:

- Meta has announced another round of layoff to cut 10,000 employees after an earlier round of 11,000 cuts in November 2022.

- There is also a hiring freeze, which should help Meta reach its efficiency goals in terms of headcount.

- Excess headcount has been a bigger drag on Meta’s earnings compared to its Reality Labs segment in the last few quarters.

- Despite cuts to the employee base, the long-term growth potential of the company remains strong.

- A more nimble Meta should be a boon for investors, as we would see more emphasis on deliverables and better growth in key metrics.

Derick Hudson

Meta (NASDAQ:META) has led other tech firms in reducing headcount and becoming a lean organization. The massive difference in revenue and headcount growth could be seen in the recent earnings report. Meta announced a revenue decline of 4% while its headcount increased by a whopping 20% year-on-year. It was inevitable that Meta would report a massive margin decline due to this trend. The management has made the right noises and decisions when it comes to headcount. After reducing the headcount by 11,000 in November 2022, it has announced another 10,000 cut in employees in the recent week. Together, these two layoffs will cut close to 25% of Meta’s employee base.

The severance package of employees will be a drag on the company’s financials for another quarter. However, by the end of this year, we should see a more nimble organization that is focused on delivering projects. It should be noted that the increase in headcount was a bigger drag on Meta’s earnings compared to Reality Lab. Long-term investors will find this proactive approach by the top management as a positive sign that it is still focused on building a sustainable business with a focus on efficiency. There should be a drastic improvement in the EPS of Meta by year-end, which should help in sustaining the current bull run in the stock.

Single chart shows the error

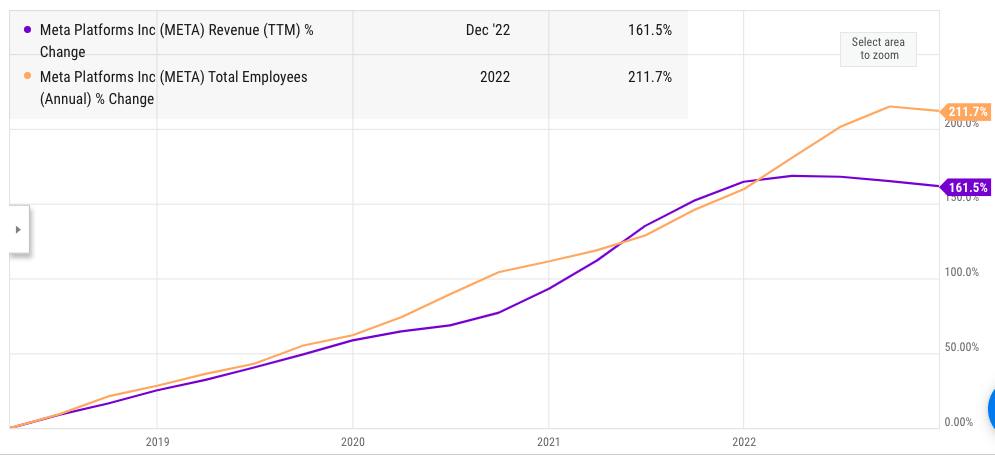

Almost all tech firms wrongly interpreted that the pandemic will lead to a long-term change in user behavior and help in building a higher revenue growth trajectory. This led Meta and other tech firms to hire massively in anticipation of future growth. However, after the opening up, there has been reduced investment by advertisers. The headwinds due to higher inflation and macroeconomic challenges have also been a factor. The error made by Meta is clearly reflected in the revenue and headcount growth trajectory of the company.

YCharts

Figure 1: Revenue and headcount trend of Meta in the last five years. Source: YCharts

We can clearly see in the above chart that Meta’s management has increased the headcount at a pace similar to revenue growth prior to 2022. However, a slowdown in revenue growth did not lead to an immediate halt in headcount expansion, which has affected the margins massively.

Company Report

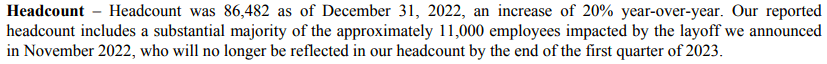

Figure 2: Meta mentioned the delayed effect of the last layoff in recent earnings. Source: Company report

In the recent earnings report, Meta mentioned that its headcount has increased by 20% YoY. The layoffs announced in November 2022 would be reflected in the first quarter of 2023. After taking into account the severance package and other costs, there is likely to be another quarter delay before Meta shows positive earnings improvement.

Similarly, the recent layoffs will also take some time to be reflected. Ideally, we should see a significant improvement in margins by the fourth quarter of 2023. This will help in improving the sentiment toward the stock.

Headcount growth more challenging than Reality Labs

Meta has seen many negative predictions about its heavy investment in Reality Labs. The jury is still out on whether this initiative will be as successful as the company hopes. However, the impact on margins due to the mismatch of headcount and revenue growth has been higher than the Reality Labs.

Company Report

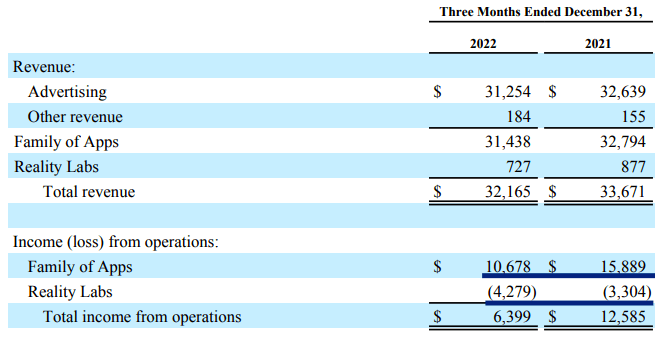

Figure 3: Meta’s revenue and income from different segments. Source: Company report

We can see that there has been over a $5 billion decline in income from Family of Apps business compared to year-ago quarter. At the same time, the incremental loss in Reality Labs segment was less than $1 billion. Hence, over 80% of the decline in income was due to Family of Apps business. Year-on-year growth of 20% in headcount contributed significantly to this decline in income.

Once the headcount aligns itself with revenue growth, we should see rapid improvement in income, margins, and EPS.

Looking beyond layoffs

Layoffs alone will not be a cure for a slowdown in revenue growth. These layoffs will help Meta regain the earlier margins, however, the management will need to convince Wall Street that it can still deliver revenue growth. Meta has a number of levers that should help the company deliver good growth in the next few years. One of the biggest is the improvement in Reels platform. The user engagement on Reels is increasing, and we should see higher monetization from this business.

It is also becoming likely that we will see some sort of ban on TikTok in the US as well as many other Western countries. The growing geopolitical tensions and higher regulations for data security should be a tailwind for the growth of Reels platform. Most of the revenue potential of TikTok would be absorbed by Meta. TikTok had a whopping valuation of $220 billion according to a recent deal, which shows the growth potential for this business segment.

Meta is also trying to build a good subscription business, which should build a recurring revenue stream for the company. The company has absorbed most of the headwinds due to changes in the privacy policy of Apple (AAPL). Going forward, this would not be a challenge for Meta in terms of year-on-year decline in ad rates, and we could see good numbers as the company adjusts to the new policies.

Impact on stock

Meta has already shown bullish momentum in the last few weeks. The stock has jumped by over 60% in the year to date. This has allowed Meta stock to recoup most of the losses it suffered in 2022. However, Meta stock is still significantly short of the peak reached during the pandemic, when it was trading at over $300.

YCharts

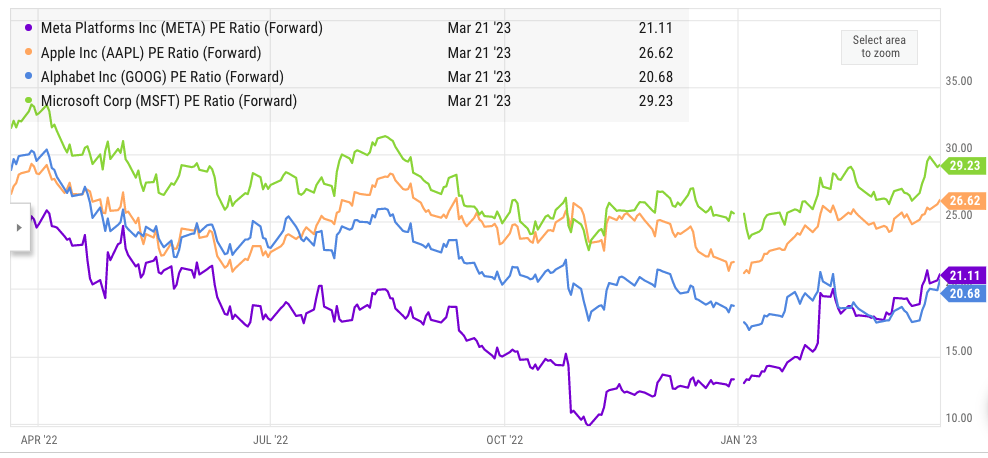

Figure 4: Comparison of forward PE of Big Tech firms. Source: YCharts

Meta’s forward PE ratio is among the lowest within the big tech companies. Rapid improvement in margins due to headcount efficiency should be a strong tailwind for the stock. The company can also show good improvement in the near term due to the monetization of Reels, subscriptions, buybacks, and more focused investment in new initiatives. Meta has a strong moat which makes the stock a good buy-and-hold option, and it is trading at a reasonable rate for a good entry point.

Investor Takeaway

The second round of layoffs announced by Meta will show its positive impact on margins by the end of the year. The company has reported 20% growth in YoY headcount in the recent quarter compared to a 4% dip in revenue. This was the main reason behind the massive decline in margins. As the headcount is streamlined, we should see better EPS in the next few quarters.

Meta stock has already jumped by over 60% this year, but it can still show good momentum, as it is trading at a significant discount to the pandemic peak. The forward PE ratio of the stock is also quite low when compared to other peers. As we see better numbers from Reels and overall margins in the next few quarters, the strong bullish sentiment toward the stock should continue.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.