Summary:

- Meta Platforms, Inc. is an interesting story as the company finally recovers almost to the point we made a good call on investing in it.

- The company’s rapid ramp-up of AR/VR spending, now with competition, is unlikely to pay out.

- The rapid growth in the company’s share price means its free cash flow doesn’t justify its valuation, and Meta stock is now a poor investment.

Justin Sullivan

Meta Platforms, Inc.’s (NASDAQ:META) share price has more than doubled YTD. After recommending the company as one of our top 5 investments of 2022, the company’s share price collapsed, but is finally back to near normal. As we’ll see throughout this article, the market has become overconfident on Meta, making it a poor investment.

Threads (The Good)

Meta has once again shown its strength in traditional markets, by launching the Threads app after substantial unhappiness with Twitter’s rate limiting.

Threads

With massive layoffs, Twitter is in a tough spot. The company needs to cut costs. It’s already refusing to pay rent in San Francisco and dealing with lawsuits as a result. It’s likely hoping to meet a settlement where rent is cut, but with the office buildings backed by massive players, we think this strategy is unlikely to pan out.

Last week, it moved on to the next step after exhausting layoffs and cost cutting. It’s suing lawyers from the acquisition, arguing the $90 million payoff was too much, and it massively rate limited users including those with the blue checkmark. Software issues, after laying off so many engineers, turned that rate limiting into a DDOS attack.

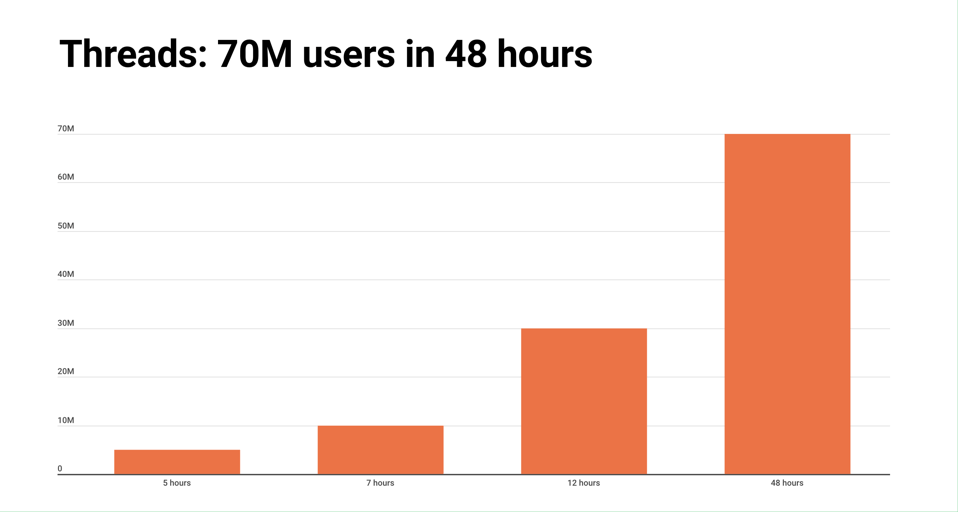

Perhaps in a brilliant move, Meta used the chaos as a chance to launch Threads. This new app is ad-free, with follower carryover from Instagram, a higher carryover limit, no blue checkmarks, and (mostly) bug free. It grew to 70 million users in 48 hours as CEO Mark Zuckerberg used his first tweet in a decade to subtly advertise it. Twitter sent a cease and desist that we don’t expect to get anywhere.

This is perhaps the best decision Meta has made since buying Instagram. We expect Threads, which has beat Chat GPT’s records for growth, to hit >1 billion users. More importantly for Meta, even if Threads doesn’t generate massive revenue by itself (similar to Messenger), we expect it to draw more people to the Meta ecosystem while hurting a major competitor (Twitter).

Financially, though, even if Threads replaces Twitter’s revenue completely, it’s not a needle mover.

AR / VR and Apple (The Bad)

Of course, Meta’s money has been going to something else the entire time, and that’s the company’s AR / VR goals.

Unfortunately for Meta, Apple (AAPL) has launched the Vision Pro. Of course, it’s not price competitive, but it represents a new project. Supposedly, Apple is continuing to work towards much more reasonably priced glasses as the next step. Given that Meta is losing billions of dollars per quarter as things currently stand ($15 billion annualized) from AR / VR, this development puts it in a jam.

Apple clearly has the financial prowess to remain easily competitive with Meta. It has internal silicon to reduce prices. It has other businesses that can help subsidize the project. $3500 vs. $400 is not price competitive. However, there are rumors (which panned out for the Vision Pro) to reduce prices with glasses or other products.

The key risk in our view is a lack of demand for the segment. Meta has been forced to reduce prices to maintain demand. Perhaps even more concerning, after massive capital spending, 2022 revenue for the segment was below 2021. Right now, we don’t see a path for the company to make the segment a winner, and the entry of Apple just emphasizes the competition.

Meta and Shareholder Returns (The Ugly)

The ugly part is whether Meta has the capability to drive shareholder returns to justify its new $750 billion valuation.

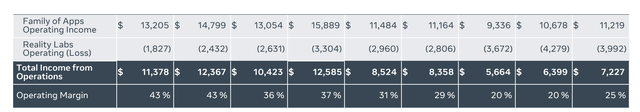

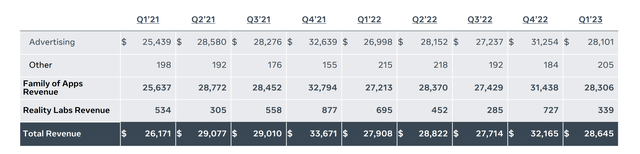

The company’s net income has dropped to roughly $30 billion annualized. The company’s revenue has stagnated substantially. The company’s total 2021 revenue was $118 billion. The company’s total 2022 revenue was $117 billion. Twitter’s 2021 revenue was $5 billion, so even if the Meta can replace and double the revenue, it’s total is only high single-digit growth.

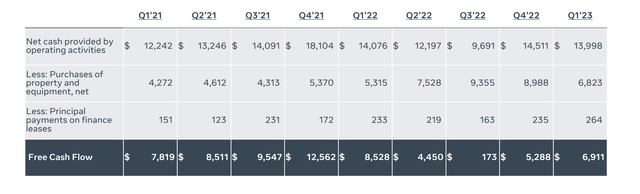

The company has a roughly $40 billion net cash position, and that lines up with its recent buyback program. Unfortunately its share price appreciation YTD makes that buyback program much less valuable. After that, the company’s returns are based on its free cash flow, or FCF. Capital spending remains high despite the fact growth has not remained as high.

The company earned $18.5 billion in FCF in 2022. In 2021, that number was almost $40 billion in FCF. The company needs almost $80 billion in FCF to justify its valuation given the tough market it is in and lack of continued growth. That makes the company a poor investment.

Thesis Risk

The largest risk to our thesis is that Meta can always redirect its business. The company is losing massive income from AR / VR, but we expect it can get an income boost from Threads once it opens up advertising as user count grows. Given the company’s market capitalization of just under $750 billion, that combination can push income to a reasonable level.

Conclusion

Meta Platforms, Inc. is an impressive company. The company’s decision to build Threads, launching it at an ideal time, with rapidly growing user count is a great call. We do expect that Threads will succeed in replacing Twitter given Twitter’s continued financial struggles and lack of ability to keep both its employees and users happy.

However, there’s some bad news for the company. It’s oft-touted massive VR / AR spending now has a wealthy competitor in the ring, one with a product ready to ship to customers. And the company can’t easily compete. We expect this expense, combined with Meta’s rapid rise in market cap versus FCF, to make it a poor investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.