Summary:

- Meta Platforms, Inc. advertising revenue has decreased while R&D and operating costs increased rapidly.

- The company’s ability to generate revenue and profitability has declined.

- Meta’s poor investments in the Metaverse could lead to short-term financial difficulties.

- There could be no positive aspects of Meta Platforms, Inc.’s financial report for Q4 2022.

Derick Hudson

Investment thesis

Meta Platforms, Inc. (NASDAQ:META) has been a tech giant and currently the leader in the Metaverse. However, a massively increasing capital expenditure and decreasing revenue could lead META to short-term financial difficulties.

The revenue decreases and expenses increase

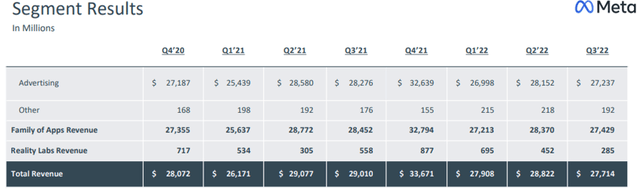

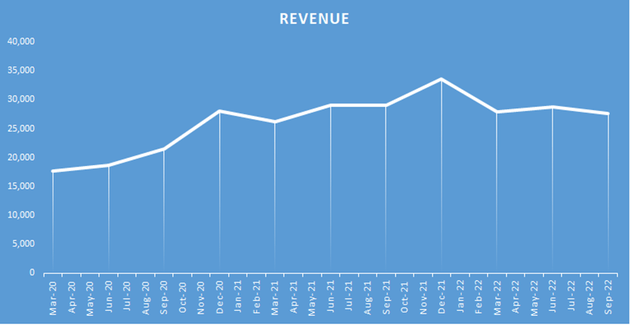

Meta’s financial report for the third quarter of 2022 showed revenue of $27.7 billion USD, a 4% decrease when compared to the same period last year. As a result, after peaking at $33.7 billion in the fourth quarter of 2021, Meta’s revenue has declined since then.

META revenue has declined. (Seeking Alpha)

The main reason is that advertising revenue is gradually declining, reaching only $27.2 billion USD, lower nearly 4% compared with the same period in 2021. The downtrend occurred in the context of high inflation, which caused many businesses to reduce advertising costs, as well as Apple’s privacy changes. Not to mention how Tiktok’s rapid growth and its market share has harmed Meta. In addition, Reality Labs continued to report negative results, with the revenue of only $285 million, a 49% decrease year-on-year.

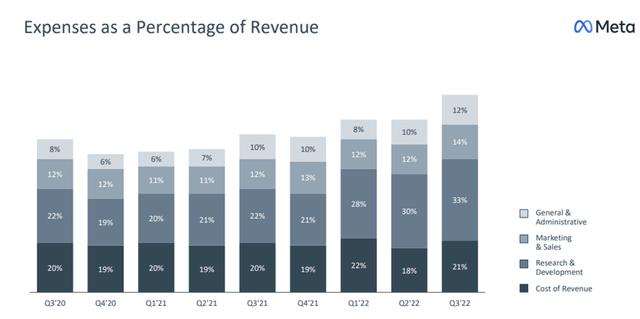

Despite the decline in revenue, the cost of revenue increased to $5.7 billion, accounting for 21% of total revenue. As a result, gross profit was only $22 billion USD in 2021, a 6% decrease from the previous year.

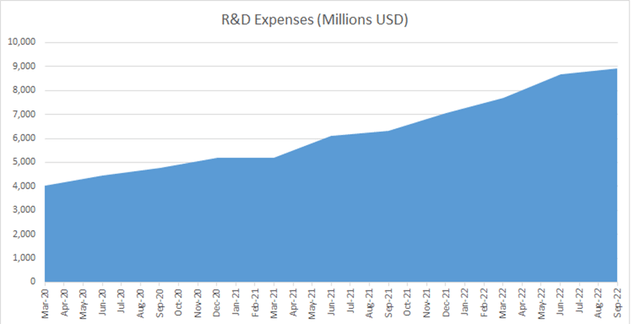

Aside from the higher cost of revenue, Selling General & Administrative Expenses and R&D Expenses both rose in respond to revenue falling. Over the same period, Selling General & Administrative Expenses increased by 8% to exceed $7 billion USD. This may be the reason why Meta announced the layoff of over 11,000 employees. Furthermore, R&D expenses have risen from $4 billion in the first quarter of 2020 to nearly $9 billion in the third quarter of 2022, accounting for 33% of total revenue.

Meta R&D expenses (Seeking Alpha)

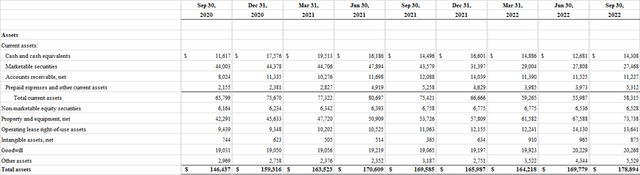

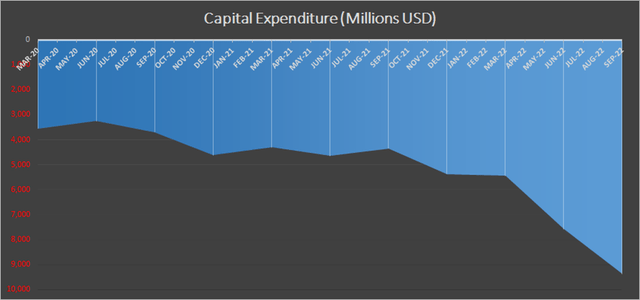

The significant investment in R&D Expenses is also reflected in Capital Expenditure, which is expected to increase when reaching $9.4 billion at the end of the third quarter of 2022, including Finance leases. This can also be seen in the balance sheet, where Meta’s net property, plant, and equipment have steadily increased over the years, reaching $87.3 billion by the end of September 2022 and accounting for 50% of total Assets.

Meta capital expenditure. (Seeking Alpha)

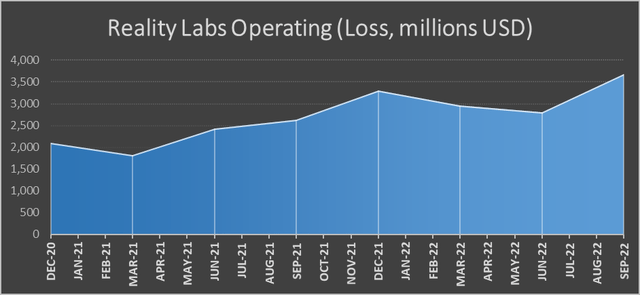

Meta has previously invested tens of billions of dollars in the design and development of the Metaverse. In terms of Reality Labs, Meta reported a $3.6 billion loss in the third quarter of 2022. It is expected that this loss will continue to rise in 2023. The company anticipates that increased investments in Reality Labs will result in increased earnings in the long run.

Reality Labs Operating. (Meta earning presentation.)

As a result, despite a decrease in revenue and a sharp increase in all expenses, Meta’s net income in the third quarter of 2022 was only $4.4 billion, a 42% decrease from the same period the previous year. As a result, Diluted Earnings Per Share are only $1.64, representing a 49% decrease in comparison to the same period last year and indicating a significant drop in profitability per share.

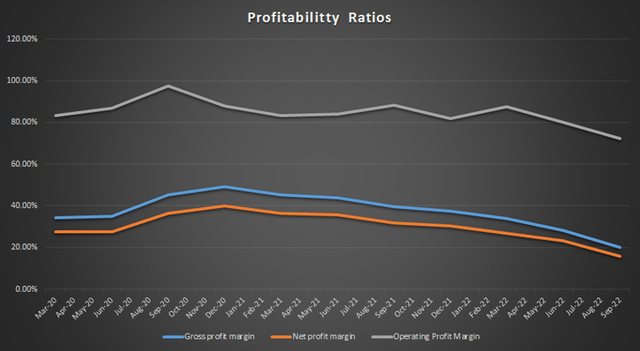

The profitability ratios has decreased

Despite the fact that Meta invests heavily in assets, particularly the Metaverse, it does not appear to be profitable. Profitability ratios such as gross profit margin, net profit margin, and operating profit margin have declined, indicating that Meta’s ability to convert revenue to profit is inefficient.

Meta profitability ratios. (Seeking Alpha)

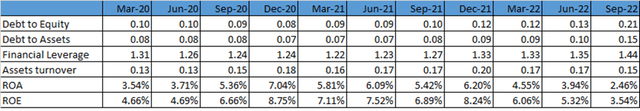

Furthermore, Meta’s ROE (Net Income/Equity) and ROA (Net Income/Total Assets) have decreased, reaching 3.54% and 2.46%, respectively. The reason is that Net Income decreased sharply while Equity and Total Assets increased, indicating that the company’s ability to generate profits for shareholders from business activities has also declined.

According to analysis of ROE based on Dupont Equation, the reason is that net profit margin fell sharply from 81.7% in the third quarter of 2021 to 72.3% in the third quarter of 2022. Furthermore, due to a 4% decrease in revenue, Asset Turnover (Revenue/Total Asset) decreased, indicating that Meta’s ability to generate revenue from assets has been lessen. The good news is that because Meta applies minimum financial leverage, the Leverage ratio has been low, even when the market is rising.

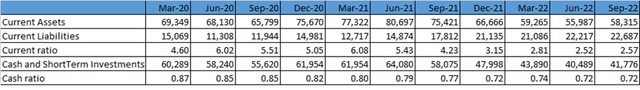

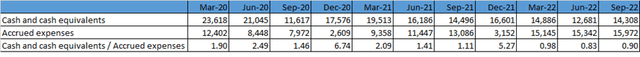

Cash & short-term investments are excessive

Cash & short-term investments were always at a high level as of September 30, 2022, reaching $41.7 billion, accounting for 23% of total assets. As a result, the Cash ratio (Cash and Short Term Investments/Current Liabilities) and the Current ratio (Current assets/Current liabilities) were also high, with Cash and Short Term Investments accounting for a large proportion. This demonstrates Meta’s liquidity, credit quality, and ability to meet short-term obligations. Hence, Meta can be operating when the global economy enters a recession and inflation remains high.

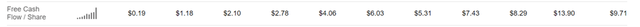

When it comes to cash flow, specifically, Free Cash Flow per Share decreased in the third quarter of 2022, falling to $0.12 USD while standing at $3.46 USD in the same period last year. With one quarter remaining in 2022, Free Cash Flow per Share TTM has decreased corresponded to fiscal 2021 but remains higher than that of 2020.

Furthermore, cash and cash equivalents/accrued expenses have fallen. Specifically, after peaking at 5.27 at the end of 2021, this indicator plummeted to 0.9 by the end of September 2022. The reason for this was that cash and cash equivalents decreased slightly before recovering, but accrued expenses increased dramatically for three consecutive quarters to nearly $16 billion USD. So, the future-looking financial obligations is expected to go higher.

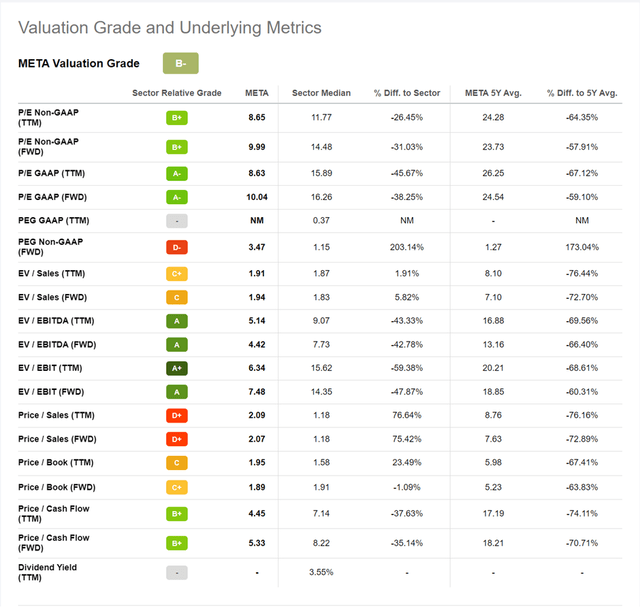

Meta valuation

Regarding multiples valuation, Meta has a P/E Non-GAAP FWD of 9.99, which is lower than the sector median of 14.48. Its P/E Non-GAPP TTM is 8.65, which is -26.5% lower than the industry average. However, the PEG Non-GAAP FWD is 3.47, 203.14% higher than the industry average of 1.15. Furthermore, Meta’s FWD Price/sales and TTM Price/sales increased to 2.07 and 2.09, respectively, which were higher than the industry averages of 75.42% and 76.64%. It indicates that Meta’s stock market price has appeared to be more expensive than the sector relative to revenues.

Although Meta has experienced a recent sale off causing its market price to drop more than 64% since its September peak. Its current market capitalization is at about $359 billion dollars while its enterprise value is at around $343.89 billion dollars. Thus, Meta market shares price is relatively higher than its intrinsic value.

Conclusion

There could be no positive prospects in 2023 for Meta in the context of a pessimistic economy and the stiff competition of the industry. Capital expenditures, including the Finance leases, is expected to be $32-33 billion in 2022, according to their plan. In 2023, capital expenditures for data centers, servers, and network infrastructure is projected to fluctuate between $34 and $39 billion. The total cost will be between $96 and $101 billion USD, while the company has not provided positive revenue forecasts for 2023.

The pursuit of Metaverse has led Meta to spend a lot of money on R&D while this field has not generated revenue yet. Furthermore, Tiktok’s fierce competition, the tendency of lowering advertising costs during economic slowdown, and Apple’s privacy changes on iOS have caused the company’s revenue to fall. Looking ahead to 2023, there are no encouraging signs, with a total cost of $90-100 billion USD and a decline in Free Cash Flow per Share. As a result, we believe Meta stock will continue to fall after its Q4 earning report (expected on February 1 after the market close) and in 2023. It would be better if the metaverse project provides a clearer signal. However, it should be noted that Meta spent more on R&D in the fiscal year, but may create commercial advantage in the long term.

Co-author, Xuan Hoai.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.