Summary:

- Meta’s shares are up nearly 5x since their 2022 lows, due to efficiency focus, Reels success, and top-notch ad targeting post-ATT.

- Concerns arise as Reels monetization improvements plateaus, competition increases, and Zuckerberg shifts focus to AI, prompting questions about Meta’s future.

- Despite worries, Meta’s growth algorithm, strong moat, and multiple growth drivers suggest a bright future with undervalued potential.

gorodenkoff/iStock via Getty Images

Meta (NASDAQ:META) has seen its shares nearly 5x from their 2022 trough, driven by a relentless focus on efficiency, huge success in Reels, and achieving best-in-class ad targeting capabilities in a post-ATT world.

Today, as Reels monetization reaches neutrality, comps begin to get tougher, and Zuckerberg directs a lot of attention and resources toward AI, investors are once again questioning the company’s future.

This is a good time to explain Meta’s complex growth algorithm and show why it has a very bright future ahead.

Introduction

I’ve been covering Meta on Seeking Alpha since July of last year. Across four articles, I discussed Meta’s year of efficiency success, the burden of the Reality Labs segment, the significant remaining upside heading into 2024, and the potential implications of a TikTok ban.

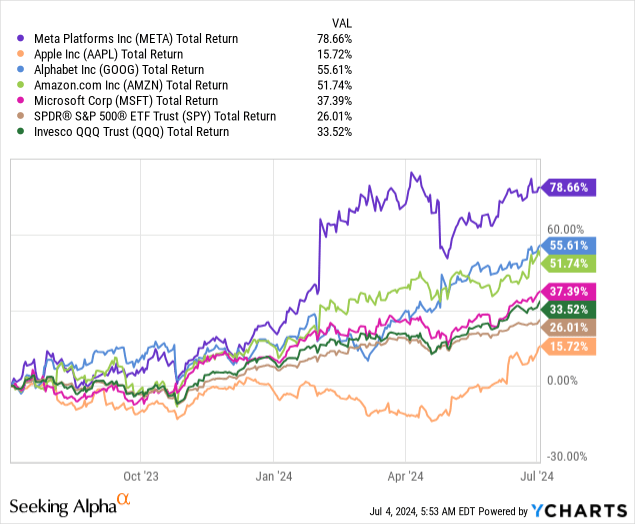

I maintained a Buy rating throughout the period, which turned out to be correct:

With Meta hugely outperforming the rest of its big tech peers and the indices, it’s reasonable to question the remaining upside.

To answer, we need to start by discussing Meta’s moat.

Meta’s Moat Post-ATT

In April 2021, Apple (AAPL) released an iOS update that included the App-Tracking-Transparency or ‘ATT’ framework. Until then, platforms like Facebook were able to track users’ actions across apps, which enabled deterministic measurement of the return on ad spend. Simply put, Meta and its advertisers knew the exact conversion rates of ads shown on Meta’s platforms.

Then came Apple, and under the excuse of privacy, it effectively killed thousands of applications whose business model relied on advertising, a form of monetization that was harder for Apple to collect fees from.

Meta was then forced to find a new way to measure the ROAS for its customers and turned to a probabilistic model. This required billions of dollars of investment, specifically on GPUs, as Meta had to build a machine-learning algorithm to gauge the conversion rates of its ads.

Aside from Alphabet’s (GOOG) Google, there aren’t too many companies in the world with enough resources to build a similar algorithm.

As a result, both Meta’s and Google’s moats significantly strengthened. Not only do they have the most eyeballs and time spent on their platforms, but they are now years ahead of any alternative in terms of measurement, and targeting.

This didn’t only kill other ad-based applications, it also made thousands of small businesses go out of business, as it’s harder to use probabilistic measures in their case.

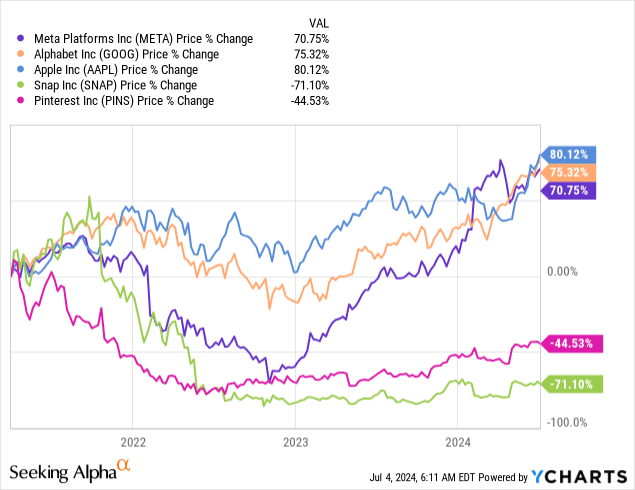

It took some time, but both Meta and Google are close to beating Apple since that ATT release (and they were way ahead until the recent WWDC surge), while smaller peers like Snapchat (SNAP) and Pinterest (PINS) couldn’t deal with the ATT implications and are still very much below their April 2021 levels.

This gives us the relevant backdrop for the next section.

Meta’s Playbook & Reels Monetization Worries

Leveraging its best-in-class advertising offering, Meta is by far the industry leader in monetizing the most popular features of 2024. This includes Stories, and of course, Reels.

Ever since TikTok took the world by storm, investors were afraid that Meta would lose its dominance in the social media landscape. However, in a typical Meta way, Zuckerberg was quick enough to realize they needed to add short-form video, and engagement skyrocketed.

Then, as Reels was very successful in increasing engagement, investors were worried about its dilutive effect on monetization.

Every time Meta adds a new feature, it starts by making it the best possible experience and then begins incorporating ads over time.

As of 2024, Reels have reached monetization neutrality, meaning Meta is essentially complacent whether a user goes through the feed, looks at Stories, or scrolls Reels.

This takes us to today.

Extraordinary Success Brings Along Worries About The Future

All those struggles that Meta encountered, including building the post-ATT infrastructure, increased competition from TikTok, regaining profitability, and dealing with a tougher advertising market, are a story of the past.

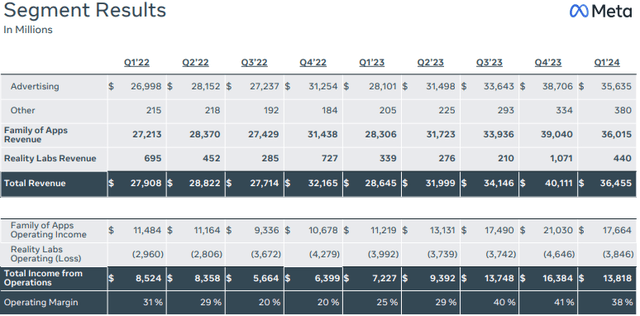

Pretty much since the second quarter of 2023, Meta had quarter after quarter of revenue growth acceleration and margin expansion:

As we can see, the upcoming second quarter will still enjoy easy comps, specifically on the margin front, but from that point on, Meta will start lapping much better quarters.

Furthermore, Reels monetization reached optimization in early 2024, so it will still be a big tailwind throughout the year, but it won’t have this outsized impact from 2025 and beyond.

Once again, investors worry about Meta’s future prospects, especially following the recent earnings call, as Meta raised both its expense and capex outlook.

Meta’s Increased Expense Guide & AI Investments

Let’s start with the profitability outlook. So far, Meta raised its expense outlook primarily due to higher legal costs, and higher infrastructure costs. This does not reflect any meaningful change in the margin outlook for the company.

Investors are justifiably uncertain about Meta’s path to monetize its AI efforts. However, there are several things that should be remembered.

First, when it comes to the development of the Llama model, Meta is playing defense against closed AI models in hopes that they won’t use their AI capabilities to (1) take away engagement from its platforms and (2) diminish the leadership of its ad platform offerings.

You can easily understand that if you use closed generative AI models to generate content and/or ads, you might use Meta’s platforms less. Making it open source makes sure the value remains in Meta’s networks.

Second, so many times in the past Meta had success with the playbook we just discussed, I see no reason to doubt Zuckerberg’s ability to succeed once again.

Zuckerberg is clearly happy with the ‘Efficient Meta’, and I can’t envision him going back to the old days of reckless spending.

With that, let’s turn to top-line growth.

The Top-Line Growth Algorithm Going Forward

Finally, we reach the key issue of this article. At this point, I think we established that margins will remain somewhat stable going forward and that Meta has a huge moat when it comes to time spent on its platforms, and monetizing it.

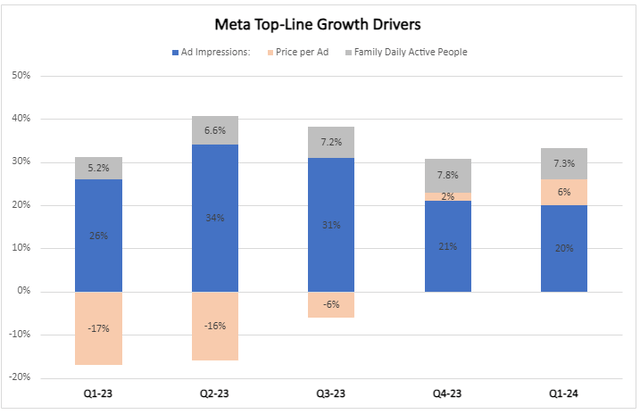

The main drivers of Meta’s top-line growth are reflected in the following graph:

Created by the author using data from Meta’s reports.

As more people become more engaged with the platforms, Meta generates more ad impressions. As the return on those ads improves, Meta charges a higher price.

Importantly, another major factor that influences the price per ad is inventory. This means that if ad impressions grow it creates a downward pressure on price.

The optimal period for revenue generation is when ad impressions are growing but demand is so high that price is growing too.

Until now, ad impressions benefitted from Reels’ ad load increasing sharply. As we progress through the quarters, this will become a less meaningful tailwind.

So, what do Meta’s growth prospects look like in the future?

First, user growth, which remains steady in the mid-to-high single-digit range (crazy to think about as Meta now has 3.24 billion daily users). This will lead to more ad impressions.

Second, ad load, as Meta continues to incorporate more ads into the platform even though most features are pretty loaded up already.

Three, price per ad, as Meta continues to offer a best-in-class advertising platform for advertisers, with a constantly improving Advtange+ suite.

Four, new products and features, such as Threads, which recently reached 175 million monthly actives, and Meta AI.

Five, higher digital advertising budgets, as more and more spending transitions to digital, and overall advertising spending continues to grow.

Six, WhatsApp Business, which continues to gain traction, as reflected by the 85% growth in non-advertising FoA revenues last quarter.

Valuation & Low Consensus Estimates

Considering all of the above, I find consensus estimates for 12% revenue growth in 2025 extremely low. In addition, EPS estimates reflect essentially flat margins, despite the fact that this year’s margins include several one-offs, primarily regarding legal costs.

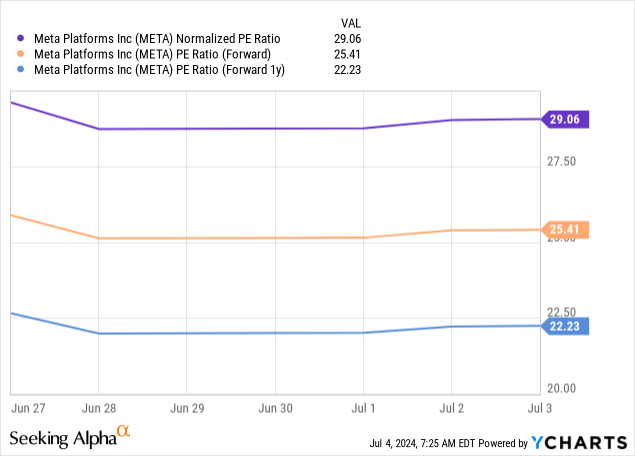

With that in mind, let’s take a look at Meta’s current multiples:

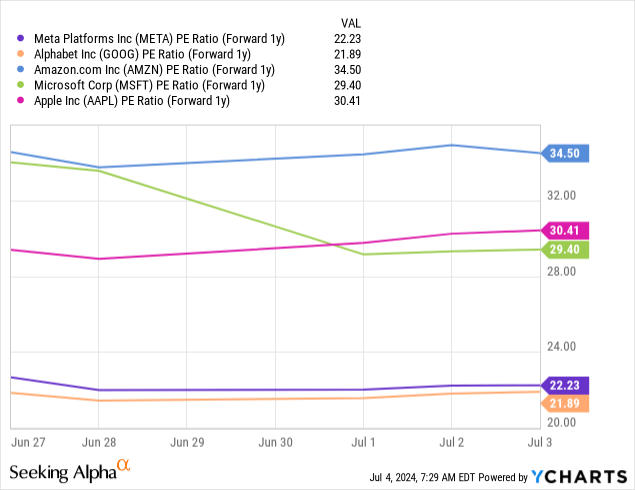

At 22 times CY25 earnings, Meta is slightly above Google as the cheapest among big tech:

That puts Meta at a market average valuation and a convenient 1.8x PEG. In my view, considering all the growth avenues Meta has and its extremely wide moat, this valuation is too low.

In my view, a 2x PEG would be fair, getting us to a price target of $574 a share, which reflects 13% upside, and a 25x P/E on CY25 earnings.

In addition, I expect Meta will surpass EPS estimates by a very significant margin, but I’ll leave that out of the calculation.

Conclusion

Meta has multiple drivers for continued mid-teens growth while at least maintaining current profitability.

Consensus estimates materially underestimate the company’s ability to sustain its efficiency gains, increase engagement, and continue to improve its advertising capabilities.

Furthermore, those estimates don’t reflect potential success in Threads, direct AI monetization, and WhatsApp business.

Even if consensus estimates are correct, Meta is still undervalued, trading at a market-average low-twenties multiple.

If expenses go out of hand it might create a near-term selloff, similar to what we say post-earnings, but I find that unlikely and irrelevant from a long-term perspective.

I reiterate Meta at Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.