Summary:

- Meta Platforms Inc., formerly Facebook, is undergoing significant restructuring, with 21,000 employees laid off in two rounds. The company’s Reality Labs division, focused on VR and AR, has yet to report a profit.

- Meta’s primary source of revenue, digital advertising, is maturing, and the company’s growth is slowing. The newly launched Threads app is expected to boost Meta’s revenue growth by attracting users from Twitter.

- Despite these challenges, I suggest that Meta is currently priced within the range of fair value. The company’s future performance will largely depend on its ability to increase growth.

Leon Neal

This article is my annual update for Meta. My last Meta article can be found here.

Company Description

Meta Platforms, Inc. (NASDAQ:META) is the largest global online social media and social networking service.

Until recently the Meta ecosystem consisted of 4 key applications – Facebook, Instagram, Messenger and WhatsApp. In July 2023 the company announced the creation of a 5th app called Threads. The company also has an augmented and virtual reality business selling both hardware and software applications in a division called Reality Labs.

The bulk of the company’s revenues come from the selling of advertising placements. The company currently has 2 reportable operating segments – Facebook Family of Apps (which comprises the advertising business and the other revenues collected from the social network business) and the virtual reality business called Reality Labs.

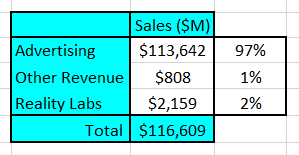

The most recent annual report showed the following revenue breakdown:

Author’s compilation using data from Meta Platforms’ 2022 10-K filing.

It is estimated that 43% of revenues come from North America, 23% from Europe and 24% from Asia-Pacific.

Meta implemented a major restructuring in November 2022 where 11,000 employees were made redundant (almost 13% of the workforce). The company took a $4,611 M charge for the restructuring which obviously negatively impacted on the reported operating margins.

In March this year Meta announced a further round of restructuring and employee layoffs. Another 10,000 employees are to be terminated. The company took an additional charge of $1,144 M in the 2023 Q1 results.

Investors should note that the Reality Labs division is yet to report an operating profit and operating losses have been increasing year on year (in 2022 the reported operating loss was $13,717 M).

Digital Advertising Market

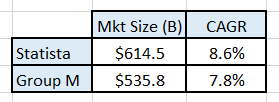

There is some conjecture about the exact size of the global digital advertising market. Statista provides a reasonable summary of the “book-ends” of the current market estimates and the expected future growth rates:

Statista

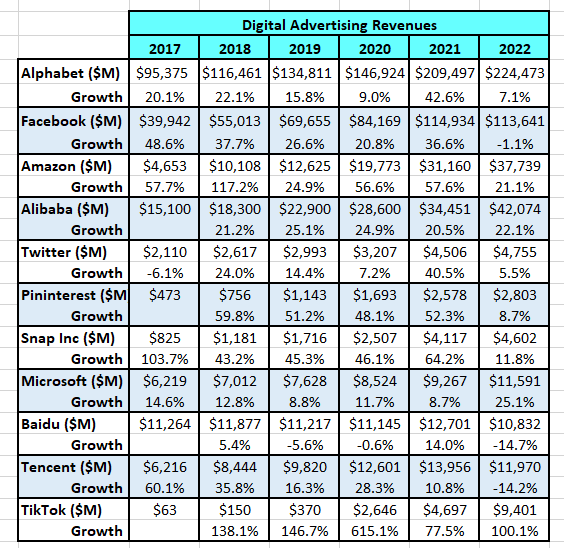

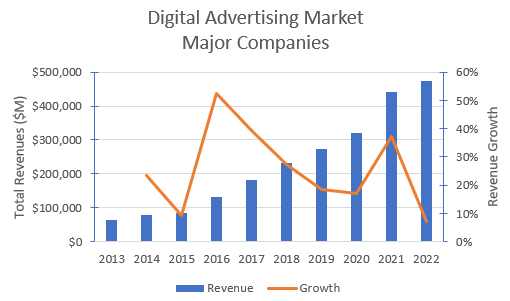

The digital market is dominated by a small number of companies but particularly by Meta and Google (GOOG) (GOOGL). Fortunately, most of the major market participants are listed companies. I have used their annual regulatory filings to put together this snapshot of their reported digital advertising revenues:

Author’s compilation using data sourced from each company’s 10-K filings with 2 exceptions – TikTok and Alibaba.

Note the TikTok’s revenues are based on estimates published by Business of Apps and Alibaba’s advertising revenues are the author’s estimate assuming that they represent 45% of its China commerce revenues.

Given that these companies comprise almost 90% of the global market (based on the lower Group M estimate of the market’s size), I have summed their revenues over time to get an appreciation of what the market trends are:

Author’s compilation.

The data indicates that prior to the COVID pandemic, sector revenue growth had started to decline, and it could be concluded that the sector was rapidly maturing. The COVID lockdowns had a major stimulatory effect on the digital advertising market. By late 2022 we started seeing signs that as the global economies re-opened, digital advertising revenue growth resumed its previous downward trajectory.

Meta has been at the forefront of the declining revenue trend.

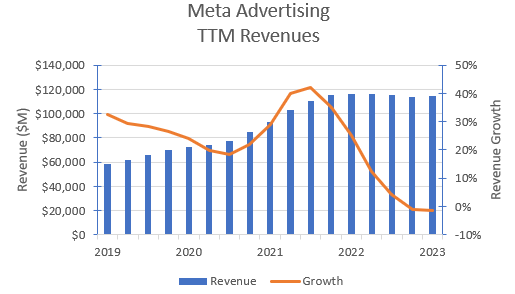

The following chart shows Facebook’s trailing 12-month revenue and annual growth rate updated quarterly since Q1 2019:

Author’s compilation using data from Meta Platforms’ 10-Q filings.

The data indicates that Meta’s trailing 12-month advertising revenues peaked during the 1st quarter of 2022 and have been declining ever since.

Meta’s declining revenues not only coincide with the maturing of the entire sector but also with the privacy changes introduced by Apple to its iPhones in April 2021.

As a result of these changes advertisers on many social media platforms have not been able to gain access to the granular user data that they had previously received. This makes advertising on these platforms less attractive and may have been a significant contributor to the slowdown of the entire sector.

The Q2 earnings reports due later this month (July 2023) will be extremely important for all social media investors (not just Meta).

Virtual & Augmented Reality Market

The virtual reality (VR) and augmented reality (AR) market comprises hardware, device controlling software and content. There are wide discrepancies about the current size of the VR/AR market.

A recent post by Statista claims that the virtual reality market at the end of 2022 was about $12 billion in size. There are many research companies who have forecast the long-term potential revenues for the sector. A typical estimate from Global Data believes that the market by 2030 will be $50 billion which represents a compound growth rate of 24%.

Meta acquired its core VR investment in 2014 when its purchased Oculus for $2 Billion. This investment has been supported with additional acquisitions of several VR software companies.

Although Meta does not report how it allocates its personnel it stated in its 2022 10-K filing that 18% of 2022 expenses were allocated to the Reality Labs division.

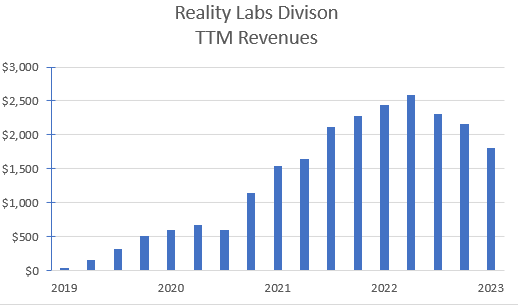

Meta has been providing Reality Lab’s revenues for the past 4 years and the following chart shows trailing 12-month revenues updated quarterly:

Author’s compilation using data from Meta Platforms’ 10-Q filings.

The concerning issue is that revenues appear to have peaked during Q2 of 2022 and have been declining quarter on quarter ever since.

This has not gone unnoticed by investors who are raising concerns that Meta is over-investing in the VR market and may not be able to generate an acceptable long-term return on investment.

Meta’s Historical Financial Performance

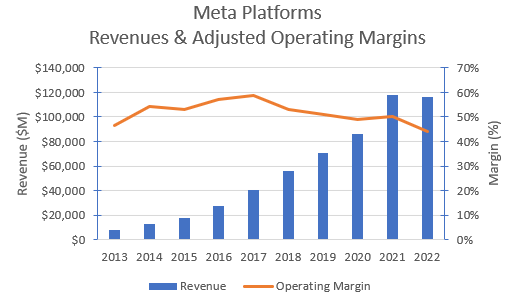

Meta’s historical revenues and adjusted operating margins are shown in the chart below:

Author’s compilation using data from Meta Platforms’ 10-K filings.

The reported operating margins have been adjusted for the impact of:

Operating leases (converting the lease payments to debt and depreciation).

Research & Development expenses by eliminating this as an operating expense (this should really be treated as a capital investment) and I have replaced it with an R & D amortization charge (I have assumed that the R & D investments have a 3 year life).

Capitalizing 20% of the expensed Sales & Marketing charge and turning it into an investment with a 3-year life (I assume that this portion of the expense is about promoting the brand for the long term).

Elimination of identifiable extraordinary expenses.

The chart indicates that although Meta’s operating margins are very healthy there is evidence that margins may have peaked and are now showing a downward trajectory. This trend started before COVID and has continued.

I suspect that much of the margin tightness has been caused by political, regulatory, and competitive pressures which are likely to increase over time.

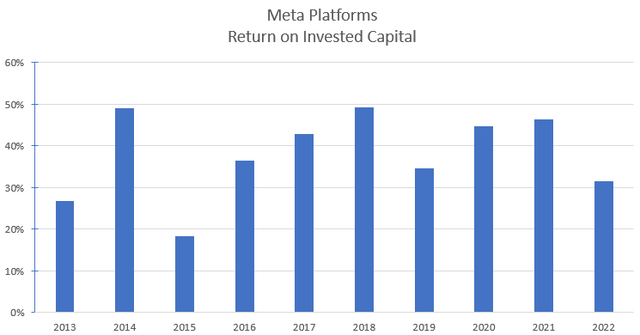

The strength of a company’s competitive position is generally reflected in its return on invested capital. I have adjusted Meta’s published financial statements to more appropriately reflect where the company is investing its cash.

My adjusted return on invested capital (ROIC) history for Meta is shown in the following chart:

Author’s compilation using data from Meta Platforms’ 10-K filings.

Note that I have adjusted the published financial data for:

- One-off extraordinary expenses.

- Operating leases.

- Capitalization of Research & Development expenses.

- Partial capitalization of Marketing & Sales expenses.

- Adding back to the capital base all asset write-offs.

Meta’s ROIC is both high and very stable, which leads me to conclude that its relative competitive position to date has been very strong.

I am concerned that if Meta cannot resolve the loss in quality that advertisers are experiencing since the introduction of technology changes to protect users’ privacy then I expect that margins will continue to decline and this in time will lead to a lower ROIC.

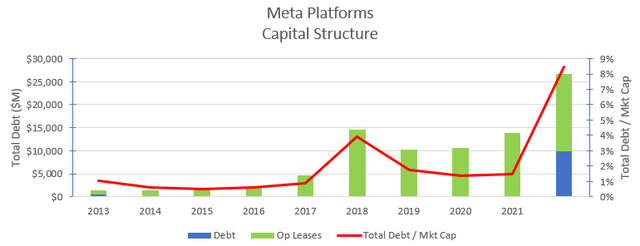

Meta’s Capital Structure

I have no significant concerns about Meta’s capital structure as shown in the following chart:

Author’s compilation using data from Meta Platforms’ 10-K filings.

The chart indicates that Meta has only recently taken on traditional long-term debt. Meta’s debt structures are within the typical ranges for companies in its sector. There is no doubt that as the company matures it will take on more debt and release more of the value embedded in its balance sheet back to shareholders.

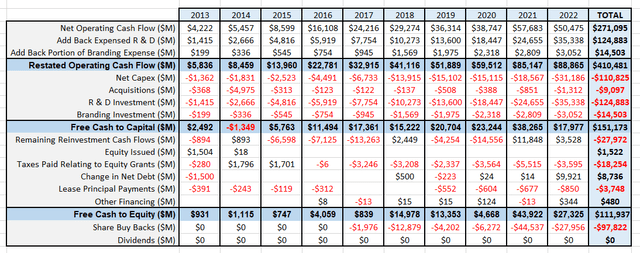

Meta’s Cash Flows

The following table summarizes Meta’s cash flows over the last 10 years:

Author’s compilation using data from Meta Platforms’ 10-K filings.

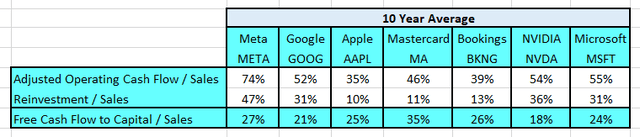

Over the last 10 years Meta has generated 27% of free cash flow to capital from its sales revenues. This is an excellent result – and in the data that I collect there is only one other company which is higher – Mastercard (MA). This is shown in the following table:

Author’s compilation using data from individual company 10-K filings.

The table also highlights the extraordinary level of reinvestment that Meta has been making back into its business. An important issue is – what is the reinvestment split between the Family of Apps division and the Reality Labs division?

Given the latest restructuring it is possible that management may be scaling back its commitment to the Reality Labs division. This may free up additional cash which could be used for an acquisition or share-buybacks.

Meta only returns cash to shareholders via share buybacks which until 2020 had been relatively modest. Over the last 2 years Meta has bought back $72,493 M in stock (this is not an insignificant amount relative to the company’s market capitalization).

In 2022 Meta expanded its balance sheet for the first time by taking on $9,921 of net debt. This is normal for maturing technology companies and a large portion of this debt was used to fund the 2022 share buybacks.

The level of future buybacks will probably trend lower over the coming years, but I expect that it will be higher than the company’s 10-year average as the company scales back its level of reinvestment and takes on additional debt.

Key Risks Facing Meta

The biggest threats to Meta’s business are driven by regulation and technology. Governments are increasingly concerned about:

- Controlling the public narrative about many contentious societal issues. There is growing evidence that Meta is being pressured to reduce the distribution of disinformation and misinformation posts (as defined by various governments and their agencies).

- Protecting the privacy of users’ information and tracking their online usage without permission.

- Market power – Meta may cause anti-trust concerns if it were to undertake a substantial acquisition which could be deemed to reduce competition. Except for the original app, most of Meta’s platforms have been acquired and internal technology developments have tended to be enhancements. Over the last 2 years more cash is starting to be used on acquisitions (although still relatively modest given the size of the company).

- The remaining key threat to Meta comes from its competitors. Will Google develop similar operating system changes for Android devices which could impact Meta’s ability to data mine? Will competitors develop a better product which causes Meta to lose its current market position?

Situational Analysis

Meta’s business model appears to be under stress. The digital advertising market, Meta’s primary source of revenue, is rapidly maturing. Meta’s recent growth has only been slightly lower than the underlying growth of the market, but this trend could worsen if the economy continues to weaken.

To make matters worse, Meta’s attempt to develop a new source of revenue growth via the VR market is taking longer than expected to reach both revenue and profitability aspirations.

How has Meta responded?

Since late last year Meta has announced two restructuring initiatives:

- November 2022 – 11,000 employees (head count at the time was 86,842) were to be terminated and several facilities would be consolidated. The total cost of the restructuring was said to be $4,610 M.

- March 2023 – a further 10,000 employees would be terminated at a total cost of $1,000 M.

A more interesting development came earlier this month (July 2023) when the new Threads app was released to the market. Threads is to become a direct competitor to Twitter and would be accessed by registered users of Instagram.

Will these actions solve Meta’s strategic problems?

The restructuring cost savings are very important. The company’s headcount at the end of these actions should be over 20% lower. Besides the obvious cost benefit there may also be organizational efficiency and execution benefits. The savings will help to buffer Meta’s operating margins in the near term.

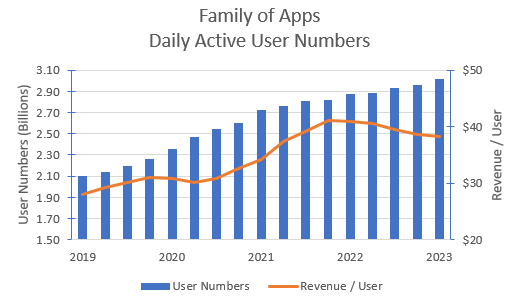

The new subscribers that Threads will attract should help to address the overall declining growth in Meta’s subscribers (the trend is shown in the following chart):

Author’s compilation using data from Meta Platforms’ 10-Q filings.

At the end of Q1 2023 the annual Daily Active User number was growing at close to 5% per year.

Threads appears to be a much closer strategic fit to the Meta business than VR. It is still very early days to make financial forecasts for this new app, but we can use the last annual public filing by Twitter (this was for the 2021 financial year) to help shape our thinking.

Threads appears to be an effort to gain market share from a competitor. At this time, I don’t think that Threads will contribute to changing the revenue growth trajectory of the digital advertising market.

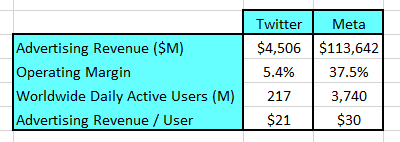

The following table compares Twitter’s 2021 financial year’s advertising revenues, operating margin, and user numbers with Meta’s most recent annual report:

Author’s compilation using data from each company’s 10-K filing.

I read recently that the Wall Street Journal reported that Twitter had 535 million Daily Active Users (DAUs) in June 2023. I am surprised by this number given that the last public report from Twitter in their 2022 Q2 10-Q filing stated that their DAU’s were 237.8 million. At June 2022 Twitter’s DAU’s were growing at a reasonably steady 16% per year.

The key conclusions from the table are:

- Twitter is a relatively small advertising business compared to Meta but it appears to be growing faster than Meta.

- Twitter has not been very profitable probably because of the low monetization rate of its market segment and its large expense base.

Due to the passage of time, there is some uncertainty in these conclusions. Under private ownership Twitter has evidently lowered its cost base (Elon Musk in a recent interview claimed that Twitter employee numbers have been reduced by 80% since he acquired the company). Musk has also introduced some initiatives to improve Twitter’s monetization rate.

I think that Threads will be a very welcome addition to the Meta universe, and it will increase Meta’s revenue growth in the near term but at this stage I don’t believe that it will be a “game-changer”.

My Investment Thesis for Meta

The advertising sector experienced a mini boom during COVID but this “sugar rush” has subsided and the sector has resumed its pre-COVID growth trajectory. Growth is slowing as the sector approaches maturity.

There is a reasonable consensus that the sector’s growth will be 7% to 8% over the next 5 years. It would not surprise me that this may prove to be optimistic (as forecasts invariably are) but I am prepared to accept this view. After year 5, market revenues will slowly decline to a terminal growth rate of 4% by year 10.

Just like the market, Meta has also hit peak growth, but the recent launch of Threads will enable Meta to gain a new source of growth by convincing subscribers to switch from Twitter. I have assumed that Meta takes 50% of Twitters’ revenues within 2 years.

Due to the lack of recent public information from Twitter it is difficult to assess whether Twitter is also showing signs of approaching maturity. I suspect that it probably is. The additional revenues that Meta will achieve by gaining share from Twitter will only be around $3,000 M to $5,000 M per year after Meta establishes its market position and from that point, Thread’s revenues should grow at the market rate.

In summary, I am forecasting that Meta’s advertising revenues will grow at 9% per year for the next 5 years before slowly declining to 4% per year by year 10.

The growth rate for Meta’s Family of Apps Other revenues has been quite volatile. It is difficult to identify causal linkages between Meta’s published metrics and what is driving this revenue. As a result, in my forecast, I have assumed that these revenues will grow by 10% this year and the rate of growth will decline by 1% per year until it reaches 4%.

Meta’s Family of Apps operating margins peaked in 2021 and have sharply declined ever since. The 2022 margins, even after adjusting for the restructuring charges, were 8% lower than 2021. This situation has persisted according to the 2023 Q1 results even allowing for some improvement (after adjusting for new restructuring charges) but remains over 7% lower than the 2021 base.

I think that competitive forces and the cost of government regulatory compliance will keep margins suppressed. There will be some medium-term benefit in lower operating costs achieved from the two recent restructurings, but most of the financial benefit will be reflected in lower reinvestment levels.

Over the last year the potential for the VR market has been scaled down relative to the initial market hype. I estimate that Meta may currently have a 23% share of this market, but Meta’s VR revenues are currently flat therefore they are potentially losing market share.

As a result of the lower investment in research and development I have scaled back the future revenues that Meta will generate from the VR market. Given the internal restructurings at Meta I am not forecasting any growth for the Reality Labs division this year. I then expect that the division can grow revenues at 15% per year for the next 4 years before growth starts to taper.

The operating margin for Meta’s Reality Labs division is currently negative. I expect that within 3 years the division will be profitable but if the Consumer Electronics sector is a guide, then the expected long-term operating margin for this division is probably around 10% to 15% (reflecting low hardware margins relative to software).

Due to anti-trust pressure, I have assumed that there will be no substantial acquisitions over the forecast period. I have not factored in any attempts by the US government to break up Meta.

Key Assumptions in Meta’s Valuation

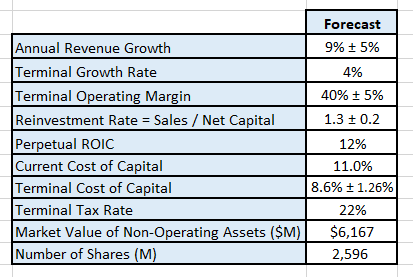

The following table summarizes the key inputs into the valuation:

Author’s model inputs.

A discounted cash flow model’s key inputs are revenue growth, margins, reinvestment and the discount factor (or cost of capital). For most of the inputs, it is relatively easy to understand my forecast spread of values with probably one exception – the terminal cost of capital. In this model I have assumed that Meta’s terminal cost of capital is equal to my estimate of the S&P500’s current average cost of capital.

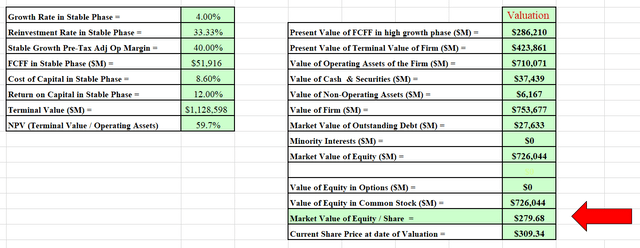

Discounted Cash Flow Valuation

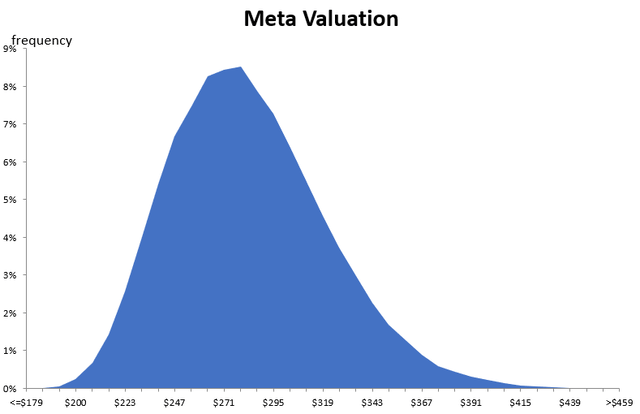

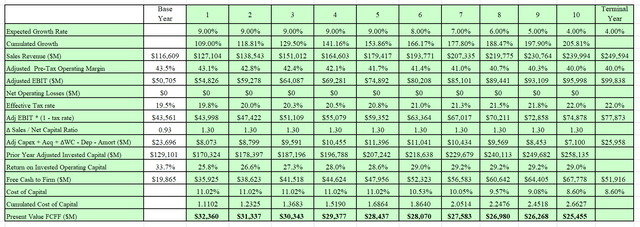

The output from my DCF model is:

Author’s model. Author’s model.

I also developed a Monte Carlo simulation for the valuation based on the range of inputs for the valuation. The output of the simulation is developed after 100,000 iterations.

The Monte Carlo simulation is very useful in helping to understand the major sources of sensitivity in the valuation:

- 55% of the variation comes from revenue growth.

- 34% of the variation comes from the terminal cost of capital.

The simulation indicates that based on my future scenario the valuation for Meta is between $179 and $459 per share with a typical value around $280.

I think that based on my scenario Meta is currently priced in the range of fair value.

Final Recommendation

The online advertising sector prior to COVID was starting to mature and the sector revenue growth rates were slowing. The global community lockdowns gave the sector a much-needed sugar hit of growth, but post COVID the slowing trend has resumed.

There have been concerns about Meta’s performance were on two levels:

- Could Meta restore faith in its advertisers by resolving their concerns about the data quality coming from Meta users?

- Will the VR investments generate the expected revenues and profits over the longer term.

The November and March restructuring announcements have bought some time for Meta. I suspect that the market now believes that Meta is serious about being better stewards of the investments being made in VR.

The recent release of the Threads app will also make it difficult for market observers to determine Meta’s medium term growth trajectory. Threads in the near term will not contribute to revenues but will potentially contribute to growth in Meta’s user base.

However, pressure will come back if the upcoming Q2 results do not show advertising revenue growth. Meta’s trailing 12-month revenues have been flat to declining for the past 5 quarters.

I have painted a reasonably optimistic scenario for Meta with above sector revenue growth, the maintenance of high operating margins and lower reinvestment levels back into its business. My Monte Carlo analysis identifies if revenue growth is not restored then it becomes difficult to justify the current share price.

The market has shown previously that it is prepared to punish the company if its performance does not live up to its promise. Investors should be wise to remember that in September 2021 Meta’s share price was around $380 and 12 months later it was $89.

Is Meta today a buy, hold or sell?

If I was answering this question without any regard to the current macro investing environment, I think that there is little doubt that Meta is a HOLD.

Current investors should carefully consider their portfolio allocation to Meta. The stock price has risen considerably over the past year and given the current uncertain global macro-environment investors may choose to lower their current allocation and bank some profits.

Long term investors could replace their long equity position with call options using a stock replacement strategy particularly with the upcoming earning announcement. As a result of the current market volatility, options are cheap, a stock replacement strategy is an excellent way to derisk this position whilst still participating in any near term price upside.

I am a holder of Meta shares. I have taken my own advice and I have trimmed my holding over the last couple of months and I continue to generate income by selling calls against my reduced long equity holding.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.