Summary:

- Meta Platforms stock has experienced a significant reversal of fortune, rallying 250% since its lows in October.

- Investors have overreacted in both directions, leading to extreme fluctuations in the stock’s valuation.

- Despite a recent earnings beat, Meta’s long-term growth prospects are uncertain, making it an unattractive investment at its current premium valuation.

zakokor/iStock via Getty Images

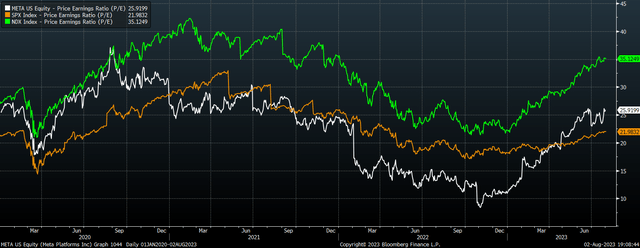

I argued last year that despite the weak long-term growth outlook for Meta Platforms (NASDAQ:META) the stock was likely to post strong returns as valuations rise from discounted levels (see ‘Meta Platforms: Growth No Longer Needed For Solid Long-Term Returns‘). After falling over 50% over the following 8 months to trade at true bargain levels with a free cash flow yield of over 10%, the stock has since rallied 250% to once again trade at a premium to the broader market. The rise in the stock from the lows in October last year represents one of the most staggering reversals of fortune for a mega cap stock I have ever seen, with the company’s value rising almost $600bn over this period. While I believe there are more egregiously overvalued stocks out there, such as Nvidia (NVDA), Tesla (TSLA), and Microsoft (MSFT), Meta is certainly no longer a buy.

Investors Are Overreacting Again, This Time To The Upside

The lows in Meta’s stock in October occurred shortly following the poor earnings report for Q3 2022 which saw revenues decline year over year and profits tank. This led to widespread calls that the company had reached peak sales and would suffer long-term declines sufficient to justify the stock’s extreme discount to the market.

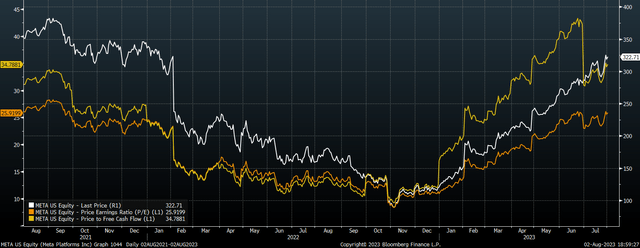

Meta Price, P/E, P/FCF (Bloomberg)

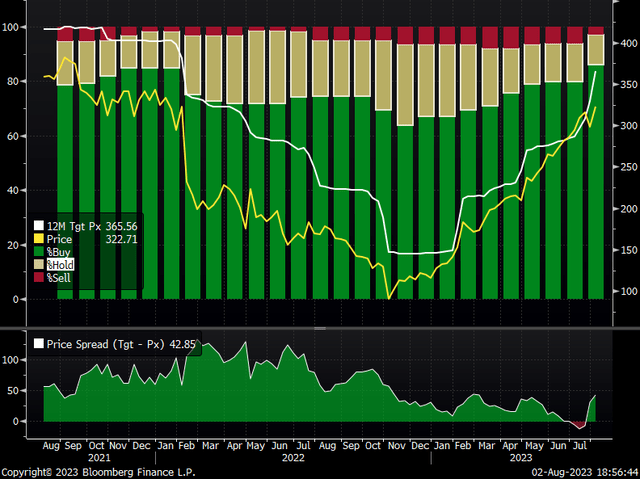

Fast forward 8 months and investors appear to be overreacting in the opposite direction, bidding up the stock in response to last month’s earnings beat, which saw revenues rise and operating costs fall amid the company’s efficiency drive, leading to a surge in profits. Wall Street analysts have raised their price targets on the stock to a further 14% upside, while the share of bulls has risen 21pp from the October lows and now sits at 86%.

Meta Analyst Recommendations (Bloomberg)

For large companies like Meta, with annual sales of over $30bn and over 3 billion users, quarterly reports are of little relevance to the stock’s returns over any significant period of time, and extrapolating the recent recovery makes as little sense as extrapolating last year’s earnings slump.

Slowing Growth And High Valuations Imply Negative Returns

While sales and earnings for Q2 were up 11% and 46% y/y respectively, the broader trend remains weak. On a trailing 12-month basis sales were up less than 1% while earnings were down 3%. If one-off losses from writedowns, legal settlements and restructuring are included, earnings are down 33% y/y in TTM terms. Despite the aggressive 4% reduction in share count over this period, unadjusted earnings per share remain down 39% from their 2021 peak.

The company has made efficiency gains from the use of AI which allowed a 14% y/y decline in headcount, and we are likely to see trailing 12-month profit margins rise over the coming quarters. However, such efficiency gains will be hard to repeat going forward, and competition is likely to limit the extent to which the company can increase revenue per user. Meanwhile, the ongoing decline in young Facebook users in developed countries presents an intractable problem for the long term.

Furthermore, continued aggressive buybacks will be difficult to sustain as the company’s balance sheet continues to deteriorate albeit from a strong base. My assumption is that Meta’s sales and earnings growth will continue to slow in line with the broader economy, which looks set to achieve no more than 1% annual growth in real terms.

This is a problem for a company that trades at 36x unadjusted earnings and 34x free cash flow. Even if we generously assume that the one-off losses over the past year will not be repeated, the stock still trades at 26x earnings which is back to a significant premium to the SPX. Even if the company continues to pay out all its free cash flow through buybacks, this would still only amount to 4% annual total real terms, which is just 2 percentage points above 10-year inflation-linked Treasuries. For a stock that can fall by over 70% in less than a year as we saw from late-2021 to late-2022, a 2% risk premium seems wholly inadequate. If investors were to implicitly require 6% annual returns on the stock as has been the long-term overage return for US stocks, the free cash flow yield would have to rise to 5%, requiring a 40% price decline.

Risks Appear Evenly Balanced

There is of course a bullish case for Meta, as for any stock. The company is the world leader in social media engagement which is an addictive yet legal product with almost zero marginal production costs, enabling gross margins of around 80%. This provides the company with a solid financial backing to experiment in other potential growth avenues such as Reality Labs. However, there is also a risk that we see governments take steps to regulate social media companies more tightly on the basis of fighting ‘misinformation’ and mental health concerns among young people. The risk-reward outlook therefore seems particularly poor at current valuations, particularly with cash now offering over 5% with no downside.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.